Tax Credit For Installing Energy Efficient Air Conditioner If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

Tax Credit For Installing Energy Efficient Air Conditioner

Tax Credit For Installing Energy Efficient Air Conditioner

https://electricityrates.com/wp-content/uploads/2019/03/TraneACUnit-1076x675.jpg

Are More Efficient Air Conditioners On The Horizon

https://www.richmondsair.com/wp-content/uploads/yay-6452826-digital.jpg

It Just Got A Lot Easier To Get A 7 500 Tax Credit For Buying An EV

https://www.thecooldown.com/wp-content/uploads/2023/03/WXeB-gLf-YYifeLczQZHnsPc2zoidhRrVucmCLcQzrM.jpeg

Energy Efficient Air Conditioner Tax Credit Homeowners looking to save money and make their homes more eco friendly can benefit from the Energy Efficient Air Conditioner Tax Credit This tax credit is part of a larger set of residential energy incentives This Q How do I know if my Home Energy Audit is eligible for a credit A Consumers can visit this IRS page on the Energy Efficient Home Improvement Credit Q What products are eligible for tax credits Home clean electricity products Solar panels for electricity from a

Effective Jan 1 2023 Provides a tax credit to homeowners equal to 30 of installation costs for the highest efficiency tier products up to a maximum of 600 for qualified air conditioners and furnaces and a maximum of 2 000 Energy Efficient Home Improvement income tax credits are available for central air conditioning systems boilers furnaces air source heat pumps and biomass stoves that reach benchmarks for high efficiency The credits apply to units purchased and installed between

Download Tax Credit For Installing Energy Efficient Air Conditioner

More picture related to Tax Credit For Installing Energy Efficient Air Conditioner

Benefits Of An Energy Efficient Appliance Bone Heating And Cooling

https://boneheatingandcooling.com/wp-content/uploads/energy-efficient-appliances-1536x1152.jpeg

What Is An R D Tax Credit

https://www.letsbegamechangers.com/wp-content/uploads/2020/01/load-image-2020-01-24T030638.645-1536x1024.jpeg

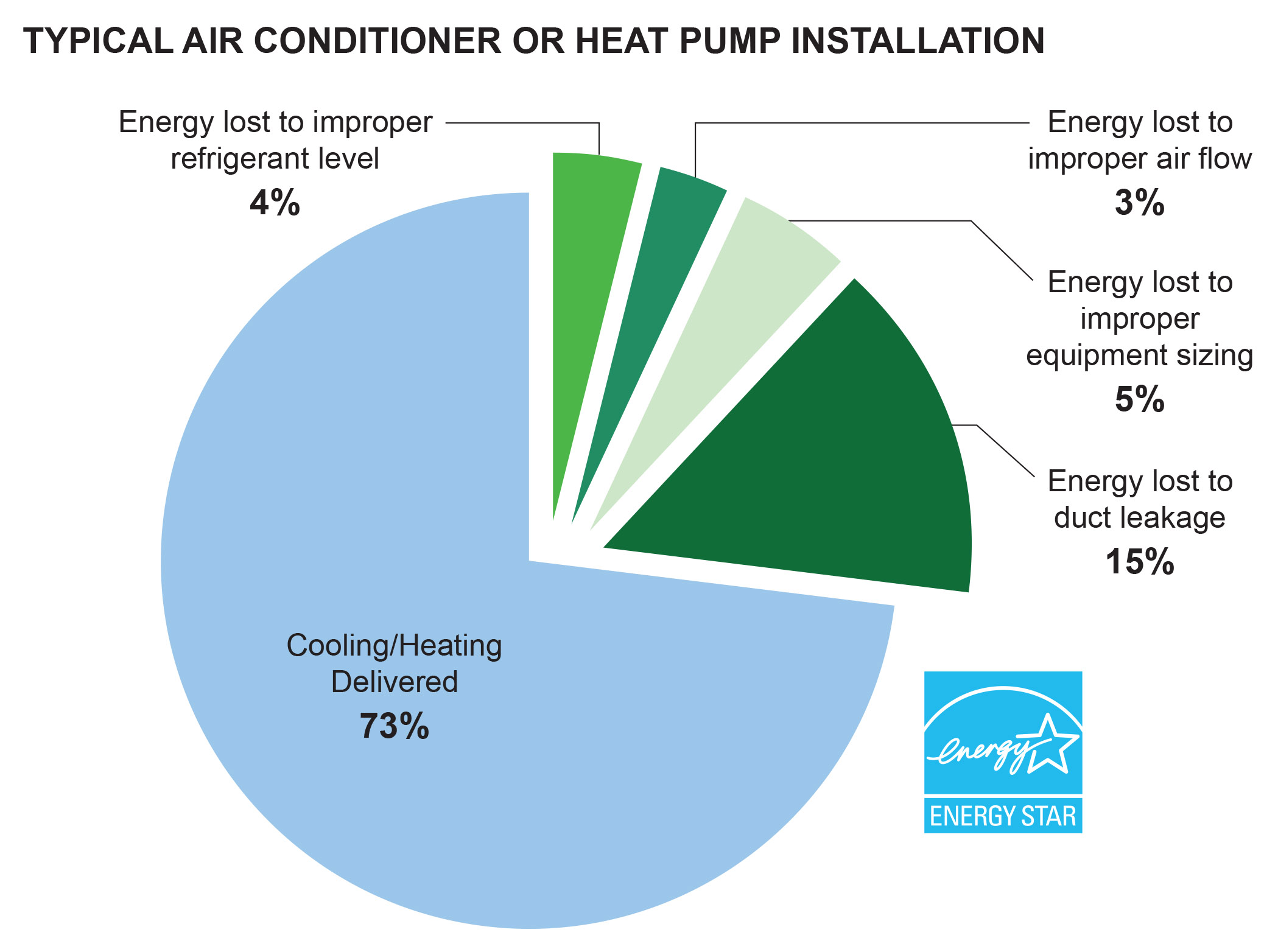

About The Smart Tools For Efficient HVAC Performance Campaign

https://www.energy.gov/sites/default/files/2022-05/EED_1862_FIG_EnergyStarPiechart.jpg

Use these steps for claiming an energy efficient home improvement tax credit for residential energy property Make sure the property on or in connection which you are installing the residential energy property is eligible The Energy Efficient Home Improvement Credit EEHIC was introduced under the Inflation Reduction Act IRA of 2022 It rewards you with tax breaks for installing qualifying energy efficient HVAC solutions in your home

The renewed Energy Efficient Home Improvement Tax Credit 25C program increases the HVAC tax credit limit for installing CEE Top Tier high efficiency equipment it is retroactive to January 1 2022 and approved until 2032 Families can claim up to 1 200 in credit each year for adding insulation or installing efficient windows and doors with a special credit of as much as 2 000 for electric heat pumps that provide

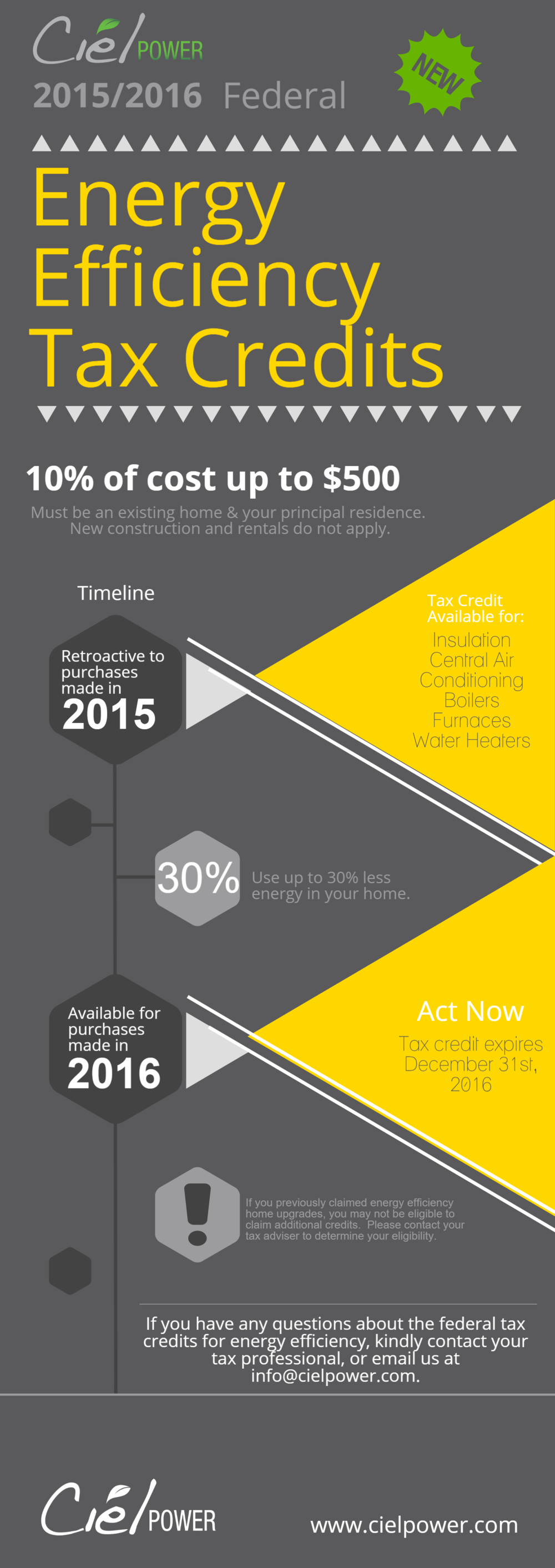

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

https://static1.squarespace.com/static/55b78a58e4b0e36966db31f9/t/56c73587cf80a157221137e4/1455896001786/

Tution Tax Credit For Students NCS CA

https://www.ncscorp.ca/wp-content/uploads/2022/03/Untitled-design-12-e1648708763193.png

https://www.irs.gov/credits-deductions/home-energy-tax-credits

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022

https://www.irs.gov/newsroom/irs-releases...

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of

EU built Electric Vehicle Tax Credit Approval Will Face Internal And

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

Historic Tax Benefit For Union Workers Championed By UDW Signed Into

The Most Energy Efficient Window Air Conditioner

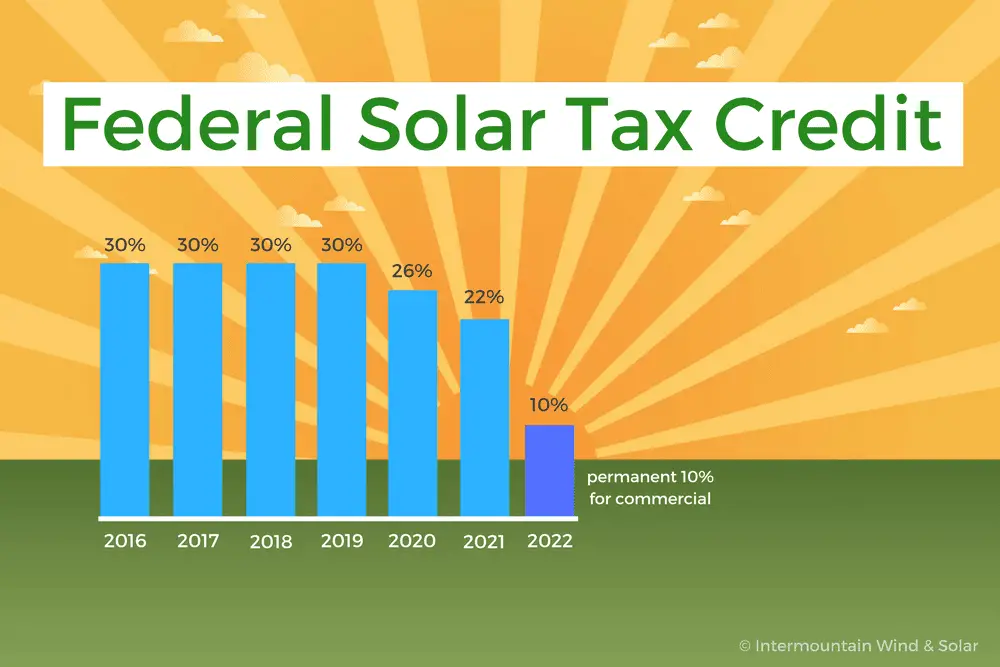

When Does Solar Tax Credit End SolarProGuide 2022

The Advantages Of An Energy Efficient Air Conditioning System

The Advantages Of An Energy Efficient Air Conditioning System

Another Way To Save New Tax Credit For Plan Participants

Best Energy Efficient Air Conditioners 2021 Review HVAC Beginners

2023 Residential Clean Energy Credit Guide ReVision Energy

Tax Credit For Installing Energy Efficient Air Conditioner - Energy Efficient Air Conditioner Tax Credit Homeowners looking to save money and make their homes more eco friendly can benefit from the Energy Efficient Air Conditioner Tax Credit This tax credit is part of a larger set of residential energy incentives This