Tax Credit Replace Air Conditioner If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022

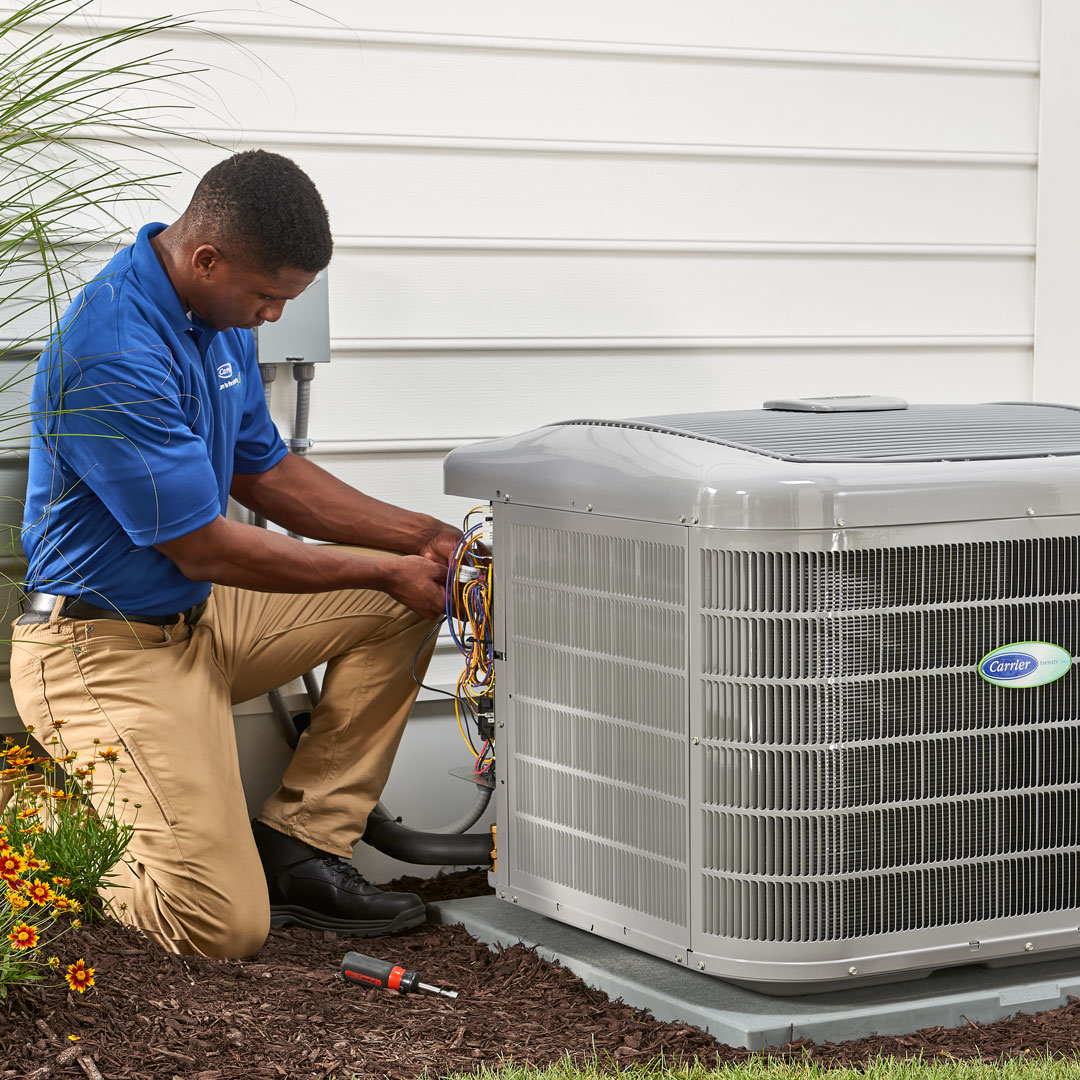

Central Air Conditioners Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings Claim the credits using the IRS Form 5695 Instructions for Form 5695 The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work

Tax Credit Replace Air Conditioner

Tax Credit Replace Air Conditioner

https://hvacseer.com/wp-content/uploads/2022/04/Does-My-Carrier-Air-Conditioner-Qualify-For-Tax-Credit.png

Federal Tax Credits For Air Conditioners Heat Pumps 2023

https://kobiecomplete.com/wp-content/uploads/2023/01/federal-tax-credits-2023-graphic-white-web.png

300 Federal Tax Credit For Air Conditioners Kobie Complete

https://kobiecomplete.com/wp-content/uploads/2020/05/air-conditioner-tax-credit-2020-680.png

Here are the highlights of ENERGY STAR certified equipment that is eligible for the tax credits Products That Qualify Central air conditioning 300 for air conditioners recognized as ENERGY STAR Most Efficient Air source heat pumps 300 for ENERGY STAR certified heat pumps If you invest in renewable energy for your home solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit of 30 of the costs for qualified newly installed property from 2022 through 2032

The Inflation Reduction Act includes rebates and tax credits to help homeowners install new heaters and other appliances How To Qualify For and Claim HVAC Tax Rebates You can claim your residential energy tax incentive when you file your federal income taxes For federal tax returns filed between 2023 and 2032 you are eligible to claim a credit equal to 30 of the cost of your installation

Download Tax Credit Replace Air Conditioner

More picture related to Tax Credit Replace Air Conditioner

What Is An Air Conditioner Tax Credit with Pictures

https://images.smartcapitalmind.com/taxformwithpenandcalculator.jpg

Cost To Replace Air Conditioner ECM Air Conditioning

https://ecmservice.com/wp-content/uploads/cost-to-replace-air-conditioner.png

Air Conditioner Tax Credit Details In 2023 How To Apply

https://airamericaac.com/wp-content/uploads/2023/04/iStock-637820494-1024x739.jpg

The Inflation Reduction Act of 2022 P L 117 169 expanded and renamed the nonbusiness energy property credit as the energy efficient home improvement credit The Home Improvement Tax Credit 25C rewards homeowners for switching to these more environmentally friendly HVAC options Learn what equipment qualifies on our rebates and tax credits page and reference additional 2023 25C Tax Credit product information below

Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products Q What do consumers do to get the credit s Effective Jan 1 2023 Provides a tax credit to homeowners equal to 30 of installation costs for the highest efficiency tier products up to a maximum of 600 for qualified air conditioners and furnaces and a maximum of 2 000 for qualified heat pumps

Does New Air Conditioners Need To Qualify For Tax Credit In 2022

https://homequeries.com/wp-content/uploads/2021/12/DOES-NEW-AIR-CONDITIONERS-NEED-TO-QUALIFY-FOR-TAX-CREDIT.jpg

The Average Cost To Replace An Air Conditioner H H Air Conditioning

https://www.hhaircon.com.au/wp-content/uploads/2022/08/average-cost-to-replace-air-conditioner-1024x598.jpg

https://www.irs.gov/credits-deductions/home-energy-tax-credits

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022

https://www.energystar.gov/about/federal-tax...

Central Air Conditioners Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings Claim the credits using the IRS Form 5695 Instructions for Form 5695

6 Signs It s Time To Replace Your A C Unit

Does New Air Conditioners Need To Qualify For Tax Credit In 2022

What Is An Air Conditioner Tax Credit with Pictures

Air Conditioner Repair Financing Why Should You Not Ignore Your Air

Air Conditioner Tax Credits

Get A Big Tax Break When You Replace An R22 Air Conditioner

Get A Big Tax Break When You Replace An R22 Air Conditioner

The Homeowners Guide To Tax Credits And Rebates

How To Claim A Tax Credit For New Central Air Conditioning Hunker

Does My New Air Conditioner Qualify For Tax Credit Credit Walls

Tax Credit Replace Air Conditioner - If you invest in renewable energy for your home solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit of 30 of the costs for qualified newly installed property from 2022 through 2032