Tax Credit For Solar On Rental Property The solar energy credit is reserved for your main residence NOT a rental property You may be able to take the Investment Tax Credit ITC using Form 3468 if you qualify See

How to Claim the Credit The credit for installing solar panels can be claimed using tax form 3468 The relevant solar credit is the Investment Tax Credit ITC in Part VI of the form You will also need to complete Part I lines 1 14 and Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming

Tax Credit For Solar On Rental Property

Tax Credit For Solar On Rental Property

https://www.kcgreenenergy.com/content/uploads/2019/06/Tax-Credit-Graphic.png

Everything You Need To Know The New 2021 Solar Federal Tax Credit

https://www.sunnova.com/-/media/Marketing-Components/Blog/Blog-Optimized-Images/Sunnova_Solar-Tax-Credits-April-Blog_History-min.ashx

The Federal Solar Tax Credit Explained Sunshine Plus Solar

https://sunshineplussolar.com/wp-content/uploads/2020/05/The-Federal-Solar-Tax-Credit-Explained-2.png

A valuable 30 credit for the cost of solar panels and related property is available for qualifying property installed in residential property used as a personal residence as well as for residential property held for rent The rules vary by credit Under the Energy Efficient Home Improvement Credit a taxpayer can claim the credit only for qualifying expenditures incurred for an existing home

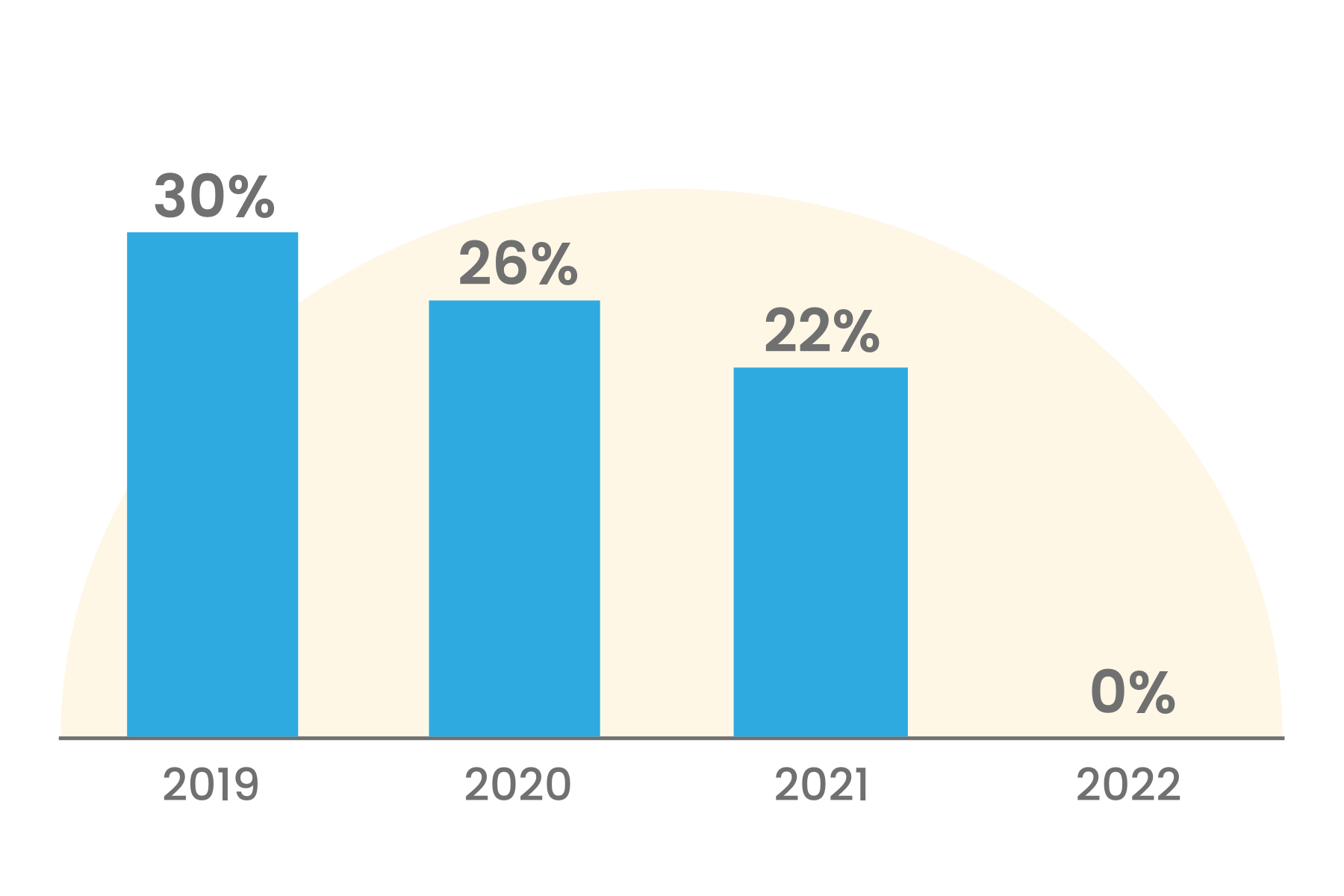

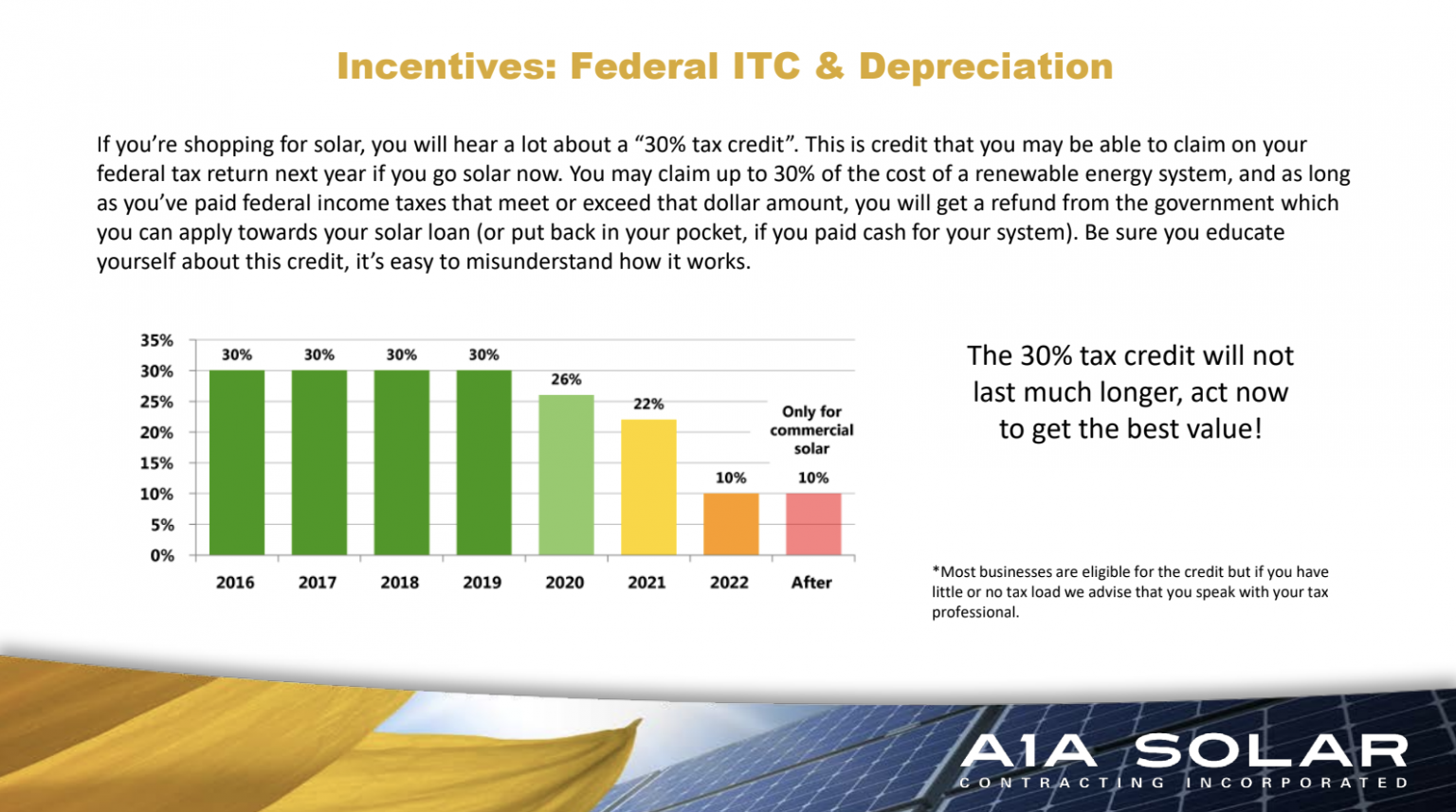

Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in 2022 If you make energy Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before

Download Tax Credit For Solar On Rental Property

More picture related to Tax Credit For Solar On Rental Property

Solar Tax Credit In 2021 SouthFace Solar Electric AZ

https://southfacesolar.com/wp-content/uploads/2021/01/136682227_5076885039018728_2629942985947998441_n-600x503.png

Solar Tax Credit Guide And Calculator

https://www.solar-estimate.org/images/pages/solar-tax-credit/residential-bar.png

Why The Solar Tax Credit Extension Is A Big Deal In 2020 EnergySage

https://news.energysage.com/wp-content/uploads/2018/03/01.04_ITC_extension-1.png

Claiming the solar tax credit for rental property you own You can t claim the Residential Clean Energy solar tax credit for installing solar power at rental properties you own unless you also live in the house for part of the year Save 30 on solar panels for your rental properties with the federal solar tax credit Learn how to claim the commercial solar tax credit in 2024 Contact Boston Solar today

For tax years 2022 to 2032 you can get a credit for up to 30 of the expense of installing solar panels this may include the price of the panels themselves sales taxes and The following expenses are included Solar PV panels or PV cells used to power an attic fan but not the fan itself Contractor labor costs for onsite preparation assembly or original

Get A 30 Federal Tax Credit For Your Solar Panel System While You Can

https://a1asolar.com/wp-content/uploads/2018/10/tax-credit-chart-1536x857.png

What You Need To Know About The ITC Solar Tax Credit Decreasing After

https://amsunsolar.com/wp-content/uploads/2019/02/ITC-Solar-Tax-Credit-A.M.-Sun-Solar.jpg

https://ttlc.intuit.com/community/investments-and...

The solar energy credit is reserved for your main residence NOT a rental property You may be able to take the Investment Tax Credit ITC using Form 3468 if you qualify See

https://taxmodern.com/articles/tax-credi…

How to Claim the Credit The credit for installing solar panels can be claimed using tax form 3468 The relevant solar credit is the Investment Tax Credit ITC in Part VI of the form You will also need to complete Part I lines 1 14 and

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

Get A 30 Federal Tax Credit For Your Solar Panel System While You Can

Filing For The Solar Tax Credit Wells Solar

How Do I Claim The Federal Solar Tax Credit

Solar Tax Credit 2016 Solar Investment Tax Credit FAQ NATiVE

What Is The Federal Tax Credit For Solar Energy YouTube

What Is The Federal Tax Credit For Solar Energy YouTube

Solar 2021 Updates 26 Federal Tax Credit Extended Until 2023

When Does Solar Tax Credit End SolarProGuide 2022

How To Claim Your Solar Tax Credit Design mlm

Tax Credit For Solar On Rental Property - Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before