Tax Credit Review Letter We re reviewing your tax return What this notice is about We re verifying your income income tax withholding tax credits and or business income If you filed a return You don t need to take any action

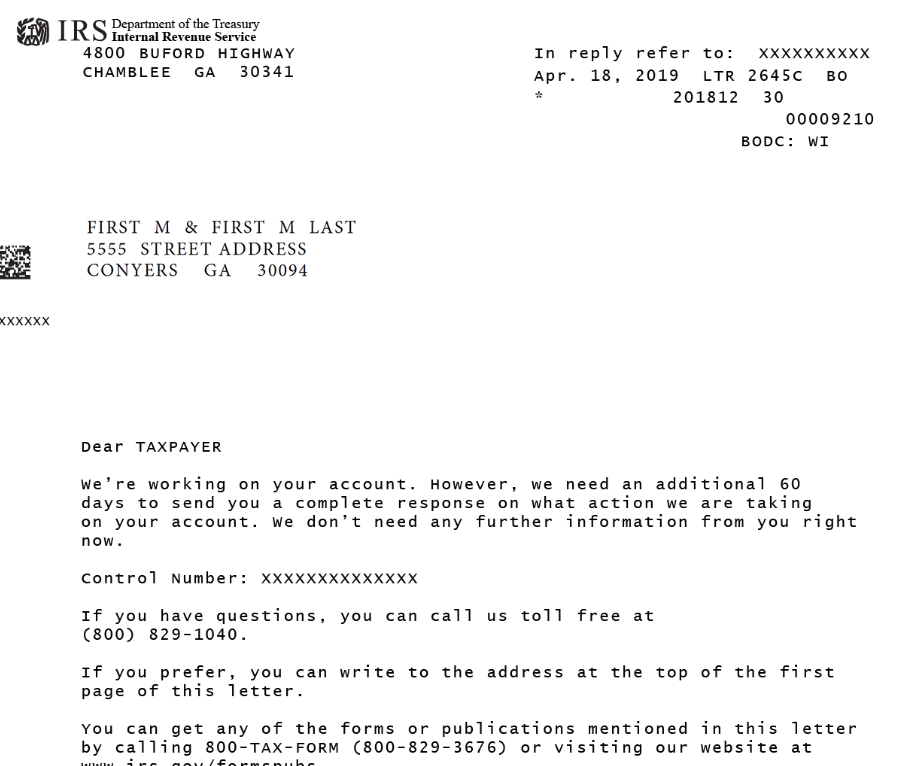

The CP05 notice is mailed to taxpayers to notify them that the IRS is holding their refund until the accuracy of the tax credits income tax withholding or business expenses has been verified This notice or letter may include additional topics that have not yet been covered here To get details on an IRS notice or letter search for it by number or topic You can find the CP or LTR number on the right corner of the letter What to do if you get a letter or notice Review it carefully and keep it for your records If we ask you to respond act by the due date What to do depends on your situation

Tax Credit Review Letter

Tax Credit Review Letter

https://www.hcmmlaw.com/blog/img/advance-child-tax-credit-letter-6419.jpg

5 Misconceptions About The R D Credit Capital Review Group

https://capitalreviewgroup.com/wp-content/uploads/2016/09/Research-Tax-Credit-Capital-Review-Group.jpg

REVI Credit Review Get Up To P250 000 CIMB Bank Loan

https://pinoymoneys.com/wp-content/uploads/2022/05/revi-credit-review-1024x576.png

Review the Who qualifies for the Earned Income Tax Credit EITC page My letter says I need to send information to verify my credit What should I do We re auditing your tax return and need information from you to The CP05 A notice is mailed to taxpayers to notify them that the IRS is holding their refund until the accuracy of the tax credits income tax withholding or business expenses has been verified This notice or letter may include additional topics that have not yet been covered here

What to do You generally have 30 days to respond to an IRS notice so there s no reason to ignore it Always check which tax year the notice relates to Do not assume that it relates to your most recent tax return Follow the instructions It may request more information or ask a specific question The Internal Revenue Service IRS will send a notice or a letter for any number of reasons It may be about a specific issue on your federal tax return or account or may tell you about changes to your account ask you for more information or request a

Download Tax Credit Review Letter

More picture related to Tax Credit Review Letter

Ohio Department Of Taxation Under Review Letter Sample 1

http://www.taxaudit.com/getattachment/bd248daa-84cf-4ec9-a7d2-0aa3fb974e6c/Ohio-Department-of-Taxation-Under-Review-Letter;

Teen Consult Letter

https://www.d.umn.edu/medweb/Courses/famconn/Images/sidetabs.gif

Additional 60 Days IRS Review Letter And 2022 Tax Refund Impact

https://savingtoinvest.com/wp-content/uploads/2022/04/image-2.png

The Internal Revenue Service IRS will almost certainly send you a letter or notice when you have unpaid taxes due But you may also receive a letter from the agency for other reasons Here s some tips for handling IRS letters and notices You ll be sent a letter in 2024 if you are eligible for Universal Credit or Pension Credit instead Use this service to report actual income from self employment if you estimated it when you

The rest of the more than 90 minute long speech was thoroughly confusing It meandered between points often going off script with ad libs that left a standard issue Trump campaign speech without If you receive a letter from the Canada Revenue Agency CRA telling you that your income tax return is being reviewed don t panic A review is not a tax audit In most cases it s simply a routine check to ensure that the information you provided on your return is correct

Virginia Department Of Taxation Review Letter Sample 1

http://www.taxaudit.com/getattachment/98081946-fe3f-4e1b-a43e-e04648bf2b56/Virginia-Department-of-Taxation-Review-Letter;

IRS Letter 6419

https://www.taxuni.com/wp-content/uploads/2022/01/IRS-Letter-6419.jpg

https://www.irs.gov/individuals/understanding-your-cp05-notice

We re reviewing your tax return What this notice is about We re verifying your income income tax withholding tax credits and or business income If you filed a return You don t need to take any action

https://www.taxpayeradvocate.irs.gov/notices/notice-cp05

The CP05 notice is mailed to taxpayers to notify them that the IRS is holding their refund until the accuracy of the tax credits income tax withholding or business expenses has been verified This notice or letter may include additional topics that have not yet been covered here

Jim Crow 2 0 Zero Percent Of GA Black Voters Had Poor Voting

Virginia Department Of Taxation Review Letter Sample 1

CEIS Review Consulting Services To The Financial Community August 2014

OPINION Open Letter On The Tax Review Debate Bailiwick Express

Where Do I Find My Universal Credit Award Letter Onvacationswall

Worksheets A Eic

Worksheets A Eic

Tax Exemption Applications Withholding Table US Legal Forms

DJ Wachter Accounting Tax Services

Request For Credit Letter Template Pack Of 5 Premium Printable

Tax Credit Review Letter - The Internal Revenue Service IRS will send a notice or a letter for any number of reasons It may be about a specific issue on your federal tax return or account or may tell you about changes to your account ask you for more information or request a