Tax Benefits For Electric Cars Uk Electric cars with zero emissions fall into the lowest benefit in kind tax band resulting in lower tax liabilities for employees This makes electric vehicles very attractive for businesses and employees As a comparison the percentage for a petrol or diesel car could be as high as 37

The current 2024 Benefit In Kind BIK rate in the UK is 2 for electric cars The 2 BIK rate is set to remain at 2 for the 2024 25 tax year after which it will increase by 1 a year each year to reach 5 in 2027 2028 In this comprehensive guide we explore BIK rates for EVs The new electric car road tax changes will affect current and future owners of EVs electric vehicles There will also be an expensive car tax supplement for electric cars exceeding 40 000 This guide will set out what road tax costs EV owners can expect right now and how much they will pay when the VED rules change for electric car

Tax Benefits For Electric Cars Uk

Tax Benefits For Electric Cars Uk

https://static01.nyt.com/images/2022/12/28/multimedia/28ev-credits-1-5aaf/28ev-credits-1-5aaf-videoSixteenByNine3000.jpg

Benefits Of Electric Vehicles Mr Electric

https://mrelectric.com/sites/default/files/styles/blog_featured_image/public/content/blog/images/mre-bloggraphicbenefitsofelectricvehicles.jpg?itok=_VnHYHM7

Newsom s 1 5 Billion Plan For Electric Cars Shifts Rebate Money To

https://s.hdnux.com/photos/01/16/23/23/20526302/22/rawImage.jpg

Calculating benefit in kind for electric cars Firstly the taxable benefit in kind of a company car is determined by the vehicle s CO2 emissions For the 2019 20 tax year low emission cars classed as up to 50g km were taxed at 16 of the list price or 20 for diesel cars Find out whether you or your employee need to pay tax or National Insurance for charging an electric car You can also check if your employee is eligible for tax relief

This means that a pure EV will have 0 BIK in 2020 2021 1 BIK in 2021 2022 and 2 BIK in 2022 2023 and in 2023 2024 and 2024 2025 There was more good news for EV buyers with VED From 1 April 2020 until 31 March 2025 all zero emission vehicles will be exempt from the Vehicle Excise Duty expensive car supplement The benefit in kind for company cars is calculated based on the car s C02 emissions and the list price of the vehicle From 6 April 2020 the benefit in kind for fully electric cars is being reduced to 0 for the tax year 2020 2021 increasing to 1 in 2021 2022 and 2 in 2022 2023 of an EV s taxable list price The government announced in

Download Tax Benefits For Electric Cars Uk

More picture related to Tax Benefits For Electric Cars Uk

Tax Benefits For Doing International Trade In Taiwan

https://www.btlaw.com.tw/Uploads/ClinicNews/3579_ff76ef31-9391-43ef-9744-20f1b95f857e.jpg

Electric Cars Are Now The Tax Vehicle Of Choice Westcourt

https://www.westcourt.com.au/wp-content/uploads/2022/07/Tax-Benefits-for-Electric-Cars.jpg

New Analysis Electric Cars In China Cheaper Than Petrol Ones

https://cdn.businessinsider.de/wp-content/uploads/2023/08/GettyImages-1513201389-scaled.jpg?ver=1691565556

Government grants for electric cars The government s plug in car grant is designed to promote the uptake of electric vehicles in the UK From 18 March 2021 the government will provide grants of up to 2 500 towards the cost of an eligible plug in vehicle where it costs less than 35 000 Firstly one of the main tax benefits of electric vehicles for both companies and the public is that they are completely exempt from road tax or vehicle excise duty VED as it was previously known This tax exemption will be available until April 2025 after which they will be taxed the same as other conventionally fueled vehicles

The EV Plug in Grant Road tax exemption Benefit in Kind BIK Salary sacrifice schemes Capital allowances Workplace Charging Scheme WCS Each one is unique and offers either an EV driver or business owner a certain amount of financial relief for owning or driving an EV Let s take a look at each one in more detail Electric Under the plans laid out today electric cars registered from April 2025 will pay the lowest rate of 10 in the first year then move to the standard rate which is currently 165 The standard

Electric Cars Business Insider Australia

https://i.insider.com/623a0848d2f08a001965fdea?format=jpeg

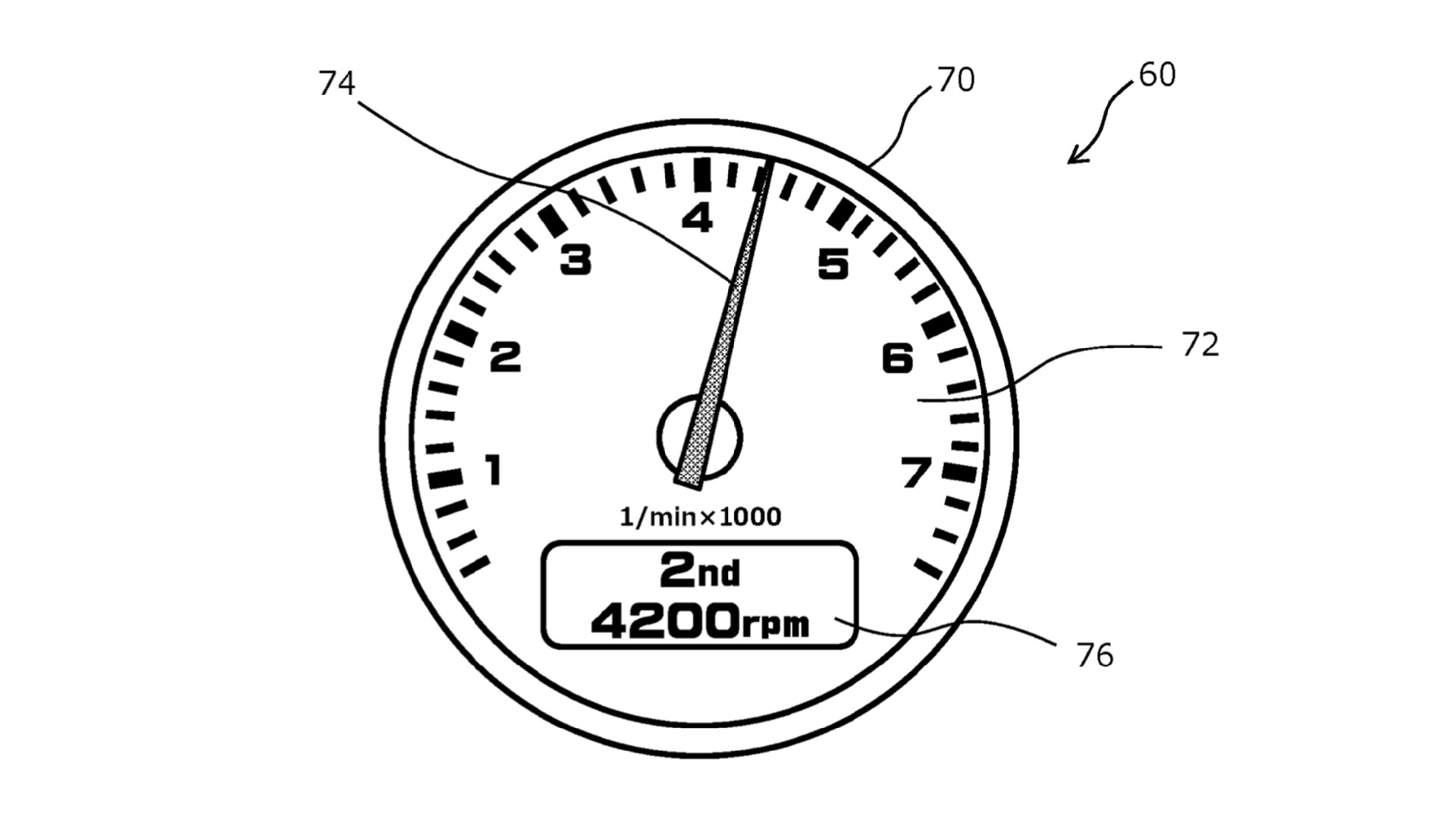

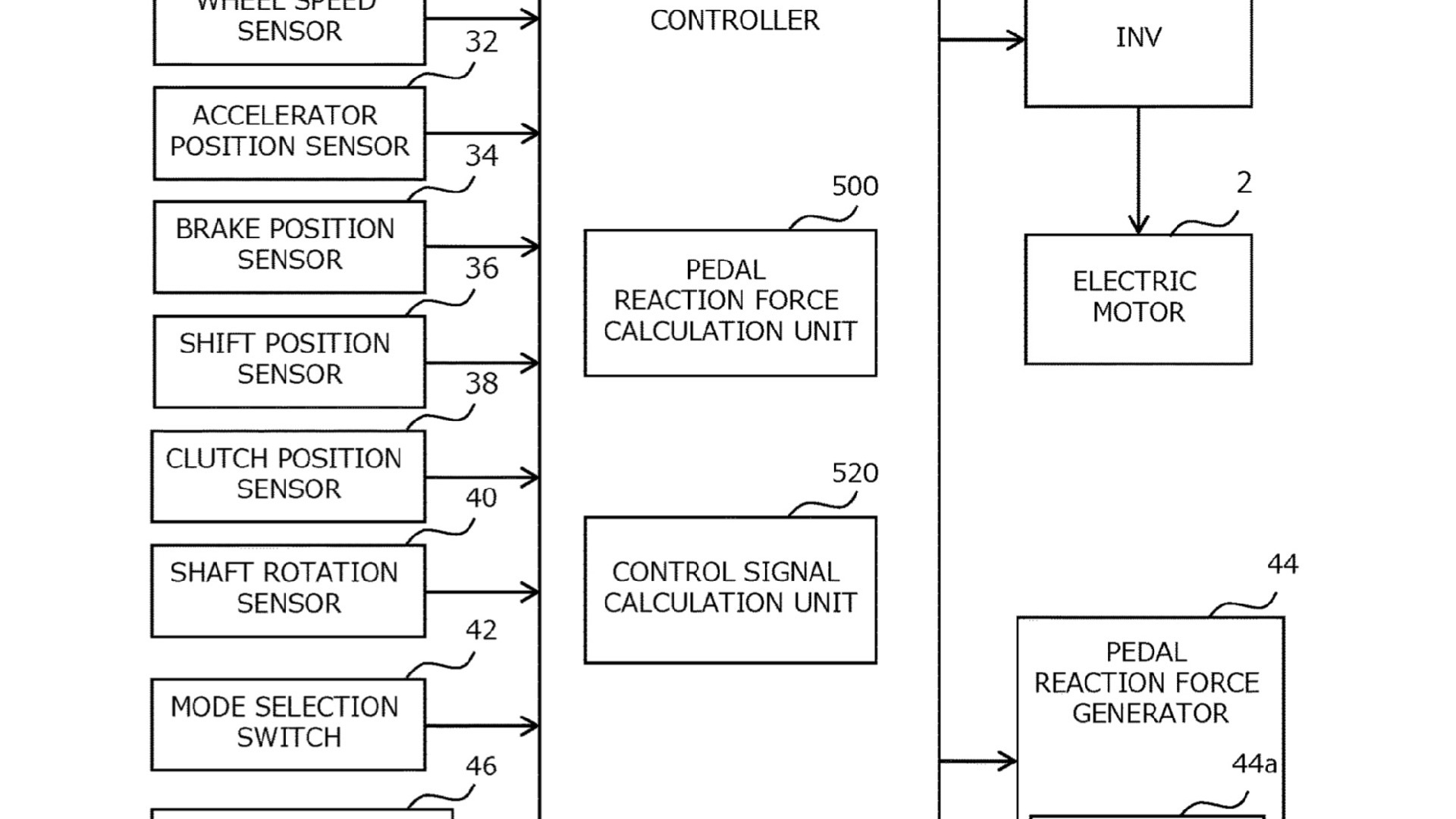

Toyota Patented A Manual Transmission For Electric Cars

https://images.hgmsites.net/hug/toyota-patent-image-of-manual-transmission-for-electric-cars_100830046_h.jpg

https://www.taxassist.co.uk/resources/articles/the...

Electric cars with zero emissions fall into the lowest benefit in kind tax band resulting in lower tax liabilities for employees This makes electric vehicles very attractive for businesses and employees As a comparison the percentage for a petrol or diesel car could be as high as 37

https://electriccarguide.co.uk/what-are-the...

The current 2024 Benefit In Kind BIK rate in the UK is 2 for electric cars The 2 BIK rate is set to remain at 2 for the 2024 25 tax year after which it will increase by 1 a year each year to reach 5 in 2027 2028 In this comprehensive guide we explore BIK rates for EVs

Tax Incentives For Electric Cars Uk Kami Mcallister

Electric Cars Business Insider Australia

Toyota Patented A Manual Transmission For Electric Cars

The Fringe Benefits Tax Exemption For Electric Cars Explained CarExpert

UK Tax Benefits For Electric Cars On Business I Do Business

Tax Benefits For Electric Cars In India 2023

Tax Benefits For Electric Cars In India 2023

Electric Cars And Road Tax DrivingElectric

Electric Car Credit Income Limit How The Electric Car Tax Credit Works

Electric Car FAQ If There Is Any Question Before Buying An Electric

Tax Benefits For Electric Cars Uk - Electric cars also qualify for zero rate vehicle excise duty VED or road tax and are exempt from the levy currently 390 that s applied if the list price is 40 000 or more