Tax Credit For College Education IRS Tax Tip 2022 123 August 11 2022 Anyone pursuing higher education including specialized job training and grad school knows it can be pricey Eligible taxpayers who paid higher education costs for themselves their spouse or dependents in 2021 may be able to take advantage of two education tax credits

The American opportunity credit can reduce your tax liability by up to 2 500 if you re paying college tuition and fees Continuing education part time classes and graduate school costs Qualified Education Expenses for Education Credits Qualified expenses are amounts paid for tuition fees and other related expense for an eligible student that are required for enrollment or attendance at an eligible educational institution

Tax Credit For College Education

Tax Credit For College Education

https://i.ytimg.com/vi/MkPwX0o9dww/maxresdefault.jpg

The American Opportunity Tax Credit For College Good Financial Cents

https://www.goodfinancialcents.com/wp-content/uploads/2009/08/The-American-Opportunity-Tax-Credit-For-College.jpg

What College Students Need To Know About Filing A Tax Return The US Sun

https://www.the-sun.com/wp-content/uploads/sites/6/2022/02/EP_COLLEGE_STUDENTS_TAXES_COMP-1.jpg?strip=all&quality=100&w=1500&h=1000&crop=1

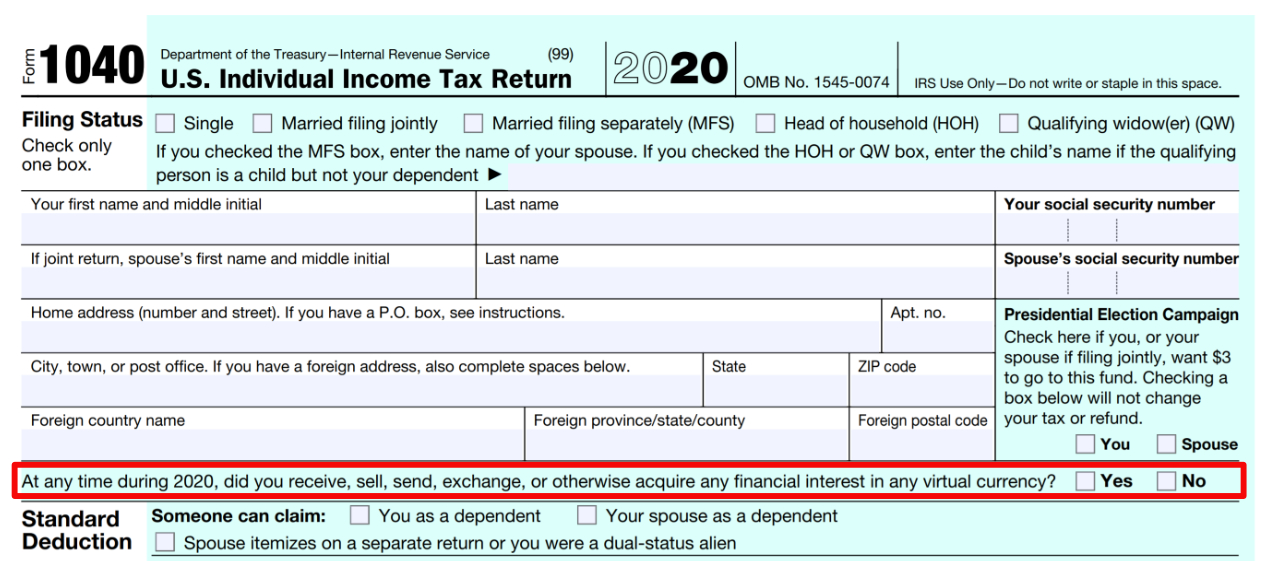

The American Opportunity Tax Credit and the Lifetime Learning Credit are federal tax credits that can lower your upcoming tax bill if you paid for college in 2023 You can claim these Education tax credits and deductions at a glance Education tax credits for 2023 taxes American taxpayers can take advantage of one of two different college tax credits to get back

Introduction If you or your dependent is a student you may want to determine whether you are eligible for one of the two educational tax credits that cover common student expenses These credits reduce your tax bill on a dollar for dollar basis An education tax credit allows you to reduce your taxes owed and may in some cases generate a tax refund The IRS offers two types of education tax credits to offset tuition and

Download Tax Credit For College Education

More picture related to Tax Credit For College Education

You Can Claim Education Tax Credit For College Students

https://finbizen.com/wp-content/uploads/2023/04/istockphoto-1265035575-612x612-1.jpg

Tax Credit For College Students YouTube

https://i.ytimg.com/vi/NdWeoxW8org/maxresdefault.jpg

Top Three BEST Student Credit Cards For Building College Credit In 2020

https://i.ytimg.com/vi/mHE8VORRrZI/maxresdefault.jpg

The American Opportunity Tax Credit AOTC is a partially refundable tax credit for college education where the student must attend at least half time The credit is available for the first four years of college education The two college specific tax credits available to students and parents are the American Opportunity Tax Credit and Lifetime Learning Credit Both need to be claimed through Form 8863 using the information you ll find on your Form 1098 T which your school will send to the student

There are two tax credits which are based on amounts spent on tuition and fees books supplies and equipment for a student who is either the taxpayer the taxpayer s spouse or a dependent The American opportunity tax credit is Worth a maximum benefit of up to 2 500 per eligible student Only for the first four years at an eligible college or vocational school For students pursuing a degree or other recognized education credential Partially refundable People could get up to 1 000 back The lifetime learning credit is

Tax Credit For College Students Best Relief YouTube

https://i.ytimg.com/vi/CiBR_ShUouA/maxresdefault.jpg

Tax Credit For College Students Maximizing Your Benefit

https://dumpil.com/wp-content/uploads/2023/10/tax-credit-for-college-students.jpg

https://www.irs.gov/newsroom/college-students...

IRS Tax Tip 2022 123 August 11 2022 Anyone pursuing higher education including specialized job training and grad school knows it can be pricey Eligible taxpayers who paid higher education costs for themselves their spouse or dependents in 2021 may be able to take advantage of two education tax credits

https://money.usnews.com/money/personal-finance/...

The American opportunity credit can reduce your tax liability by up to 2 500 if you re paying college tuition and fees Continuing education part time classes and graduate school costs

Tax Credits For College Students A Comprehensive GuidE FUCISE COM

Tax Credit For College Students Best Relief YouTube

Bill Would Give 2 200 Tax Credit For College Grads In IT Workforce

Why Almost Everything You ve Learned About Tax Credit For College

Don t Miss Tax Credit For College Expenses Cowdery Tax

Tax Credit For College Students And Parants OATC FSA Recipients Benefit

Tax Credit For College Students And Parants OATC FSA Recipients Benefit

Tution Tax Credit For Students NCS CA

Tax Credit For College Students

Tax Credit For College Students Living At Home World Informs

Tax Credit For College Education - The American Opportunity Tax Credit and the Lifetime Learning Credit are federal tax credits that can lower your upcoming tax bill if you paid for college in 2023 You can claim these