Tax Credit For Solar In California If you are a California resident looking to install solar panels there are multiple incentives you can take advantage of to lower the cost of your system including a property tax

The federal solar investment tax credit ITC is the biggest incentive for most going solar in California The ITC is worth 30 of the system s total cost including equipment labor and On this page we cover all of the solar and battery incentives rebates and tax credits available for your California home solar installation We also provide guidance on how low income solar power programs work

Tax Credit For Solar In California

Tax Credit For Solar In California

https://enlightenedsolar.com/wp-content/uploads/2021/08/solar-panels.jpeg

How Does The Federal Tax Credit For Solar Work Tampa Bay Solar

https://tampabaysolar.com/wp-content/uploads/2022/04/AdobeStock_201159810-2048x1365.jpeg

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

https://www.ecohousesolar.com/wp-content/uploads/2022/09/Ecohouse-Tax-Credit-Featured-09.png

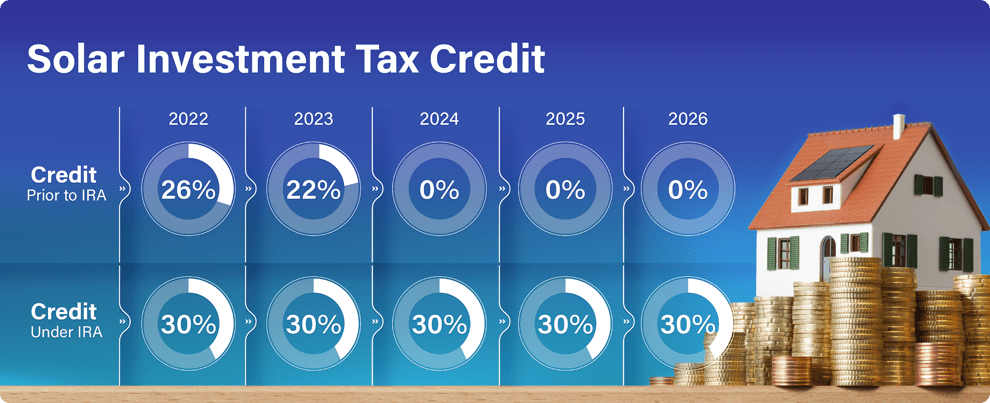

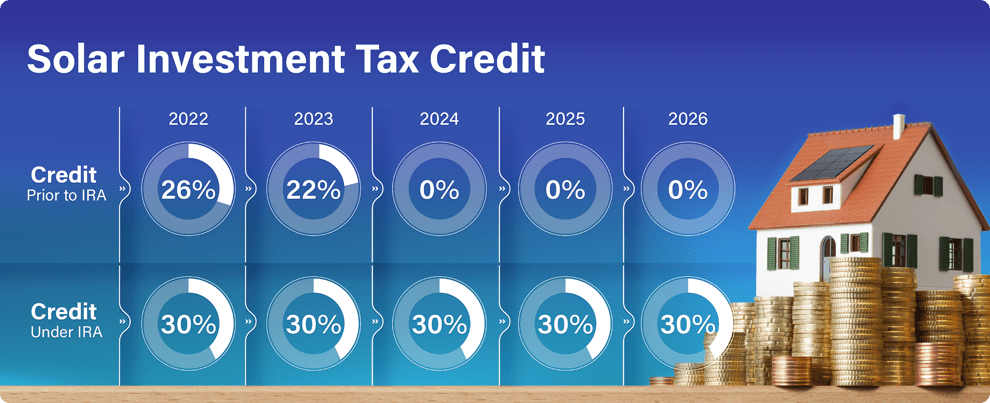

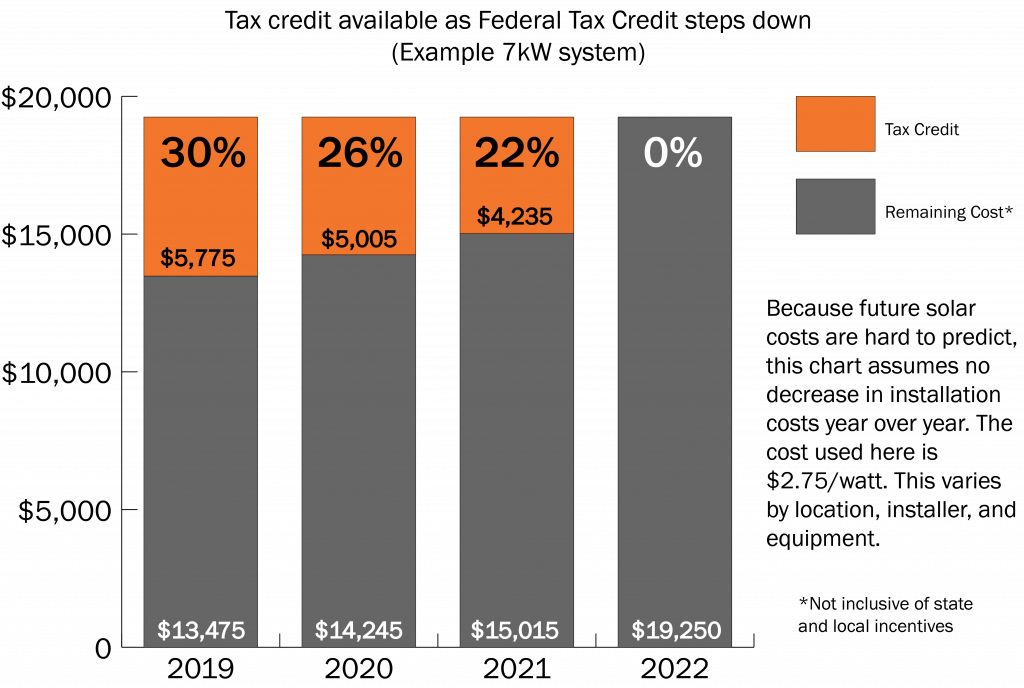

The Residential Clean Energy Credit formerly known as the federal investment tax credit ITC can reduce your solar panel system s cost by 30 Your entire system qualifies for this incentive including equipment labor permitting and sales tax Solar tax credits encourage investments in solar energy by giving you money back at tax time The amount of tax benefit will usually be a percentage of the amount invested in solar energy

The federal solar tax credit is one of the most valuable incentives in California and it s available to all residents It s designed to help reduce the effective cost of converting to solar and incentivize residents to adopt renewable energy Are you eligible for solar incentives and solar tax credits in California Learn more about the California solar tax credit for 2023 and eligibility requirements

Download Tax Credit For Solar In California

More picture related to Tax Credit For Solar In California

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

https://i.ytimg.com/vi/1fI71WzZo5w/maxresdefault.jpg

Inflation Reduction Act Could Have Big Benefit For Solar In Arizona

https://www.gannett-cdn.com/presto/2022/08/27/PPHX/623d257e-9630-4f68-8547-57776753aa7b-B9318124902Z.1_20150717233810_000_GHBBCODT1.1-0.png?crop=3215,1809,x0,y159&width=2400&height=1350&format=pjpg&auto=webp

What You Need To Know About The ITC Solar Tax Credit Decreasing After

https://amsunsolar.com/wp-content/uploads/2019/02/ITC-Solar-Tax-Credit-A.M.-Sun-Solar.jpg

The first tax incentive to mention is the 30 federal solar tax credit also known as the ITC or Residential Clean Energy Credit This federal tax credit is worth 30 of the cost of installing solar and battery storage systems with no limit The biggest solar incentive California residents can take advantage of is the federal solar tax credit also called the Investment Tax Credit ITC According to our 2024 survey of 1 000 recent solar buyers 64 took advantage of the ITC as a way to get money back

For California homeowners looking to go solar available solar tax credits incentives and rebates can help mitigate the installation and equipment costs while net energy metering and net billing provide ways to be compensated for exported solar energy Regardless of where you live in California there are a few solar incentives and rebates for you including property assessed clean energy PACE property tax exemption for PV systems and net energy metering NEM

The Federal Solar Tax Credit Can Save You Thousands Green Ridge Solar

https://greenridgesolar.com/wp-content/uploads/2019/01/tax-credit-change-.jpg

The Federal Solar Tax Credit Explained Sunshine Plus Solar

https://sunshineplussolar.com/wp-content/uploads/2020/05/The-Federal-Solar-Tax-Credit-Explained-2.png

https://www.marketwatch.com/guides/solar/california-solar-tax-credits

If you are a California resident looking to install solar panels there are multiple incentives you can take advantage of to lower the cost of your system including a property tax

https://www.consumeraffairs.com/solar-energy/...

The federal solar investment tax credit ITC is the biggest incentive for most going solar in California The ITC is worth 30 of the system s total cost including equipment labor and

Solar Tax Credit 2016 Solar Investment Tax Credit FAQ NATiVE

The Federal Solar Tax Credit Can Save You Thousands Green Ridge Solar

The Federal Tax Credit For Solar Power Has Dropped To 26

Solar Tax Credit 2022 Incentives For Solar Panel Installations

2021 Solar Investment Tax Credit What You Need To Know

From Rooftops To Roadways What The Inflation Reduction Act Means For

From Rooftops To Roadways What The Inflation Reduction Act Means For

Go Solar In 2019 To Take Full Advantage Of The Federal Solar Tax Credit

How The New Inflation Reduction Act 30 Solar Tax Credit Works

Solar Tax Credit In 2021 SouthFace Solar Electric AZ

Tax Credit For Solar In California - Solar tax credits encourage investments in solar energy by giving you money back at tax time The amount of tax benefit will usually be a percentage of the amount invested in solar energy