Suffolk County Property Tax Reduction Verkko 13 kes 228 k 2022 nbsp 0183 32 Wikimedia Commons Homeowners on Long Island who earn less than 250 000 per year will automatically receive a property tax rebate from the state To qualify homeowners must be eligible for a

Verkko Suffolk County s median tax bill 9 472 New York median tax bill 8 081 United States median tax bill 3 399 If you accept the median Suffolk County tax assessment then over ten years time you are going to pay nearly 14 000 more than the average New York resident and over 60 000 more than the average American Verkko Real Property Tax Service Agency Dennis Brown Director Address 300 Center Drive Riverhead New York 11901 631 852 1550 FAX 631 852 3470 larry suffolkcountyny gov Begining March 13 2020 there will be only limited access to the services of the Suffolk County Real Property Tax Service Agency until further

Suffolk County Property Tax Reduction

Suffolk County Property Tax Reduction

https://3.bp.blogspot.com/-8tg5HSIgSvc/VzTEWQUo96I/AAAAAAAAAgk/fINidEI24_Q40g_YHid6DSHgcs6UBFRkwCLcB/s1600/actnow.JPG

Property Taxes Laurelcountysheriff Com

https://images.builderservices.io/s/cdn/v1.0/i/m?url=https:%2F%2Fstorage.googleapis.com%2Fproduction-bluehost-v1-0-5%2F395%2F427395%2FBLdANkE5%2F49687cfe5e17476f80f5a128d6d2852a&methods=resize%2C1200%2C5000

Property Tax Grievance The Heller Clausen Grievance Group LLC

http://www.grieveourtaxes.com/blog/wp-content/uploads/2013/04/suffolk-1024x310.jpg

Verkko Apply Online Today Or Call NASSAU COUNTY 516 342 4849 SUFFOLK COUNTY 631 302 1940 Residential Tax Grievance We set the record for tax reductions 73 443 in Nassau County 29 185 in Suffolk County Property tax grievance is a formal complaint filed on your behalf against your town s assessed value on your property Verkko What Should I Look For In the Best Property Tax Reduction Services in Suffolk County Experience a successful track record of reductions specializing in your county and no upfront fees or costs unless your tax bill is reduced

Verkko 27 toukok 2022 nbsp 0183 32 Property tax exemptions Property tax exemptions home Senior citizens exemption Veterans exemption Exemption for persons with disabilities Exemptions for agricultural properties Check your assessment Contest your assessment Learn about assessments and property taxes Property sales and Verkko The County Comptroller is also authorized to accept partial payments of a minimum of 200 towards any outstanding property tax For additional information please contact the Suffolk County Comptroller s Office at 631 852 3000 or go to our website at www suffolkcountyny gov

Download Suffolk County Property Tax Reduction

More picture related to Suffolk County Property Tax Reduction

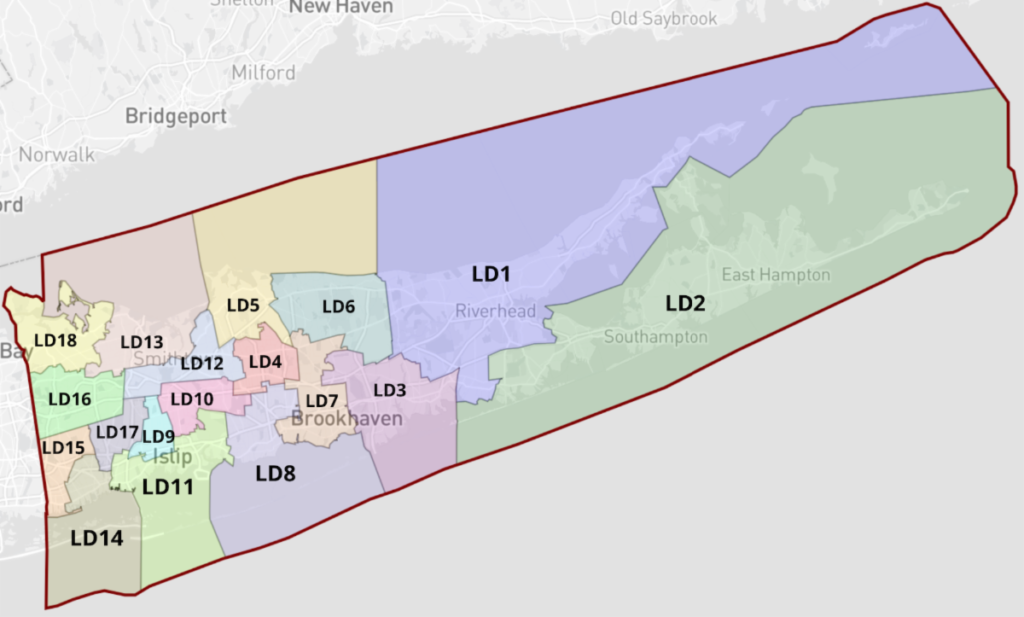

Modern Map Suffolk County With District Labels Vector Image

https://cdn2.vectorstock.com/i/1000x1000/09/31/modern-map-suffolk-county-with-district-labels-vector-23600931.jpg

/GettyImages-124248414-5a1f06e696f7d000191126f2.jpg)

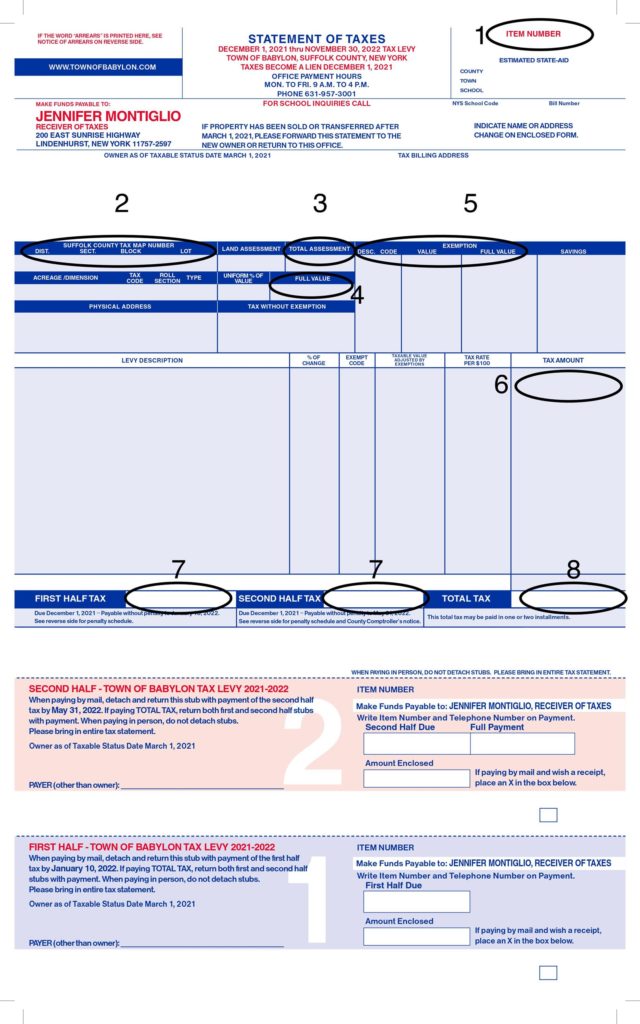

How To Find Your Tax Map Number In Suffolk County NY

https://www.tripsavvy.com/thmb/nHSVS-hXIT15_Lee7j-na6rxB-I=/2120x1414/filters:fill(auto,1)/GettyImages-124248414-5a1f06e696f7d000191126f2.jpg

4 Options When Facing Back Property Taxes Nassau Suffolk County NY

https://leavethekey.com/wp-content/uploads/2020/04/Facing-Back-Property-Taxes-in-Nassau-or-Suffolk-County-New-York.jpg

Verkko Where can I pay my past due property taxes A Please contact the Suffolk County Comptroller s office at 631 852 3000 or on the web at Verkko The Suffolk County Comptroller s Office administers the collection of delinquent property taxes the county hotel motel tax and bail while maintaining and protecting the records of the nearly 600 000 property tax parcels in the County

Verkko APPLY ONLINE We Specialize in Grieving Property Taxes on Long Island Call or Text us 516 776 4744 APPLY TODAY SUFFOLK DEADLINE MAY 2024 NASSAU DEADLINE MARCH 2024 Overpaying Find out instantly if you could save 44 Thanks Message sent Calculate NO REDUCTION NO FEE Pay Just 50 of First Years Verkko 31 elok 2023 nbsp 0183 32 Senior citizens exemption Local governments and school districts in New York State can opt to grant a reduction on the amount of property taxes paid by qualifying senior citizens This is accomplished by reducing the taxable assessment of the senior s home by as much as 50

Complete Guide For 2023 Property Taxes In Suffolk County Property Tax

https://i0.wp.com/hellertaxgrievance.com/wp-content/uploads/2022/11/suffolk-county-property-taxes-2023.png

What You Need To Know About Nassau County Commercial Property Tax

https://www.propertytaxrefund.com/wp-content/uploads/2021/12/iStock-494431417.jpg

https://www.wshu.org/long-island-news/2022-06-13/long-island...

Verkko 13 kes 228 k 2022 nbsp 0183 32 Wikimedia Commons Homeowners on Long Island who earn less than 250 000 per year will automatically receive a property tax rebate from the state To qualify homeowners must be eligible for a

https://hellertaxgrievance.com/complete-guide-for-2023-property-taxes...

Verkko Suffolk County s median tax bill 9 472 New York median tax bill 8 081 United States median tax bill 3 399 If you accept the median Suffolk County tax assessment then over ten years time you are going to pay nearly 14 000 more than the average New York resident and over 60 000 more than the average American

Sign The Petition To Support The Suffolk County Redistricting Maps

Complete Guide For 2023 Property Taxes In Suffolk County Property Tax

Nassau Suffolk County Tax Grievance Processes Differences

Suffolk County Property Tax Grievance Deadline YouTube

Suffolk County Tax Lien Auction 2024 Valli Isabelle

Mid Suffolk Council Tax Rise And 25 Million In Property Investment

Mid Suffolk Council Tax Rise And 25 Million In Property Investment

Nassau Suffolk Long Island NYC Real Estate Property Tax Reduction

Property Tax Reduction Consultants Tick Tock Suffolk County s

Nassau Suffolk Long Island NYC Real Estate Property Tax Reduction

Suffolk County Property Tax Reduction - Verkko The County Comptroller is also authorized to accept partial payments of a minimum of 200 towards any outstanding property tax For additional information please contact the Suffolk County Comptroller s Office at 631 852 3000 or go to our website at www suffolkcountyny gov