Tax Break For Child Care Expenses The child and dependent care tax credit is a tax break for working people with qualifying dependents It can help to offset the costs of caregiving expenses

The Child and Dependent Care Credit is a tax break specifically for working people to help offset the costs associated with caring for a child or dependent with disabilities Your federal income tax may be reduced by claiming the Credit for Child and Dependent Care expenses on your tax return Who is eligible to claim the credit You may be eligible to claim

Tax Break For Child Care Expenses

Tax Break For Child Care Expenses

https://i.pinimg.com/originals/4b/17/34/4b17341b5d90d996a968eba0ed418c24.jpg

How To Score A Tax Break For Your Charitable Giving

https://image.cnbcfm.com/api/v1/image/106268833-1574881176855gettyimages-522951298.jpeg?v=1574881259&w=1920&h=1080

How To Use Tax Credits For Child Care Expenses The Money Coach

https://askthemoneycoach.com/wp-content/uploads/2014/01/iStock_000001230665Small.jpg

Here s how the FSA compares to the tax credit for dependent care when determining which one could benefit you the most come tax time For example if your child for whom you pay child and dependent care expenses turns 13 years old and no longer qualifies on September 16 count only those expenses through September 15 Also see Yearly limit under Dollar Limit later

The child tax credit is a 2 000 benefit available to those with dependent children under 17 For 2024 and 2025 1 700 of the credit will be potentially refundable In 2021 the American Rescue Plan Act expanded the child and dependent care tax credit CDCTC to temporarily provide a refundable credit of up to 50 percent of child care costs for a child under age 13 or any dependent physically or

Download Tax Break For Child Care Expenses

More picture related to Tax Break For Child Care Expenses

How Do Tax Write Offs Work Jpdesignerts

https://i.ytimg.com/vi/0Mwmx9e1e7g/maxresdefault.jpg

CHILD CARE TAX Statement Form Daycare Or Childcare Printable Etsy

https://i.etsystatic.com/23403566/r/il/f7133a/3736849859/il_1140xN.3736849859_31z4.jpg

Claiming Childcare Expenses In Canada Blueprint Accounting

https://www.experienceyourblueprint.com/wp-content/uploads/Claiming-Childcare-expenses-on-Your-Personal-Tax-Return-Blog-Feature-Img.png

Families with children often pay less in taxes than their childless peers at the same income level But some of those benefits like the child tax credit CTC are unavailable to Luckily the federal government offers two tax breaks that can help defray some of these costs the child care credit and dependent care accounts If you pay for day care preschool or a nanny it pays to learn about these two

As a nonrefundable tax break the credit can reduce your tax liability to zero However you won t get a refund if the expenses you incurred are lower than the maximum The Child Care Tax Credit officially known as the Child and Dependent Care Tax Credit CDCTC for short provides taxpayers with children a much needed tax break from childcare

Why Do Parents Pay So Much For Child Care When Early Educators Earn So

https://i.pinimg.com/originals/ba/6c/89/ba6c89329ae53d213007445626ad9273.png

Tax Credit Or FSA For Child Care Expenses Which Is Better

https://static.wixstatic.com/media/62b39d_9cd40e7758b749f88e3057d23a1a03f5~mv2.jpg/v1/fit/w_1000%2Ch_572%2Cal_c%2Cq_80/file.jpg

https://www.nerdwallet.com › article › t…

The child and dependent care tax credit is a tax break for working people with qualifying dependents It can help to offset the costs of caregiving expenses

https://turbotax.intuit.com › tax-tips › family › the...

The Child and Dependent Care Credit is a tax break specifically for working people to help offset the costs associated with caring for a child or dependent with disabilities

Medical Alert Blog Tagged Tax Break For Caregivers

Why Do Parents Pay So Much For Child Care When Early Educators Earn So

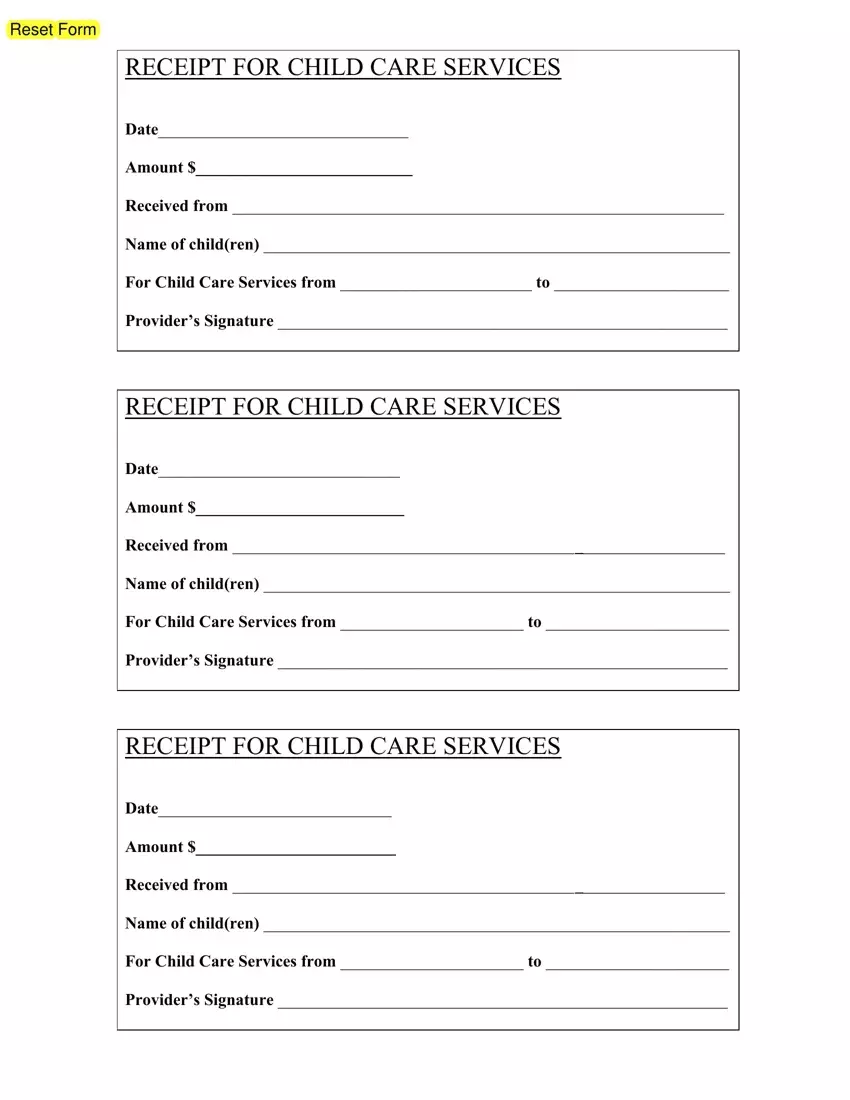

Childcare Receipt Fill Out Printable PDF Forms Online

The Child Care For Working Families Act Is D j Vu All Over Again

Dems Put Paid Leave Back In Their Plan And A Big Tax Break For The Rich

Are There Tax Breaks For Child Care Expenses YouTube

Are There Tax Breaks For Child Care Expenses YouTube

King County WA On Twitter Applications Open On June 13 Eligible

The Local Tax Break Many Retirees Don t Know About but Should WSJ

New Tax Break For Seniors Charitable Gift Annuity From IRA Macro

Tax Break For Child Care Expenses - CNN In his latest targeted tax relief promise former President Donald Trump said Sunday that he d push for a tax credit for family caregivers I m announcing a new policy