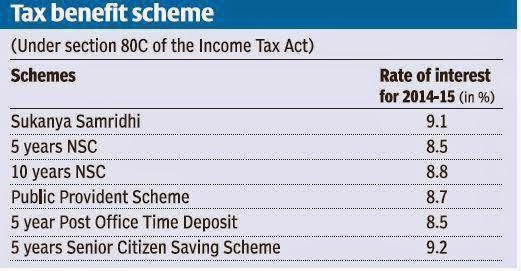

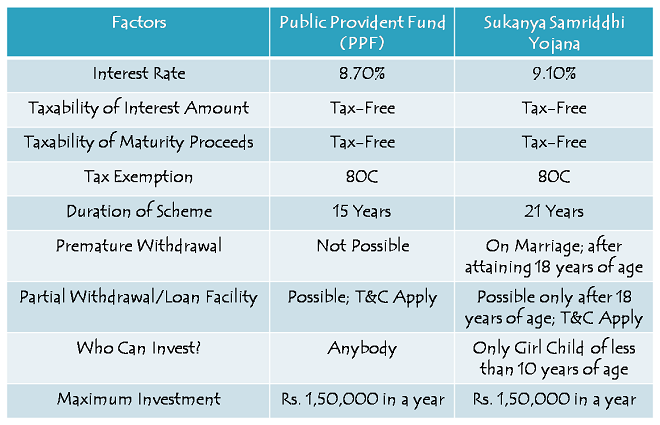

Sukanya Samriddhi Yojana Income Tax Rebate Web 24 sept 2021 nbsp 0183 32 1 Investment made under Sukanya Samriddhi Yojana Scheme is eligible for deduction under Section 80C conditional on maximum of Rs 1 5 lakh 2 The interest

Web 21 sept 2022 nbsp 0183 32 Tax Benefits Investments made in the sukanya yojana are eligible for a tax deduction You can claim a deduction upto Rs 1 5 lakh under section 80C Also interest earned and maturity amount are also Web 17 f 233 vr 2022 nbsp 0183 32 The Sukanya Samriddhi Yojana scheme is currently offering 7 6 for the quarter ending September 30 2022 The scheme comes with various tax benefits For

Sukanya Samriddhi Yojana Income Tax Rebate

Sukanya Samriddhi Yojana Income Tax Rebate

https://assets1.cleartax-cdn.com/cleartax/images/1619423810_image1.png

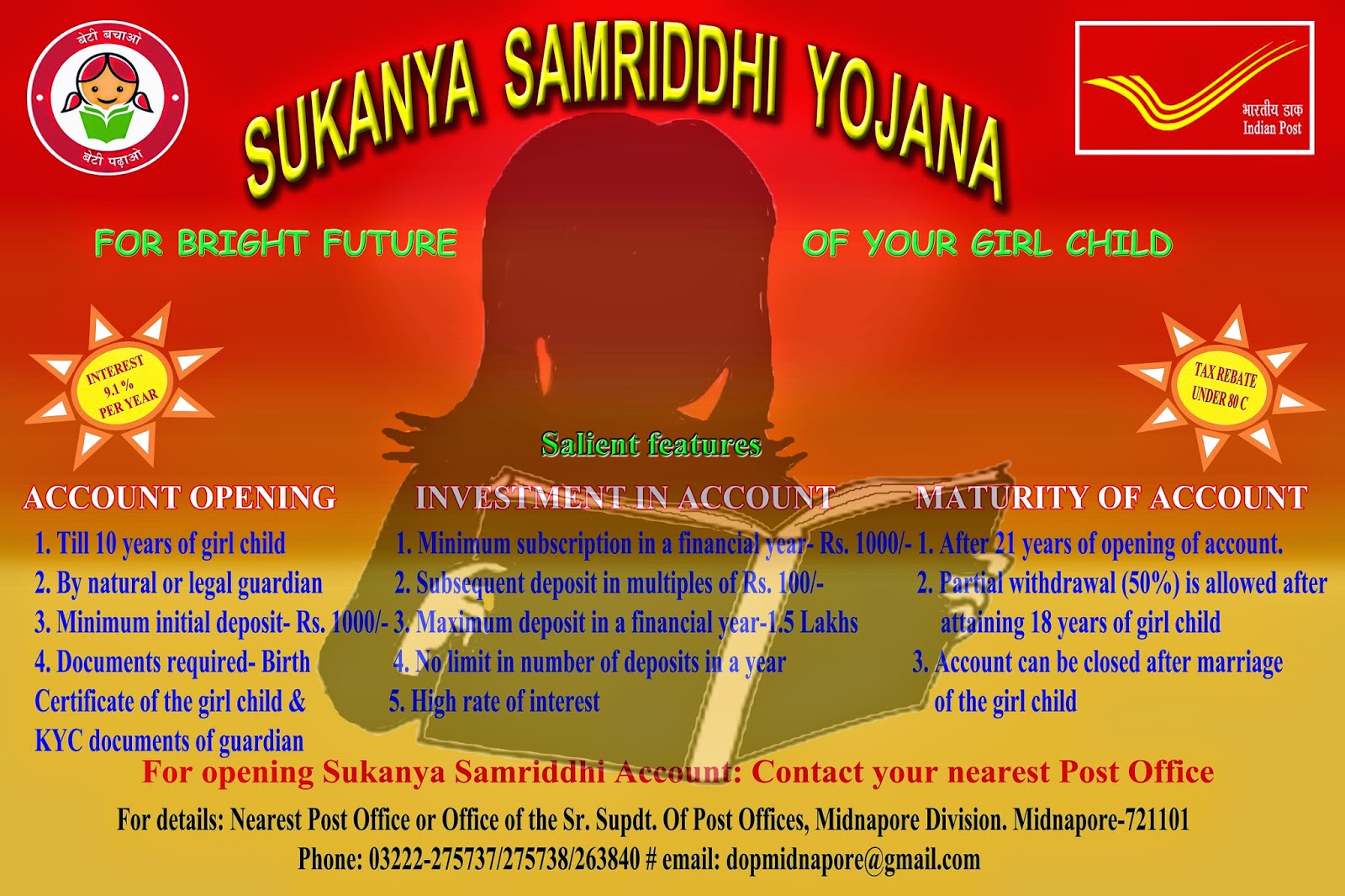

Sukanya Samriddhi Yojana

https://studycafe.in/wp-content/uploads/2021/09/SUKANYA-SAMRIDDHI-YOJANA-AND-TAX-BENEFITS-AROUND-IT.jpg

Sukanya Samriddhi Account Details Guide Updated 2023 With Tax

https://i0.wp.com/stableinvestor.com/wp-content/uploads/2015/04/Sukanya-Samriddhi-Account-Chart.png?fit=577%2C457&ssl=1

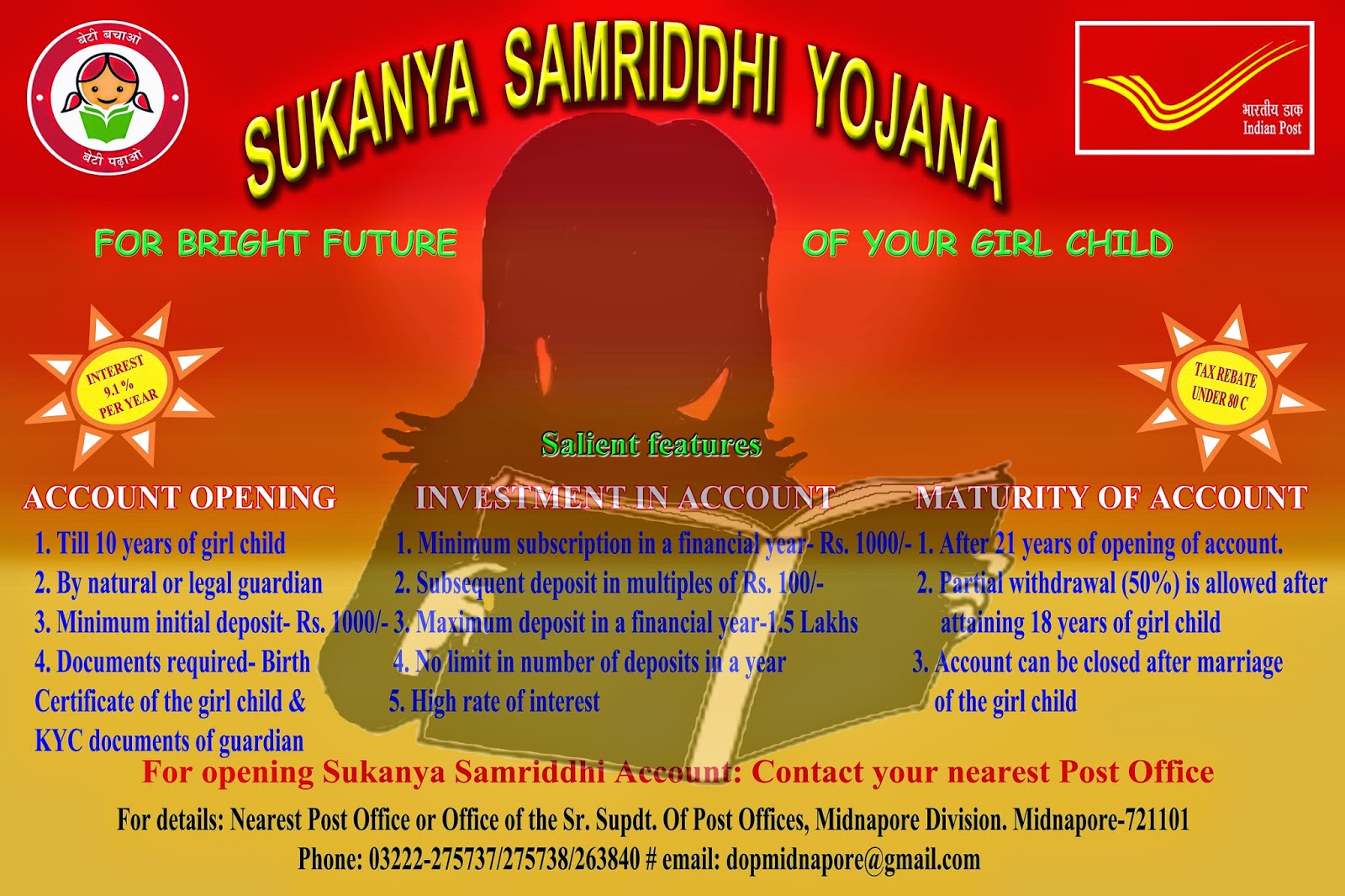

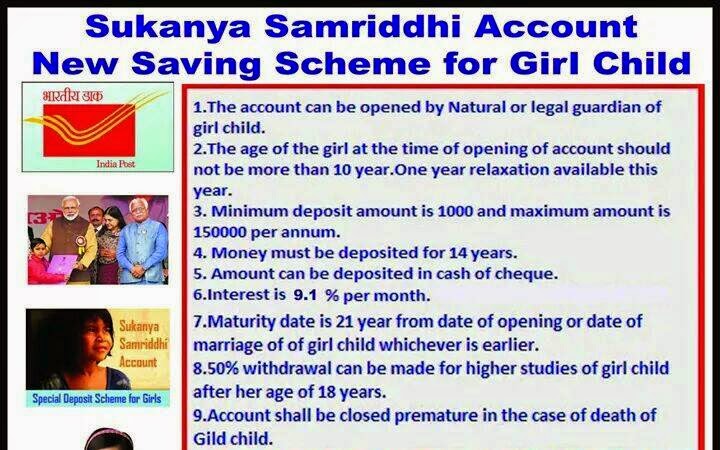

Web 9 ao 251 t 2018 nbsp 0183 32 Sukanya Samriddhi Account Scheme is a small deposit scheme for girl child as part of Beti Bachao Beti Padhao campaign which would provide income tax Web 13 juin 2020 nbsp 0183 32 Latest News Date 20 May 2021 The Income Tax Department extends the following due dates Income Tax Return filing date extended to 31st Dec 21 from 30th

Web 4 ao 251 t 2023 nbsp 0183 32 Sukanya Samriddhi Yojana is a government backed small savings scheme for the benefit of a girl child It is a part of the Web 10 ao 251 t 2018 nbsp 0183 32 Sukanya Samriddhi Yojana Eligibility Tax Benefits Rules All you need to know The Financial Express Stock Stats Top Gainers Top Losers Indices Nifty 50

Download Sukanya Samriddhi Yojana Income Tax Rebate

More picture related to Sukanya Samriddhi Yojana Income Tax Rebate

Sukanya Samriddhi Yojna How To Open SSY Account Tax Benefits Tax2win

https://emailer.tax2win.in/assets/guides/ssy/sukanya-samriddhi-yojana.jpg

Sukanya Samriddhi Yojana SSY Calculator Your Child May Have 51 Lakh

https://www.livemint.com/lm-img/img/2023/05/20/600x338/Sukanya_Samriddhi_Yojana_SSY_calculator_1684551801758_1684551801959.jpg

Sukanya Samriddhi Account Yojana At A Glance SA POST

http://4.bp.blogspot.com/-Pm2s4SuGVJ8/VN43JvF7K4I/AAAAAAAAS-E/PUcDWu5cvE0/s1600/TAX%2BBenefit.jpg

Web 30 juin 2023 nbsp 0183 32 The scheme falls within the purview of section 80C of the income tax act of India 1961 Hence your contributions towards it are eligible for tax exemption for up to 1 5 lakh Here the maximum Web 25 f 233 vr 2020 nbsp 0183 32 The Sukanya Samriddhi Yojana is a government backed small deposit scheme for a girl child and her financial needs It was launched as part of the Beti

Web 31 mai 2023 nbsp 0183 32 In Sukanya Samriddhi Yojana the minimum deposit amount is 250 which was Rs 1000 before 5 July 2018 and the maximum deposit 1 5 Lakh in a financial Web 1 sept 2023 nbsp 0183 32 The Minimum Investment is 250 per annum The Maximum Investment is 1 50 000 per annum The Maturity Period is 21 years At present SSY has several tax

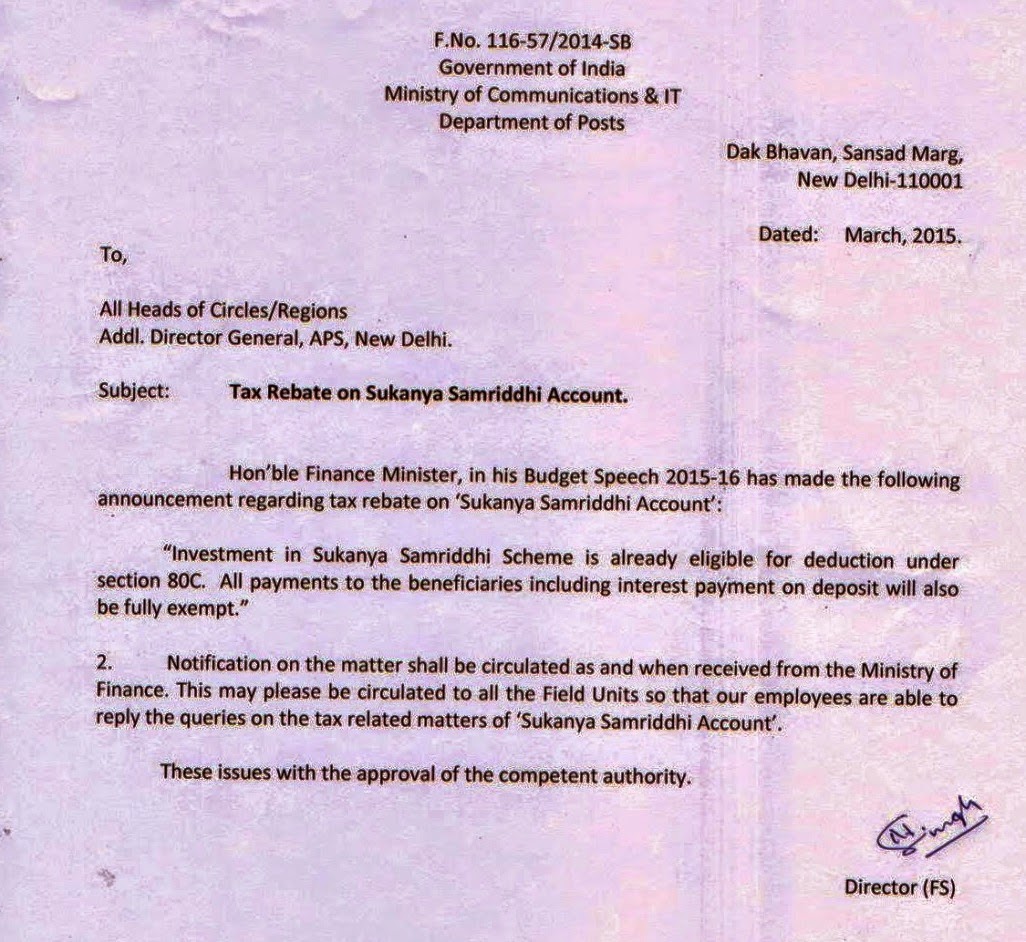

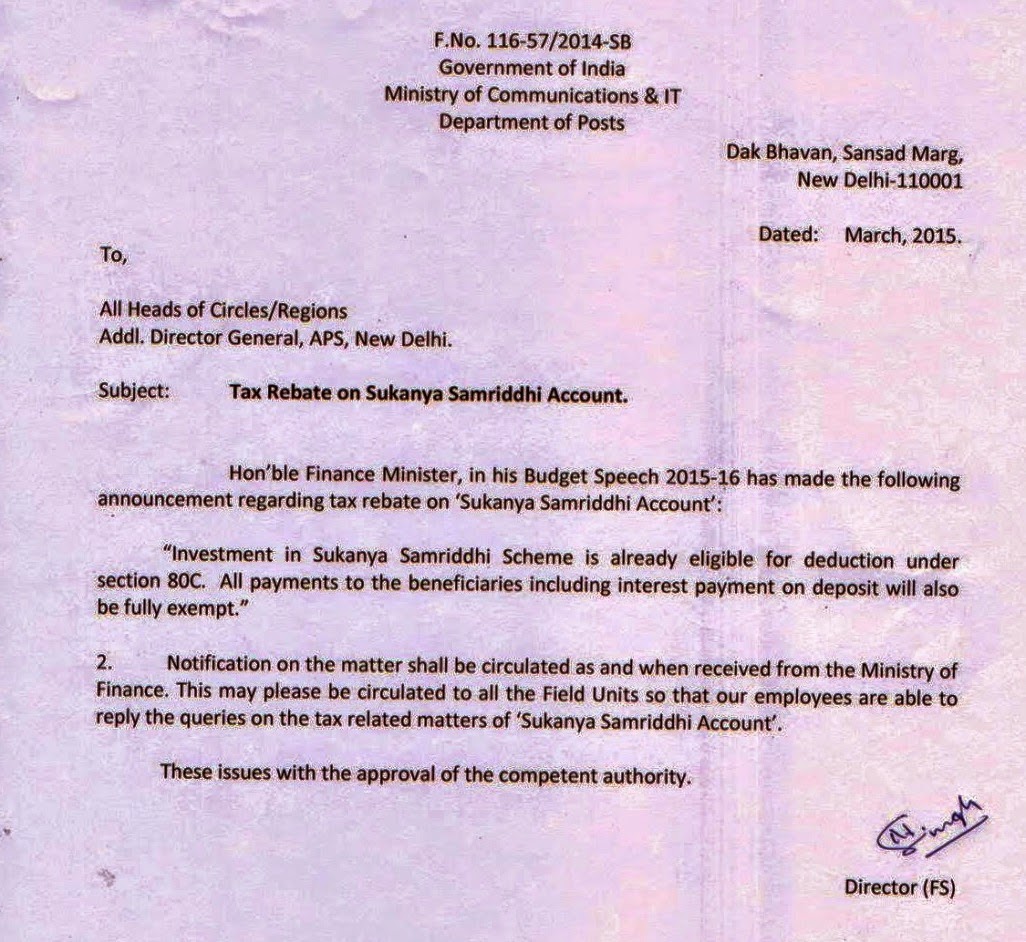

Tax Rebate On Sukanya Samridhi Account SSA SA POST

https://2.bp.blogspot.com/-yX9deV4dyy8/VPacV44Z_WI/AAAAAAAATjk/pFd1UTJ3gAI/s1600/SSA.jpeg

Sukanya Samriddhi Yojana Scheme Eligibility Tax Benefit Account

https://i.pinimg.com/originals/d4/39/6c/d4396cea2e0add6804ff00d8b9bf1064.jpg

https://taxguru.in/income-tax/sukanya-samriddhi-yojana-tax-benefits.html

Web 24 sept 2021 nbsp 0183 32 1 Investment made under Sukanya Samriddhi Yojana Scheme is eligible for deduction under Section 80C conditional on maximum of Rs 1 5 lakh 2 The interest

https://www.etmoney.com/learn/saving-schem…

Web 21 sept 2022 nbsp 0183 32 Tax Benefits Investments made in the sukanya yojana are eligible for a tax deduction You can claim a deduction upto Rs 1 5 lakh under section 80C Also interest earned and maturity amount are also

Sukanya Samriddhi Account SSA Deposits Eligible For Deduction U s

Tax Rebate On Sukanya Samridhi Account SSA SA POST

Sukanya Samriddhi Yojana How To Accumulate 63 Lakh When Your Girl

Sukanya Samriddhi Yojana Account SSY SSA Scheme Details Calculator And

Sukanya Samridhi Yojana Pritivesh Wikipedia

Sukanya Samriddhi Yojana Banners And Training Materials PPT SA POST

Sukanya Samriddhi Yojana Banners And Training Materials PPT SA POST

Sukanya Samriddhi Account Saving Scheme For Girl Child SA POST

Revealed Is It Good To Invest In Sukanya Samriddhi Yojana For Your

Sukanya Samriddhi Yojana Tax Free Small Savings Scheme For A Girl

Sukanya Samriddhi Yojana Income Tax Rebate - Web 10 ao 251 t 2018 nbsp 0183 32 Sukanya Samriddhi Yojana Eligibility Tax Benefits Rules All you need to know The Financial Express Stock Stats Top Gainers Top Losers Indices Nifty 50