Tax Credit On Interest From Mortgage In general yes The mortgage interest deduction allows you to reduce your taxable income by the amount of money you ve paid in mortgage interest during the year Need to back up How

You may be able to claim a mortgage interest credit if you were issued a mortgage credit certificate MCC by a state or local government Figure the credit on Form 8396 Mortgage Interest Credit If you take this credit you must reduce your mortgage interest deduction by the amount of the credit A tax credit reduces how much tax you pay dollar for dollar If you owe 1 000 and get a 100 tax credit your tax bill drops to 900 If you get a 100 deduction you only save a

Tax Credit On Interest From Mortgage

Tax Credit On Interest From Mortgage

https://www.wikihow.com/images/6/6d/Calculate-Mortgage-Interest-Step-14.jpg

Mortgage Interest Rate A New Tax Regime Allows The Deduction Of

https://img.etimg.com/thumb/msid-74081237,width-1070,height-580,imgsize-176280,overlay-etwealth/photo.jpg

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

A mortgage interest tax credit or relief is a tax relief based on the amount of qualifying mortgage interest that you pay in a tax year for your home To qualify for a tax credit on mortgage interest repayments you must have paid interest on money that you borrowed to purchase repair develop or improve your main residence How to claim the IRS mortgage interest deduction If you paid more than 600 in mortgage interest last year keep an eye out for a Form 1098 from your mortgage lender in the coming weeks

The home mortgage interest deduction HMID allows homeowners who itemize on their tax returns to deduct mortgage interest paid on up to 750 000 worth of their loan principal It s one of If your yearly salary is 120 000 you can use the mortgage interest you paid to reduce your taxable income to 100 000 This means you ll only pay taxes on 100 000 of your income not

Download Tax Credit On Interest From Mortgage

More picture related to Tax Credit On Interest From Mortgage

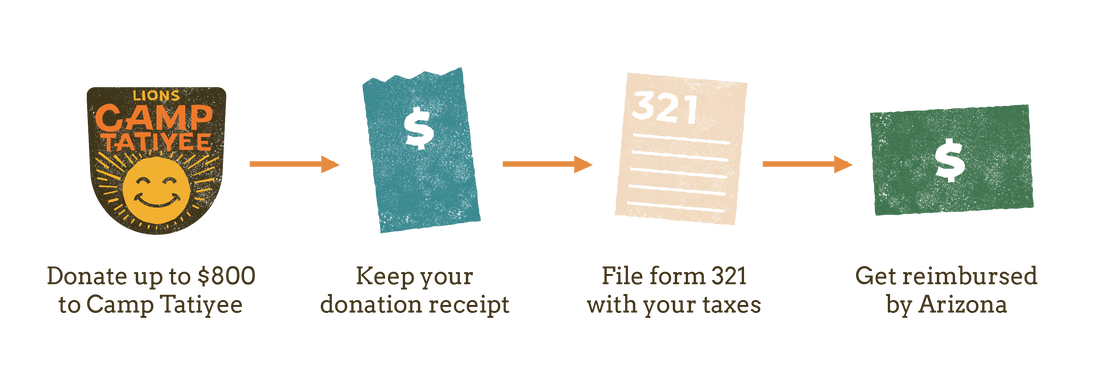

Arizona Charitable Tax Credit Lions Camp Tatiyee

https://www.camptatiyee.org/uploads/1/3/9/8/139890559/ct-webgraphics-2019-e1548359590479_orig.png

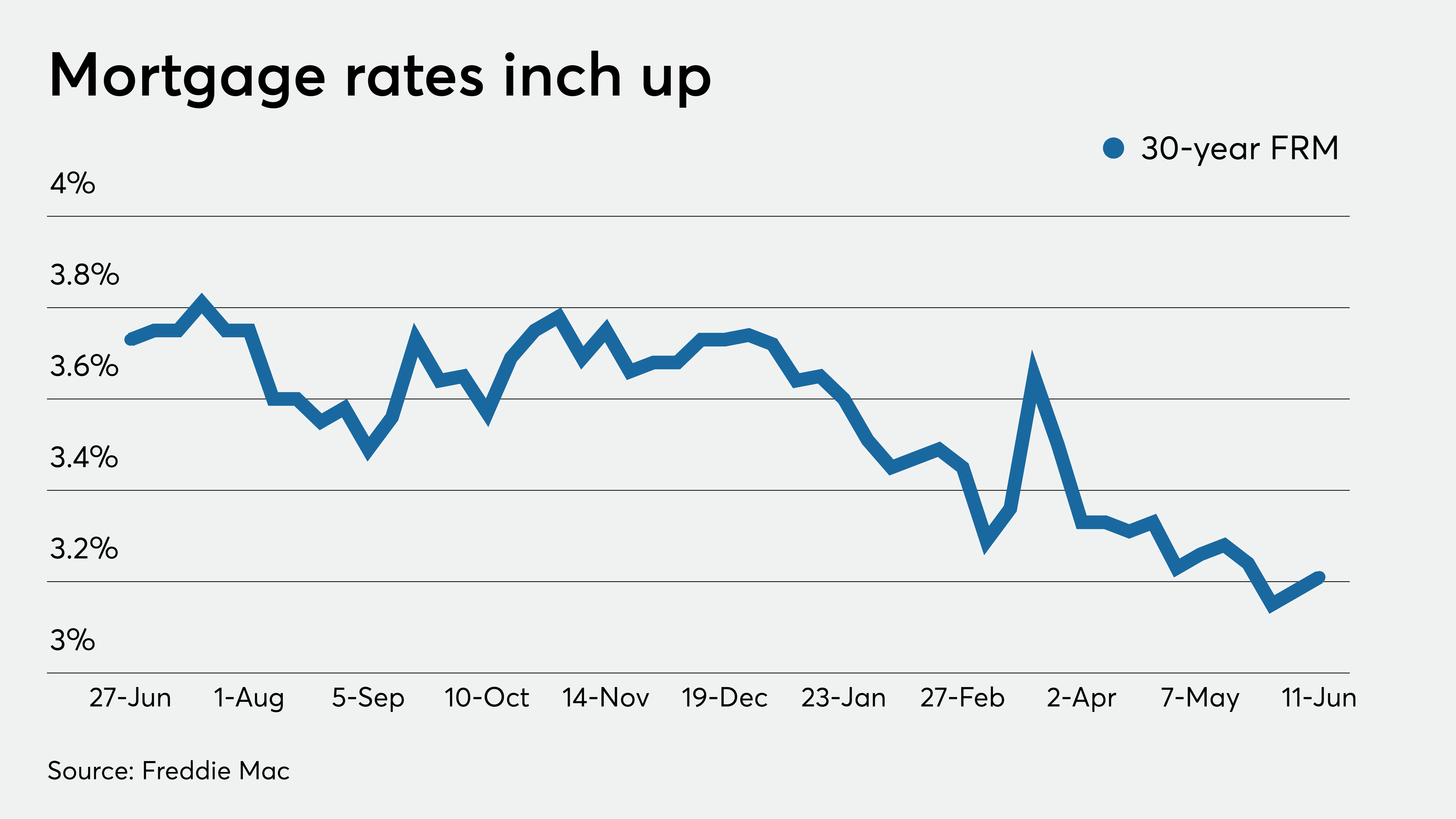

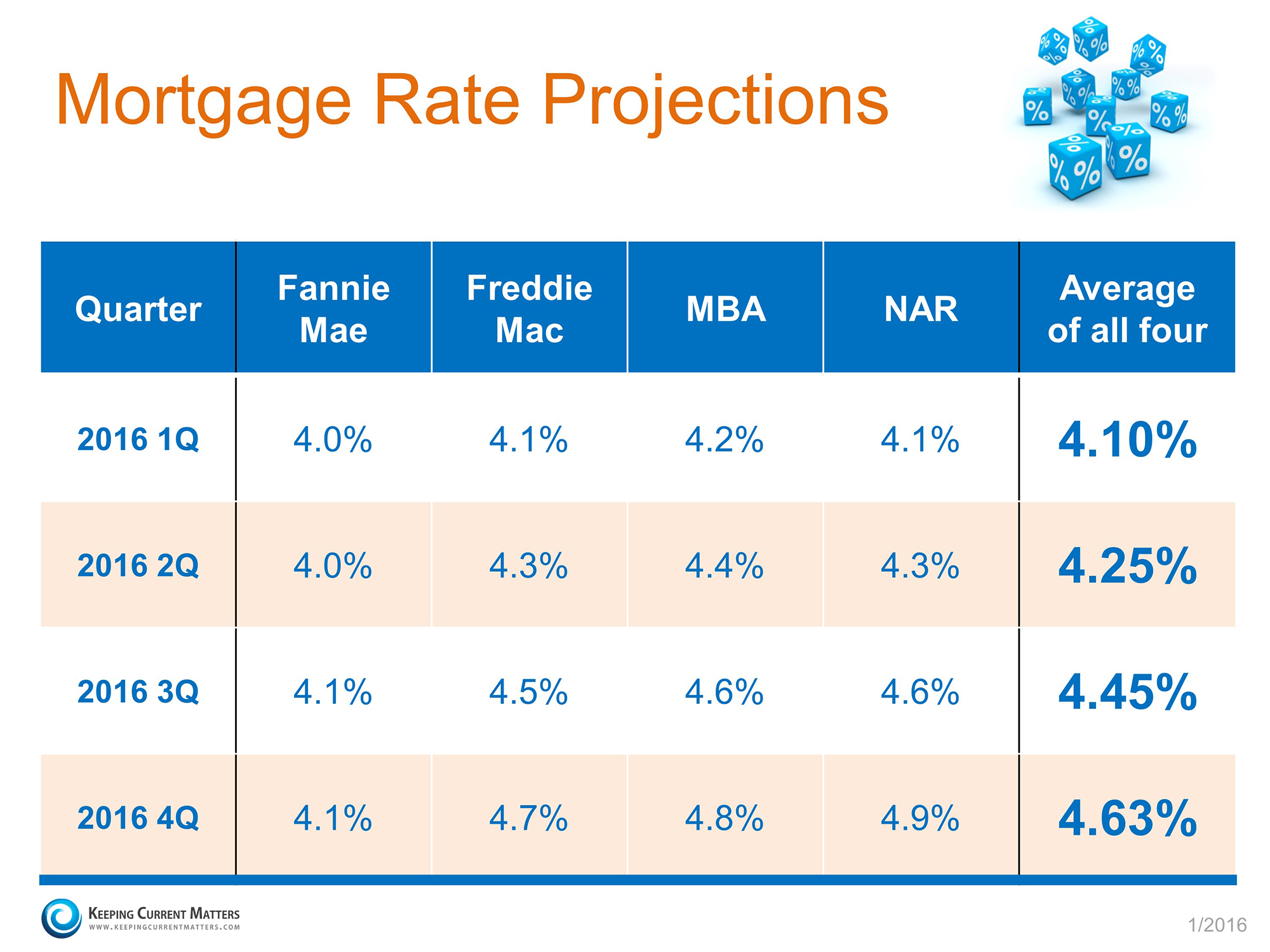

Where Are Mortgage Rates Headed Mortgage Rates Mortgage Protection

https://i.pinimg.com/originals/e3/5a/40/e35a40d873cd88b828bddb0a4eb0c367.jpg

Cautious Lawmakers Put 1 48B In Tax Credit Proposals In Holding

https://lailluminator.com/wp-content/uploads/2023/04/Dist22-scaled.jpg

The mortgage interest deduction is a tax incentive for homeowners This itemized deduction allows homeowners to subtract mortgage interest from their taxable income lowering the amount of taxes they owe Homeowners can also claim the deduction on loans for second homes providing that they stay within IRS limits See What You Mortgage interest is tax deductible on mortgages of up to 750 000 unless the mortgage was taken out before Dec 16 2017 then it s tax deductible on mortgages of up to 1 million A mortgage calculator can help you determine how much interest you paid each month last year

The mortgage interest deduction MID allows borrowers to write off a portion of the interest on their home loan That lowers your taxable income and can move you into a lower tax bracket About Tax Deductions for a Mortgage Written by a TurboTax Expert Reviewed by a TurboTax CPA Updated for Tax Year 2023 November 28 2023 2 47 PM OVERVIEW You can deduct the interest that you pay on your mortgage loan if the loan meets IRS mortgage requirements TABLE OF CONTENTS Mortgage interest

Pin By 360 Realtors LLP On Article Ambiguity Tax Credits Old Things

https://i.pinimg.com/originals/e5/7a/59/e57a596909536f0ec7f6176803502153.jpg

Individuals Children s Promise Act Tax Credit Canopy Children s

https://mycanopy.org/wp-content/uploads/2022/11/tax-credit-individual.jpg

www.nerdwallet.com/article/taxes/mortgage...

In general yes The mortgage interest deduction allows you to reduce your taxable income by the amount of money you ve paid in mortgage interest during the year Need to back up How

www.irs.gov/publications/p936

You may be able to claim a mortgage interest credit if you were issued a mortgage credit certificate MCC by a state or local government Figure the credit on Form 8396 Mortgage Interest Credit If you take this credit you must reduce your mortgage interest deduction by the amount of the credit

Wealth Strategies Political Donations Yield Sizable Tax Credits

Pin By 360 Realtors LLP On Article Ambiguity Tax Credits Old Things

Tax Credits For Working Families What Is The Earned Income Tax Credit

What The Fed s 0 Interest Rate Plan Means For Mortgage Rates Muevo

Mortgage Rates Jump Above 6 For First Time Since 2008 The New York Times

Are The Current Mortgage Interest Rates Good And How Can You Tell HFH

Are The Current Mortgage Interest Rates Good And How Can You Tell HFH

PDF The Effects Of The Child Tax Credit On Labor Supply

Where Are Interest Rates Headed This Year

One Checklist That You Should Keep In Mind Before Attending Mortgage

Tax Credit On Interest From Mortgage - Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to