Tax Benefit On Home Renovation What Home Improvements Are Tax Deductible in 2023 Most home improvements like putting on a new roof or performing routine maintenance don t qualify for any immediate tax breaks However some known as capital improvements may raise the value of your home

Your Home Renovation Could Be Tax Deductible Here s What You Should Know Depending on the type of renovations you may be able to save money on your taxes this year Home improvements and taxes When you make a home improvement such as installing central air conditioning or replacing the roof you can t deduct the cost in the year you spend the money But if you keep track of those expenses they may help you reduce your taxes in the year you sell your house

Tax Benefit On Home Renovation

Tax Benefit On Home Renovation

https://assetyogi.b-cdn.net/wp-content/uploads/2017/06/income-tax-benefit-on-second-home-loan-889x500-768x432.jpg

How To Be Your Own Contractor And Save Thousands On Your New House Or

https://i.pinimg.com/originals/a9/05/99/a9059915e3c9a3bce555b3fc272e5c58.jpg

Home Loan Tax Benefit Usa Home Sweet Home Insurance Accident

https://housing.com/news/wp-content/uploads/2016/04/Home-Loans-Tax-Benefits-if-you-own-Multiple-Homes-blog.png

Generally speaking home improvements aren t tax deductible but there are some tax saving opportunities worth keeping in mind Capital improvements can help save money on capital gains tax after selling a home while certain medical related and energy efficient improvements can lead to tax benefits Most home improvements aren t tax deductible but the IRS does specify situations in which you can write off expenses as you improve your home Here are home improvements that could save

You can receive potential tax deductions on improvements that make your home more energy efficient or meet medical needs Tax deductions may also be available to improve your home office space or maintain your rental property If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032

Download Tax Benefit On Home Renovation

More picture related to Tax Benefit On Home Renovation

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

https://homefirstindia.com/app/uploads/2022/07/Untitled-design-14.png

Home Loan Tax Benefit saving In 2019 20 In Hindi tax Benefit saving On

https://i.ytimg.com/vi/TqmeyW7QUDY/maxresdefault.jpg

Income Tax Benefit On Home Loan Your Quick Guide On Tax Exemption

https://static.tnn.in/photo/msid-99078262,imgsize-56716,updatedat-1680063914632,width-1280,height-720,resizemode-75/99078262.jpg

In some cases home improvements can result in tax deductions But before tearing down the walls in your house and expecting huge tax write off results there are several important factors The U S Department of the Treasury recently shared an update on the Inflation Reduction Act IRA including statistics on 2023 s residential energy tax credit claims and there s a lot to unpack According to the report More than 1 2 million American families have claimed over 6 billion in credits for residential clean energy

If you own your own home you might be able to save on your tax returns Get the most value from your home with these eight tax deductions Aug 8 2024 Americans claimed more than 8 billion in climate friendly tax credits under the Inflation Reduction Act last year according to new data released by the Treasury Department a

Here s Everything You Need To Know About Tax Benefit On Home Loan

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjZzD6lrtScY0z46tDa5_EiPNOKEkI6dVvuHsxWoHQ_LJsc5ZHiJrdmQxx4OUA5Gr41Y68m86viHUiDajer4LpEDvZdP_3eL856I_BCcrJHcpnqXfIWzOFm95ZxhgkSQruDVE7KX5tSezNQozaCvPzBJJLenEVb6cP1glx7N8lHvcDma-xUwXIJRP-MQQ/s1200/home loan tax benefit.jpg

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

https://homefirstindia.com/app/uploads/2022/07/Untitled-1.png

https://www.familyhandyman.com/article/what-home...

What Home Improvements Are Tax Deductible in 2023 Most home improvements like putting on a new roof or performing routine maintenance don t qualify for any immediate tax breaks However some known as capital improvements may raise the value of your home

https://www.realsimple.com/are-home-renovations...

Your Home Renovation Could Be Tax Deductible Here s What You Should Know Depending on the type of renovations you may be able to save money on your taxes this year

Why A Good Health Insurance Is Essential

Here s Everything You Need To Know About Tax Benefit On Home Loan

How To Get Tax Benefit On Loan Against Property Tata Capital

What Are The Tax Benefit On Home Loan FY 2020 2021

Income Tax Benefits On Home Loan Loanfasttrack

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

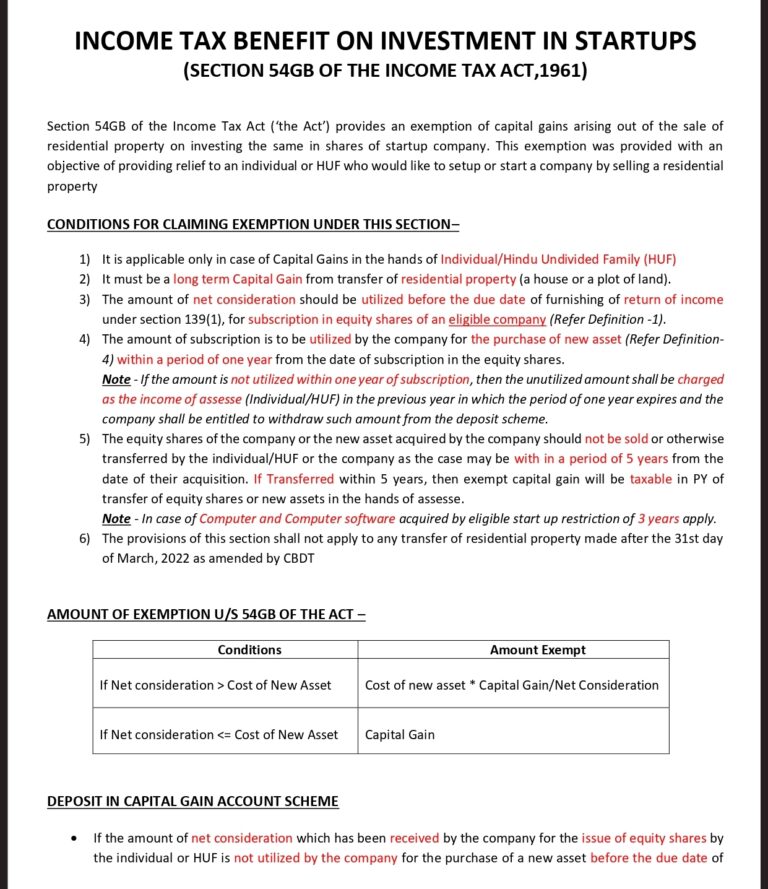

TAX BENEFIT ON INVESTMENT IN STARTUPS U S 54GB CA Rajput

Income Tax Benefit On Home Loan Repayment IDFC FIRST Bank

How To Claim Tax Benefit On Home Loan For Under Construction Property

Tax Benefit On Home Renovation - Most home improvements aren t tax deductible but the IRS does specify situations in which you can write off expenses as you improve your home Here are home improvements that could save