Statute Of Limitations On Georgia State Back Taxes Seven year statute of limitation under O C G A 48 3 21 was applicable to a county tax assessment for back taxes and penalties against a company that did not report the

General statute of limitations providing that an action to enforce a right accruing to an individual under state statute must be brought within 20 years after the e If a claim for refund of taxes paid for any taxable period is filed within the last six months of the period during which the commissioner may assess the amount of taxes

Statute Of Limitations On Georgia State Back Taxes

Statute Of Limitations On Georgia State Back Taxes

https://i.ytimg.com/vi/xl2F288WpMA/maxresdefault.jpg

Under What Circumstances Are Statutes Of Limitation Extended

https://lirp.cdn-website.com/83617c2d/dms3rep/multi/opt/Statute+of+limitations+book+on+judge+desk+with+gavel+and+other+court+items-1920w.jpeg

California Statute Of Limitations On Debt Oaktree Law

https://oaktreelaw.com/wp-content/uploads/2021/06/California_statute_limitations.jpeg

The IRS statute of limitations allows for ten years in which the IRS can collect back taxes A few states follow the IRS standards while others have more or less Except for executions issued by the commissioner all county municipal or other tax executions before or after legal transfer and record shall be enforced within

The statute of limitations is three years in Georgia from 2017 For those taxpayers who decide to increase the loss carryforward to ten years the statute of Georgia sales and use taxes must be assessed within three years after the return is filed O C G A Sec 48 2 49 O C G A Sec 48 8 64 A return filed before the last day

Download Statute Of Limitations On Georgia State Back Taxes

More picture related to Statute Of Limitations On Georgia State Back Taxes

What Are Statutes Of Limitations In Texas Criminal Cases YouTube

https://i.ytimg.com/vi/e4C7nQ8nIk0/maxresdefault.jpg

Is There A Statute Of Limitations On Partition Actions CCP 318

https://www.underwood.law/blog/wp-content/uploads/2023/01/Underwood-Blog-Images-1.png

Statute Of Limitations On Debt In Georgia Bournakis Mitchell P C

https://debtfreega.com/wp-content/uploads/2021/10/title-Statute-of-Limitations-on-Debt-in-Georgia.jpg

Georgia Department of Revenue State Tax Executions the Georgia Department of Revenue can assess the individual at any time No statute of limitations applies to non How long should you keep your state tax records in case of an audit Many states audit within three years but some have much longer Learn your state s limit

The Georgia State Law Tax Clinic helps low income taxpayers with IRS disputes Learn more about statutes of limitation on collections refunds and more Most state statutes of limitations range from three to four years from the later of the income tax return due date or the date the return was filed However if a taxpayer fails

:max_bytes(150000):strip_icc()/state-by-state-list-of-statute-of-limitations-on-debt-960881-Final-a906cc8bbdb640ee8acdb02c7e81377b.png)

Statutes Of Limitations On Debt Collection By State

https://www.thebalancemoney.com/thmb/7Ifsm7G2h5L3Uo8JSBCzxsDBMmg=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/state-by-state-list-of-statute-of-limitations-on-debt-960881-Final-a906cc8bbdb640ee8acdb02c7e81377b.png

What Is The Statute Of Limitations For Personal Injury In Georgia

https://i.ytimg.com/vi/lndfEnNGiTU/maxresdefault.jpg

https://law.justia.com/codes/georgia/2020/title-48/...

Seven year statute of limitation under O C G A 48 3 21 was applicable to a county tax assessment for back taxes and penalties against a company that did not report the

https://law.justia.com/codes/georgia/2020/title-9/...

General statute of limitations providing that an action to enforce a right accruing to an individual under state statute must be brought within 20 years after the

Federal Implications Of Passthrough Entity Tax Elections

:max_bytes(150000):strip_icc()/state-by-state-list-of-statute-of-limitations-on-debt-960881-Final-a906cc8bbdb640ee8acdb02c7e81377b.png)

Statutes Of Limitations On Debt Collection By State

Statute Of Limitations Georgia The Law Ladies

What Is The California Statute Of Limitations On Medical Debt

Personal Injury Lawsuit Time Limits The Statute Of Limitations In Georgia

Georgia s Statute Of Limitations For Personal Injury Claims What You

Georgia s Statute Of Limitations For Personal Injury Claims What You

Statute Of Limitations In Florida For Credit Card Debt Dollar Keg

Georgia Debt Statute Of Limitations Collection Relief On Debt

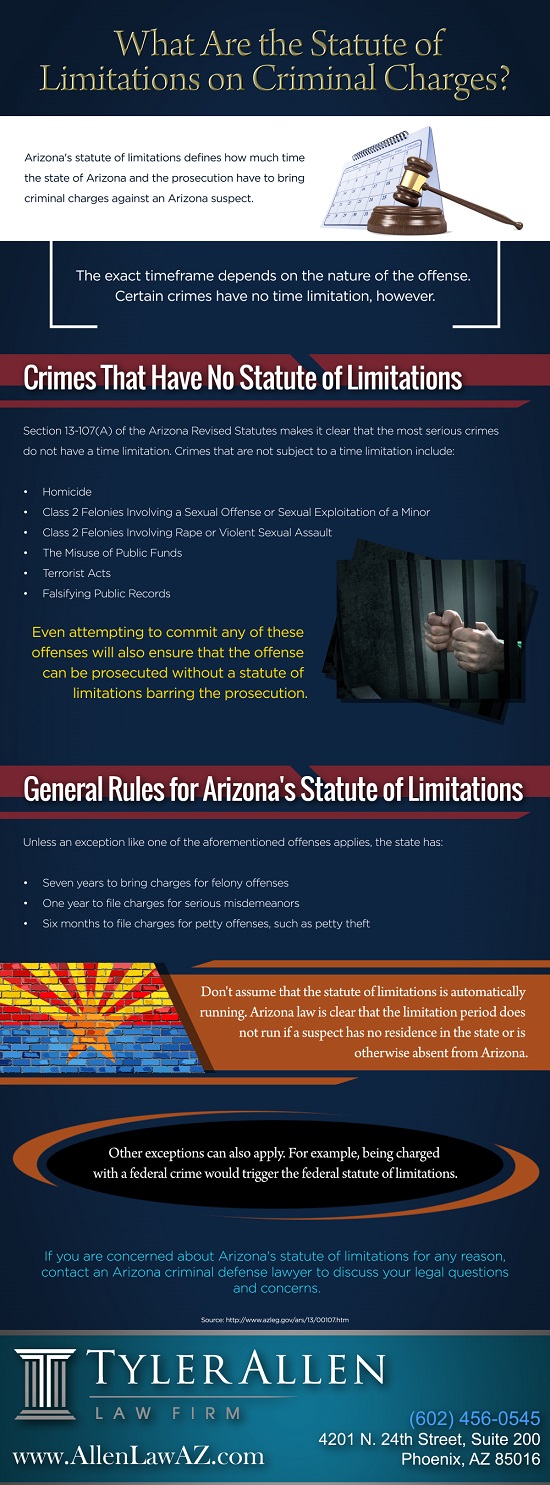

What Are The Statute Of Limitations On Criminal Charges Infographic

Statute Of Limitations On Georgia State Back Taxes - Georgia Civil Statutes of Limitations The statute of limitations in a civil case defines the time period in which a lawsuit must be filed Here s an overview of