Tax Back On Rental Property You can deduct expenses from your rental income when you work out your taxable rental profit as long as they are wholly and exclusively for the purposes of

The first 1 000 of your income from property rental is tax free This is your property allowance Contact HM Revenue and Customs HMRC if your income from property In general we recommend that you report the rental income you receive and the expenses of renting in advance This way your taxes are kept up to date and you will not have to pay any back tax later The final deadline for reporting is when you

Tax Back On Rental Property

Tax Back On Rental Property

https://turbotax.intuit.ca/tips/images/rental-income-tax.jpg

Income Tax On Rental Property Income In India Income Tax On House

https://i.ytimg.com/vi/XwTRJ6_b5no/maxresdefault.jpg

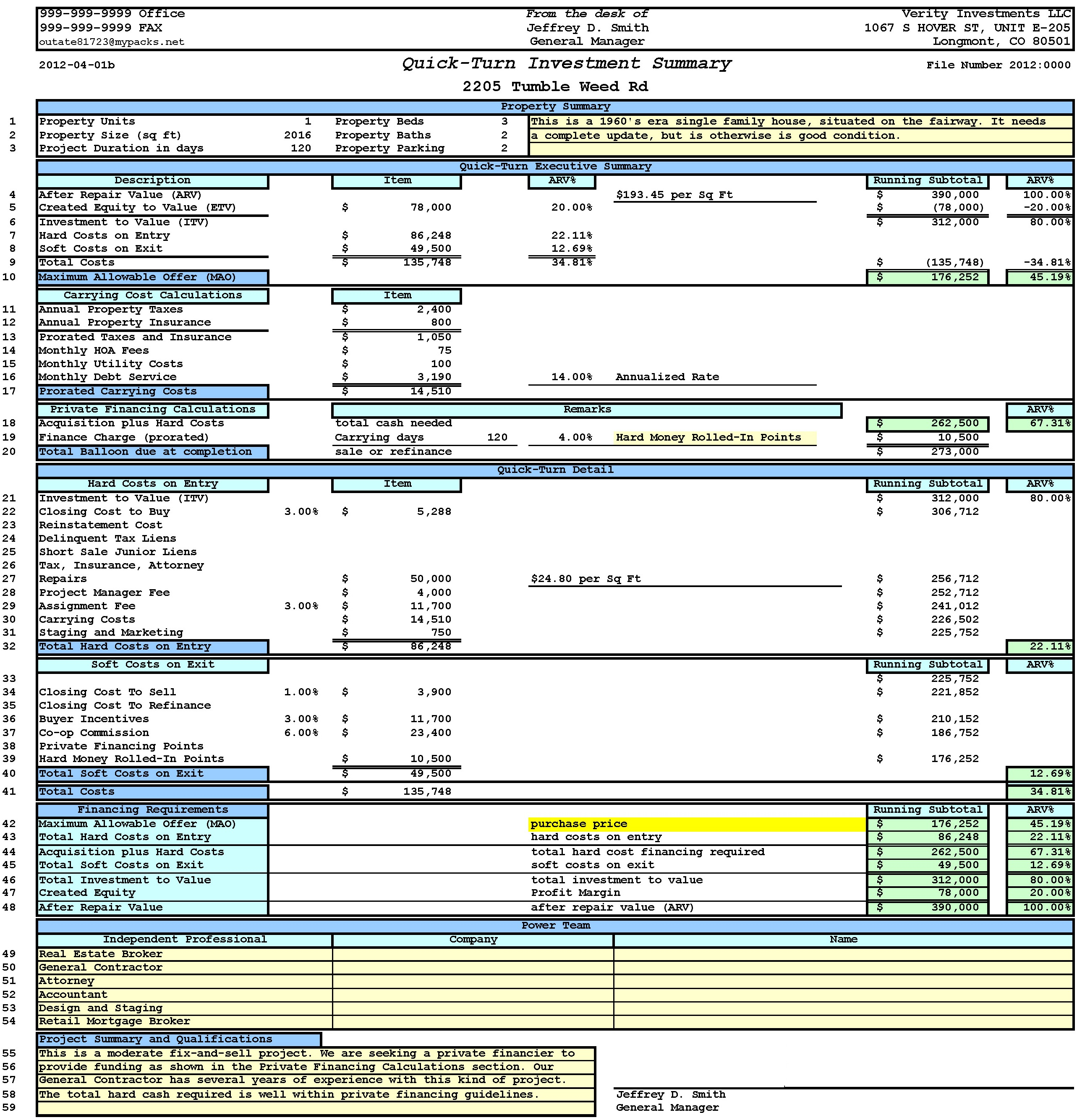

Rental Property Tax Deductions A Comprehensive Guide Credible Cash

https://i.pinimg.com/originals/8e/f4/2c/8ef42c9ab3dffc9b087a7a496909a1de.png

Rental income tax breakdown Your rental earnings are 18 000 You can claim 1 000 as a tax free property allowance As a result your taxable rental income will be 17 000 The first 12 270 will be taxed at 20 You can reduce your tax bill as a landlord by deducting many of the expenses you incur when letting out a property Find out how these work and what you can claim

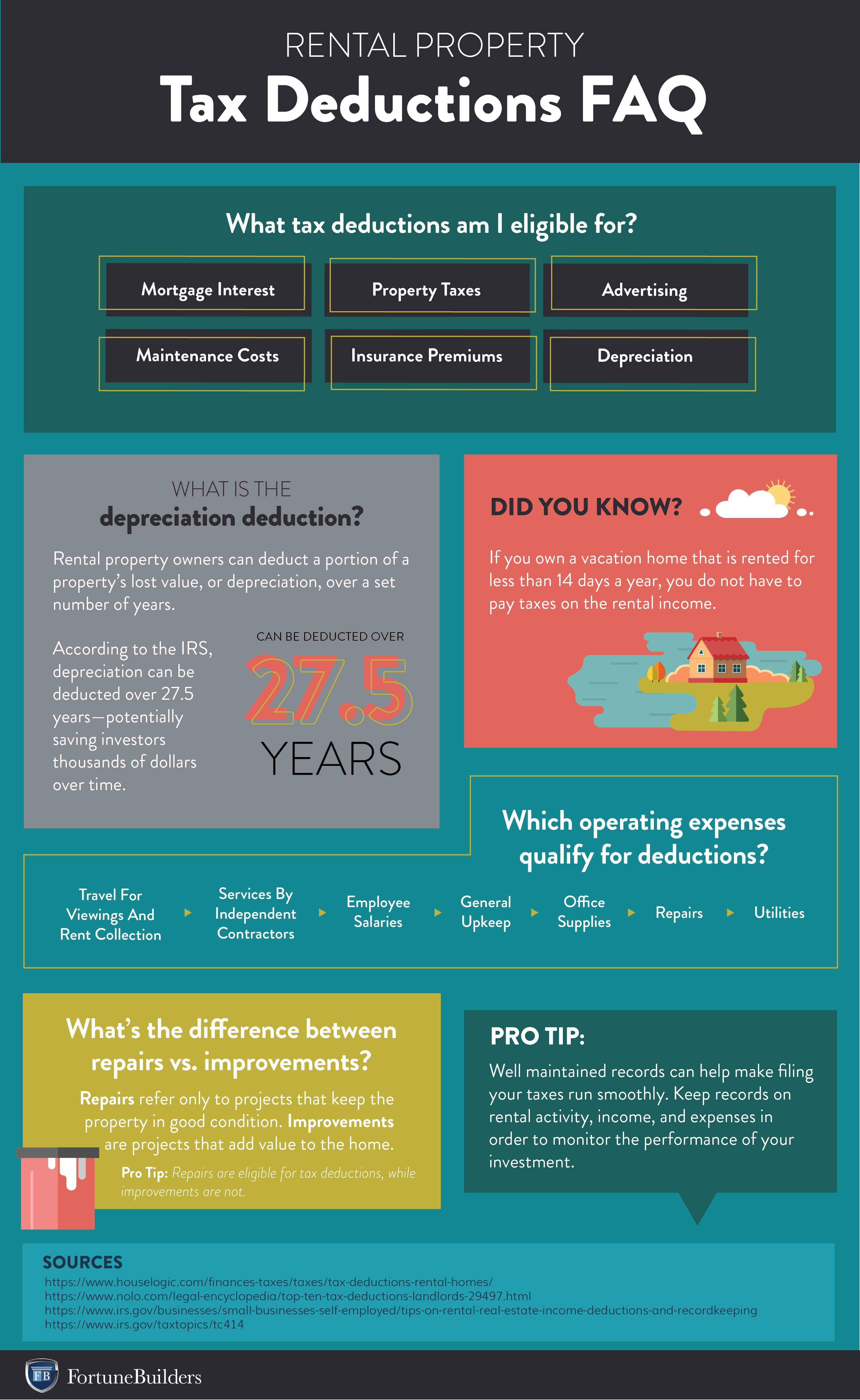

In this article we ll explain how rental income tax rates work and how to use expenses from owning and operating a rental property to reduce taxable net income while still having plenty of free cash flow Broadly if a person makes an overall loss from a UK property business in a tax year the loss can be relieved in one or more of the following ways by being carried forward to set against future profits of the same UK property business

Download Tax Back On Rental Property

More picture related to Tax Back On Rental Property

3 Ways To Claim Tax Back WikiHow

https://www.wikihow.com/images/c/ca/Claim-Tax-Back-Step-15-Version-2.jpg

Rental Agreement Templates Lease Agreement Rental Property Property

https://i.pinimg.com/originals/91/68/6d/91686daef156789ec87b496946ac453c.jpg

Is Insurance Claim On Rental Property Taxable ALLCHOICE Insurance

https://allchoiceinsurance.com/wp-content/uploads/2021/05/Is-Insurance-Claim-on-Rental-Property-Taxable-ALLCHOICE-Insurance-North-Carolina-1024x576.jpg

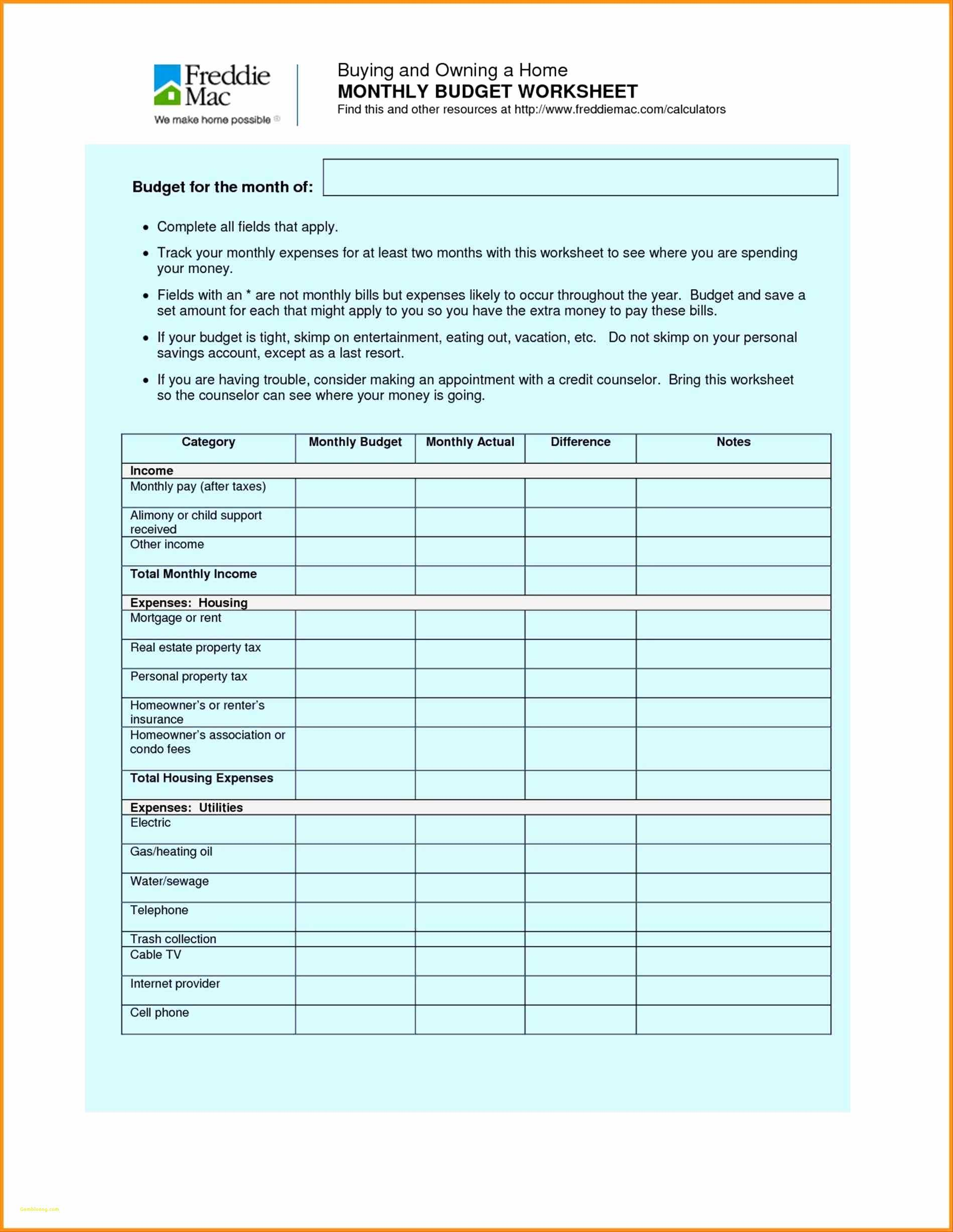

If you receive rental income from the rental of a dwelling unit there are certain rental expenses you may deduct on your tax return These expenses may include mortgage You will usually need to fill in a self assessment tax return if you earn money from renting out property The deadline for making a paper tax return is 31 October For an online return the deadline is 31 January the

There are 25 main rental property deductions that most real estate investors can take to reduce taxable net income Expenses may be deducted for items such as normal Photo RNZ More than 50 000 property investors are losing money on their rentals Inland Revenue data shows Information released under the Official Information

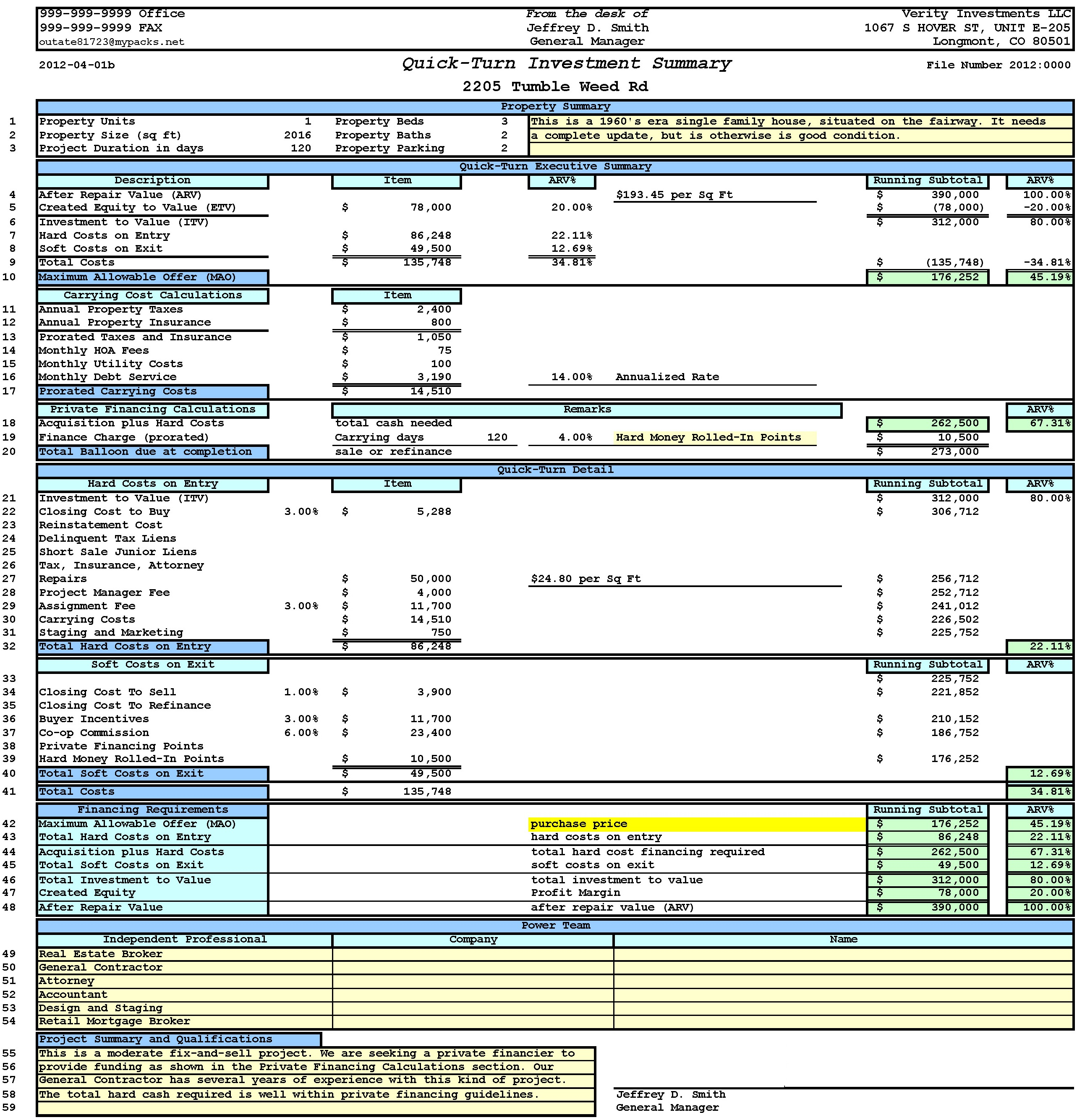

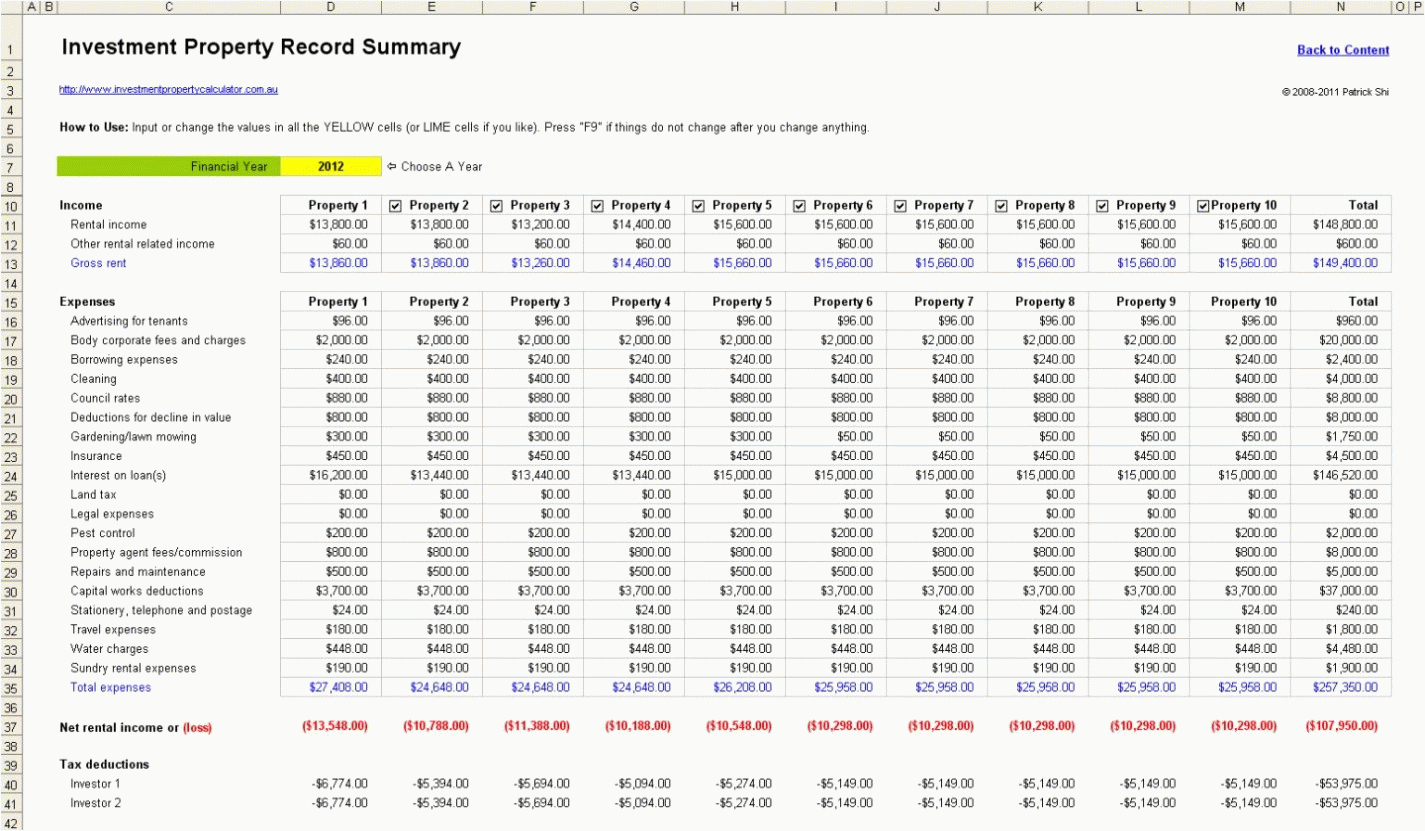

Rental Home Spreadsheet Pertaining To Rental Property

https://db-excel.com/wp-content/uploads/2019/01/rental-property-spreadsheet-template-free-pertaining-to-rental-property-return-on-investment-spreadsheet-management-free.jpg

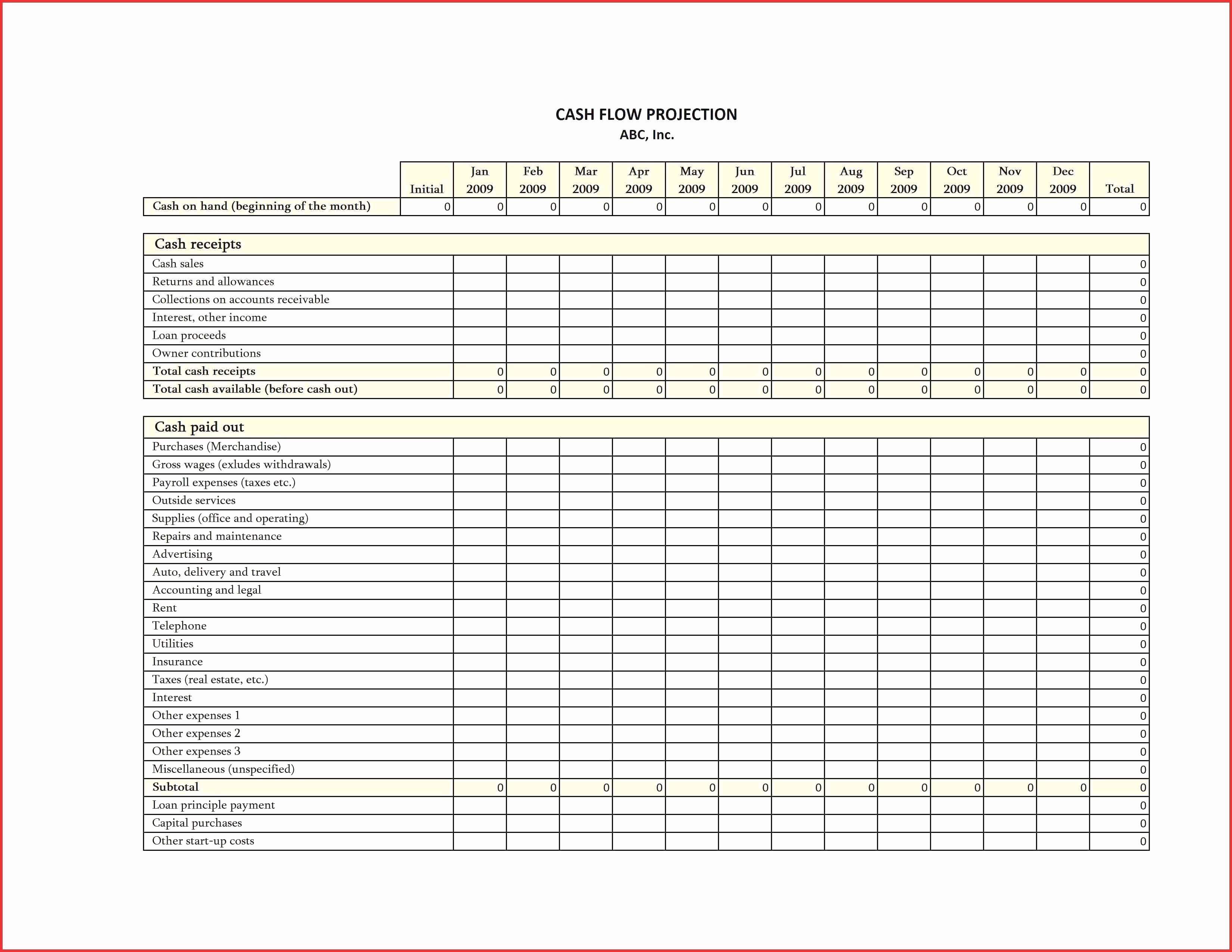

Tax Expenses Template

https://db-excel.com/wp-content/uploads/2019/01/tax-return-spreadsheet-australia-regarding-rental-property-expenses-spreadsheet-template-australia-expense.jpg

https://www.gov.uk/guidance/income-tax-when-you...

You can deduct expenses from your rental income when you work out your taxable rental profit as long as they are wholly and exclusively for the purposes of

https://www.gov.uk/renting-out-a-property/paying-tax

The first 1 000 of your income from property rental is tax free This is your property allowance Contact HM Revenue and Customs HMRC if your income from property

Can I Claim Back Tax Paid In The US

Rental Home Spreadsheet Pertaining To Rental Property

Rental Income Template

Rental Income Tax Rate Calculator Info Slott

Learn How To Sell Your Rental Property Development Business In Just 9

Spreadsheet For Rental Income And Expenses With Rental Income

Spreadsheet For Rental Income And Expenses With Rental Income

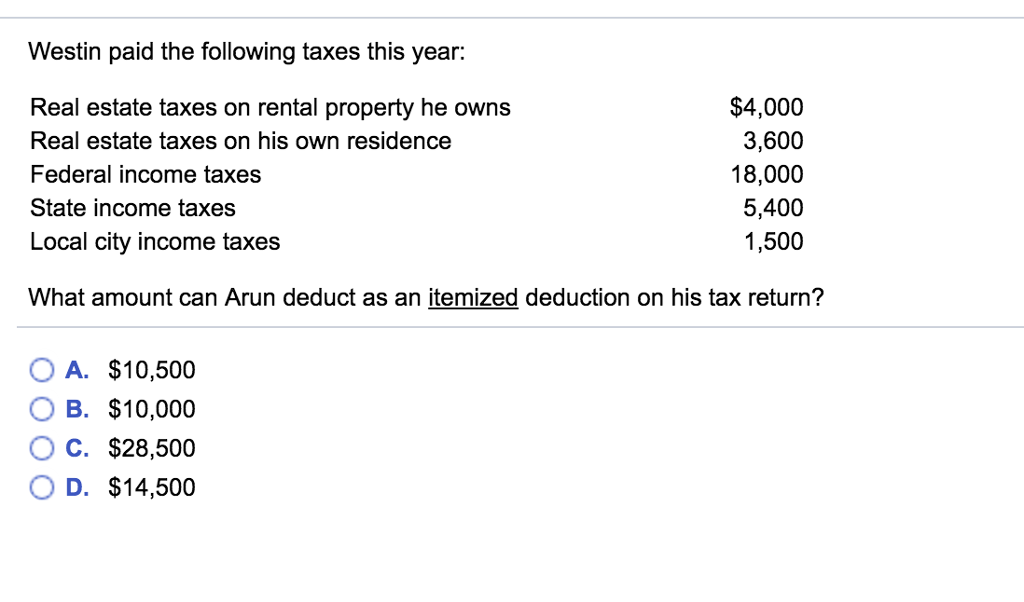

Solved Westin Paid The Following Taxes This Year Real Chegg

How Is Rental Income Taxed What You Need To Know FortuneBuilders

Historic Returns From Investing In Rental Homes Arrived Learning

Tax Back On Rental Property - If you rent out a property for more than 14 days during the year you must report the rental income on your tax return and the net income is taxable as ordinary income