Student Loan Interest Tax Credit Calculator Canada Receive a 15 tax credit based on the interest you paid on your student loans in 2022 and the preceding five years To qualify for the student loan tax credit

Tax credits for student loans You receive a 15 tax credit on any interest you pay on your government student loans each year This credit applies to At writing this is 15 percent But the provinces vary in their tax credit rates This means you get a different payback on your tax credit depending on where you live This Debt 101

Student Loan Interest Tax Credit Calculator Canada

Student Loan Interest Tax Credit Calculator Canada

https://blog.turbotax.intuit.com/wp-content/uploads/2020/05/You-can-deduct-student-loan-interest-if-you-meet-the-following-qualifications.jpg?w=580

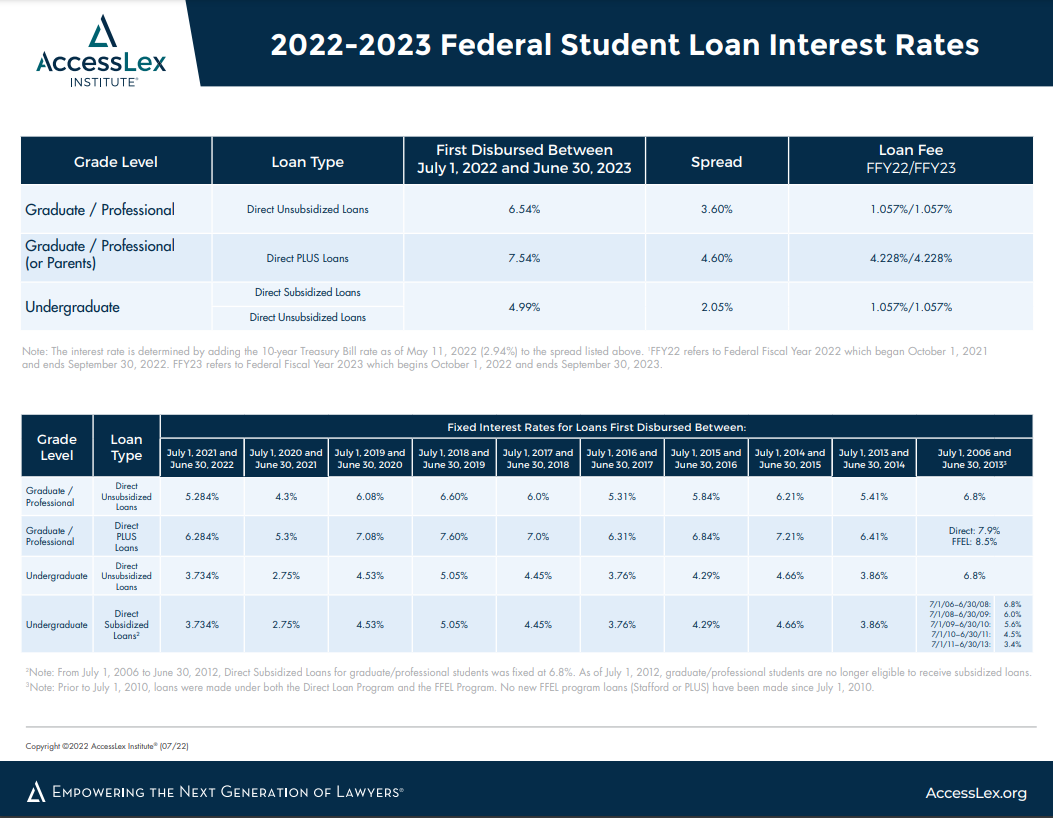

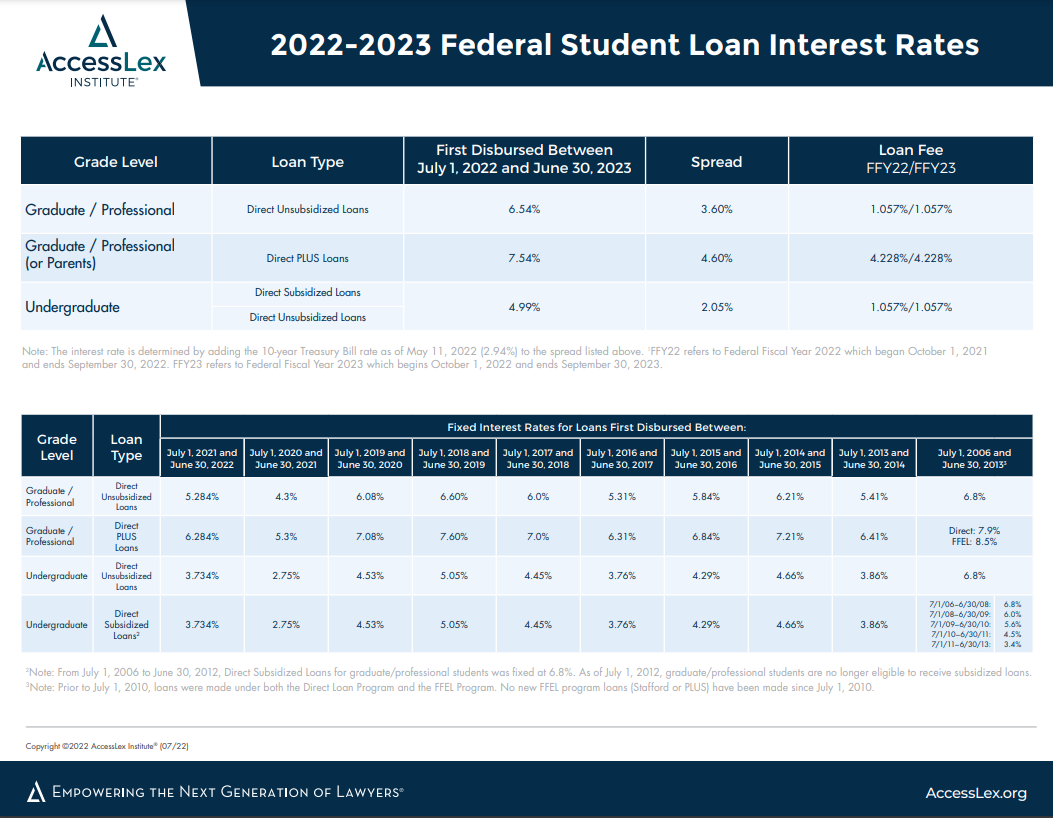

Federal Student Loan Interest Rates AccessLex

https://www.accesslex.org/sites/default/files/inline-images/Federal Student Loan Interest Rates_2022 2023.png

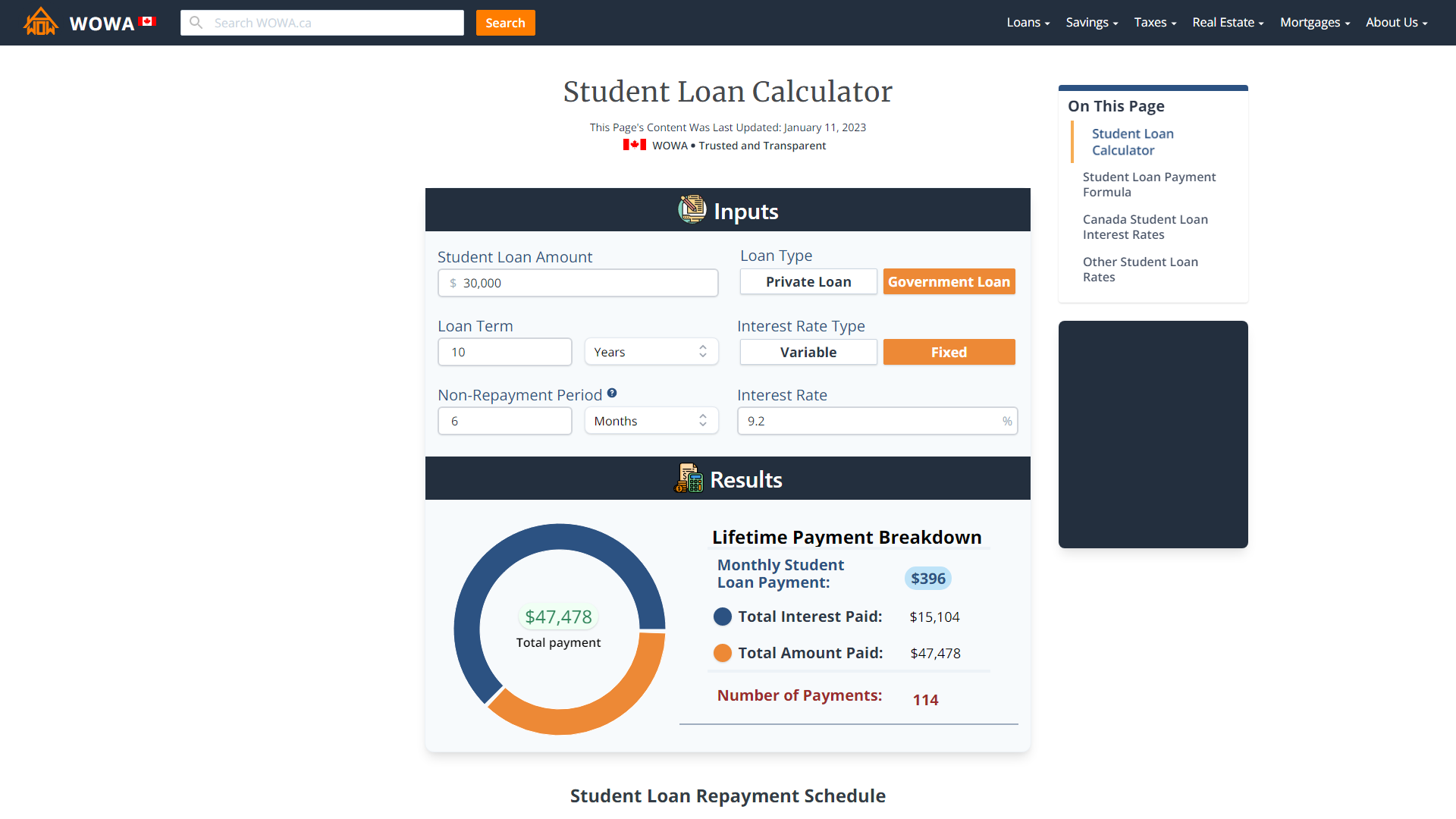

Student Loan Calculator Canada WOWA ca

https://wowa.ca/static/img/opengraph/student-loan-calculator.png

The longer it takes you to repay your loan the more interest you ll accrue and the more money you ll ultimately have to pay back Use this student loan calculator The student loan interest tax credit estimate provided through the Repayment Calculator is only an estimate of the annual tax credit amount that may be available based on your

The most common non refundable tax credits that apply to students are Canada employment amount interest paid on student loans tuition education and textbook If they used TurboTax the software would calculate the tax credit for interest paid on the student loan How much of your student loan interest should you claim You should claim as much of your tax

Download Student Loan Interest Tax Credit Calculator Canada

More picture related to Student Loan Interest Tax Credit Calculator Canada

Account Suspended Student Loan Debt Student Loans Best Student Loans

https://i.pinimg.com/originals/6a/19/de/6a19de8f425df290ef065cc9301e5b92.png

What Credit Score Is Needed For A Student Loan Student Loan Planner

https://i.pinimg.com/736x/2e/07/9f/2e079f114099105e16f736f2fbed4d0c.jpg

/student-loan-interest-deduction-3193022_HL-6a2dfcbfdccb47479d5a544f175feaf1.gif)

The Federal Student Loan Interest Deduction

https://www.thebalancemoney.com/thmb/4CpyfpIiY3PR6DdBUhGkiXJXdEE=/1500x1000/filters:fill(auto,1)/student-loan-interest-deduction-3193022_HL-6a2dfcbfdccb47479d5a544f175feaf1.gif

This calculator allows you to select your province and enter the interest rate fixed or variable for you Canadian Federal and Provincial Student Loans It will There are both federal and provincial non refundable tax credits for student loan interest The tax credit is calculated by multiplying the lowest federal provincial territorial tax

Taxes More services You are here Student Aid Estimator The Student Aid Estimator shows the amount of federal student aid you could receive from the Canada Student Welcome Manitoba Federal and Provincial Manitoba student loans are now integrated into one with the NSLSC Get to know us better To learn more about the

Certificate Courses Student Loans Higher Education Expand Goo

https://i.pinimg.com/originals/77/3c/34/773c34226e31586700a3c5640808a657.jpg

Student Loan Interest Tax Deduction Milliken Perkins Brunelle

https://millikenperkins.com/wp-content/uploads/2020/05/05_26_20_153549086_ITB_560x292.jpg

https://turbotax.intuit.ca/tips/claiming-student...

Receive a 15 tax credit based on the interest you paid on your student loans in 2022 and the preceding five years To qualify for the student loan tax credit

https://www.canada.ca/en/services/benefits/...

Tax credits for student loans You receive a 15 tax credit on any interest you pay on your government student loans each year This credit applies to

Student Loan Interest Deduction 2013 PriorTax Blog

Certificate Courses Student Loans Higher Education Expand Goo

Student Loan Interest Tax Deduction YouTube

Lower Your Student Loan Interest Rate NOW

Treasury Sets Student Loan Interest Rates Near Historic Lows

6 Best Tax Tips For Student Loan Borrowers Student Loan Planner

6 Best Tax Tips For Student Loan Borrowers Student Loan Planner

Learn How The Student Loan Interest Deduction Works

Is My First Student Loan Bill Really Over 1 000

16 Best Private Student Loans Of March 2021 NerdWallet Student

Student Loan Interest Tax Credit Calculator Canada - The student loan interest tax credit estimate provided through the Repayment Calculator is only an estimate of the annual tax credit amount that may be available based on your