Tax Benefit Rule Explained Most taxpayers seek any legitimate way to pay less tax One common source that is frequently overlooked by tax advisors and more often

The Tax Benefit Rule is a fundamental principle in tax law that addresses the treatment of recovered amounts that were previously deducted Essentially if a taxpayer The Tax Benefit Rule is a tax principle in the U S tax code that addresses the treatment of tax deductions that are recovered in a subsequent year The rule ensures that taxpayers don t receive a double benefit from both a deduction

Tax Benefit Rule Explained

Tax Benefit Rule Explained

https://i.ytimg.com/vi/UaG2oAF0Rc0/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGCUgTSh_MA8=&rs=AOn4CLDp9qyLmSKQ9lI3VylXpiZKjvgFRw

The Tax Benefit Rule Doctrine YouTube

https://i.ytimg.com/vi/B4P2s81M7R0/maxresdefault.jpg

Tax Benefit On NPS Save More Money

http://savemoremoney.in/wp-content/uploads/2022/04/Tax-Benefit-On-NPS.png

The tax benefit rule is a feature of the United States tax system Its main principle is that if a taxpayer recovers a sum of money that should have been paid in the past they The Tax Benefit Rule operates by considering the impact of realized tax benefits deferred tax assets and tax liabilities influencing tax planning strategies and financial decision making

In recent years the tax benefit rule has been applied to nu merous areas of taxation First a product of case law it was em bodied in the Internal Revenue Code thirty five years ago in The tax benefit rule was originally established by case law but later codified as Section 111 It provides a taxpayer is not permitted to retain the tax benefit of a deduction

Download Tax Benefit Rule Explained

More picture related to Tax Benefit Rule Explained

Tax Benefit Rule Doctrine Explained With Exam CPA Exam Regulation

https://i.ytimg.com/vi/5IK0zYZ9v7s/maxresdefault.jpg

Tax Benefit Rule YouTube

https://i.ytimg.com/vi/rU_csNF342I/maxresdefault.jpg

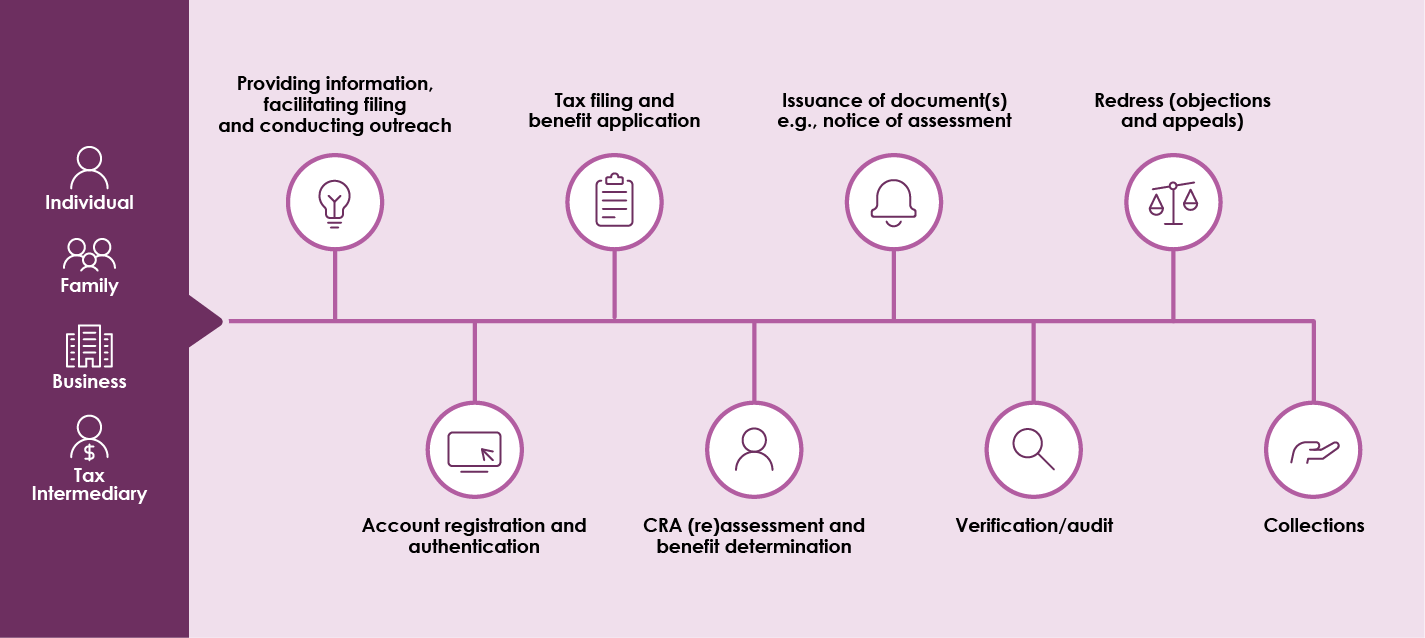

Welcome To The CRA Canada ca

https://www.canada.ca/content/dam/cra-arc/corp-info/aboutcra/mnstrl-bndr-2021/tax-benefit-admin-functions.png

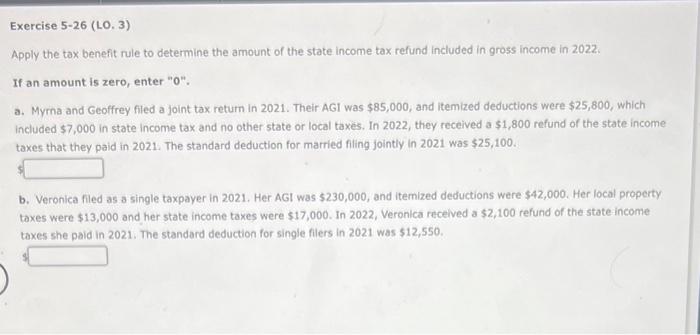

The tax benefit rule is a doctrine embedded in U S tax law that ensures fairness across fiscal periods When a taxpayer recovers an amount previously deducted that amount becomes part of their gross income in the ISSUE If a taxpayer received a tax benefit from deducting state and local taxes under section 164 of the Internal Revenue Code in a prior taxable year and the taxpayer taxes in the current

The tax benefit rule is a principle in tax law that affects how individuals and businesses report their income To put it simply if you received a tax deduction in a previous year and later recover The tax benefit rule states that if a tax deduction is taken in a prior year and the underlying amount is recovered in a subsequent period then the underlying amount must be included in

Tax Benefit Rule Examples Matilde Painter

https://thumbor.forbes.com/thumbor/711x358/https://specials-images.forbesimg.com/imageserve/618be34d322f395ce83b72d2/Joint-tax-rates-2022/960x0.jpg?fit=scale

Tax Bill s Pass Through Rule Will Benefit Internet Entrepreneurs

https://dumbpassiveincome.com/wp-content/uploads/2017/12/tax-bill-pass-through-rule-696x464.jpg

https://www.cpajournal.com › unlocking...

Most taxpayers seek any legitimate way to pay less tax One common source that is frequently overlooked by tax advisors and more often

https://accountinginsights.org › tax-benefit-rule...

The Tax Benefit Rule is a fundamental principle in tax law that addresses the treatment of recovered amounts that were previously deducted Essentially if a taxpayer

The Pennsylvania Tax Benefit Rule Compared To The Federal Rule

Tax Benefit Rule Examples Matilde Painter

Tax Reduction Company Inc

What Is The Tax Benefit Rule The Benefit Rule Explained

Solved Exercise 5 26 LO 3 Apply The Tax Benefit Rule To Chegg

Defined Benefit Plan Clipboard Image

Defined Benefit Plan Clipboard Image

Where Could Interest And Tax Rates Be Headed Mercer Advisors

Tax Benefit Rule Examples Doing A Wonderful Forum Diaporama

Expense Management Software Expense Reimbursements

Tax Benefit Rule Explained - The tax benefit rule is a federal tax concept partially codified under Sec 111 which generally requires a taxpayer to include in gross income recovered amounts that the taxpayer