Tax Credit Working Through Covid Verkko 7 helmik 2021 nbsp 0183 32 So the maximum credit for the first two quarters of 2021 is 7 000 per employee per quarter This is not a loan There is no forgiveness Now go back to your form 941 and deduct or credit

Verkko 19 toukok 2020 nbsp 0183 32 New Zealand made a temporary change to its in work tax credit by removing the hours threshold so that workers who see their hours in work reduced Verkko 26 tammik 2021 nbsp 0183 32 As a result of the new legislation eligible employers can now claim a refundable tax credit against the employer share of Social Security tax equal to 70

Tax Credit Working Through Covid

Tax Credit Working Through Covid

https://dlr.sd.gov/workforce_services/businesses/publications/employer_connection/images/ffcra_tax_credit.png

Business Impact Of COVID 19 On SMEs 2020 CSO Central Statistics Office

https://www.cso.ie/en/media/csoie/releasespublications/documents/ep/businessimpactofcovid-19onsmes/2020/infographic/Business_Impact_of_COVID-19_on_SMEs_2020_infographic.png

3 Tax Credits To Maximize Your Refund The Motley Fool

https://g.foolcdn.com/editorial/images/428327/taxcredit.jpg

Verkko 12 maalisk 2021 nbsp 0183 32 The new relief bill will make the first 10 200 of benefits tax free if your income is less than 150 000 This applies to 2020 only If you ve already filed Verkko The Employee Retention Credit provides an Eligible Employer with a tax credit that is allowed against certain employment taxes The credit is refundable which means

Verkko 1 tammik 2022 nbsp 0183 32 COVID 19 legislation enacted in March 2020 created significant temporary employment tax credits to help employers continue to pay workers even if Verkko We re offering tax help for individuals families businesses tax exempt organizations and others including health plans affected by coronavirus Child Tax Credit The 2021

Download Tax Credit Working Through Covid

More picture related to Tax Credit Working Through Covid

/https:%2F%2Fspecials-images.forbesimg.com%2Fimageserve%2F1180386785%2F0x0.jpg)

Working Through To After COVID 19

https://thumbor.forbes.com/thumbor/fit-in/1200x0/filters:format(jpg)/https:%2F%2Fspecials-images.forbesimg.com%2Fimageserve%2F1180386785%2F0x0.jpg

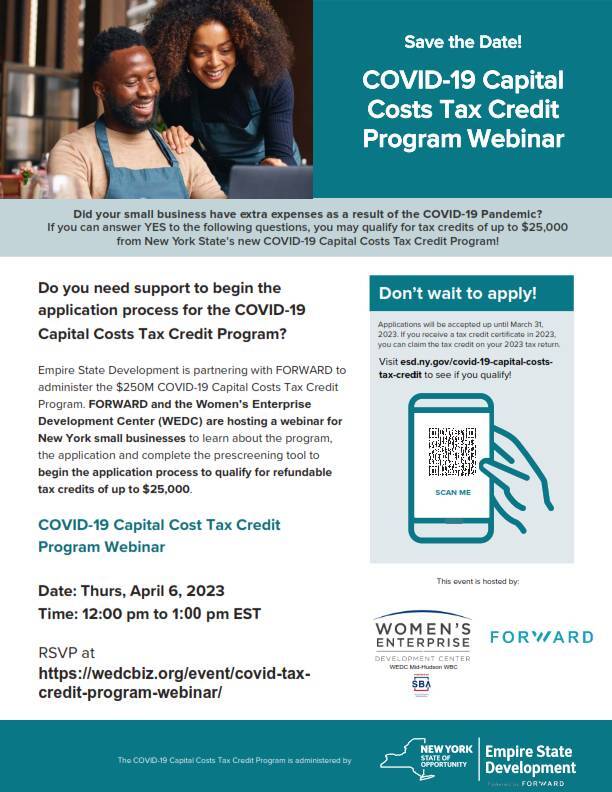

COVID 19 Capital Costs Tax Credit Program Webinar WEDC

https://wedcbiz.org/wp-content/uploads/COVID-19-Tax-Credit-Program-4-16-23.jpg

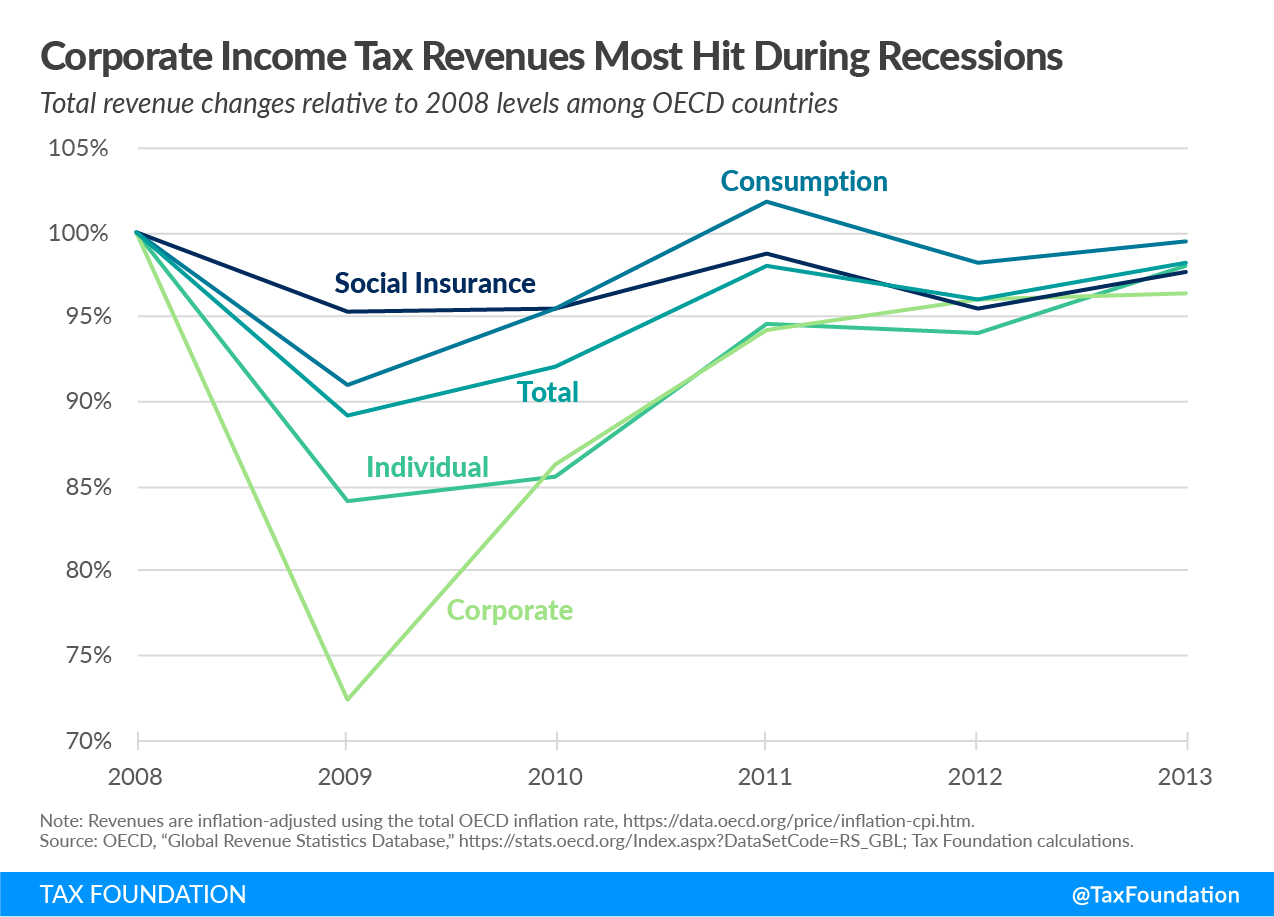

Global Responses To COVID 19 Pandemic Tax Foundation

https://taxfoundation.org/wp-content/uploads/2020/08/TF_FF723_fig_1.png

Verkko 21 tammik 2021 nbsp 0183 32 This guidance is intended to provide more certainty to taxpayers during this exceptional period This guidance represents the Secretariat s views on the Verkko 12 tammik 2023 nbsp 0183 32 COVID Tax Tip 2022 165 Grandparents and others with eligible dependents shouldn t miss out on the 2021 child tax credit COVID Tax Tip 2022 162

Verkko 17 tammik 2023 nbsp 0183 32 Workers aren t being paid up to 26 000 because of a COVID 19 related tax credit as claim suggests If Your Time is short Congress created the employee retention tax credit to incentivize Verkko 2 kes 228 k 2023 nbsp 0183 32 The tax credit for paid sick leave applies to eligible self employed taxpayers who are unable to work including telework or working remotely due to

COVID 19 Response Tax Update Businesses Can Claim Tax Refunds And

https://lewisbrisbois.com/assets/images/taxreturnmoneyledgers.jpg

Investment Glossary Income Tax Credit Armstrong Advisory Group

https://armstrongadvisory.com/wp-content/uploads/2019/07/TaxCreditHeader-e1564402571833.jpeg

https://www.theguardian.com/business/2021/f…

Verkko 7 helmik 2021 nbsp 0183 32 So the maximum credit for the first two quarters of 2021 is 7 000 per employee per quarter This is not a loan There is no forgiveness Now go back to your form 941 and deduct or credit

https://www.oecd.org/coronavirus/policy-responses/tax-and-fiscal...

Verkko 19 toukok 2020 nbsp 0183 32 New Zealand made a temporary change to its in work tax credit by removing the hours threshold so that workers who see their hours in work reduced

Changes To Tax Filings Related To COVID 19 Penn Community Bank

COVID 19 Response Tax Update Businesses Can Claim Tax Refunds And

Photos Of Donald Trump working Through COVID 19 Spark Suspicion

Working Through COVID 19 3 Tips For HR Managers And Employers

Do s And Dont s How To Protect Yourself From The New Coronavirus

Find Out If You Benefit From The Earned Income Tax Credit

Find Out If You Benefit From The Earned Income Tax Credit

To Fight Covid 19 Only The Formal Economy Is Getting Tax Breaks The

COVID 19 Tax And Working From Home Everything You Need To Know CIB

Photos Of Donald Trump working Through COVID 19 Spark Suspicion

Tax Credit Working Through Covid - Verkko 1 tammik 2022 nbsp 0183 32 COVID 19 legislation enacted in March 2020 created significant temporary employment tax credits to help employers continue to pay workers even if