Turbotax Recovery Rebate Credit 2023 IR 2023 217 Nov 17 2023 The Internal Revenue Service is reminding those who may be entitled to the Recovery Rebate Credit to file a tax return and claim their money before it s too late

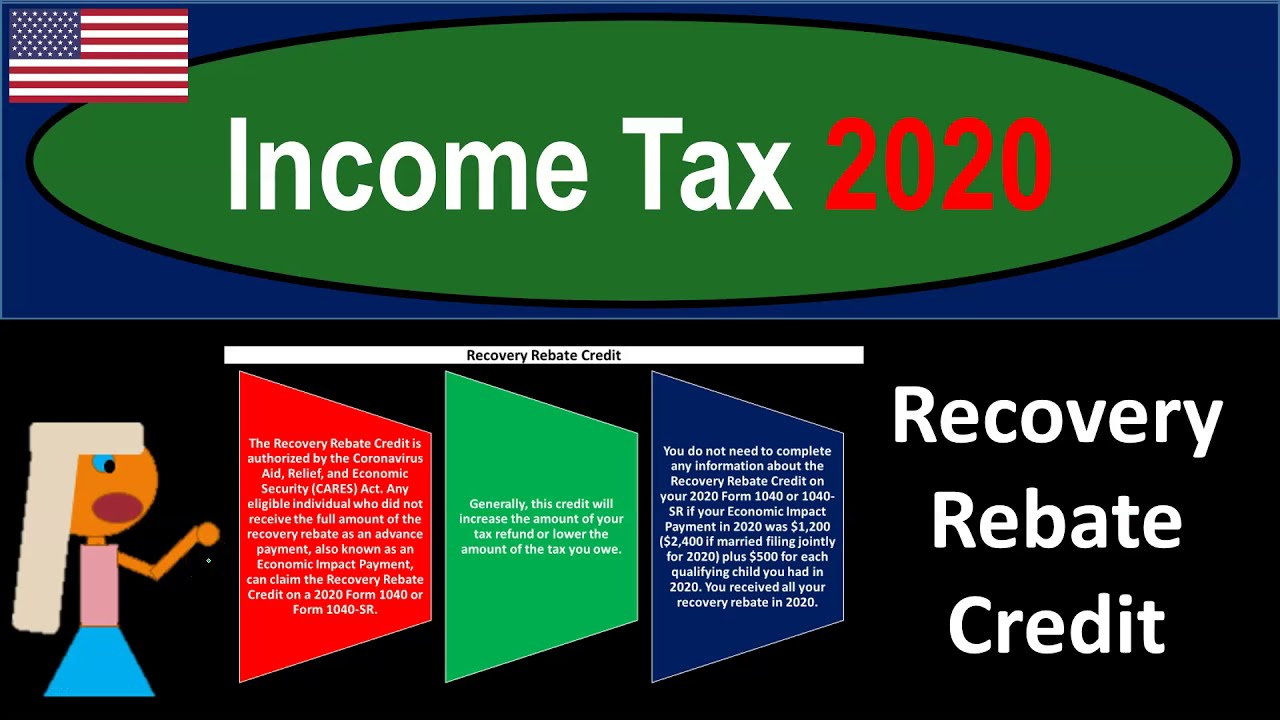

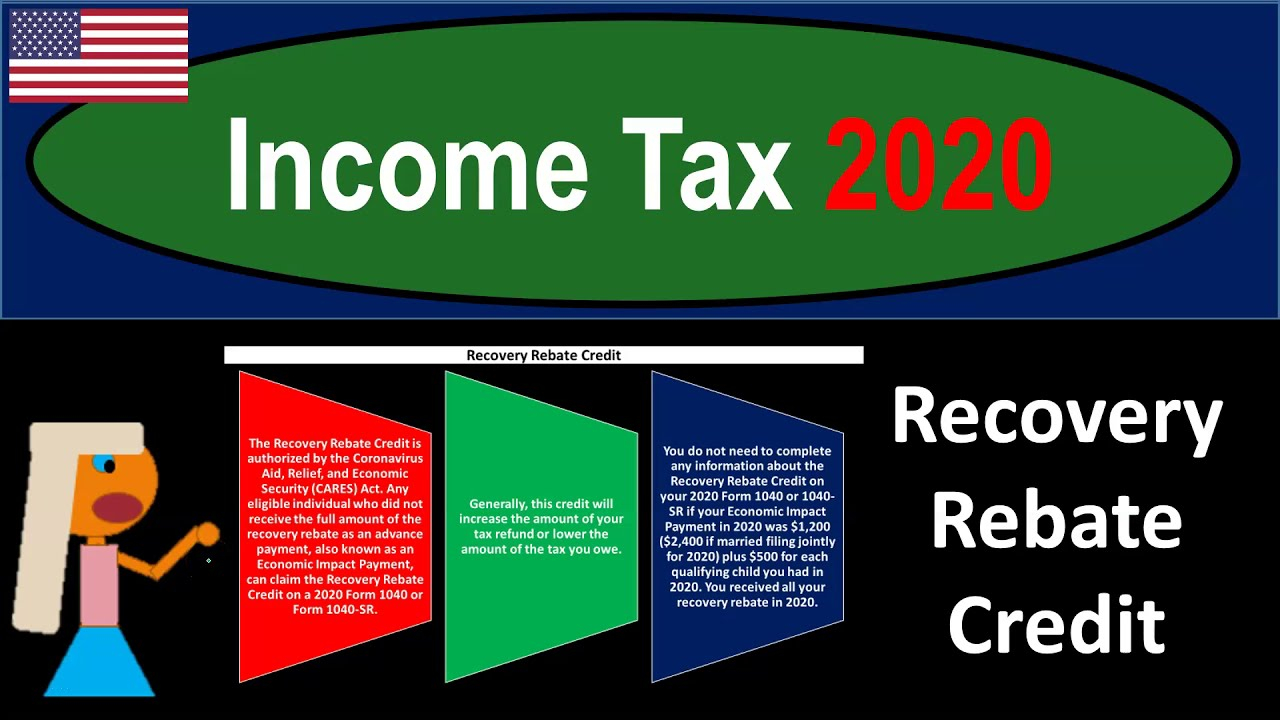

IRS Statements and Announcements Page Last Reviewed or Updated 12 Feb 2024 Eligible individuals can claim the Recovery Rebate Credit on their Form 1040 or 1040 SR These forms can also be used by people who are not normally required to file tax returns but are eligible for the credit The Recovery Rebate Credit is a credit that was authorized by the Coronavirus Aid Relief and Economic Security CARES Act So if you were eligible for an Economic Impact P ayment EIP commonly referred to as a stimulus payment but did not receive one or you received less than the full amount as an advanced

Turbotax Recovery Rebate Credit 2023

Turbotax Recovery Rebate Credit 2023

https://www.recoveryrebate.net/wp-content/uploads/2023/02/recovery-rebate-credit-worksheet-turbotax-studying-worksheets-3.jpg

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-recovery-rebate-credit-worksheet-pdf-irsyaqu-recovery-rebate-3.png?w=530&ssl=1

Turbotax Recovery Rebate Credit 2023 Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/recovery-rebate-credit-worksheet-turbotax-studying-worksheets-24.png?w=1050&ssl=1

The stimulus check rebate will completely phase out at 80 000 for single filers with no qualifying dependents and 160 000 for those married filing jointly with no dependents How To Claim the Recovery Rebate Credit on a Tax Return You will need to file your recovery rebate worksheet along with your 2020 or 2021 federal tax return whichever is applicable

SOLVED by TurboTax 751 Updated November 23 2023 The IRS will adjust your refund if you claimed the Recovery Rebate Credit but didn t qualify or overestimated the amount you should have received If you have an adjusted gross income AGI of up to 75 000 112 500 Head of Household 150 000 married filing jointly you could be eligible for the full amount of the recovery rebate 600 for eligible individuals 1 200 for joint taxpayers and an additional 600 for each dependent child under 17

Download Turbotax Recovery Rebate Credit 2023

More picture related to Turbotax Recovery Rebate Credit 2023

Where To Enter Recovery Rebate Credit In Turbotax Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/does-turbotax-give-the-irs-my-direct-deposit-information-trending-now.jpg?resize=683%2C1024&ssl=1

Recovery Rebate Credit Worksheet Turbotax Studying Worksheets

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/recovery-rebate-credit-worksheet-turbotax-studying-worksheets-1.jpg?w=1280&ssl=1

Recovery Rebate Credit On Turbotax Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/how-to-claim-stimulus-recovery-rebate-credit-on-turbotax-11.png

These updated FAQs were released to the public in Fact Sheet 2022 27 PDF April 13 2022 If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax return even if you don t usually file taxes to claim it Your 2021 Recovery Rebate Learn how to claim the Recovery Rebate Credit on your tax return using TurboTax This tutorial provides step by step instructions on checking eligibility reporting missing payments and

The Recovery Rebate Credit is what the stimulus is referred to now Is there a stimulus check for 2023 As of the date of publishing this article there is no prospect of receiving a stimulus check for 2023 at the Federal level Intuit Help Intuit Common questions about the Recovery Rebate Credit and economic impact payments SOLVED by Intuit 439 Updated over 1 year ago For tax year 2021 your clients may be eligible to claim the Recovery Rebate Credit on their tax returns

Stimulus Check Irs Turbotax STIMUQ Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/stimulus-check-irs-turbotax-stimuq.png

2023 Recovery Rebate Credi Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/recovery-rebate-credit-2022-2023-credits-zrivo-5.jpg

https://www.irs.gov/newsroom/irs-reminds-eligible...

IR 2023 217 Nov 17 2023 The Internal Revenue Service is reminding those who may be entitled to the Recovery Rebate Credit to file a tax return and claim their money before it s too late

https://www.irs.gov/newsroom/recovery-rebate-credit

IRS Statements and Announcements Page Last Reviewed or Updated 12 Feb 2024 Eligible individuals can claim the Recovery Rebate Credit on their Form 1040 or 1040 SR These forms can also be used by people who are not normally required to file tax returns but are eligible for the credit

Turbotax Return TurboTax Tax Return App Max Refund Guaranteed For

Stimulus Check Irs Turbotax STIMUQ Recovery Rebate

35 What If Worksheet Turbotax Worksheet Source 2021 Recovery Rebate

How To Claim Stimulus Check 2021 Turbotax It S Not Too Late Claim A

Stimulus Checks Tax Return Irs Turbotax QATAX Recovery Rebate

Recovery Rebate Credit 2023 Married Filing Separately Recovery Rebate

Recovery Rebate Credit 2023 Married Filing Separately Recovery Rebate

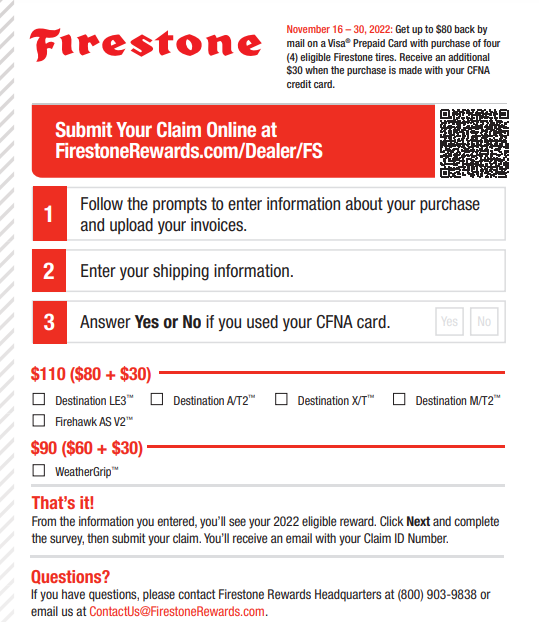

Firestone Rebates 2023 Printable Rebate Form Recovery Rebate

Recovery Rebate Credit Worksheet Turbotax Studying Worksheets

Recovery Rebate Credit 2023 Limits Recovery Rebate

Turbotax Recovery Rebate Credit 2023 - How To Claim the Recovery Rebate Credit on a Tax Return You will need to file your recovery rebate worksheet along with your 2020 or 2021 federal tax return whichever is applicable