What Is Corporate Net Income Tax Corporate tax refers to the amount charged by the government on a company s profits or net income It is an essential source of revenue for the government It is also known as corporation tax

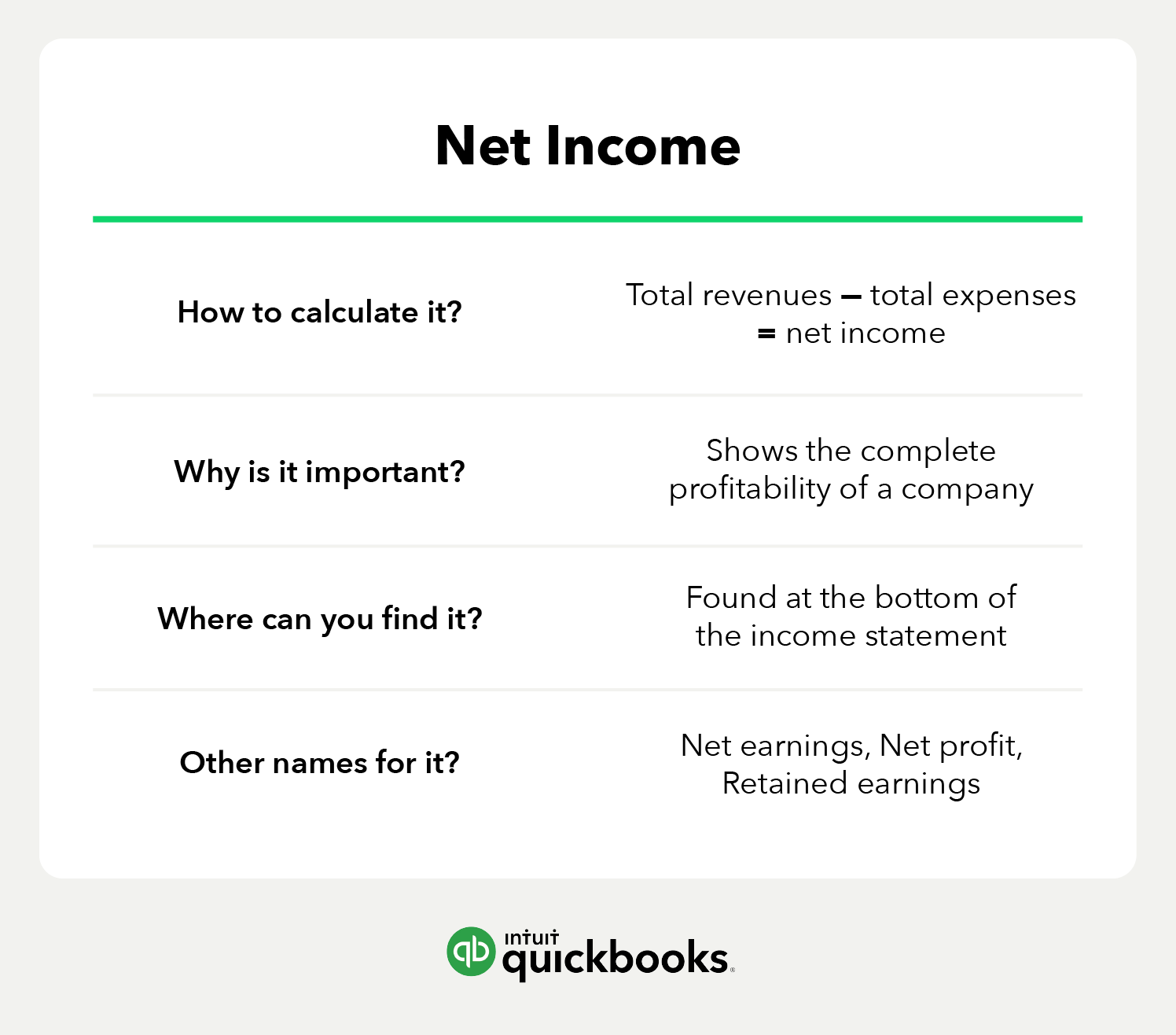

A corporate tax is a tax imposed on the net profit of a corporation that is taxed at the entity level in a particular jurisdiction Net profit for corporate tax is generally the financial statement net profit with modifications and may be defined in great detail within each country s tax system Corporate tax is an expense of a business cash outflow levied by the government that represents a country s main source of income whereas personal income tax is a type of tax governmentally imposed on an individual s income such as wages and salaries

What Is Corporate Net Income Tax

What Is Corporate Net Income Tax

http://cdn.statcdn.com/Infographic/images/normal/25017.jpeg

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

How To Calculate Net Income In Finance Haiper

https://www.investopedia.com/thmb/kXfSkhhw0-QCdPUbrNqPeI9rpn4=/2092x0/filters:no_upscale():max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg

What Is Net Income After Tax Earnings Formula Calculator

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/09/17160238/Net-Income-Calculator-960x632.jpg

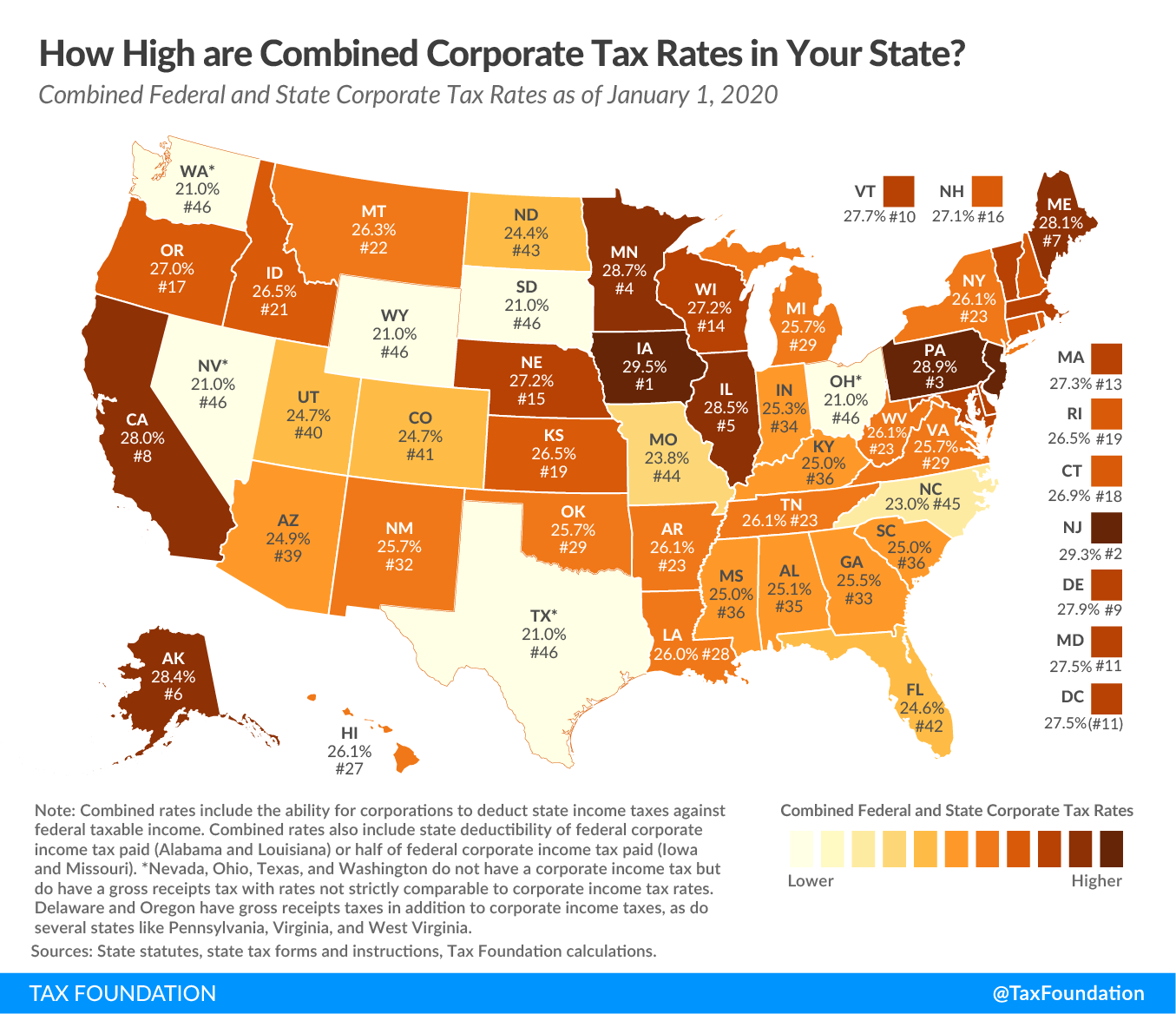

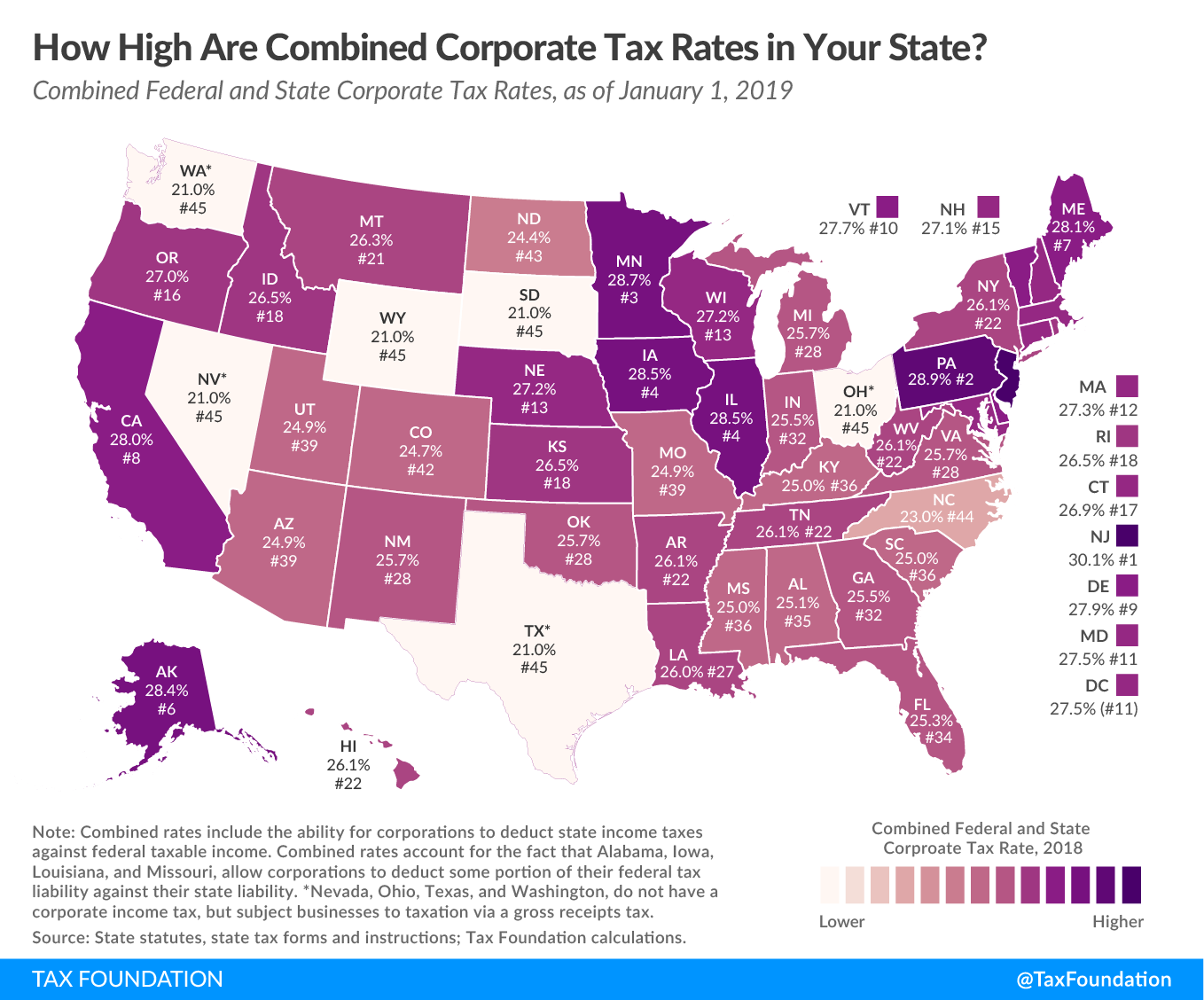

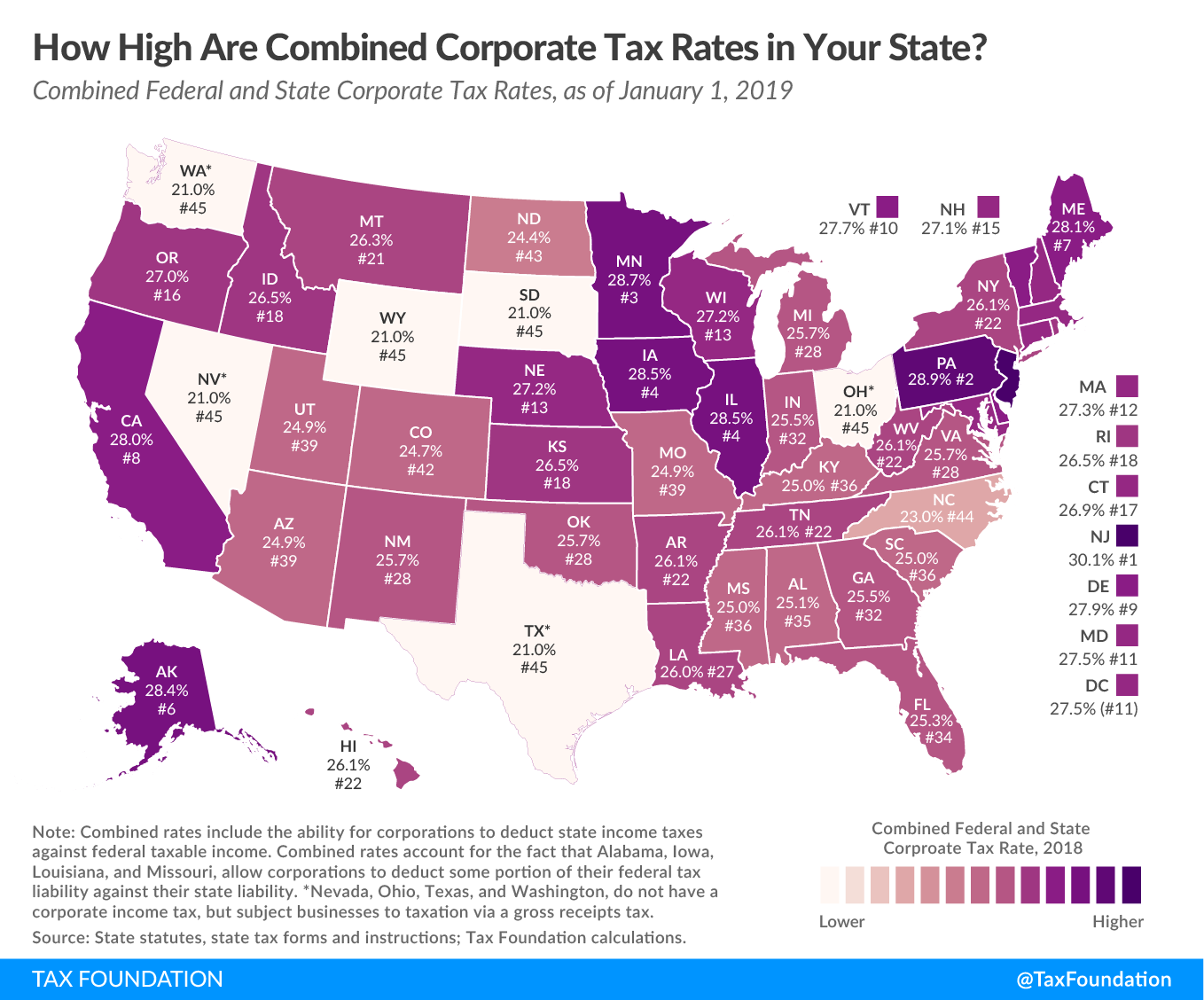

A corporate income tax CIT is levied by federal and state governments on business profits Many companies are not subject to the CIT because they are taxed as pass through businesses with income reportable under the individual income tax Corporate income tax is based on net taxable income as defined under federal or state law Generally taxable income for a corporation is gross income business and possibly non business receipts less cost of goods sold less allowable tax deductions

The corporate income tax is the third largest source of federal revenue although substantially smaller than the individual income tax and payroll taxes It raised 424 7 billion in fiscal year 2022 8 7 percent of all federal revenue and 1 7 percent of gross domestic product GDP Tax on corporate profits is defined as taxes levied on the net profits gross income minus allowable tax reliefs of enterprises

Download What Is Corporate Net Income Tax

More picture related to What Is Corporate Net Income Tax

Net Income What Is It How Is It Measured

https://www.annuity.org/wp-content/uploads/net-income-formula-2-640x0-c-default.jpg

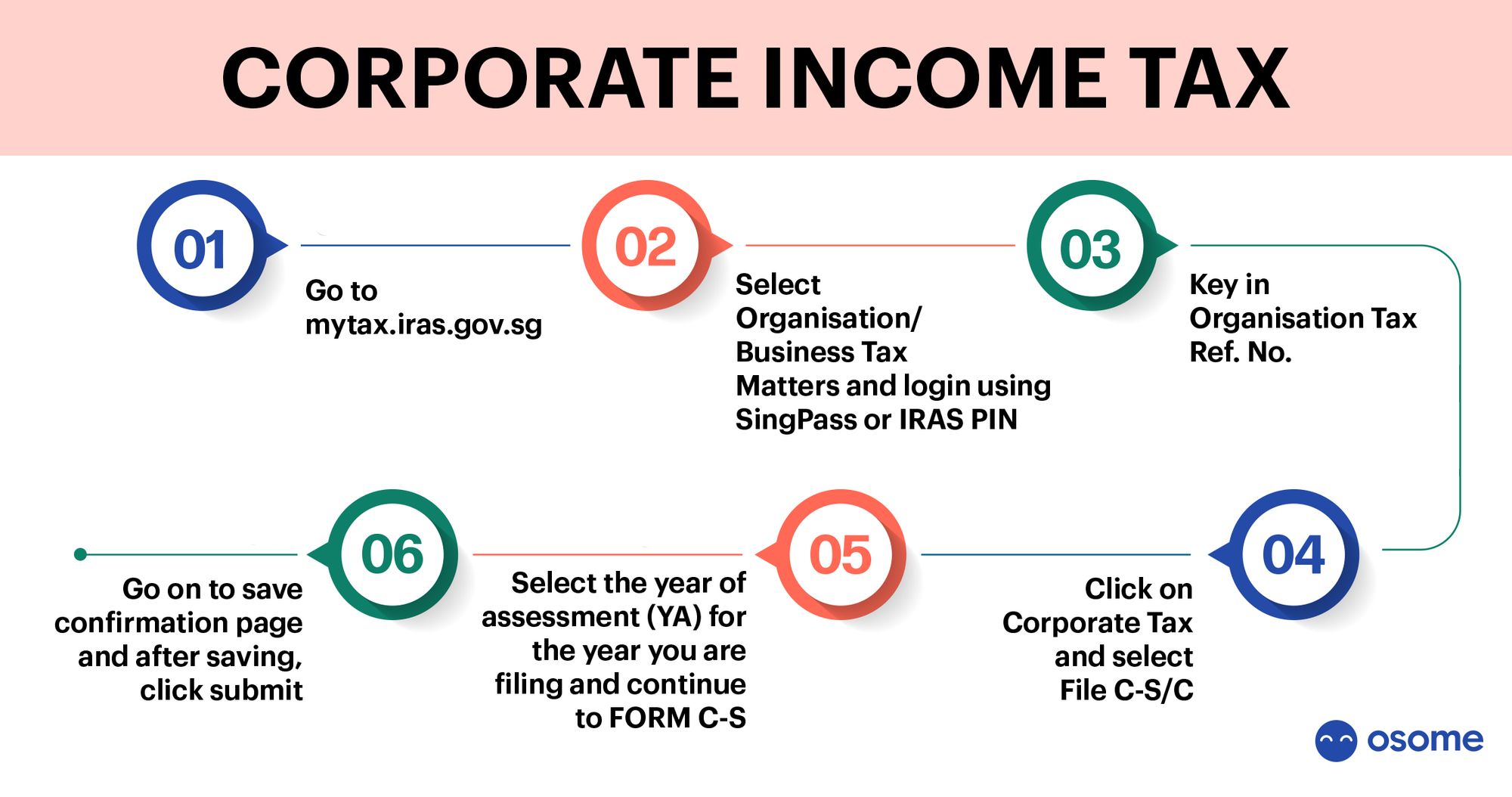

Singapore Company s Annual Filing Requirements ACRA IRAS

https://osome.com/content/images/2021/09/Corporate-Income-Tax-Filing-Process-Scheme.jpeg

Combined State And Federal Corporate Income Tax Rates In 2020 Upstate

https://upstatetaxp.com/wp-content/uploads/2020/01/CIT-Tax-Burden-on-Corporate-Profits-01-e1580483509757-1.png

Corporate income tax is the percentage of profits a business must pay to the government Corporate profits consist of revenue minus the cost of goods sold COGS general and administrative expenses G A depreciation R D interest and other operating costs During 2018 through 2025 owners of sole proprietorships partnerships limited liability companies and S corporations may deduct for income tax purposes up to 20 of the net income from the entity Regular C corporations are not pass through entities thus their shareholders do not qualify for this deduction

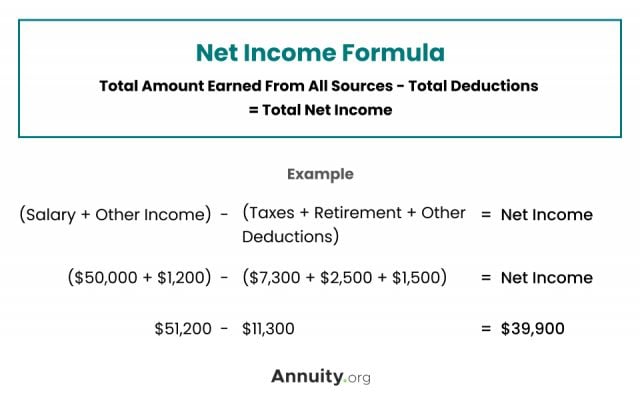

Corporate income tax is generally based on net taxable income This is the gross income minus any applicable tax deductions In any case you should begin with determining your corporation s annual income A corporation is taxed on its net income or its revenue minus expenses Revenue is what the corporation earns for selling goods or providing services Expenses are referred to as deductions The corporation is allowed to deduct anything ordinary and necessary to conduct business However certain deductions are limited

_0.png)

Income Tax Law State Income Tax Law

https://files.taxfoundation.org/legacy/docs/CIT-Share-of-State-Tax-Revenue-(Large)_0.png

Corporate Tax Definition And Meaning Market Business News

https://i2.wp.com/marketbusinessnews.com/wp-content/uploads/2016/09/Corporate-tax-rates-in-the-United-States.jpg?fit=610%2C667&ssl=1

https://www.wallstreetmojo.com › corporate-tax

Corporate tax refers to the amount charged by the government on a company s profits or net income It is an essential source of revenue for the government It is also known as corporation tax

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg?w=186)

https://en.wikipedia.org › wiki › Corporate_tax

A corporate tax is a tax imposed on the net profit of a corporation that is taxed at the entity level in a particular jurisdiction Net profit for corporate tax is generally the financial statement net profit with modifications and may be defined in great detail within each country s tax system

Income Tax Rate For Company Private Limited Provenience Provenience

_0.png)

Income Tax Law State Income Tax Law

Net Profit Calculator Online NaidiaGelica

25 Percent Corporate Income Tax Rate Details Analysis

Sauer Bildhauer nderungen Von Net Worth Formula Balance Sheet Emulsion

State Corporate Income Taxes Increase Tax Burden On Corporate Profits

State Corporate Income Taxes Increase Tax Burden On Corporate Profits

How Do Net Income And Operating Cash Flow Differ

Corporate Taxes Who Pays The Corporate Income Tax Tax Foundation

Tax And Taxation Corporate Income Tax

What Is Corporate Net Income Tax - The corporate income tax is the third largest source of federal revenue although substantially smaller than the individual income tax and payroll taxes It raised 424 7 billion in fiscal year 2022 8 7 percent of all federal revenue and 1 7 percent of gross domestic product GDP