Tax Benefits For Disabled Veterans Special tax considerations for veterans Disabled veterans may be eligible to claim a federal tax refund based on an increase in the veteran s percentage of

Certain tax breaks apply automatically such as disability benefits received from the Department of Veterans Affairs DVA DVA benefits should not be included in your VA disability benefit payments aren t taxed including any disability compensation disability pension payments disability grants for home or vehicle

Tax Benefits For Disabled Veterans

Tax Benefits For Disabled Veterans

https://vaclaimsinsider.com/wp-content/uploads/2021/05/Arkansas-100-Disabled-Veteran-Property-Tax-Exemption-1024x1024.jpg

100 VA Disability Benefits Additional Benefits You Get At 100

https://www.hillandponton.com/wp-content/uploads/2021/02/Benefits-2023-Featured.png

Top 25 Disabled Veteran Benefits You May Not Know About New VA

https://vaclaimsinsider.com/wp-content/uploads/2020/04/Top-25-Disabled-Veteran-Benefits-You-May-Not-Know-About-Post-Image-VA-Claims-Insider.jpg

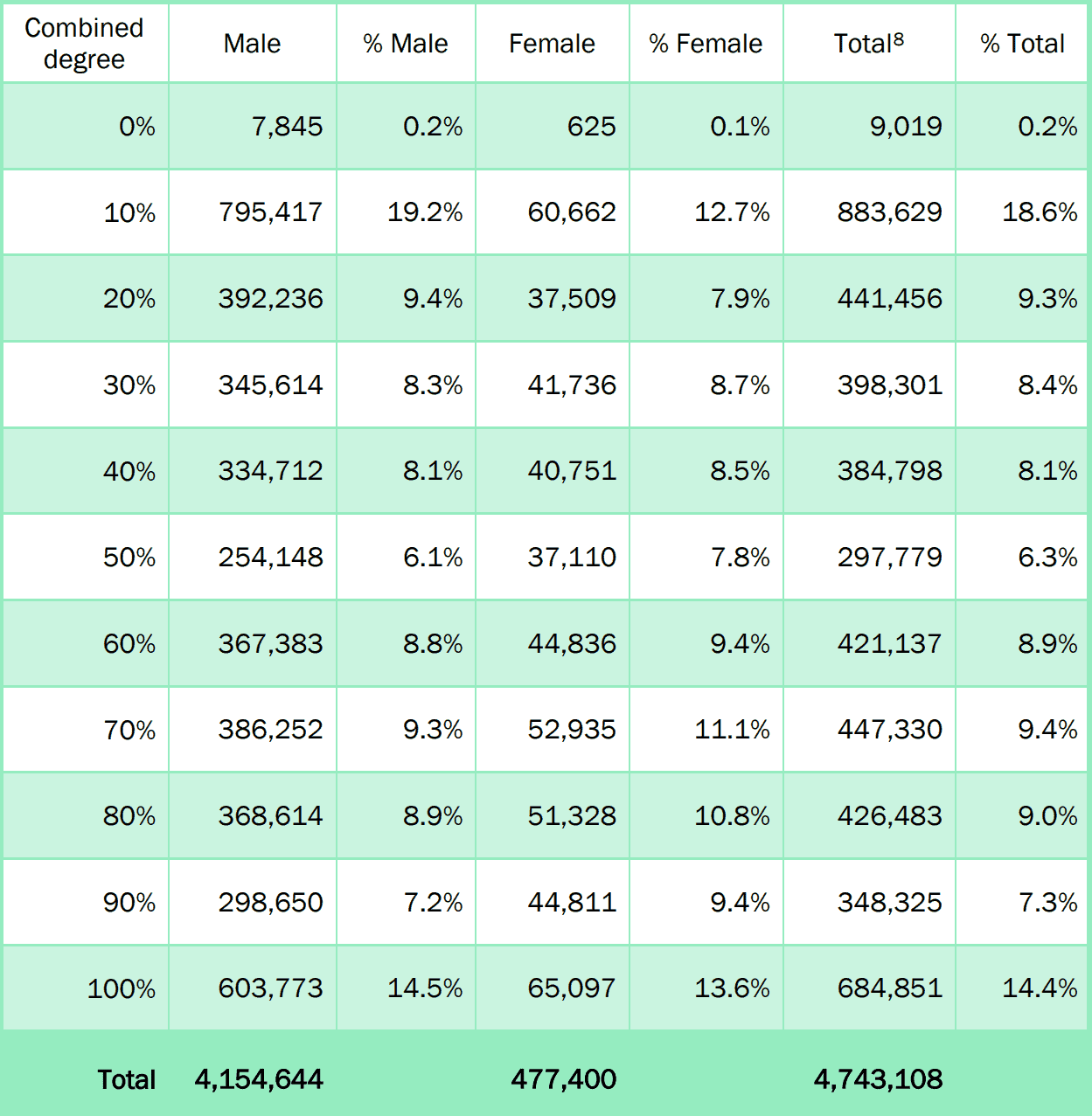

VA disability benefits Don t include disability benefits you receive from the Department of Veterans Affairs VA in your gross income If you are a military retiree and don t receive 5 tax breaks for veterans The federal government offers numerous benefits to veterans but a few stand out as advantageous when it comes to filing your taxes

Disabled veterans can qualify for property tax exemptions at the state level These breaks which are usually tied to a specific disability rating can help a veteran As a Veteran you may be eligible for certain tax benefits under the tax code This year s filing deadline is April 18 Here s what you need to know

Download Tax Benefits For Disabled Veterans

More picture related to Tax Benefits For Disabled Veterans

100 VA Disability Pay VA Disability Rates 2021

https://va-disability-rates.com/wp-content/uploads/2021/08/top-100-disabled-veteran-benefits-explained-va-claims-1.png

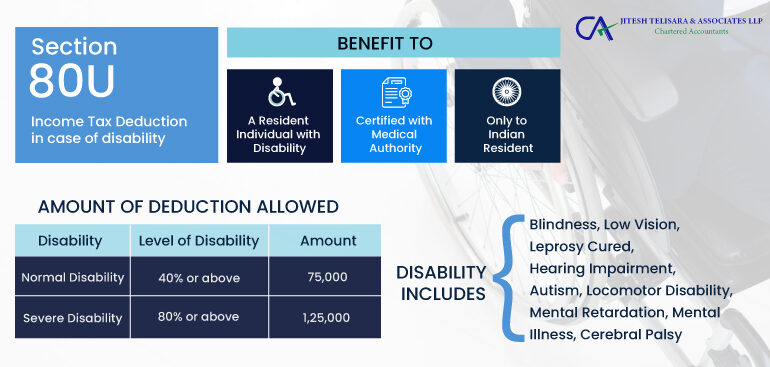

Tax Benefits For Disabled Individuals Blog

https://cajiteshtelisara.com/blog/wp-content/uploads/2020/08/80U-770x367.jpg

Veteran Tax Exemption 100 Disabled Veteran Benefits YouTube

https://i.ytimg.com/vi/9IynZhqWHbA/maxresdefault.jpg

Federal Tax Benefits for Disabled Veterans If you are a disabled veteran IRS gov says you may qualify for federal tax breaks depending on circumstances This However military disability retirement pay and veterans benefits including service connected disability pension payments are almost always fully excluded from

Tax Benefits for Disabled Veterans The following tax breaks and benefits are available to Veterans with a disability rating from the VA Tax free income and The answer to the question Is VA disability taxable is no Veterans receiving VA disability benefits do not have to report them as income or pay taxes on

Texas Veteran Property Tax Exemption Disabled Veteran Benefits

https://assets.site-static.com/userFiles/3705/image/dis-vet-tax-header.png

Veteran Tax Exemptions By State

https://www.communitytax.com/wp-content/uploads/2019/10/vet3.png

https://www.irs.gov/individuals/military/special...

Special tax considerations for veterans Disabled veterans may be eligible to claim a federal tax refund based on an increase in the veteran s percentage of

https://turbotax.intuit.com/tax-tips/military/top...

Certain tax breaks apply automatically such as disability benefits received from the Department of Veterans Affairs DVA DVA benefits should not be included in your

Top 15 States For 100 Disabled Veteran Benefits CCK Law

Texas Veteran Property Tax Exemption Disabled Veteran Benefits

How To Get Va Disability Benefits

Tax Benefits For Disabled Individuals MYCPAPRO

Additional Benefits For 100 Disabled Veterans CCK Law

Top Tax Breaks For Disabled Veterans

Top Tax Breaks For Disabled Veterans

DAV Oklahoma 100 Disabled American Veterans Pay No Property Tax ad

VA Benefits For Spouses Of Disabled Veterans CCK Law

Tax Benefits Available To Disabled Taxpayers

Tax Benefits For Disabled Veterans - Disabled veterans can qualify for property tax exemptions at the state level These breaks which are usually tied to a specific disability rating can help a veteran