Tax Credit For Working Through Pandemic 2023 AP By Madison Czopek January 17 2023 Workers aren t being paid up to 26 000 because of a COVID 19 related tax credit as claim suggests If Your Time is short Congress created the

Tax Changes for 2023 Say Goodbye to Many COVID 19 Credits and Deductions Taxes U S News Taxes Personal Finance Money Home Tax Changes for 2023 Say Goodbye to Many COVID 19 We re offering tax help for individuals families businesses tax exempt organizations and others including health plans affected by coronavirus Child Tax Credit The 2021 Child Tax

Tax Credit For Working Through Pandemic 2023

Tax Credit For Working Through Pandemic 2023

https://www.cbpp.org/sites/default/files/2023-04/policybasics-eitc_rev4-28-23_f1.png

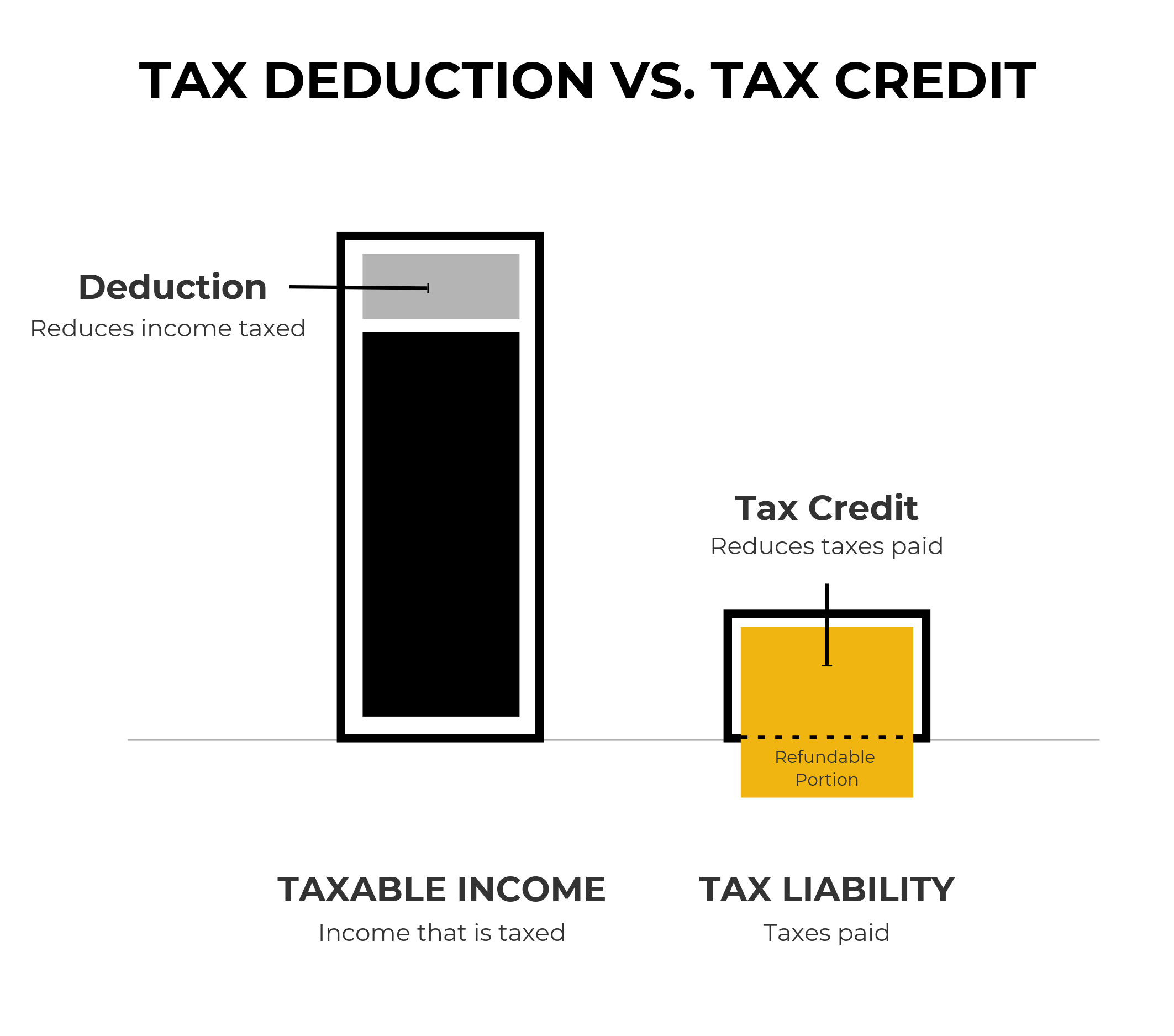

Tax Credits Save You More Than Deductions Here Are The Best Ones

https://www.gannett-cdn.com/-mm-/14ee05d59f10019b9af859e1b8044dff44c16b5c/c=0-64-2118-1261&r=x1683&c=3200x1680/local/-/media/2017/03/28/USATODAY/USATODAY/636262972570306279-tax-credits.jpg

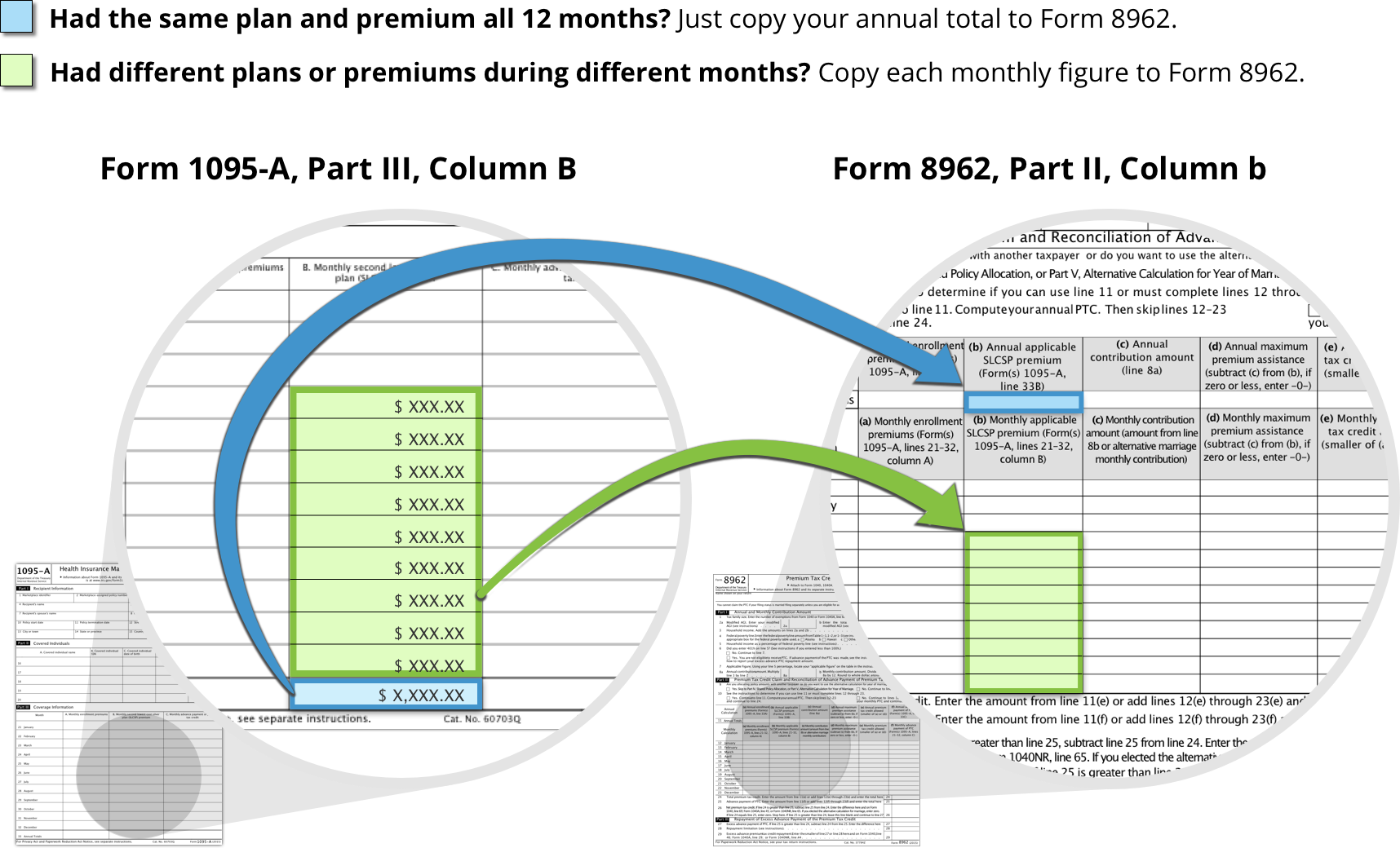

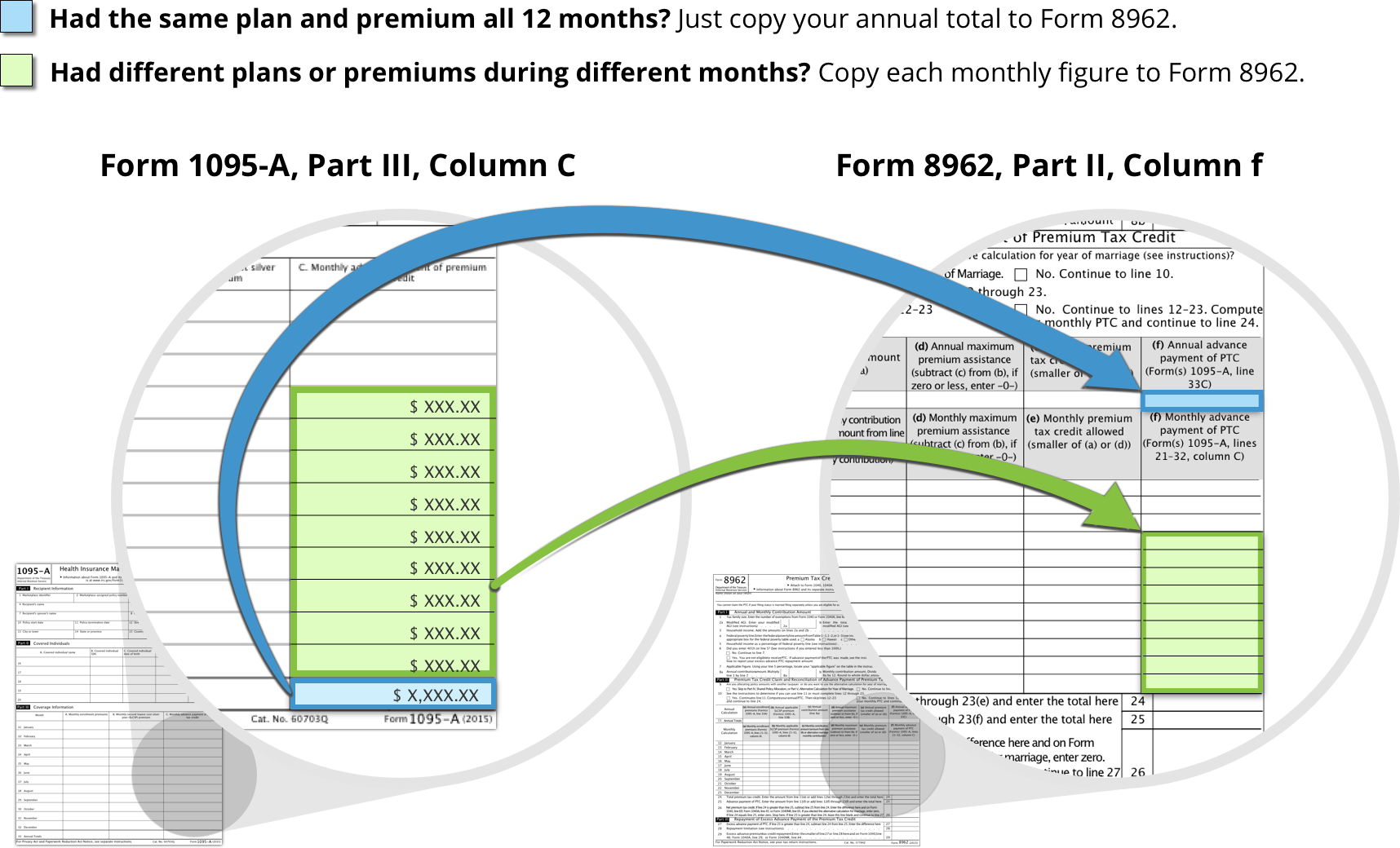

How To Reconcile Your Premium Tax Credit HealthCare gov

https://www.healthcare.gov/assets/content-modals/reconcile-silver.png

OVERVIEW If you re self employed the coronavirus COVID 19 pandemic is likely impacting your business Here s what tax relief is available under the major coronavirus Eligible Employers can claim the Employee Retention Credit equal to 50 percent of up to 10 000 in qualified wages including qualified health plan expenses on wages paid after

Among the several pandemic tax credits returning to 2019 levels is the Child Tax Credit CTC Filers that qualified for a 3 600 per dependent in 2021 will get a credit of 2 000 in The EITC expansion will benefit an estimated 17 4 million American workers increasing their ability to pay rent and other bills afford enough food access health

Download Tax Credit For Working Through Pandemic 2023

More picture related to Tax Credit For Working Through Pandemic 2023

How To Reconcile Your Premium Tax Credit HealthCare gov

https://www.healthcare.gov/assets/content-modals/reconcile-credit.png

2020 Policy Proposals Working Family Tax Credits

https://www.bellpolicy.org/wp-content/uploads/2019/07/tax-deduction-vs.-tax-credit.png

What Is Recovery Rebate Tax Credit For 2020 All About AOTAX COM

https://www.aotax.com/wp-content/uploads/2021/02/What-is-Recovery-Rebate-Tax-Credit-for-2020-all-about-1-1080x675.jpg

A part of the 2020 CARES Act the Employee Retention Credit ERC also referred to as the Employee Retention Tax Credit ERTC is a refundable payroll tax credit Employers can claim a pandemic era tax credit worth up to 26 000 per worker if a government order fully or partially suspended their operations Some employers and tax

The Coronavirus Aid Relief and Economic Security CARES Act P L 116 136 created the employee retention credit ERC available to all businesses that continued to pay Dec 07 2023 12 00 PM ET Around 46 million self employed Americans may be eligible to claim up to 32 220 in tax credit refunds from the IRS due to COVID 19 LONDON UK December

New Child Tax Credit Explained When Will Monthly Payments Start

https://media.9news.com/assets/KUSA/images/6401c0ff-2eae-43ab-87f9-5318969aa0f5/6401c0ff-2eae-43ab-87f9-5318969aa0f5_1920x1080.jpg

Small Businesses May Be Eligible For Up To 250 000 In Tax Credits

https://gusto.com/wp-content/uploads/2018/04/Federal-RD-Tax-Credit-Gusto-SBR-04-2018.jpeg

https://www.politifact.com/factchecks/2…

AP By Madison Czopek January 17 2023 Workers aren t being paid up to 26 000 because of a COVID 19 related tax credit as claim suggests If Your Time is short Congress created the

https://money.usnews.com/.../tax-chan…

Tax Changes for 2023 Say Goodbye to Many COVID 19 Credits and Deductions Taxes U S News Taxes Personal Finance Money Home Tax Changes for 2023 Say Goodbye to Many COVID 19

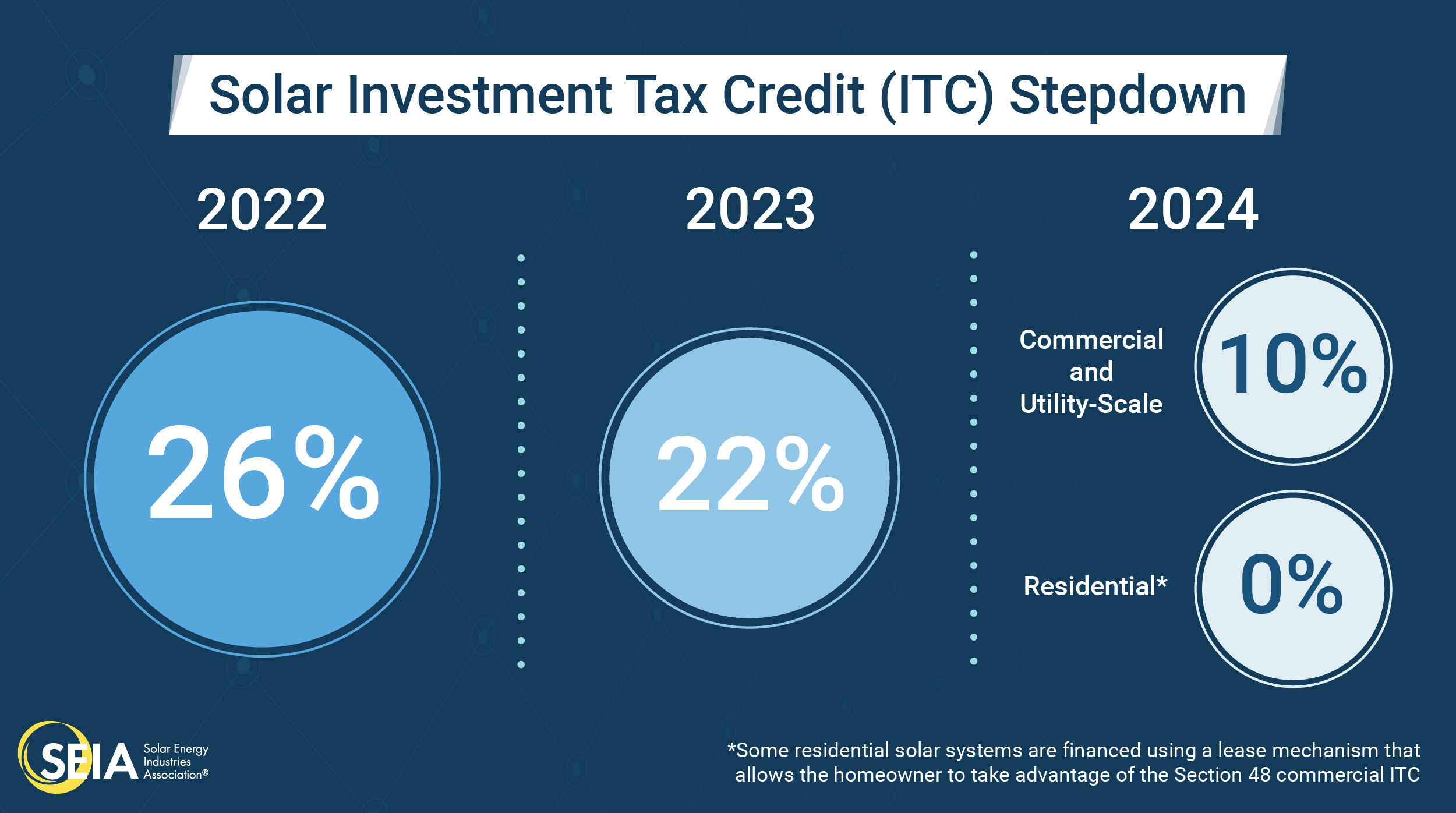

Solar Investment Tax Credit ITC SEIA

New Child Tax Credit Explained When Will Monthly Payments Start

Some COVID 19 Programs Out Of Money Options The ERC Tax Credit For

Chart COVID Crisis Results In Staggering Loss Of Working Hours Statista

IRS Changes For Tax Year 2022 Returns Next Step Enterprises

Treasury And IRS Issue Long Awaited Proposed Regulations For Section

Treasury And IRS Issue Long Awaited Proposed Regulations For Section

Policy Basics Tax Exemptions Deductions And Credits Center On

Early Learning Coalition Of Broward County Inc Learn More About The

Minnesota Income Tax Credit For Past Military Service MN Tax Lawyer

Tax Credit For Working Through Pandemic 2023 - Among the several pandemic tax credits returning to 2019 levels is the Child Tax Credit CTC Filers that qualified for a 3 600 per dependent in 2021 will get a credit of 2 000 in