Tax Credit For School Tuition An education tax credit allows you to reduce your taxes owed and may in some cases generate a tax refund The IRS offers two types of education tax credits to offset tuition and fees you

An education credit helps with the cost of higher education by reducing the amount of tax owed on your tax return If the credit reduces your tax to less than zero you OVERVIEW There are two federal education tax credits that can cut your tax bill by thousands of dollars You ll save more with the American Opportunity Credit up to 2 500 per student but it s typically only available

Tax Credit For School Tuition

Tax Credit For School Tuition

https://www.nerdwallet.com/ca/wp-content/uploads/sites/2/2022/01/GettyImages-936987292-e1643665970419.jpg

Tution Tax Credit For Students NCS CA

https://www.ncscorp.ca/wp-content/uploads/2022/03/Untitled-design-12-e1648708763193.png

Chapter 9 Tax Credits For Foreign Estate Tax TAX CREDIT FOR FOREIGN

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/13670d83508fce97953b9582fddf4f67/thumb_1200_1553.png

Education tax credits can help reduce the amount of tax owed or provide a refund if the credit exceeds what you owe in some cases giving you extra money to pocket into your personal funds This is great news if you re a student on a The Lifetime Learning Credit reduces your tax bill on a dollar for dollar basis for a portion of the tuition fees and other qualifying expenses you pay for yourself a spouse or a dependent to enroll in a post secondary school

Generally there are two education tax credits that you can claim Here is everything you need to know and who qualifies Credit Amount for 2023 and 2024 up to 2 500 of the cost of tuition fees and course materials paid during the taxable year per eligible student Tax credit can be received for 100 of the first 2 000 plus 25 of the next 2 000 that has

Download Tax Credit For School Tuition

More picture related to Tax Credit For School Tuition

Historic Tax Benefit For Union Workers Championed By UDW Signed Into

https://udwa.org/wp-content/uploads/TaxCredit.png

What Is The Tuition Tax Credit In Canada And How Does It Work

https://instaccountant.com/wp-content/uploads/2022/08/tuition-credit.jpg

Another Way To Save New Tax Credit For Plan Participants

https://insights.rpag.com/hubfs/Imported_Blog_Media/GettyImages-1077235824-1.jpg

Individual tax credits and deductions allow parents to receive state income tax relief for approved educational expenses which can include private school tuition books supplies computers tutors and transportation Do tuition and related expenses paid to attend a private high school qualify for an education credit If I pay college tuition and fees with a tax free scholarship can I claim

Specifically this law allows families to pay for up to 10 000 in private school tuition at elementary or secondary schools from funds in a 529 savings account Just keep in The American Opportunity Tax Credit lets you claim all of the first 2 000 you spend on eligible education expenses plus 25 of the next 2 000 for a total of 2 500

California Competes Tax Credit For Business Owners

https://capatacpa.com/wp-content/uploads/2019/02/taxtime.jpg

US Treasury Department Issues Guidelines Around A New Tax Credit For

https://s.hdnux.com/photos/01/35/50/67/24546784/3/rawImage.jpg

https://www.forbes.com › advisor › taxe…

An education tax credit allows you to reduce your taxes owed and may in some cases generate a tax refund The IRS offers two types of education tax credits to offset tuition and fees you

https://www.irs.gov › newsroom › tax-benefits-for...

An education credit helps with the cost of higher education by reducing the amount of tax owed on your tax return If the credit reduces your tax to less than zero you

How Much Is The Child Tax Credit For 2023 Here s What You Need To Know

California Competes Tax Credit For Business Owners

Georgia Tax Credits For Workers And Families

Information On The 2018 Adoption Tax Credit

Tax Credit Campaign Campaign

Tuition Agreement Template

Tuition Agreement Template

Sample Letter Tuition Payment Form Fill Out And Sign Printable PDF

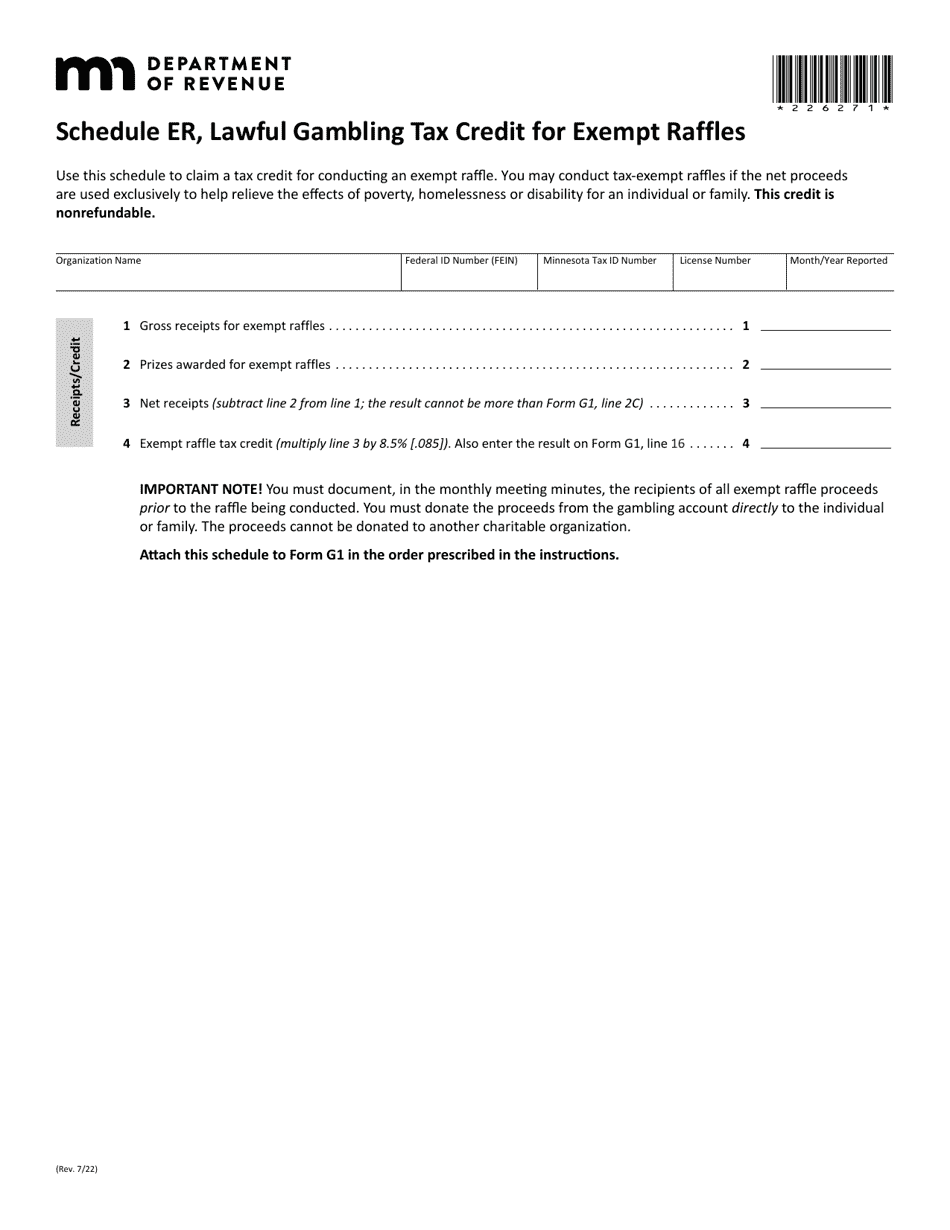

Schedule ER Download Fillable PDF Or Fill Online Lawful Gambling Tax

IRS Announces New 2024 Tax Brackets How To Find Yours Kvue

Tax Credit For School Tuition - Certain tax credits deductions and savings plans can help with the cost of higher education expenses Read below to see which option could work for you and the students in