Tax Credit For Energy Efficient Heat Pump 2023 Air Source Heat Pumps Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax

2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 for the tax year the improvements are

Tax Credit For Energy Efficient Heat Pump 2023

Tax Credit For Energy Efficient Heat Pump 2023

https://kobiecomplete.com/wp-content/uploads/2023/01/federal-tax-credits-2023-graphic-white-web.png

2023 Energy Efficient Home Credits Tax Benefits Tips

https://accountants.sva.com/hubfs/sva-certified-public-accountants-biz-tip-energy-efficient-home-improvement-credit-more-opportuniities-in-2023-01.png

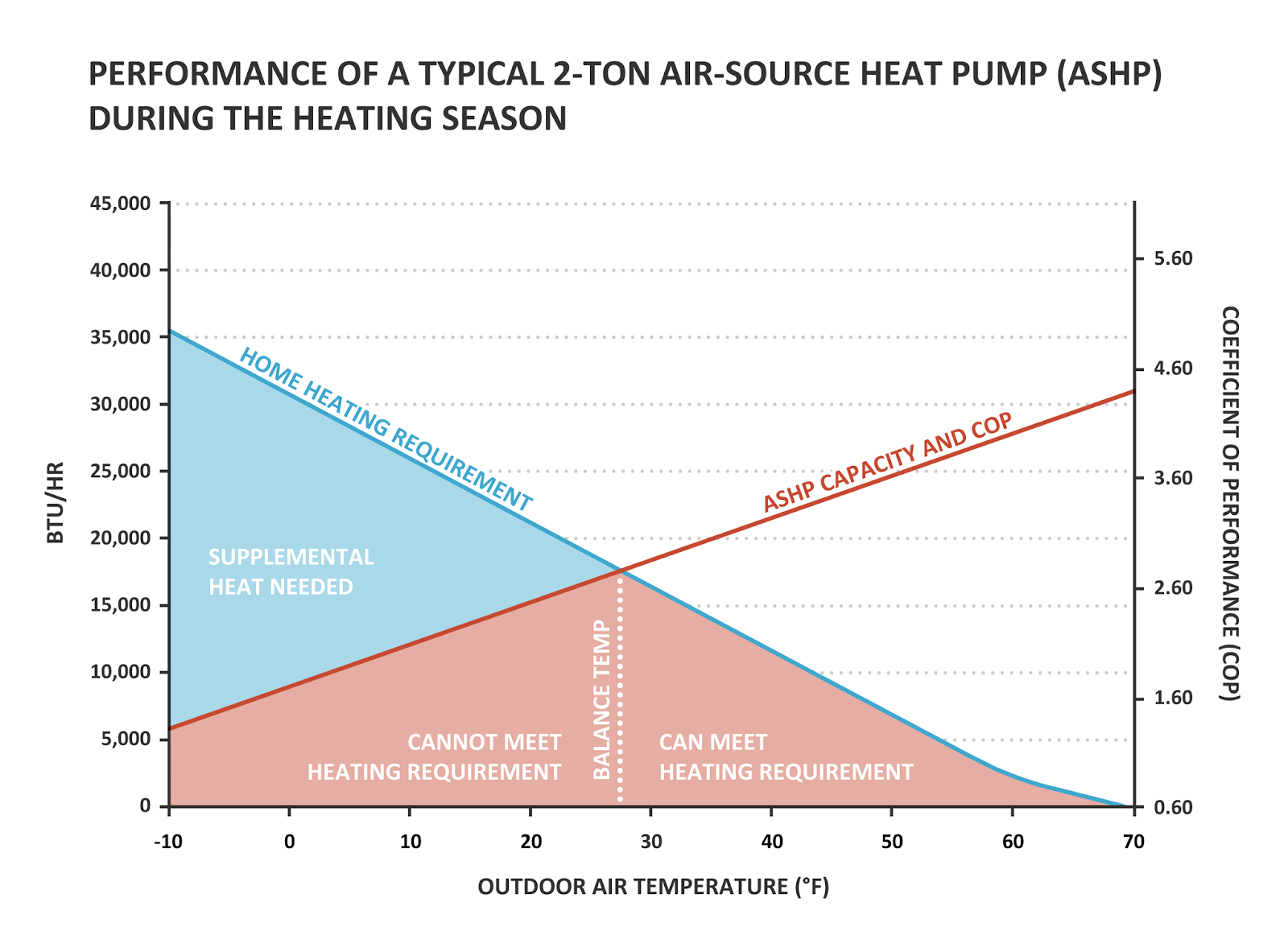

EERE Success Story Energy Efficient Heat Pump For Colder Regions Keeps

https://www.energy.gov/sites/default/files/styles/full_article_width/public/CCHP_1.jpg?itok=Y4ld3cs3

Save Up to 2 000 on Costs of Upgrading to Heat Pump Technology These energy efficient home improvement credits are available for 30 of costs up to 2 000 and can be combined with credits up to 1 200 for other qualified As explained in the related IRS release IR 2024 280 October 24 2024 for property placed in service beginning in 2023 a taxpayer may take a credit under equal to

Q How do I know if my Home Energy Audit is eligible for a credit A Consumers can visit this IRS page on the Energy Efficient Home Improvement Credit Q What Updated Tax Credit Available for 2023 2032 Tax Years 30 of cost up to 2 000 per year 30 of cost up to 600 Subject to cap of 1 200 year ents in non urban or low income com

Download Tax Credit For Energy Efficient Heat Pump 2023

More picture related to Tax Credit For Energy Efficient Heat Pump 2023

Heat Pumps Can Help Oregonians Achieve Clean Cooling Oregon Capital

https://oregoncapitalchronicle.com/wp-content/uploads/2022/09/Heat-hot-weather-Getty-Images.jpg

Form 5695 Which Renewable Energy Credits Apply For The 2023 Tax

https://phantom-marca.unidadeditorial.es/ac74621e18bc098b394c3393658acfb3/resize/1200/f/jpg/assets/multimedia/imagenes/2023/01/17/16739726135614.jpg

2023 Energy Tax Credits To Make Your Home And Business More Efficient

https://media.licdn.com/dms/image/D5612AQEWphBfDfm3Ww/article-cover_image-shrink_720_1280/0/1673882827995?e=2147483647&v=beta&t=bZYyKU6kTlNdUadZz0lYqEDuaRIcyUbNMu7waFDYbaQ

Tax Credits for Energy Efficiency Improvements Total Annual Limit The 2 000 heat pump credit can be combined with credits up to 1 200 for other qualified upgrades made in one tax year In total the maximum annual credit for the energy efficient home improvement credit is generally 1 200 Sec 25C b 1 For certain heat pumps heat pump water

If you opt to install a heat pump you ll be eligible for a federal tax credit for models that achieve the Consortium for Energy Efficiency s CEE highest tier for efficiency CR s Heat Heat pumps are rapidly gaining popularity as an energy efficient option for home heating and cooling With a 30 percent tax credit available for a range of heat pump solutions up to 2 000 per year it s a great time to investigate if this clean technology is

3 Ways A Heat Pump Will Increase The Energy Efficiency Of Your Home

https://media.licdn.com/dms/image/D4D12AQGR9VuM4CTckA/article-cover_image-shrink_600_2000/0/1686615858048?e=2147483647&v=beta&t=9O_L6sWPQlTn03GS5qjNYUUSegZzOe8-2qCgyHjK5dM

New EV Tax Credits For Tesla In The Inflation Reduction Act

https://assets.website-files.com/5ffe1568b0a42818305550d1/6009b906ae43c5a0644e00d3_Image from iOS-p-2000.jpeg

https://www.energystar.gov › ... › air-so…

Air Source Heat Pumps Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax

https://www.irs.gov › credits-deductions › home-energy-tax-credits

2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit

US Treasury Department Issues Guidelines Around A New Tax Credit For

3 Ways A Heat Pump Will Increase The Energy Efficiency Of Your Home

A Heat Pump Strategy That Works Thoughts From A Minimalist Christian

2023 Home Energy Federal Tax Credits Rebates Explained

U S Restarts 10 Billion Tax Credit For Clean Energy Makers Data

It Just Got A Lot Easier To Get A 7 500 Tax Credit For Buying An EV

It Just Got A Lot Easier To Get A 7 500 Tax Credit For Buying An EV

Georgia Tax Credits For Workers And Families

IRS Announces New 2024 Tax Brackets How To Find Yours Kvue

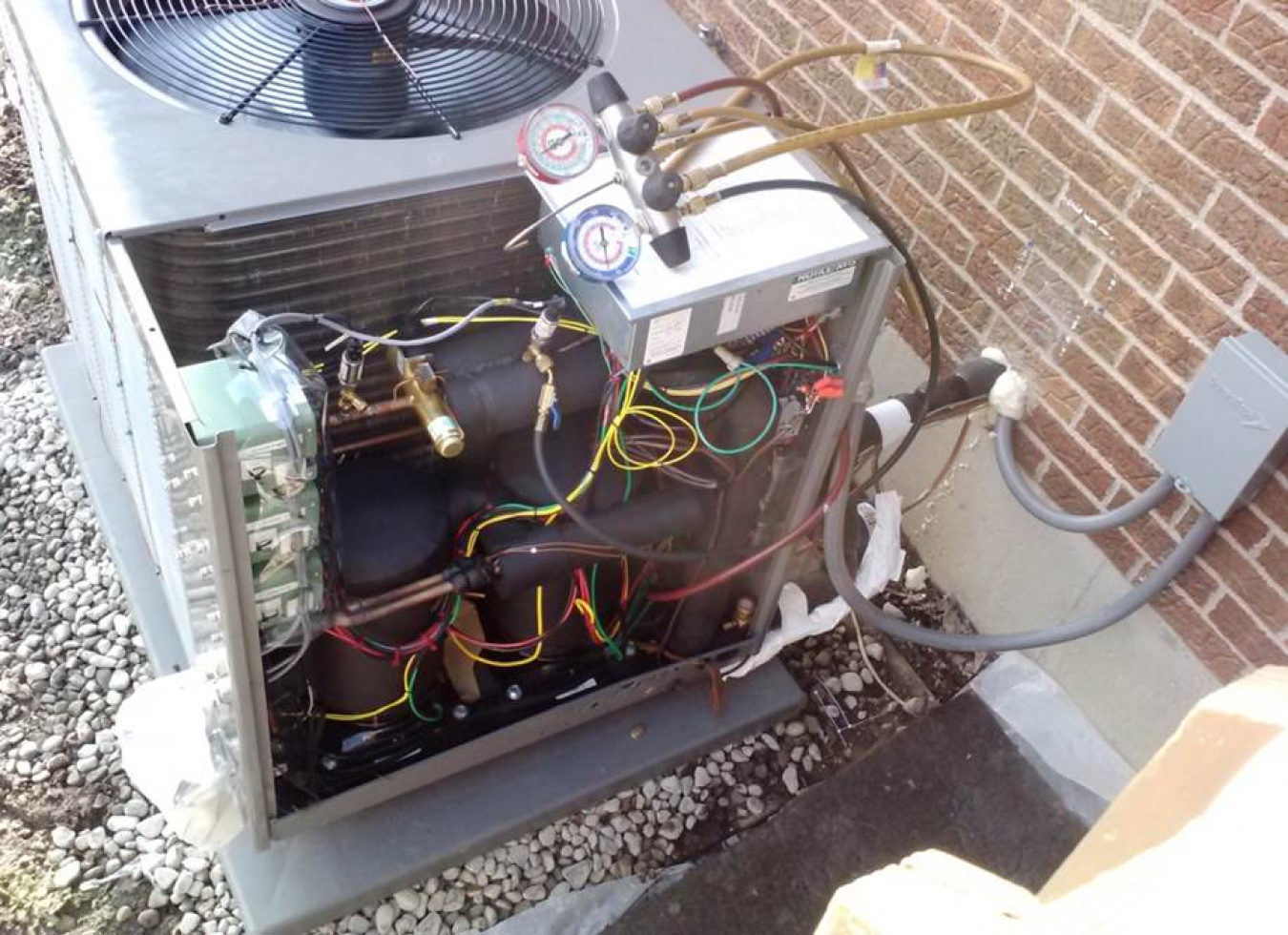

Need A Heat Pump Thermostat Recommendation HVAC DIY Chatroom Home

Tax Credit For Energy Efficient Heat Pump 2023 - Updated Tax Credit Available for 2023 2032 Tax Years 30 of cost up to 2 000 per year 30 of cost up to 600 Subject to cap of 1 200 year ents in non urban or low income com