Tax Benefit Ev Vehicle The updated 2024 edition offers a comprehensive look at the tax benefits and incentives for electric vehicles and charging infrastructure in the 27 EU member states Iceland Norway Switzerland and the United Kingdom

The current electric car Benefit in Kind BIK rate for the year 2023 is 2 This means that users of electric company cars will be liable to pay tax on 2 of the vehicle s list price with the exception of commercial electric vans Regarding tax benefits for acquisition passenger cars and combined zero emission vehicles used for commercial purposes both battery electric vehicles BEVs and fuel cell electric vehicles FCEVs enjoy VAT

Tax Benefit Ev Vehicle

Tax Benefit Ev Vehicle

https://www.clm.co.uk/wp-content/uploads/2019/07/Company-Car-Tax-Tables-10th-july-2019-before2020.png

Ev Sales In The Us 2022 House Infrastructure Bill Includes New Tax

https://cleantechnica.com/files/2020/10/US-EV-BEV-PHEV-Share-of-New-Vehicle-Sales-2015-2021.png

Tax Benefit From Electric Vehicle

https://taxguru.in/wp-content/uploads/2022/05/Tax-Benefit-from-Electric-Vehicle.jpg

Electric cars with zero emissions fall into the lowest benefit in kind tax band resulting in lower tax liabilities for employees This makes electric vehicles very attractive for businesses and employees As a comparison the EV buyers can claim up to 1 5 lakh income tax deduction on the interest paid for vehicle loans under section 80EEB of the IT Act The all electric Hyundai Ioniq 5 launched earlier this year

Tax Benefit MOST IMPORTANT THING You get a deduction of Rs 1 50 000 under section 80EEB on the interest paid on loan taken to buy Electric vehicles Low GST rate The government has reduced the rate of Charging of electric vehicles at workplace is exempted from income tax 2021 2025 Purchase incentive of 2 000 granted for households to purchase or lease a new BEV in class M1 and M1G provided value 50 000 Incentive is valid

Download Tax Benefit Ev Vehicle

More picture related to Tax Benefit Ev Vehicle

Tax Benefit For Electric Vehicle Purchase Loan

https://www.basunivesh.com/wp-content/uploads/2022/07/Section-80EEB-Tax-Benefit-for-electric-vehicle.png

2021 Electric Car Tax Credit Irs Galore Blogging Picture Show

https://evadoption.com/wp-content/uploads/2019/03/Sample-EVs-Federal-EV-tax-credit-amount-calculation.png

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://electrek.co/wp-content/uploads/sites/3/2021/01/EV-Federal-Tax-Credits.jpg?quality=82&strip=all&w=1600

Explore the benefits of Section 80EEB providing a deduction for interest paid on loans for Electric Vehicles EVs Understand the eligibility criteria quantum of deduction and conditions for availing this tax benefit Tax Incentives for Electric Cars Income Tax Deduction Section 80EEB of the Income Tax Act allows buyers of electric vehicles to claim tax savings of up to Rs 1 50 000 on the interest paid on a loan obtained

If you get a company car at work you ll get taxed on it as a benefit in kind But this tax rate is currently just 2 of the list price for company EVs far less than the 20 or 40 Discover the tax benefits of electric vehicles under Section 80EEB in this comprehensive post Learn about eligibility and how to maximize your EV tax benefits at 5paisa

Company BIK And Road Tax Benefits On Electric Company Cars OVO Energy

https://www.ovobyus.com/transform/8e525380-7cdb-4f69-986e-f9f368404f08/?&io=transform:fill,width:900&format=png

ICE Versus EV The Business Case For Fleets To Change Broker News

https://brokernews.co.uk/wp-content/uploads/2020/08/ICEvcEV.jpg

https://www.acea.auto › fact

The updated 2024 edition offers a comprehensive look at the tax benefits and incentives for electric vehicles and charging infrastructure in the 27 EU member states Iceland Norway Switzerland and the United Kingdom

https://electriccarguide.co.uk › what-are-the...

The current electric car Benefit in Kind BIK rate for the year 2023 is 2 This means that users of electric company cars will be liable to pay tax on 2 of the vehicle s list price with the exception of commercial electric vans

Electric Vehicle Cost Benefit Analysis Arizona Atlas EV Hub

Company BIK And Road Tax Benefits On Electric Company Cars OVO Energy

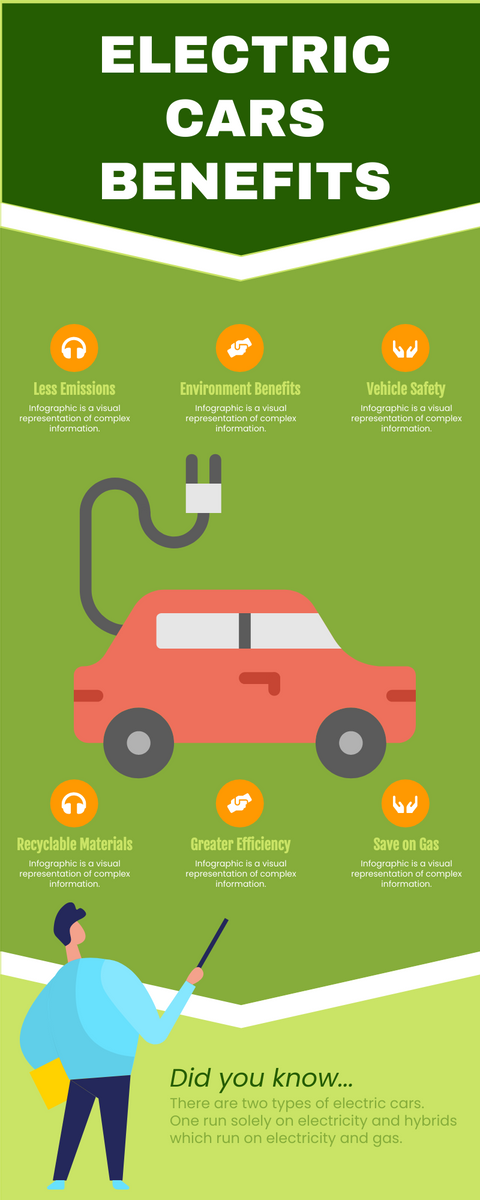

Benefits Of Electric Vehicles Infographic Infographic Template

Electric Vehicle Cost Benefit Analysis Plug in Electric Vehicle Cost

Proposed 15 000 EV Tax Credit Would Tesla Benefit Torque News

Here Are The Benefits Of Electric Vehicles infographic Infographic

Here Are The Benefits Of Electric Vehicles infographic Infographic

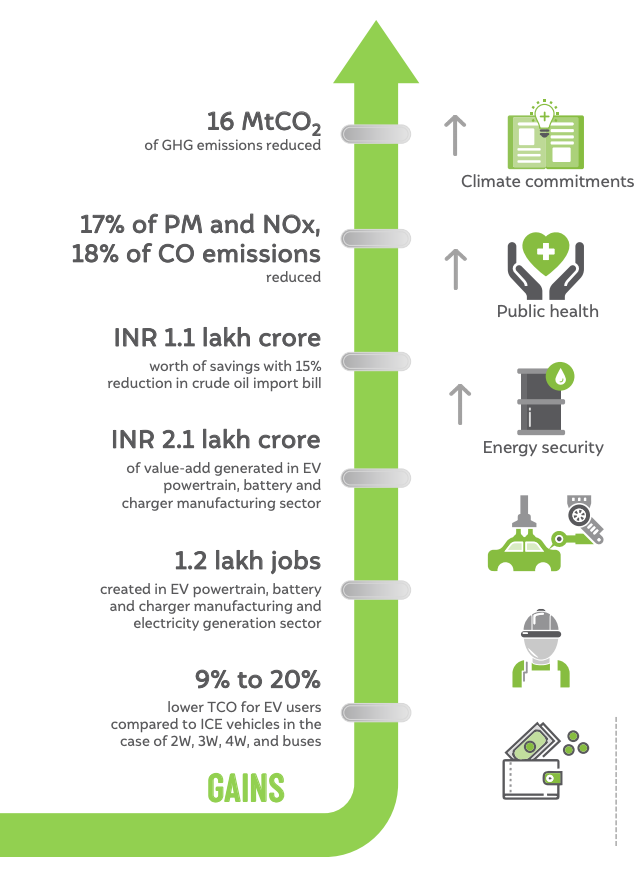

How Electric Vehicle Transition Can Impact India s Economy In 2030

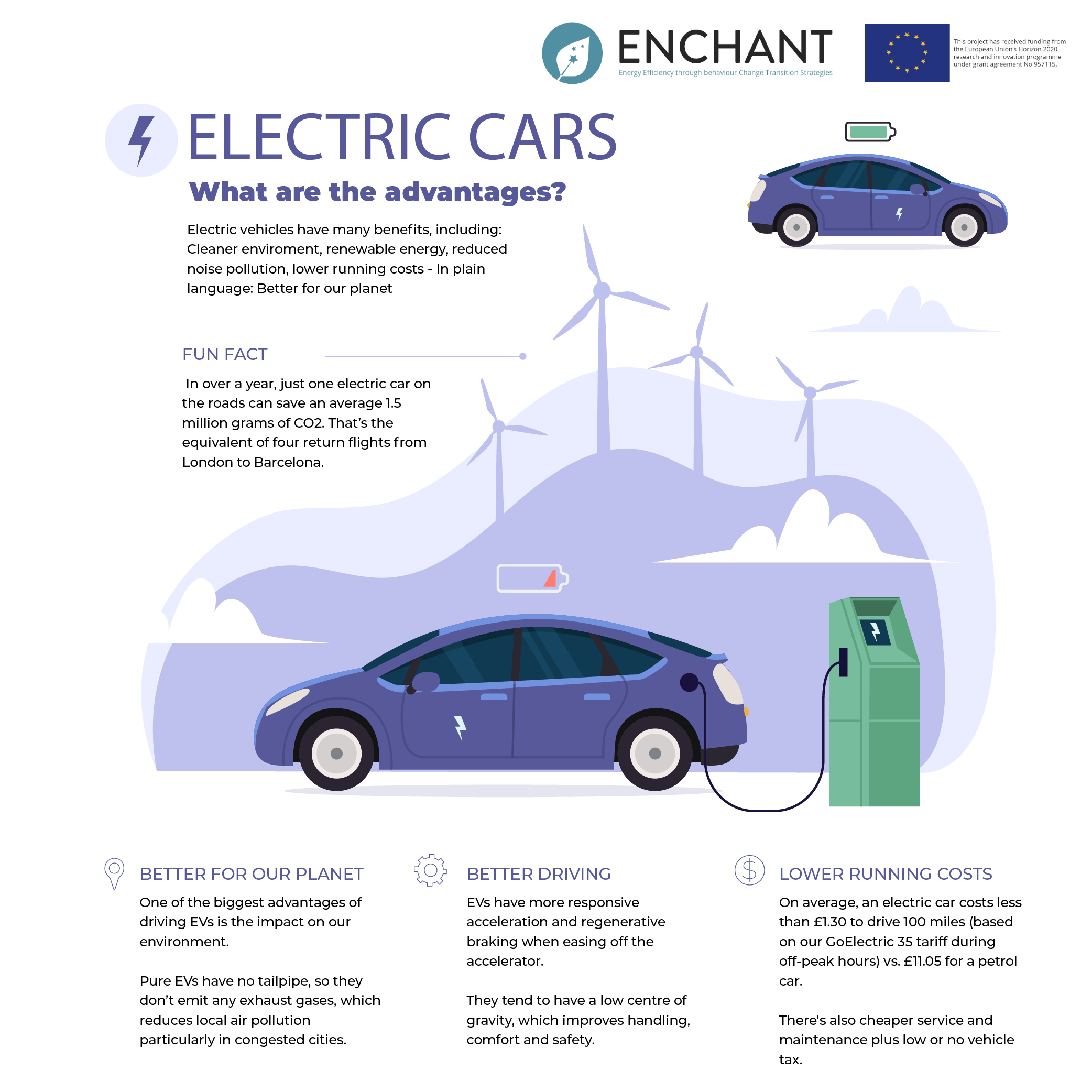

Electric Cars What Are The Advantages Enchant

Electric Vehicle EV Incentives Rebates

Tax Benefit Ev Vehicle - EV buyers can claim up to 1 5 lakh income tax deduction on the interest paid for vehicle loans under section 80EEB of the IT Act The all electric Hyundai Ioniq 5 launched earlier this year