Student Tuition Tax Credit Transfer To Parent Web If student claims the credit taxable income becomes 1 3k 4 5k above BPA minus 3 2k T2202 and the estimated reduced tax owing of the tuition credit is about 640 3 2k

Web 20 Juni 2019 nbsp 0183 32 If these tax credits are from 2014 or earlier no Credits can only be transferred in their effective tax year 2015 credits can only be transferred to a spouse Web 16 Feb 2021 nbsp 0183 32 One option is to transfer tuition amounts you paid to a supporting person so they can claim the tuition tax credit This may be a parent grandparent spouse or

Student Tuition Tax Credit Transfer To Parent

Student Tuition Tax Credit Transfer To Parent

https://maplemoney.com/wp-content/uploads/tuition-tax-credits-pin.jpg

TUITION TAX CREDITS Explained For Canadian Students T2202 TD1 T1213

https://i.ytimg.com/vi/fq7uBQmlrkc/maxresdefault.jpg

Tuition Tax Credit In Canada How It Works NerdWallet

https://www.nerdwallet.com/ca/wp-content/uploads/sites/2/2022/01/GettyImages-936987292-e1643665970419.jpg

Web 5 Dez 2023 nbsp 0183 32 At that point the student is then able to transfer the remaining amount to a spouse common law partner parent or grandparent or carry forward the remaining amount to a future tax year Web 21 Feb 2023 nbsp 0183 32 If they choose to transfer the credit they can transfer up to 5 000 less the amount used to reduce tax owing So if they reduced their tax by 1 000 the most that can be transferred is 4 000 They

Web 8 Apr 2013 nbsp 0183 32 If there is an amount left over when they ve used their tax credits to bring their income tax payable down to zero they can transfer the leftover amount to a Web 12 Dez 2023 nbsp 0183 32 If you don t have enough employment income to make full use of your tuition tax credit you can carry the amount forward to future years or transfer it to a spouse or other eligible family member like your

Download Student Tuition Tax Credit Transfer To Parent

More picture related to Student Tuition Tax Credit Transfer To Parent

Everything You Need To Know About The College Tuition Tax Credit

https://cdn.collegereaction.com/who_should_claim_the_tuition_credit.png

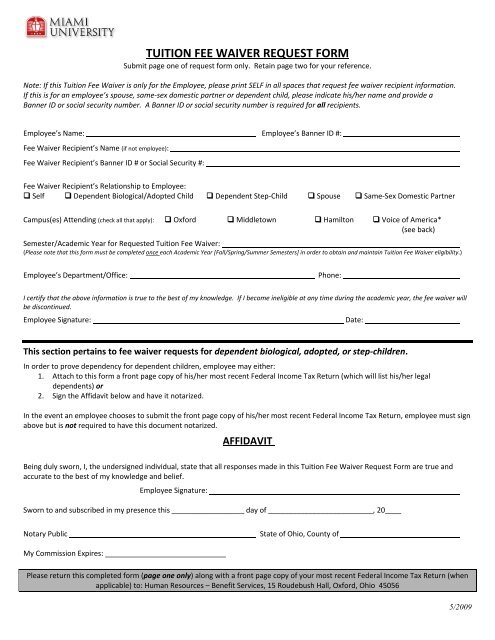

TUITION FEE WAIVER REQUEST FORM

https://img.yumpu.com/33140919/1/500x640/tuition-fee-waiver-request-form.jpg

What Is The Tuition Tax Credit In Canada And How Does It Work

https://instaccountant.com/wp-content/uploads/2022/08/tuition-credit.jpg

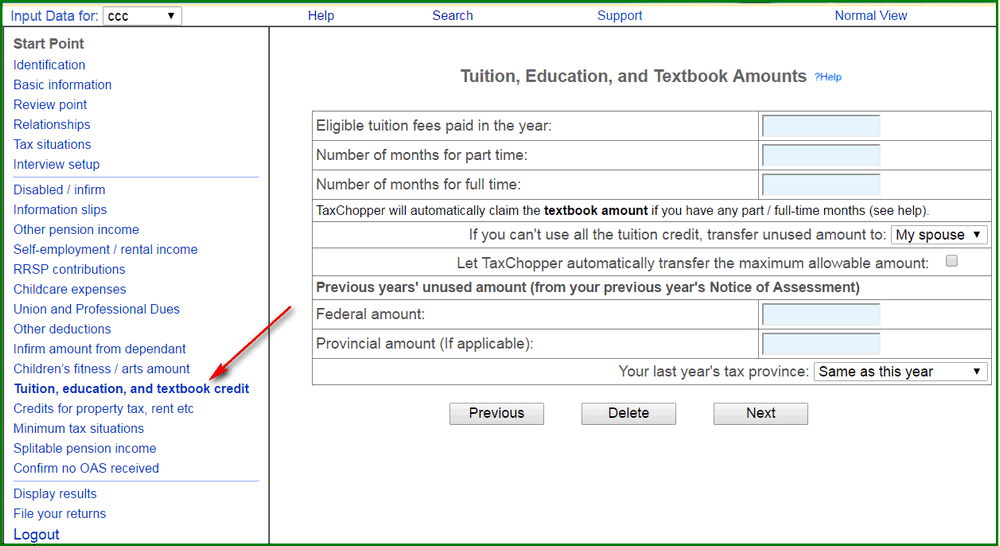

Web 30 Sept 2020 nbsp 0183 32 Your child can transfer up to 5 000 of the tax credit less the amount used to reduce tax owing So if they reduced their tax owing by 1 000 the most that can be transferred is 4 000 The tuition amount Web If part of the tuition education and textbook amounts are transferred to a parent or grandparent they will claim this on line 324 of their tax return Amounts transferred to a

Web 8 M 228 rz 2017 nbsp 0183 32 You can pass on 5 000 worth of credits to your spouse parents or grandparents and carry forward the remaining 1 000 for use against your taxes in the Web You may transfer a maximum of 5 000 of the current year s federal tuition amount and where available the applicable maximum for provincial and territorial tuition education

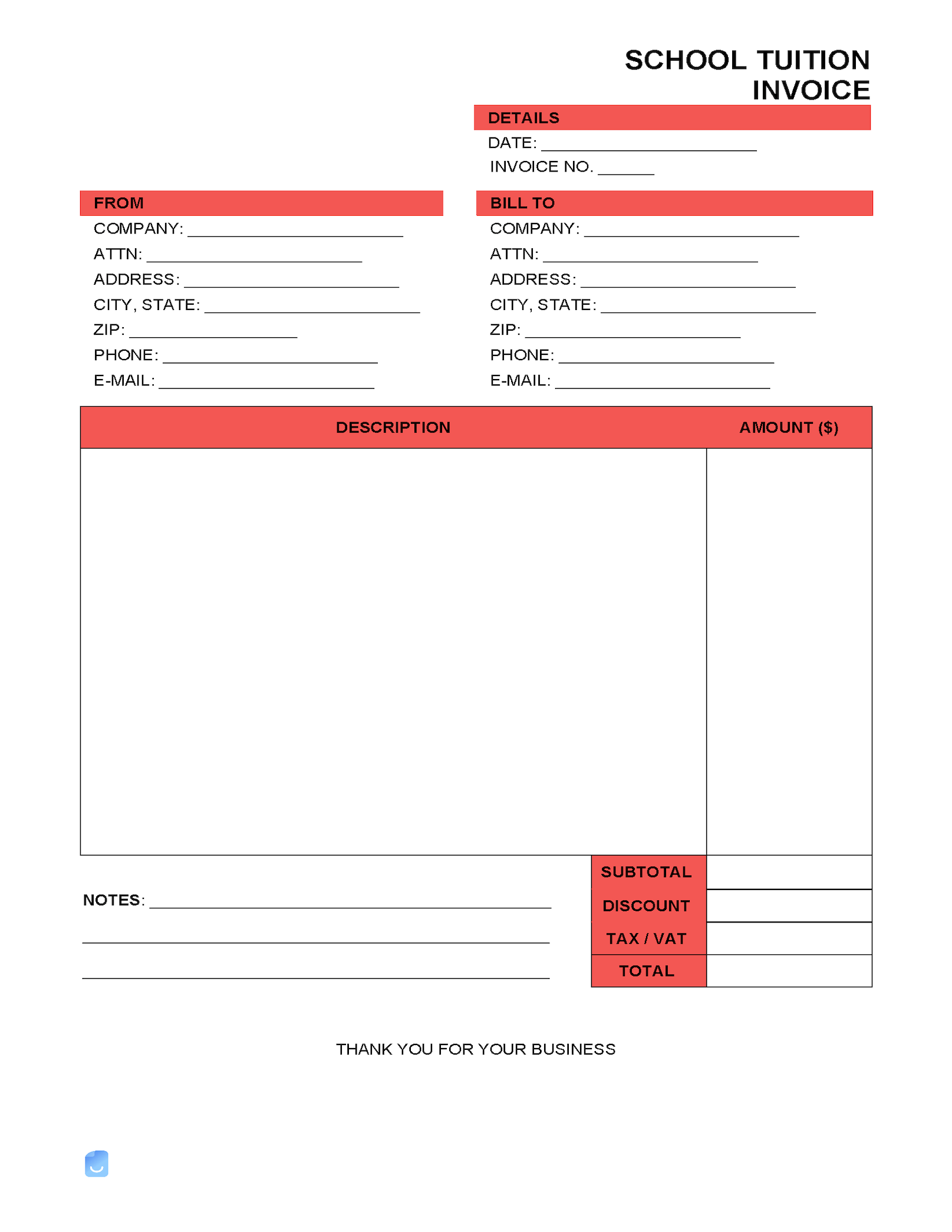

School Tuition Invoice Template Invoice Maker

https://im-next-wp-prod.s3.us-east-2.amazonaws.com/uploads/2022/11/School-Tuition-Invoice-Template.png

Tuition Agreement Template Sfiveband

https://i0.wp.com/eforms.com/images/2019/02/School-Tuition-Payment-Plan-Agreement.png?fit=1600%2C2070&ssl=1

https://www.reddit.com/.../tuition_tax_credit_claim_or_transfer_to_parent

Web If student claims the credit taxable income becomes 1 3k 4 5k above BPA minus 3 2k T2202 and the estimated reduced tax owing of the tuition credit is about 640 3 2k

https://money.stackexchange.com/questions/110301

Web 20 Juni 2019 nbsp 0183 32 If these tax credits are from 2014 or earlier no Credits can only be transferred in their effective tax year 2015 credits can only be transferred to a spouse

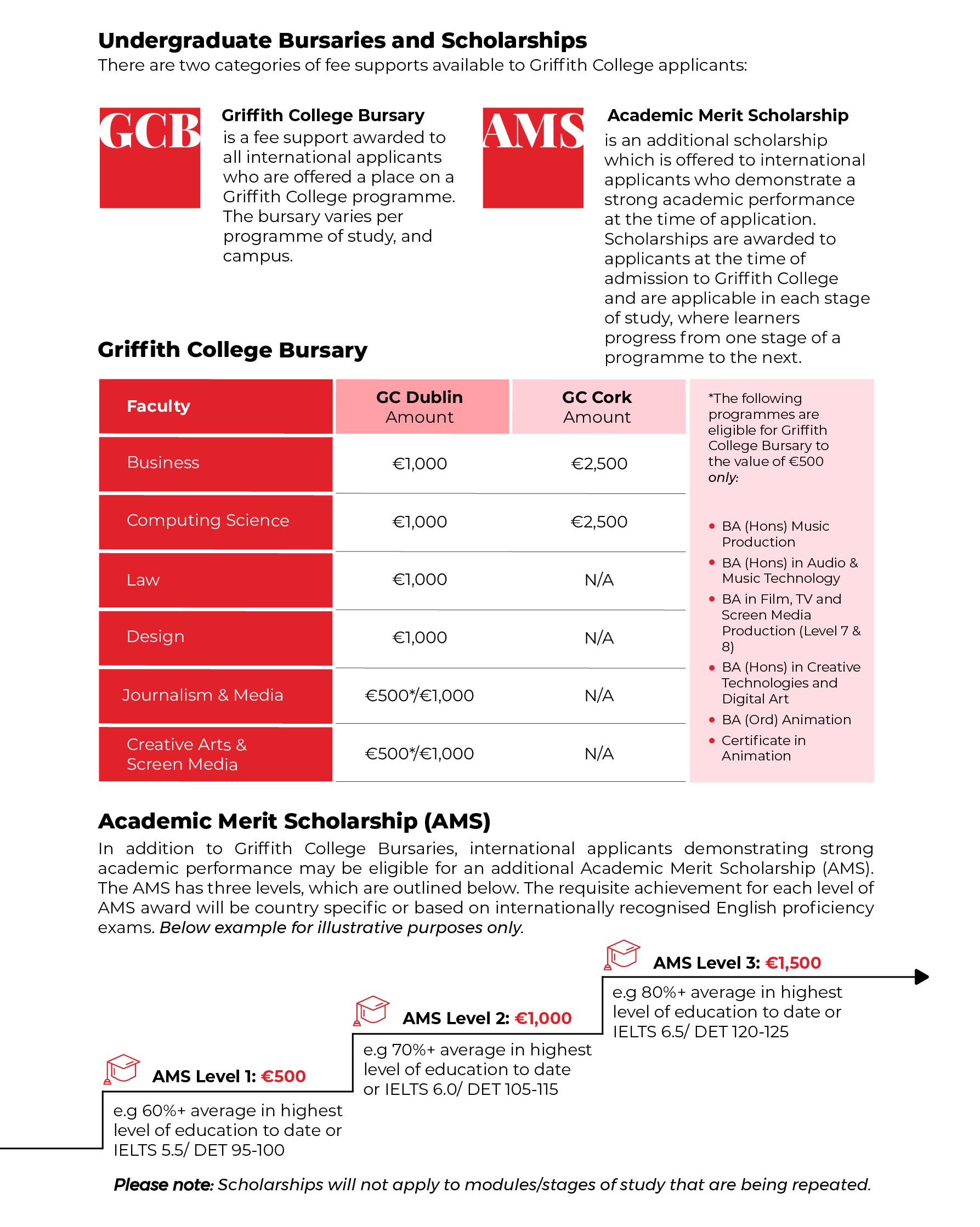

Non EU Tuition Fees Scholarships And Bursaries Griffith College

School Tuition Invoice Template Invoice Maker

1098 T Form How To Complete And File Your Tuition Statement

CHILD CARE TAX Statement Form Daycare Or Childcare Printable Etsy

Tuition Transfer To Parent T1 Protaxcommunity

Your Unused Provincial Tuition Amounts

Your Unused Provincial Tuition Amounts

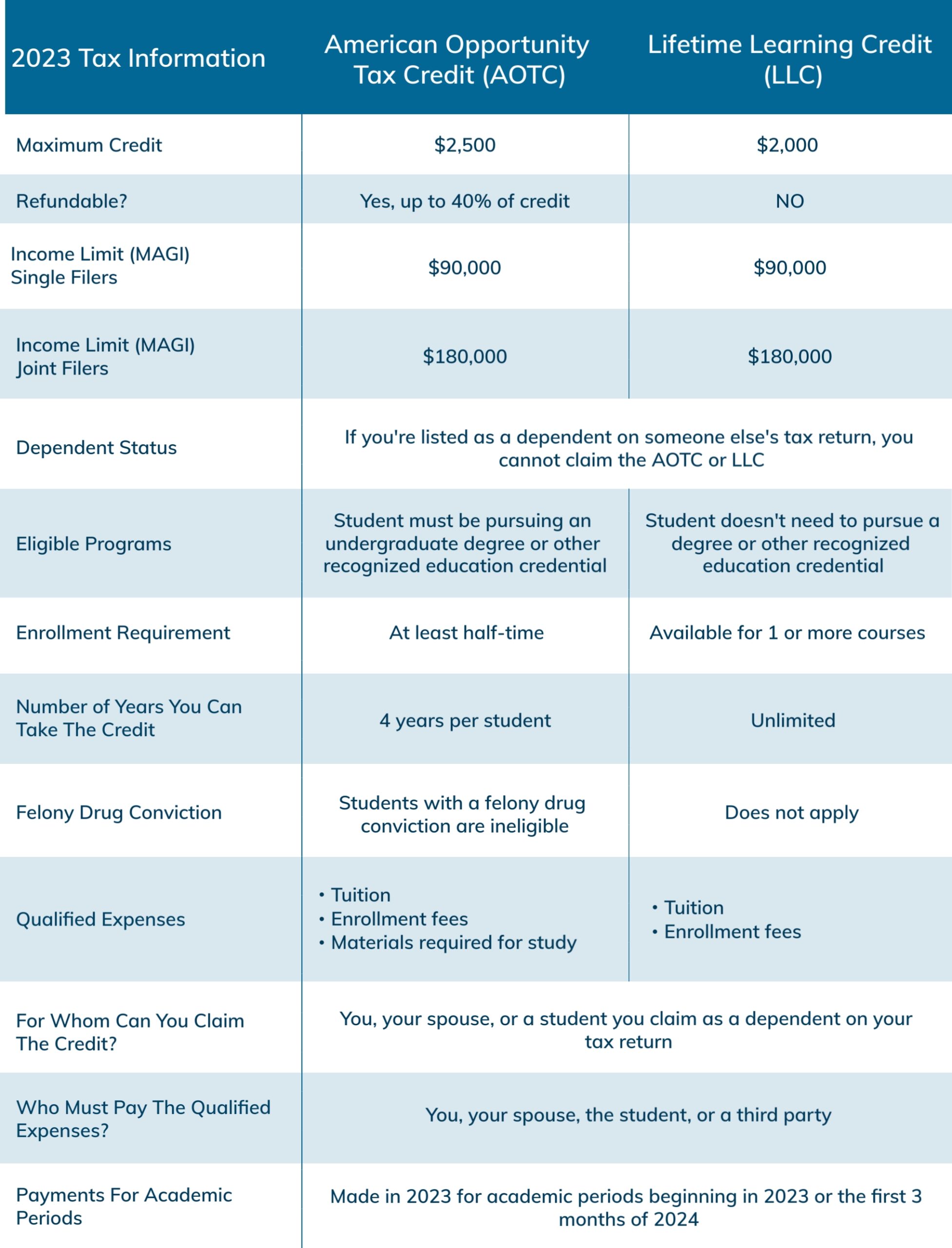

2023 Education Tax Credits Are You Eligible

Tuition Credit

Claiming Tuition Fees With Your T2202A Certificate H R Block Canada

Student Tuition Tax Credit Transfer To Parent - Web 4 Jan 2023 nbsp 0183 32 How do I transfer my unused tuition credits to someone else Updated January 04 2023 In order to transfer your unused tuition credits to someone else