Corporate Income Tax Rebate Ya2023 Web The deadline for filing your Corporate Income Tax Return Form C S Form C S Lite Form C for the Year of Assessment YA 2023 is 30 Nov 2023 On this page Filing of the

Web Corporate Income Tax rebates were applicable for the Years of Assessment YAs 2013 to 2020 The rebates are no longer available for YA 2023 based on Budget 2023 us Web Corporate income tax rate and rebate The corporate income tax rate would remain at 17 for year of assessment YA 2023 with no corporate income tax rebate proposed

Corporate Income Tax Rebate Ya2023

Corporate Income Tax Rebate Ya2023

https://www.rebate2022.com/wp-content/uploads/2023/05/latest-income-tax-slab-rates-for-fy-2022-23-ay-2023-24-budget-2022.jpg

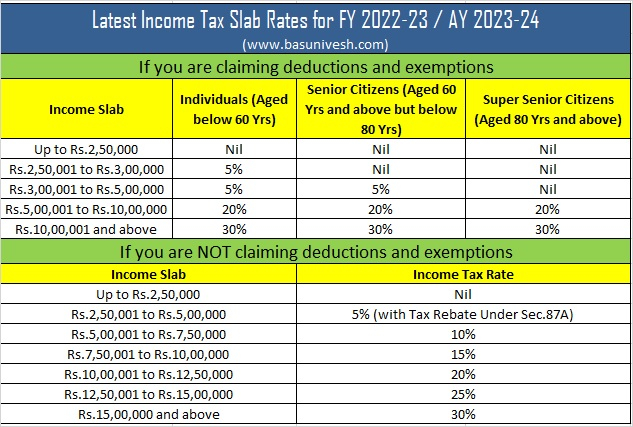

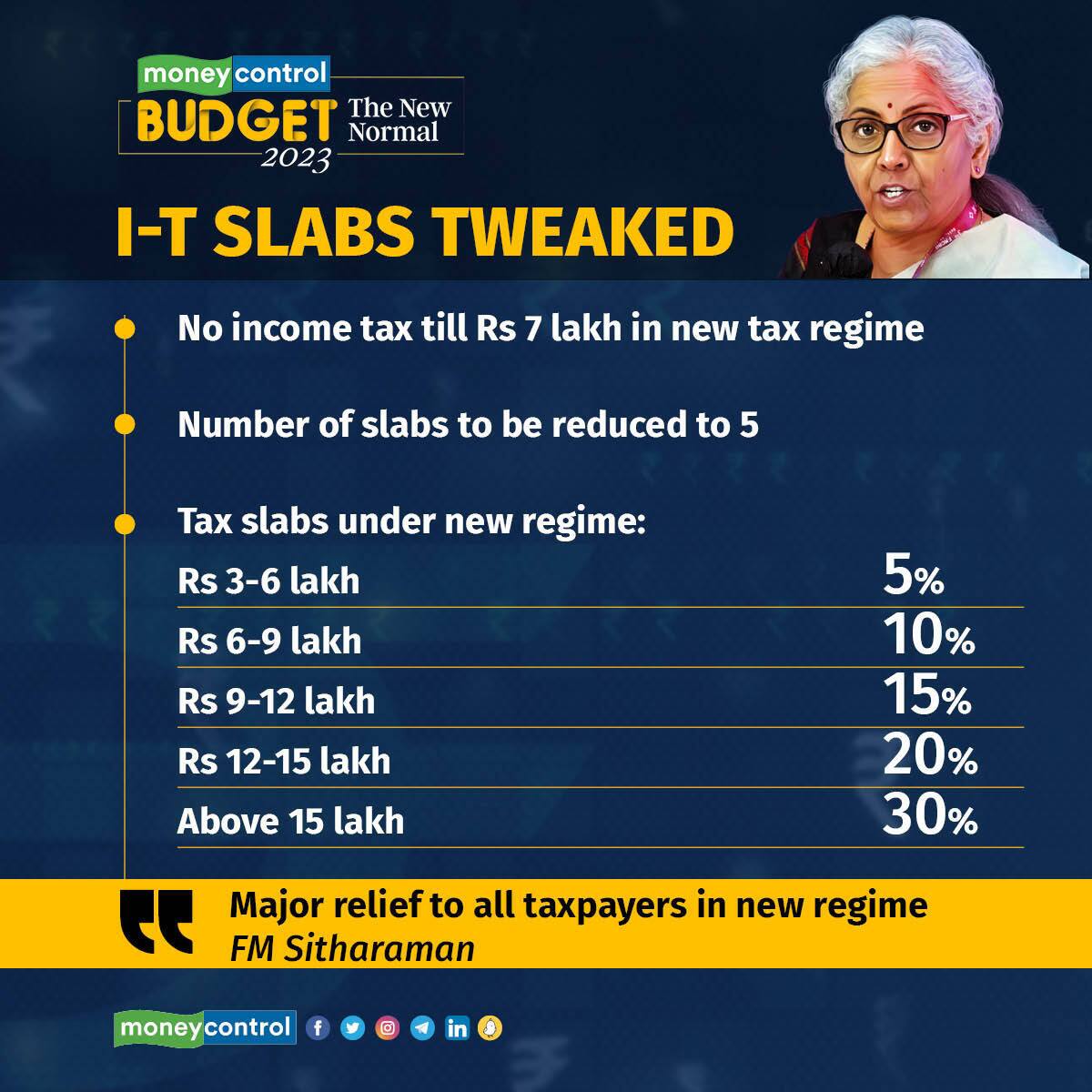

New Slabs More Rebate 5 Big Personal Income Tax Changes In Budget 2023

https://images.moneycontrol.com/static-mcnews/2023/02/Budget-2023-I-T-slabs-tweaked-2.jpg

Singapore Corporate Tax Rebate Ya 2022 Rebate2022

https://www.rebate2022.com/wp-content/uploads/2023/05/singapore-corporate-tax-rate-singapore-taxation-guide-2021.jpg

Web 9 Seamless Filing from Software SFFS enables qualifying companies and their tax agents to prepare and file Form C S to IRAS directly from software at the click of a Web 14 mars 2023 nbsp 0183 32 The Singapore corporate income tax rebate is no longer available for YA 2023 This is based on the Singapore Budget 2023 which was delivered by Singapore s Deputy Prime Minister and Minister for

Web For YA 2018 a tax rebate of 40 capped at S 15 000 is given The 40 tax rebate is on tax payable excluding tax on income subject to final withholding tax and tax deducted at Web 8 sept 2023 nbsp 0183 32 IR 2023 166 Sept 8 2023 Capitalizing on Inflation Reduction Act funding and following a top to bottom review of enforcement efforts the Internal Revenue

Download Corporate Income Tax Rebate Ya2023

More picture related to Corporate Income Tax Rebate Ya2023

Personal Income Tax Relief Malaysia 2023 YA 2022 The Updated List Of

https://i0.wp.com/blog.fundingsocieties.com.my/wp-content/uploads/2023/03/Personal-Income-Tax-Relief-Malaysia-2023-YA-2022.png?fit=1200%2C628&ssl=1

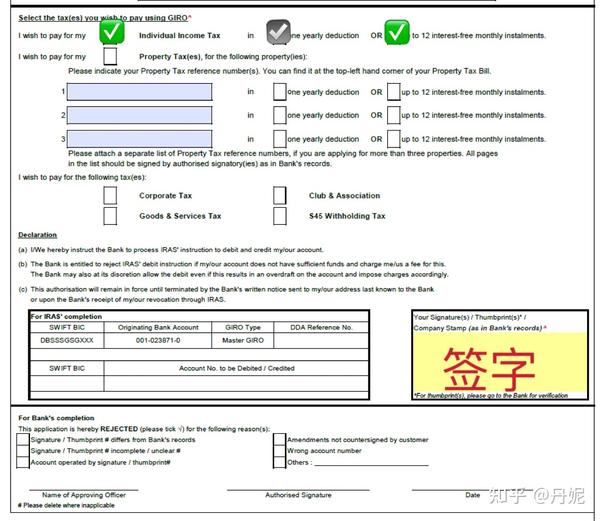

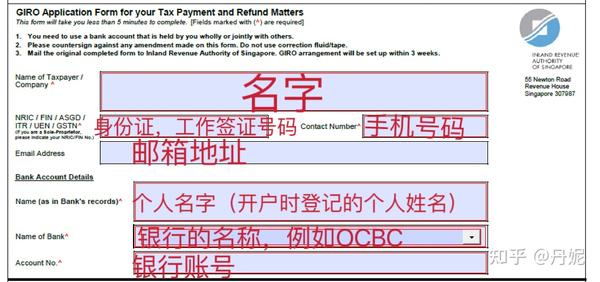

YA2023

https://pic2.zhimg.com/v2-bd74e6c411cef4bf06e2eee84e091d69_b.jpg

YA2023

https://pic4.zhimg.com/v2-eff68e38dddb319d79cc51b7de748f43_b.jpg

Web Current YA 2022 Proposed effective from YA 2023 With the additional condition existing companies and LLPs should review their foreign shareholding as they may no longer be Web Effective from YA 2023 Tiered rate incentive based on outcome Income tax rate for the first RM150 000 of chargeable income be reduced from 17 to 15 Effective from YA 2023

Web Corporate income tax rate for MSMEs will be reduced from 17 to 15 on the first chargeable income of RM150 000 while MSME now excludes companies or LLPs that Web Singapore s Corporate Income Tax rate is 17 Expand all Definition of a Company Basis Period amp Year of Assessment Corporate Income Tax Rate Corporate Income Tax

Georgia Income Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/03/Georgia-Tax-Rebate-2023-768x683.png

Business News New Income Tax Slabs 2023 24 From Income Tax Exemption

https://st1.latestly.com/wp-content/uploads/2023/02/Income-Tax-2023-24_2.jpg

https://www.iras.gov.sg/taxes/corporate-income-tax/basics-of-corporate...

Web The deadline for filing your Corporate Income Tax Return Form C S Form C S Lite Form C for the Year of Assessment YA 2023 is 30 Nov 2023 On this page Filing of the

https://www.mazars.sg/.../Corporate-Taxation/Corporate-Income-Tax-Re…

Web Corporate Income Tax rebates were applicable for the Years of Assessment YAs 2013 to 2020 The rebates are no longer available for YA 2023 based on Budget 2023 us

Malaysia Income Tax Here Are The Tax Reliefs To Claim For YA 2022

Georgia Income Tax Rebate 2023 Printable Rebate Form

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS

Deferred Tax And Temporary Differences The Footnotes Analyst

YA2023 Reducing Your Personal Income Tax In Six Ways SG Financial Advice

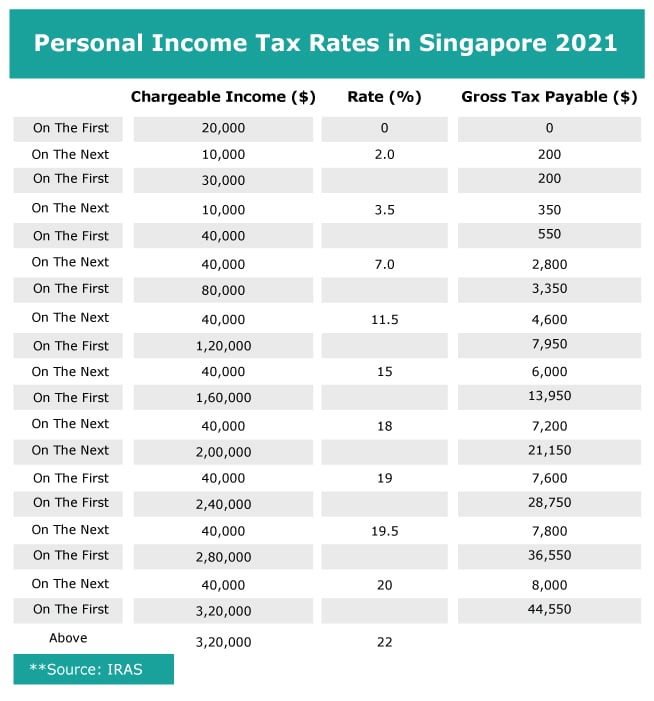

Singapore Income Tax 2023 Guide Singapore Income Tax Rates How To

Singapore Income Tax 2023 Guide Singapore Income Tax Rates How To

Updated Corporate Income Tax Rates In The OECD Mercatus Center

Comprehensive Stimulus Checks And Income Rebates For 2023 Financial

All About Corporate Tax In India For Your Business SME Infoline

Corporate Income Tax Rebate Ya2023 - Web 16 f 233 vr 2021 nbsp 0183 32 Corporate income tax The corporate income tax rate remains at 17 with a partial tax exemption on the first SGD 200 000 of a company s normal chargeable