Tax Credit On Insurance Premium The basics Q1 What is the Premium Tax Credit updated Feb 24 2022 Q2 What is the Health Insurance Marketplace Q3 How do I get advance payments of the Premium Tax Credit updated Feb 24 2022 Q4 What happens if my income family size or other circumstances changes during the year updated Feb 24 2022 Eligibility Q5

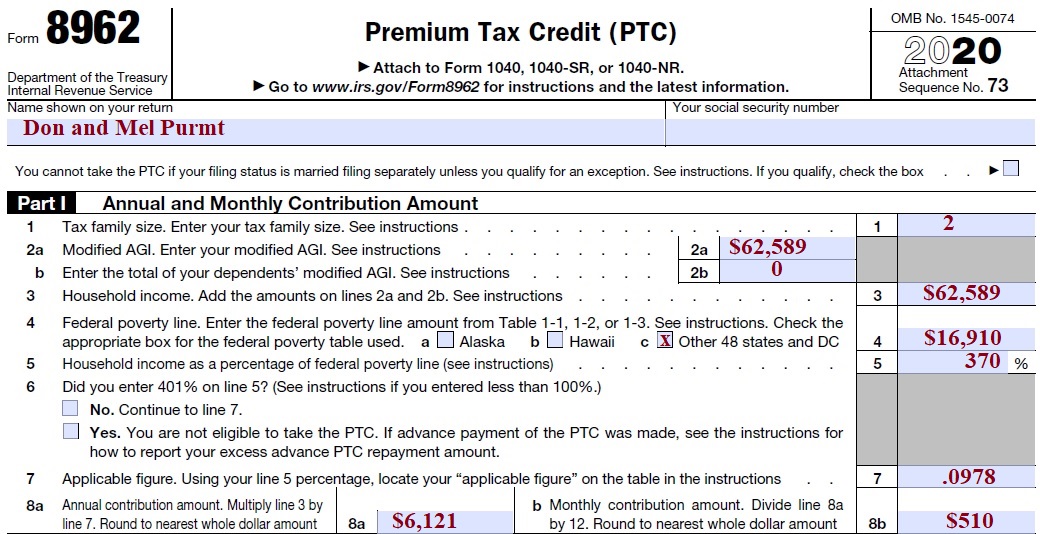

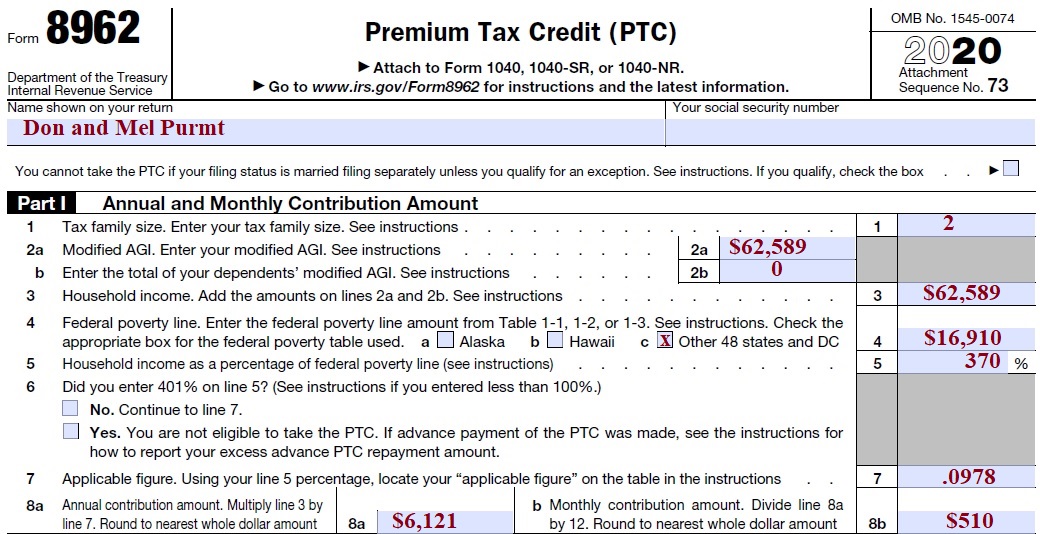

The premium tax credit is a refundable credit that helps some taxpayers afford health insurance premiums The advance PTC lowers the premiums themselves The premium tax credit also known as PTC is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through the Health Insurance Marketplace To get this credit you must meet certain requirements and file a tax return with Form 8962 Premium Tax Credit PTC

Tax Credit On Insurance Premium

Tax Credit On Insurance Premium

https://www.lockyers.co.uk/wp-content/uploads/2017/05/IPT.jpg

Incremental Medical Tax Celiac Canada

https://www.celiac.ca/wp-content/uploads/2023/01/tax-issue-photos-2.jpg

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

A premium tax credit also called a premium subsidy lowers the cost of your health insurance You can apply the discount to your insurance bill every month or you can get the credit as a refund on your federal income taxes Given that transportation facility and Medical insurance are made mandatory under DMA vide MHA order businesses could avail the input tax credit on such expenses even though the ITC is not allowed under normal circumstances

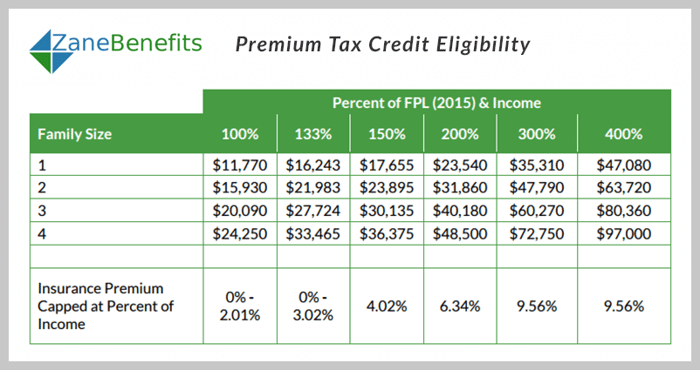

The health insurance premium tax credit was designed to help lower income Americans pay for insurance but if you re not careful you could end up owing money at tax time The Premium Tax Credit is a tax credit intended to subsidize the purchase of health plans offered through the federal and state health benefit exchanges The size of your credit will depend

Download Tax Credit On Insurance Premium

More picture related to Tax Credit On Insurance Premium

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

Which Is Better Paying Health Insurance Premiums Pre Tax Or Post Tax

https://i1.wp.com/goneonfire.com/wp-content/uploads/2019/12/014b_Which-is-Better_-Paying-Health-Insurance-Premiums-Pre-Tax-or-Post-Tax_.png?fit=1920%2C1280&ssl=1

How The Premium Tax Credit Works

https://global-uploads.webflow.com/5f8b3b580a028fb03a114a0c/60564e03dc76a2b097dc90ab_tech-daily-pz_L0YpSVvE-unsplash.jpg

The premium tax credit is a refundable tax credit that can help lower your insurance premium costs when you enroll in a health plan through the Health Insurance Marketplace Hampered by high health insurance premiums The enhanced premium tax credit includes provisions to improve affordability and reduce those costs

Premium Tax Credit Eligibility Expanded The premium tax credit was originally enacted as part of the Affordable Care Act a k a Obamacare to help lower and middle income Americans The premium tax credit PTC is a refundable credit that helps you cover premiums for healthcare insurance Here s how it works and how to claim it

Premium Tax Credit WhatTaxpayers Need To Know Tax Relief Center

https://i.pinimg.com/originals/d8/bf/5c/d8bf5c8f2a6724d32c86a120a90b5947.png

Further Increase To Insurance Premium Tax 1st October 2016 Sharrocks

https://www.sharrockinsurance.co.uk/wp-content/uploads/2016/09/ipt-increase-1024x903.jpg

https://www.irs.gov/affordable-care-act/...

The basics Q1 What is the Premium Tax Credit updated Feb 24 2022 Q2 What is the Health Insurance Marketplace Q3 How do I get advance payments of the Premium Tax Credit updated Feb 24 2022 Q4 What happens if my income family size or other circumstances changes during the year updated Feb 24 2022 Eligibility Q5

https://www.nerdwallet.com/article/taxes/premium-tax-credit

The premium tax credit is a refundable credit that helps some taxpayers afford health insurance premiums The advance PTC lowers the premiums themselves

Health Insurance Premium Tax Credit Income Limits What Are They

Premium Tax Credit WhatTaxpayers Need To Know Tax Relief Center

Insurance Premium Tax Increase Connect Insurance

Advance Premium Tax Credit How The Federal Government Can Help

Tax Credit Where It s Due CineMontage

Health Insurance 1095A Subsidy Flow Through IRS Tax Return

Health Insurance 1095A Subsidy Flow Through IRS Tax Return

Individuals Children s Promise Act Tax Credit Canopy Children s

Individual Responsibility For Premium Costs In Premium Tax Credit

Tax Credits For Working Families What Is The Earned Income Tax Credit

Tax Credit On Insurance Premium - A premium tax credit often referred to as a premium subsidy is a tax credit that offsets some or all of the amount that policyholders would otherwise have to pay to purchase individual or family health insurance