Tax Credit Childcare 2022 Verkko 9 marrask 2023 nbsp 0183 32 How to claim the child and dependent tax credit The child and dependent care credit can be claimed on tax returns filed

Verkko 27 marrask 2023 nbsp 0183 32 The child tax credit is a tax benefit for people with qualifying children For the 2023 tax year taxpayers may be eligible Verkko 11 kes 228 k 2021 nbsp 0183 32 The following FAQs can help you learn if you are eligible and if eligible how to calculate your credit Further information is found below and in IRS Publication

Tax Credit Childcare 2022

Tax Credit Childcare 2022

https://www.himama.com/blog/wp-content/uploads/2022/09/General-Blog-Post-Template-2022-09-08T110944.932.png

Childcare 2022 Election Where The Major Parties Stand

https://new-cdn.mamamia.com.au/mamamia-pwa.appspot.com/cms_images/originals/Lrttbgf0sbp51mf7fNBm_1652757949994.png

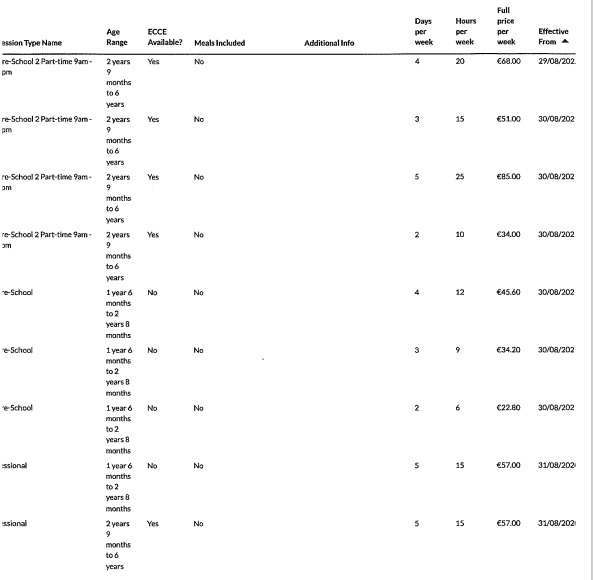

Childcare 2022 2023 Fees Ballyspillane Community Family Resource Centre

https://ballyspillanecfrc.ie/wp-content/uploads/2022/09/Childcare-hours-4.jpg

Verkko IRS Tax Tip 2022 33 March 2 2022 Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child Verkko 11 helmik 2022 nbsp 0183 32 In other words families with two kids who spent at least 16 000 on day care in 2021 can get 8 000 back from the IRS through the expanded tax credit

Verkko You qualify for the full amount of the 2022 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 Verkko 13 tammik 2022 nbsp 0183 32 Sarah O Brien sarahtgobrien Share Key Points For your 2021 tax return the cap on expenses eligible for the child and dependent care tax credit is

Download Tax Credit Childcare 2022

More picture related to Tax Credit Childcare 2022

2023 Denominational Celebration Childcare Volunteer To Receive

https://i0.wp.com/update.gci.org/wp-content/uploads/2022/08/DC2023-Childcare-Promo_Web-Banner-02-1024x840.png?ssl=1

Child Tax Credit 2022 Save Invest Pay Off Debt

https://imageio.forbes.com/specials-images/imageserve/630cfe929f725c8ce9401034/0x0.jpg?format=jpg&width=1200

Universal Credit Childcare In 2022 What You Could Get

https://www.your-benefits.co.uk/wp-content/uploads/2022/03/pexels-cottonbro-3662667-comp-1-e1660914417846.jpg

Verkko 18 lokak 2023 nbsp 0183 32 A qualifying individual for the child and dependent care credit is Your dependent qualifying child who was under age 13 when the care was provided Your Verkko The Child Tax Credit will help all families succeed The American Rescue Plan increased the Child Tax Credit from 2 000 per child to 3 000 per child for children over the age

Verkko 27 marrask 2023 nbsp 0183 32 Rates for Working Tax Credit Childcare element of Working tax credit Child Benefit and Guardian s Allowance for the 2022 to 2023 tax year are Verkko 19 lokak 2023 nbsp 0183 32 In most years you can claim the credit regardless of your income The Child and Dependent Care Credit does get smaller at higher incomes but it doesn t

Taking A Stand For Children Through The Child Tax Credit Tax Credits

https://i0.wp.com/www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2022/02/TCWF_knockout_horizontal.png?w=4439&ssl=1

Guardian Childcare Education On LinkedIn Want To Make A Fresh Start

https://media-exp1.licdn.com/dms/image/C4D22AQEFqa1cddxf3Q/feedshare-shrink_2048_1536/0/1641335588247?e=2147483647&v=beta&t=LQ0RC4bC9yL5wOkMO_oPXkBw0AGCo22ZOpbne1OpHIU

https://www.nerdwallet.com/.../taxes/child-an…

Verkko 9 marrask 2023 nbsp 0183 32 How to claim the child and dependent tax credit The child and dependent care credit can be claimed on tax returns filed

https://www.nerdwallet.com/.../taxes/qualify-c…

Verkko 27 marrask 2023 nbsp 0183 32 The child tax credit is a tax benefit for people with qualifying children For the 2023 tax year taxpayers may be eligible

Tax free Childcare And Universal Credit Scheme Manufacturing NI

Taking A Stand For Children Through The Child Tax Credit Tax Credits

The Employer provided Childcare Tax Credit Finansdirekt24 se

Tax Credit Universal Credit Impact Of Announced Changes House Of

New Child Tax Credit Opens The Door For Old Scams

New Child Tax Credit Opens The Door For Old Scams

Child Tax Credit Explained 2020 YouTube

What The New Child Tax Credit Could Mean For You Now And For Your 2021

Childcare Tax Credit Small Business Advocacy Council SBAC

Tax Credit Childcare 2022 - Verkko 11 helmik 2022 nbsp 0183 32 In other words families with two kids who spent at least 16 000 on day care in 2021 can get 8 000 back from the IRS through the expanded tax credit