Stimulus Tax Credit 2023 People who are missing a stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2020 or 2021 federal tax return

Partner and Promotional Materials Recovery Rebate Credit and Economic Impact Payments Page Last Reviewed or Updated 28 Dec 2023 We re committed to helping you get your economic impact or stimulus payment as soon as possible See if you are eligible for an Economic Impact Payment More than 200 members of the House support a plan to renew the 300 a month child tax credit payments and a 2 000 baby bonus Here s what it means

Stimulus Tax Credit 2023

Stimulus Tax Credit 2023

https://d.newsweek.com/en/full/2167518/economic-stimulus-checks-are-printed.jpg

State Stimulus Check 2023 Everything You Should Know For The Next Year

https://www.digitalmarketnews.com/wp-content/uploads/2022/01/stimulus-check-4.jpg

Stimulus Payments 2023 Status Will The States Be Sending More Checks

https://phantom-marca.unidadeditorial.es/778029e3aa70e6360ae362ce5d6706e3/crop/130x0/1149x679/resize/1320/f/jpg/assets/multimedia/imagenes/2022/07/27/16589106528713.png

Increase the Child Tax Credit Earned Income Tax Credit and Child and Dependent Care Tax Credit Experts say that less generous tax breaks from the pandemic including the expanded child tax credit earned income tax credit and no stimulus checks translate to lower refunds

File your taxes to get your full Child Tax Credit now through April 18 2022 Get help filing your taxes and find more information about the 2021 Child Tax Credit How much is the 2023 child tax credit Right now unless Congress makes last minute changes the 2023 child tax credit is worth up to 2 000 per qualifying child

Download Stimulus Tax Credit 2023

More picture related to Stimulus Tax Credit 2023

Recovery Rebate Tax Credit Guidelines 2023 How To File For The

https://i.ytimg.com/vi/AEKUK2SMNRs/maxresdefault.jpg

Stimulus Check 2023 Check You Are Eligible To Get It Or Not Raj Neet

https://rajneetug2021.com/wp-content/uploads/2023/03/Untitled-design.png

Stimulus Checks 2023 How Many States Are Still Sending Checks Marca

https://phantom-marca.unidadeditorial.es/2ba554ed65725e4345ff8b2bc0fc6477/resize/1200/f/jpg/assets/multimedia/imagenes/2023/01/02/16726495945172.jpg

Democrats seek a complete return of the expanded child tax credit from President Joe Biden s COVID 19 stimulus bill while Republicans are spearheading their own version of The refundable portion of the child tax credit would increase to 1 800 for tax year 2023 1 900 for 2024 and 2 000 for 2025 and a new calculation would expand access The current

How much are payments The deal is set to include direct payments of up to 600 to eligible adults plus 600 per child dependent This means that under the new relief For the 2023 tax year taxes filed in 2024 the maximum child tax credit will remain 2 000 per qualifying dependent but the partially refundable payment will increase up to 1 600 per the

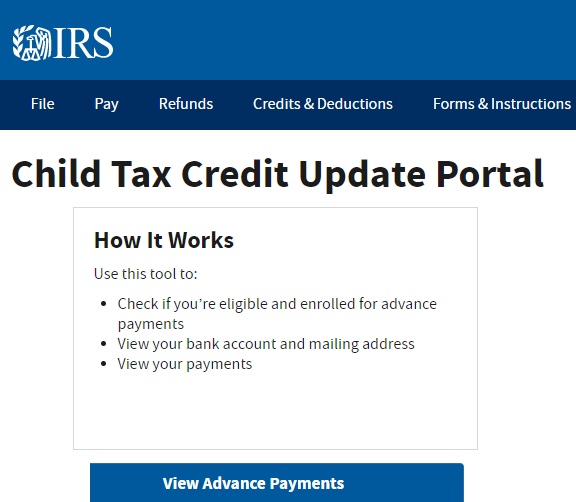

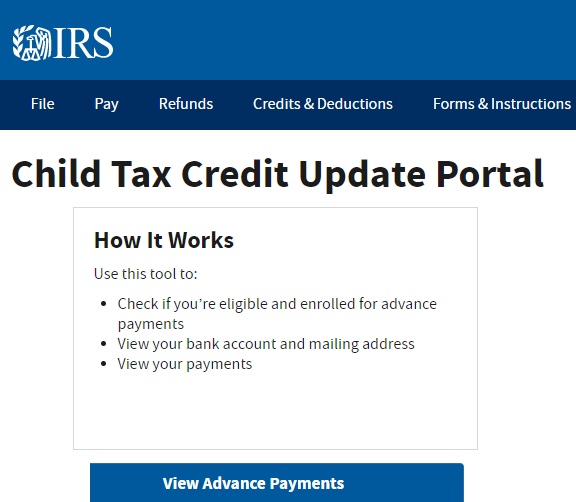

IRS Child Tax Credit Portal 2023 Login Advance Update Bank Information

http://refundschedule.us/wp-content/uploads/2022/01/IRS-Child-Tax-Credit-Portal-Login-Advance-Update-Bank-Information-Payments-Dates-Phone-Number-Stimulus.jpg

T20 0214 Implement A Universal Earned Income Tax Credit UEITC

https://www.taxpolicycenter.org/sites/default/files/styles/full-page-1500x700/public/model-estimates/images/t20-0214.png?itok=cv7koeSl

https://www.irs.gov/newsroom/recovery-rebate-credit

People who are missing a stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2020 or 2021 federal tax return

https://www.irs.gov/coronavirus/economic-impact-payments

Partner and Promotional Materials Recovery Rebate Credit and Economic Impact Payments Page Last Reviewed or Updated 28 Dec 2023 We re committed to helping you get your economic impact or stimulus payment as soon as possible See if you are eligible for an Economic Impact Payment

IRS Tax Refunds Calendar For 2023 Gives Break Up Average Tax Refunds To

IRS Child Tax Credit Portal 2023 Login Advance Update Bank Information

Changes In The Employee Retention Tax Credit With New Stimulus Bill

Stimulus Checks Update Here s What You Need To Know About relief

You Can Get Up To 25 000 In Stimulus Checks But You Have To Act Fast

5000 Child Tax Credit Good News Second Stimulus Check Update Stimulus

5000 Child Tax Credit Good News Second Stimulus Check Update Stimulus

Federal Aid In 2022 No More Stimulus Checks In Sight Child Tax Credit

How Much Per Month Was The Child Tax Credit Leia Aqui How Much Child

Fourth Stimulus Check And Child Tax Credit News Summary 14 July 2021

Stimulus Tax Credit 2023 - For the 2024 tax year tax returns filed in 2025 the child tax credit will be worth 2 000 per qualifying child with 1 700 being potentially refundable through the additional child tax