Tax Benefits For Dependent Parents The information in this article is up to date for tax year 2024 returns filed in 2025 Yes you can claim your parents as dependents on your tax return but there are specific IRS criteria you ll need to meet In this guide

You must have provided over half of your parent s support for the year to claim them as a dependent under IRS rules This includes all money spent supporting them including food Parents have special tax situations and benefits Tax breaks for parenting expenses can result in a lower tax bill and a higher refund Here are some key things new parents need

Tax Benefits For Dependent Parents

Tax Benefits For Dependent Parents

https://digitalasset.intuit.com/IMAGE/A7GUqbw2k/rules-for-claiming-a-dependent-on-your-tax-return_L8LODbx94.jpg

TAX BENEFITS FOR PROFESSIONAL INCOME Presumptive Income Tax Planning

https://i.ytimg.com/vi/4MQjJ2tP6Is/maxresdefault.jpg

-1200x628.jpg)

Donor Advised Funds Tax Benefits For Charity Morgan Stanley

https://www.morganstanley.com/content/dam/msdotcom/articles/donor-advised-funds-tax-benefits-for-charitable-giving/A-Tax-Efficient-Way-tw-(social)-1200x628.jpg

Even though the dependency exemption was eliminated under the tax reform there are still some tax benefits you can take advantage of to maximize your tax refund if you have dependents These tax benefits can Claiming a parent as a dependent can provide significant financial benefits but there are specific IRS rules and requirements that must be met to qualify If you re supporting

If your mother qualifies to be your dependent the tax savings come at you in a few ways If you are unmarried on the last day of the year and qualify to claim your parent as a dependent you are also permitted to file as Understand what are the requirements for claiming a child as a dependent on your taxes who else you can claim as a dependent and how it can save you thousands

Download Tax Benefits For Dependent Parents

More picture related to Tax Benefits For Dependent Parents

Tax Benefits For Doing International Trade In Taiwan

https://www.btlaw.com.tw/Uploads/ClinicNews/3579_ff76ef31-9391-43ef-9744-20f1b95f857e.jpg

Income Tax Benefits For

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiVDBSFzwqkRg01RVnm4ZQBB9x-fwNWBfzLPycDffgBfuwgOrJIRuQbQHq0Cm1nZGDintyyd3bng05iEwiuR68gQocBcQozQPYhaQbxUjM8KmYYeH7p-bjznqnEZyN88MQkgMPo6tl7jHtkZm1mAFw53ZNY3HRcckuh02FQIQRDKYGbC5coLMKwPuctzA/w0/Income Tax benefit for Retirees-1.jpg

Undertaking For Dependent Parents Sample Undertaking Declaration For

https://www.lettersinenglish.com/wp-content/uploads/Undertaking-for-Dependent-Parents-Sample-Undertaking-Declaration-for-Dependent-Parents.jpg

Here s what to know about the dependent tax deduction and related credits to better navigate your family s taxes The Child Tax Credit can reduce your taxes by up to 2 000 per qualifying child aged 16 or younger If you do If you are caring for your mother or father you may be able to claim your parent as a dependent on your tax return This would allow you to get a tax credit for that parent the maximum tax refund is currently 500 per parent

You can claim the child and dependent tax credit by filing an IRS Form 1040 1040 SR or 1040 NR and attaching a Form 2441 on your tax return You must enter the credit on By understanding the qualifying child and relative tests impact on filing status special circumstances tax planning and optimization and common tax forms and schedules you can

The 10 Top Tax Benefits For Businesses

https://blog.concannonmiller.com/hubfs/Tax Benefits - Businesses- gold sign copy.png#keepProtocol

Guide To Tax Filing Benefits For College Students H R Block

https://resource-center.hrblock.com/wp-content/uploads/2021/01/Image-tax-benefits-for-students-1024x727.png

https://www.eztaxreturn.com › blog › can-i-c…

The information in this article is up to date for tax year 2024 returns filed in 2025 Yes you can claim your parents as dependents on your tax return but there are specific IRS criteria you ll need to meet In this guide

https://www.hrblock.com › ... › claiming-parents-on-taxes

You must have provided over half of your parent s support for the year to claim them as a dependent under IRS rules This includes all money spent supporting them including food

Guide To Tax Filing Benefits For College Students H R Block

The 10 Top Tax Benefits For Businesses

529 Plans Archives Conner Ash

Solved Problem 3 27 LO 1 Compute The Taxable Income For Chegg

Expert Tips For Filling Out VA Form 21 686c For Adding Dependents To

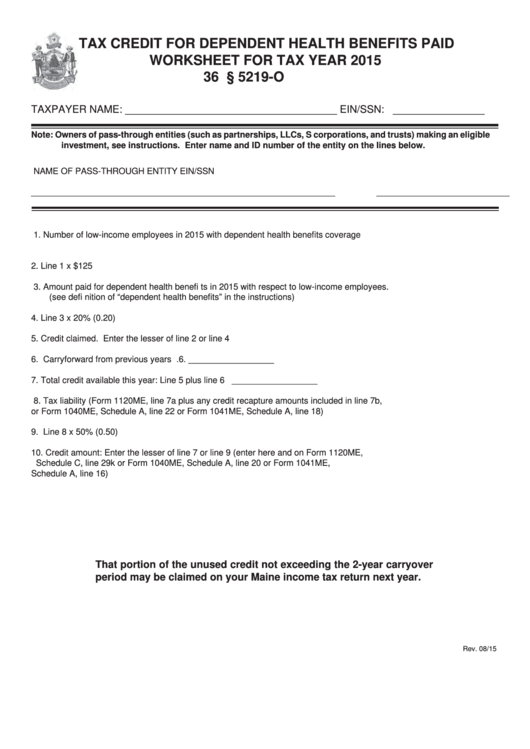

Tax Credit For Dependent Health Benefits Paid Worksheet 2015

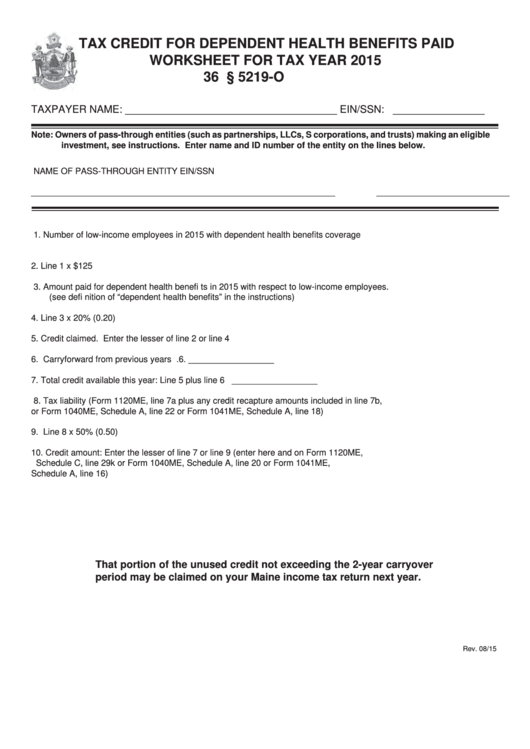

Tax Credit For Dependent Health Benefits Paid Worksheet 2015

Amazing Tax Benefits You Get For Owning A Home The Reluctant Landlord

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)

Tax Credits

What Is The Phase Out For Dependent Care Credit Latest News Update

Tax Benefits For Dependent Parents - Claiming a parent as a dependent can yield valuable tax breaks including a lower taxable income and possible deductions or credits However you must meet Internal Revenue