Tax Credit Form For Wood Burning Stove A The tax credit was signed into law on December 21 2020 and stoves purchased and installed in 2021 and 2022 will qualify for the 26 tax credit In 2023 the tax credit

Beginning in 2023 consumers buying highly efficient wood or pellet stoves or larger residential biomass heating systems may be eligible to claim a 30 tax credit capped The federal 25c tax credit on wood and pellet stoves can save you up to 2000 How so With the August 16 2022 signing of the Inflation Reduction Act IRA

Tax Credit Form For Wood Burning Stove

Tax Credit Form For Wood Burning Stove

https://irp.cdn-website.com/486121ac/dms3rep/multi/Screen+Shot+2021-09-29+at+11.37.54+AM.png

Wood Burning Stove Size Calculator quick And Simple House And Proud

https://houseandproud.com/wp-content/uploads/2021/12/Size-calculator-for-wood-burning-stoves-UK.jpg

Wood Stove With Chimney Exiting Through The Lacing Pin Area Http

https://i.pinimg.com/originals/59/f7/37/59f7375b73e9d7ef335d457a03356d42.jpg

From January 1 2023 through December 31 2032 taxpayers who install qualifying wood and pellet stoves will receive a 30 tax credit that is capped at 2 000 annually based Is there a Federal tax credit available for new wood stoves Yes We are referring all questions regarding the current 26 Federal tax credit on wood heaters known as the 2021 2023 Biomass Stove 25 D

Tax Credit Duration Amount From January 1 2023 to December 31 2032 homeowners can get a tax credit of 30 on both the purchase and installation of With the signing of the 2022 Inflation Reduction Act high efficiency wood stoves now qualify for a 30 tax credit under Section 25 C of the Internal Revenue Code This tax credit is

Download Tax Credit Form For Wood Burning Stove

More picture related to Tax Credit Form For Wood Burning Stove

Antique Wood Burning Stove Staten Island Pick Up EBay

https://i.ebayimg.com/images/g/KucAAOSwK99kxDJa/s-l1600.jpg

APG Outdoor Wood Gas Wood burning Stove Portable Folding Firewood Stove

https://images.nexusapp.co/assets/a2/03/ac/120466645.jpg

FREE Wood Burning Stove Donation From Subscriber YouTube

https://i.ytimg.com/vi/AkukyQpfBj4/maxresdefault.jpg

It is a 30 percent non refundable tax credit for purchasing and installing a qualifying biomass burning stove before between January 1 2023 and December 31 In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the

For qualified fuel cell property see Lines 7a and 7b later You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property The current version of IRS Form 5695 is accurate for taking the 300 tax credit under section 25 C for purchases made in 2019 The new tax credit is for the

Top Loading Wood Stove Todalaactualidadmotor

https://i.pinimg.com/originals/9b/72/8b/9b728b60353ec1f78c581f1174975c2a.gif

Can You Use Duraflame Logs In A Wood Stove Freedom Residence

https://freedomresidence.com/wp-content/uploads/2022/03/Can-You-Use-Duraflame-Logs-In-A-Wood-Stove.jpg

https://woodstove.com/tax-credit-initiatives

A The tax credit was signed into law on December 21 2020 and stoves purchased and installed in 2021 and 2022 will qualify for the 26 tax credit In 2023 the tax credit

https://www.hpba.org/Advocacy/Biomass-Stove-Tax-Credit

Beginning in 2023 consumers buying highly efficient wood or pellet stoves or larger residential biomass heating systems may be eligible to claim a 30 tax credit capped

How To Keep A Wood Burning Stove Burning Cosywarmer

Top Loading Wood Stove Todalaactualidadmotor

8 Reasons Why You Need A Wood Burning Stove Home Living

Pin On Home

Disability Tax Credit Form PDF Visual Impairment Medical Diagnosis

Wood Heat Vs Pellet Stove What s The Difference Best Pellet Stove

Wood Heat Vs Pellet Stove What s The Difference Best Pellet Stove

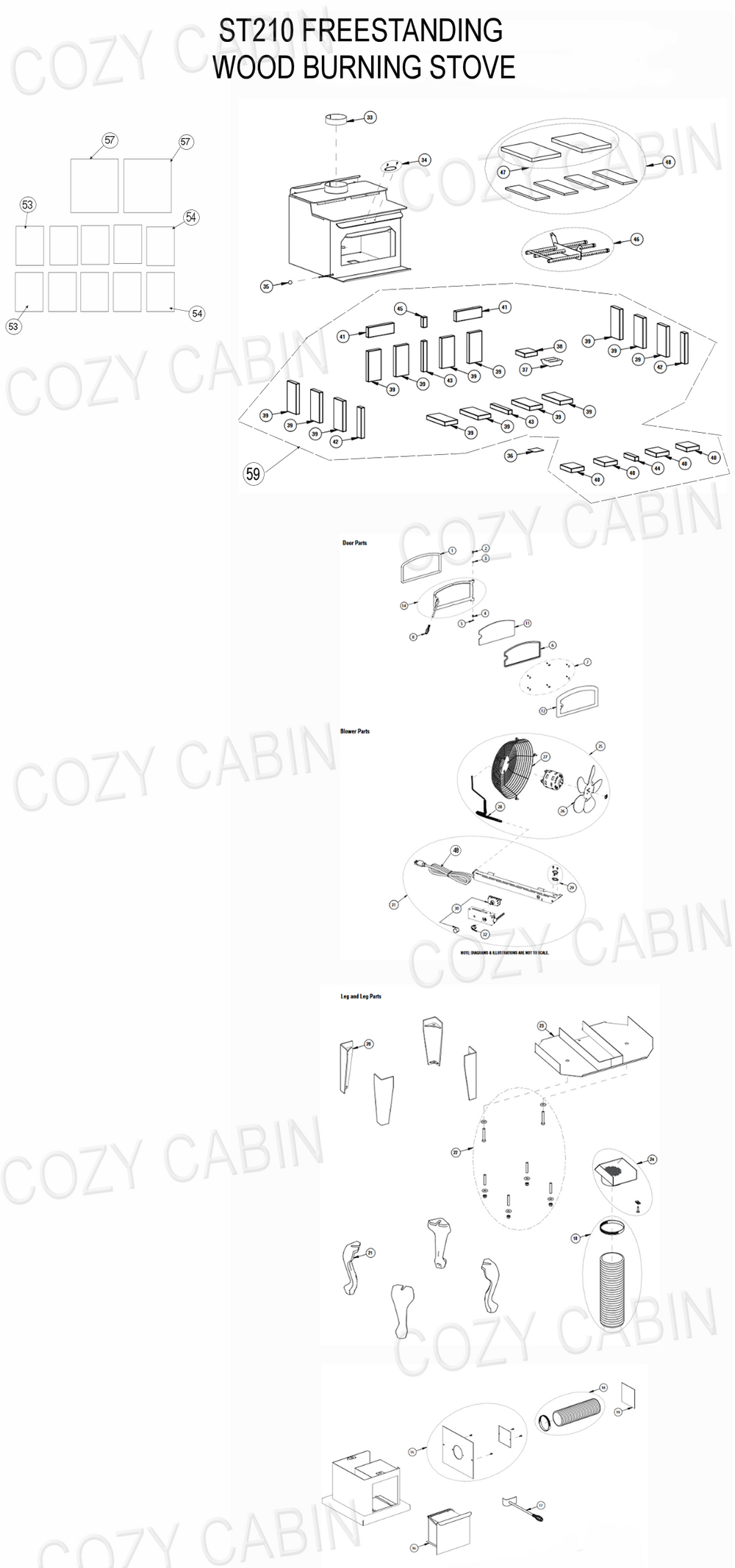

County Collection Freestanding Wood Burning Stove ST210 ST210 The

Vermont Castings Intrepid Wood Burning Stove Black Traditional Doors

Buy Coal And Ash Bucket With Shovel And Hand Broom 2 Gallon Portable

Tax Credit Form For Wood Burning Stove - Beginning with the 2023 tax return you will file in 2024 you can claim a 30 tax rebate on your federal income tax return To claim your tax rebate you will need