Tax Break For Hybrid Car 2022 Consumer Reports details the list of 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act

If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Internal Revenue If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified

Tax Break For Hybrid Car 2022

Tax Break For Hybrid Car 2022

https://lh3.googleusercontent.com/Or0MGDygOo9IazEYjBJMaC6ZzwqKERXZzfjv3TRUoUE0FFN3ZV1-EbOk3rjC2iZ0FlnPLIJ3GZTzhLEX_-XnMusfJ1dsqDsFOsVp=s1000

Net Zero Super Deduction For UK Businesses Invinity

https://invinity.com/wp-content/uploads/2021/05/shutterstock_1911122770_Tax-return-scaled.jpg

China Ev Package News China Unveils 72 Billion Tax Break For EVs

https://i.ytimg.com/vi/Cm_Y_wPI7Yo/maxresdefault.jpg

All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount As of late 2023 just seven plug in hybrids are eligible for a federal tax credit but there s a workaround

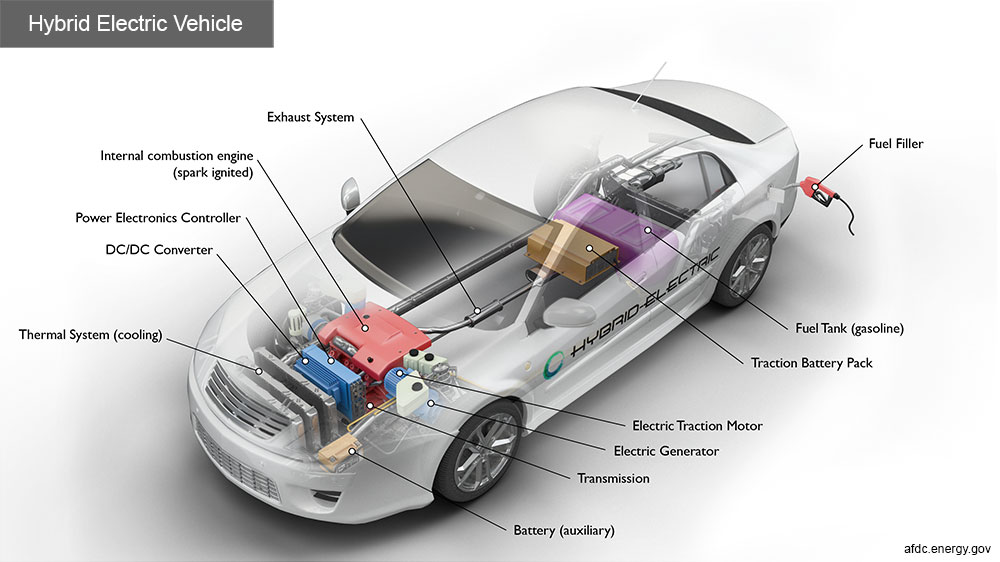

How EV PHEV and Hybrid Tax Credits Are Determined First off tax credit is determined by the type of electric vehicle and by the size of the battery Some plug in hybrid models qualify A federal hybrid car tax credit is available to consumers who buy plug in electric vehicles EVs in the United States According to the U S Department of Energy you can receive a tax credit of

Download Tax Break For Hybrid Car 2022

More picture related to Tax Break For Hybrid Car 2022

Potential 6 billion Tax Break For LNG Producers In BC CityNews Vancouver

https://vancouver.citynews.ca/wp-content/blogs.dir/sites/9/2017/04/24/horganscrumkretzel.jpg

What Is A Hybrid Car And How Do They Work DAX Street

https://daxstreet.com/wp-content/uploads/2022/09/Hybreid.jpeg

Unemployment Benefits And 2022 Tax Returns Fingerlakes1

https://www.fingerlakes1.com/wp-content/uploads/2021/08/auto-draft-147.jpg

Today s guidance marks a first step in the Biden Administration s implementation of Inflation Reduction Act tax credits to lower costs for families and Plug in hybrid all electric and fuel cell electric vehicles purchased new in or after 2023 may be eligible for a federal income tax credit of up to 7 500

Electric vehicles purchased in 2022 or before are still eligible for tax credits If you bought a new qualified plug in electric vehicle in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 Learn more If you purchased a new all electric vehicle EV or plug in hybrid electric vehicle PHEV during or after 2010 you may be eligible for a federal income tax credit

Getting A Tax Break For Donating To Charity YouTube

https://i.ytimg.com/vi/M2XIqP4kHNo/maxresdefault.jpg

)

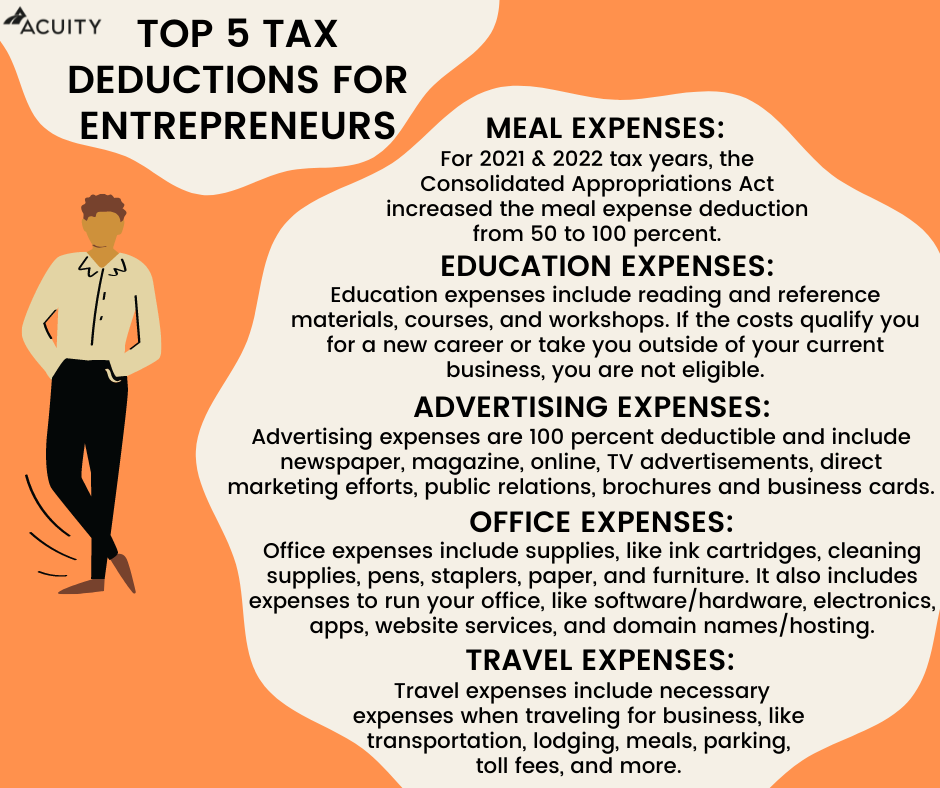

Federal Budget 2022 Tax Breaks For Small Business

https://assets.cdn.thewebconsole.com/S3WEB6522/blogImages/626a2a3351489.jpg?v=2&geometry(550>)

https://www.consumerreports.org/car…

Consumer Reports details the list of 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act

https://www.irs.gov/credits-deductions/...

If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Internal Revenue

New Tax Break For Seniors Charitable Gift Annuity From IRA Macro

Getting A Tax Break For Donating To Charity YouTube

Car Tax Bands For 2021 And 2022 Blog Wilsons Group

How Do You Write Off Fuel On Your Taxes Leia Aqui Is It Better To

/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/NXZPRXBGWVFEZMZYXJRCUJJ7VE.jpg)

Hochul Shouldn t Have Revived Unfair Tax Break For Luxury condo

Hybrid Car Battery Price In Bangladesh Car Care BD

Hybrid Car Battery Price In Bangladesh Car Care BD

Tax Rebates Normal Hybrid Cars 2022 2023 Carrebate

How To Get A Tax Break For Temporary Work Assignments CPA Practice

Ending Tax Break For Ultrawealthy May Not Take Act Of Con Flickr

Tax Break For Hybrid Car 2022 - As of late 2023 just seven plug in hybrids are eligible for a federal tax credit but there s a workaround