Tax Benefit On Electric Bike If you have a bicycle owned or leased by your employer in your personal use you are considered to receive a bicycle benefit The bicycle benefit is exempt from tax up to 1 200

With this invoice you ll be able to reclaim the VAT and reduce your corporation tax bill too For example buying a 1 200 bike you d be able to claim back 200 in VAT and another 190 in The Cycle to Work Scheme is a tax efficient way to encourage employees to travel to and from work by bike You can use the Cycle to Work scheme for both electric e bikes

Tax Benefit On Electric Bike

Tax Benefit On Electric Bike

https://api.brusselstimes.com/wp-content/uploads/2021/09/for-sale-c-tierra-mallorca-unsplash-1024x769.jpg

Tax Benefit On Electric Vehicles Inside Narrative

https://insidenarrative.com/wp-content/uploads/2022/12/Tax-Benefits-On-Electric-Vehicles-1024x576.jpg

Income Tax Benefit On Second Home Loan Complete Guide

https://assetyogi.b-cdn.net/wp-content/uploads/2017/06/income-tax-benefit-on-second-home-loan-889x500-768x432.jpg

Electric bikes There are also tax benefits to be had from a two wheeled perspective With the Cycle to Work scheme companies can offer a tax free benefit to employees Under Section 80EEB you can get tax benefit of up to Rs 1 5 lacs for the interest paid towards the loan taken to purchase an electric vehicle The benefit is available for purchase of both electric bikes and car

The blog explains Section 80EEB a tax deduction offering up to Rs 1 5 lakh on interest for electric car loans It emphasizes eligibility amount of deduction and conditions for This blog article provides an overview of the income tax as well as VAT treatment of electric bicycles which are not motor vehicles under traffic law as of the 2019 assessment

Download Tax Benefit On Electric Bike

More picture related to Tax Benefit On Electric Bike

Tax Benefit On Health Insurance 2021 Beshak

https://cms-prod.s3.ap-south-1.amazonaws.com/Tax_Benefit_on_Health_Insurance_9747bb25e5.jpg

Avail Tax benefit On Personal Loan MY Wicked Armor

https://www.mywickedarmor.com/wp-content/uploads/2021/02/Is-there-any-Tax-Benefit-on-Personal-Loan.jpg

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

https://homefirstindia.com/app/uploads/2022/07/Untitled-design-14.png

For an E scooter with a minimum value of 2 500 applies a 13 5 deduction of half of the purchase price you can subtract from your profits Therefore you will pay less taxes over your Yes electric bikes are tax deductible in the UK You can get a reimbursed up to 1 000 for the cost of an electric bike through the Cycle to Work scheme which allows

Thanks to the tax free benefit employees can acquire a bicycle for themselves at up to 30 off The benefit covers our partner Vapaus wide range of bicycles from traditional bikes to electric bikes as well as various bike accessories EV buyers can claim up to 1 5 lakh income tax deduction on the interest paid for vehicle loans under section 80EEB of the IT Act The all electric Hyundai Ioniq 5 launched

How To Claim Tax Benefits On Home Loan Bleu Finance

https://bleu-finance.com/wp-content/uploads/2021/05/Home-Loan0428.jpg

Tax Benefit On An Electric Bike In India

https://www.hdfcergo.com/images/default-source/two-wheeler-insurance-page-images/tax-benefit-on-an-electric-bike-in-india.jpg

https://www.vero.fi › en › individuals › tax-cards-and...

If you have a bicycle owned or leased by your employer in your personal use you are considered to receive a bicycle benefit The bicycle benefit is exempt from tax up to 1 200

https://blog.accountancyextra.co.uk › blog › can-my...

With this invoice you ll be able to reclaim the VAT and reduce your corporation tax bill too For example buying a 1 200 bike you d be able to claim back 200 in VAT and another 190 in

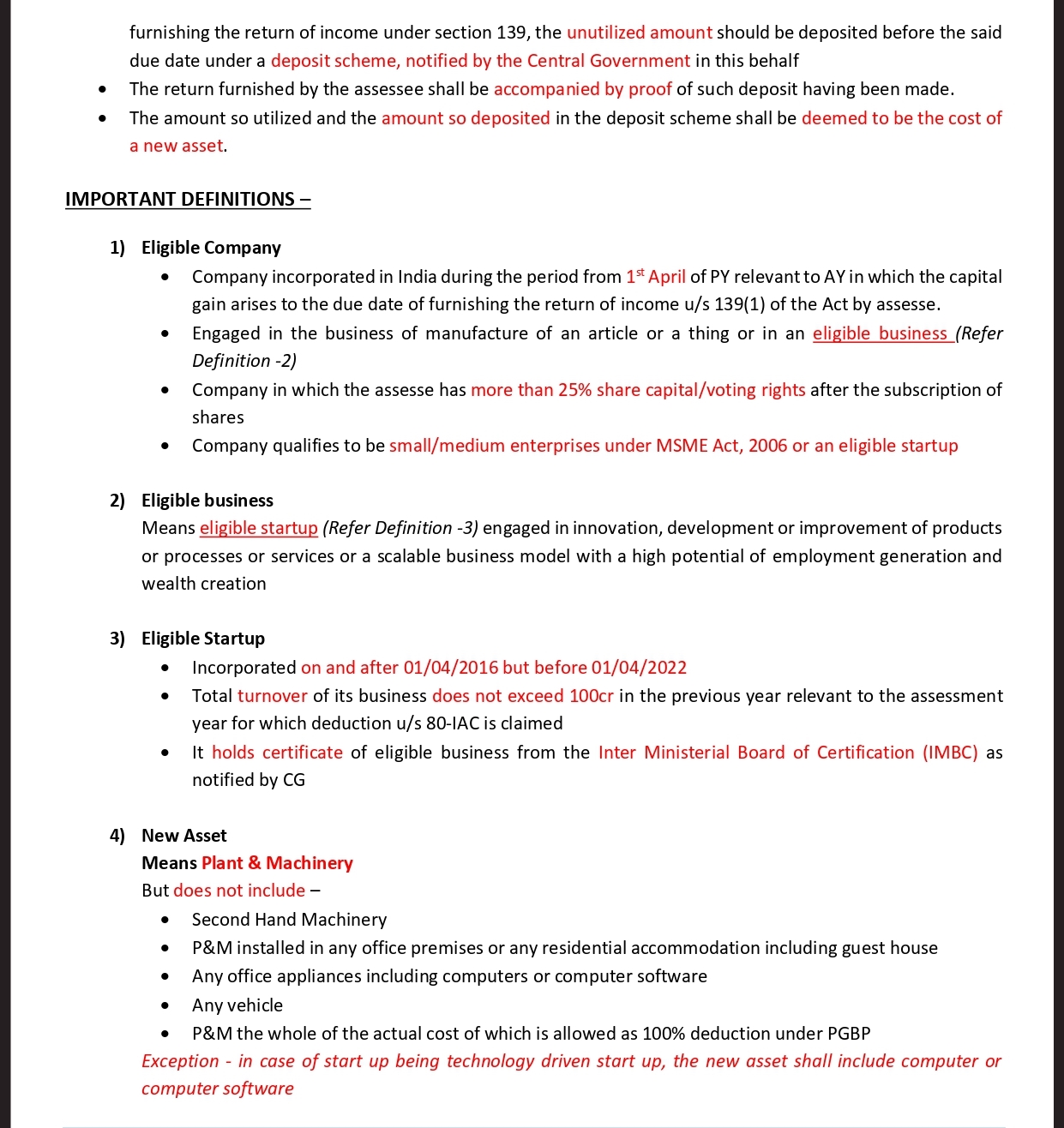

TAX BENEFIT ON INVESTMENT IN STARTUPS U S 54GB CA Rajput

How To Claim Tax Benefits On Home Loan Bleu Finance

How To Avail Tax Benefits On Personal Loan Tata Capital Blog

TAX BENEFIT ON INVESTMENT IN STARTUPS U S 54GB CA Rajput

To Tables

Electric Scooter Health Benefits In Lichfield Okai Neon Pro

Electric Scooter Health Benefits In Lichfield Okai Neon Pro

Home Loan Tax Benefit saving In 2019 20 In Hindi tax Benefit saving On

Why A Good Health Insurance Is Essential

How To Get Tax Benefit On Loan Against Property Tata Capital

Tax Benefit On Electric Bike - This blog article provides an overview of the income tax as well as VAT treatment of electric bicycles which are not motor vehicles under traffic law as of the 2019 assessment