Tax Credits For Healthcare Workers Updated March 21 2023 The tax laws have changed Discover some of the tax benefits registered nurses can claim and tips for nursing students Credit RgStudio Getty Images Are you ready to earn your online nursing degree

The Premium Tax Credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased through the Health Insurance Marketplace also known as the Exchange The size of your Premium Tax Credit is based on a sliding scale Eligible Employers may claim tax credits for qualified leave wages paid to employees on leave due to paid sick leave or expanded family and medical leave for reasons related to COVID 19 taken for periods of leave beginning on April 1 2020 and ending on March 31 2021

Tax Credits For Healthcare Workers

Tax Credits For Healthcare Workers

https://www.dailymoss.com/wp-content/uploads/2023/03/simplified-erc-application-2022-claim-tax-credits-for-smbs-with-ppp-loans-6407fcf41985b.jpg

StayWell Housing For Healthcare Workers

https://www.staywell.ca/img/Info-Pages/health-contract.png

Cool Federal Tax Credits For Energy Efficient Homes GVEC

https://www.gvec.org/wp-content/uploads/2023/08/shutterstock_667165351-scaled.jpg

More information is available in the IRS Statement about Letter 6534 The premium tax credit also known as PTC is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through the Health Insurance Marketplace 1 8 Image credit Getty Images Bonus Pay for Health Care Workers First Responders Health care workers and first responders including police and firefighters among essential

The Opportunity The Coronavirus Aid Relief and Economic Security CARES Act signed into law on March 27 2020 provides several incentives for hospitals and healthcare organizations The Employee Retention Credit ERC is one of them The ERC provides a refundable credit of up to 5 000 per employee to eligible employers October 19 2022 Working in the healthcare industry may allow you to take a bite out of the amount you pay to the IRS each year Specific tax breaks for healthcare workers enable you to claim deductions for work related expenses

Download Tax Credits For Healthcare Workers

More picture related to Tax Credits For Healthcare Workers

Tax Credits For Taking Risks YouTube

https://i.ytimg.com/vi/j3uaeYNHIKQ/maxresdefault.jpg

WOTC 101 Tax Credits For Healthcare Apploi

https://eggi5ktv3g4.exactdn.com/wp-content/uploads/2023/04/iStock-1226515483.jpg?strip=all&lossy=1&ssl=1

Tax Credits MJA Associates

https://mja-associates.com/wp-content/uploads/2023/12/AdobeStock_124656824.jpg

Who is Eligible for a Health Care Credit Before 2021 the PTC was available to people with household incomes from 100 to 400 of the poverty level who bought health coverage through an H R 3505 To amend the Internal Revenue Code of 1986 to allow a refundable tax credit against income tax for certain healthcare professionals 117th Congress 2021 2022 Bill Hide Overview More on This Bill Constitutional Authority Statements CBO Cost Estimates 0 Subject Policy Area Taxation Summary 1

The premium tax credit is a refundable credit that helps lower the cost of your monthly health insurance premium You must meet the requirements and file a specific form with your tax return to qualify for it Find out if you meet the requirements and qualify and what steps you must take to claim the premium tax credit Key Takeaways The Premium Tax Credit PTC makes health insurance more affordable by helping eligible individuals and their families pay premiums for coverage purchased through the Health Insurance Marketplace also referred to as the Marketplace or Exchange There are two ways to get the credit

3 MASSIVE Tax Credits For Business Owners YouTube

https://i.ytimg.com/vi/lTmRKyOLWoU/maxresdefault.jpg

Understanding Direct Pay And Transferability For Tax Credits In The

https://www.americanprogress.org/wp-content/uploads/sites/2/2023/06/GettyImages-1258043080.jpg

https://nursejournal.org/ask-a-nurse/tax-benefits-for-registered-nurses

Updated March 21 2023 The tax laws have changed Discover some of the tax benefits registered nurses can claim and tips for nursing students Credit RgStudio Getty Images Are you ready to earn your online nursing degree

https://www.irs.gov/affordable-care-act/...

The Premium Tax Credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased through the Health Insurance Marketplace also known as the Exchange The size of your Premium Tax Credit is based on a sliding scale

Alberta Creates Tax Credit For Large scale Agri processing Investment

3 MASSIVE Tax Credits For Business Owners YouTube

Tax Credits For EU Electric Vehicles To Dominate U S Trade Talks

Chapter 9 Tax Credits For Foreign Estate Tax TAX CREDIT FOR FOREIGN

Tax Credits For Plumbers Get Money From Government No Paybacks

We Must Protect Tax Credits For Working Families

We Must Protect Tax Credits For Working Families

Tax Credits For Giving Ozarks Food Harvest

When Are Tax Credits Ending How To Apply For Universal Credit

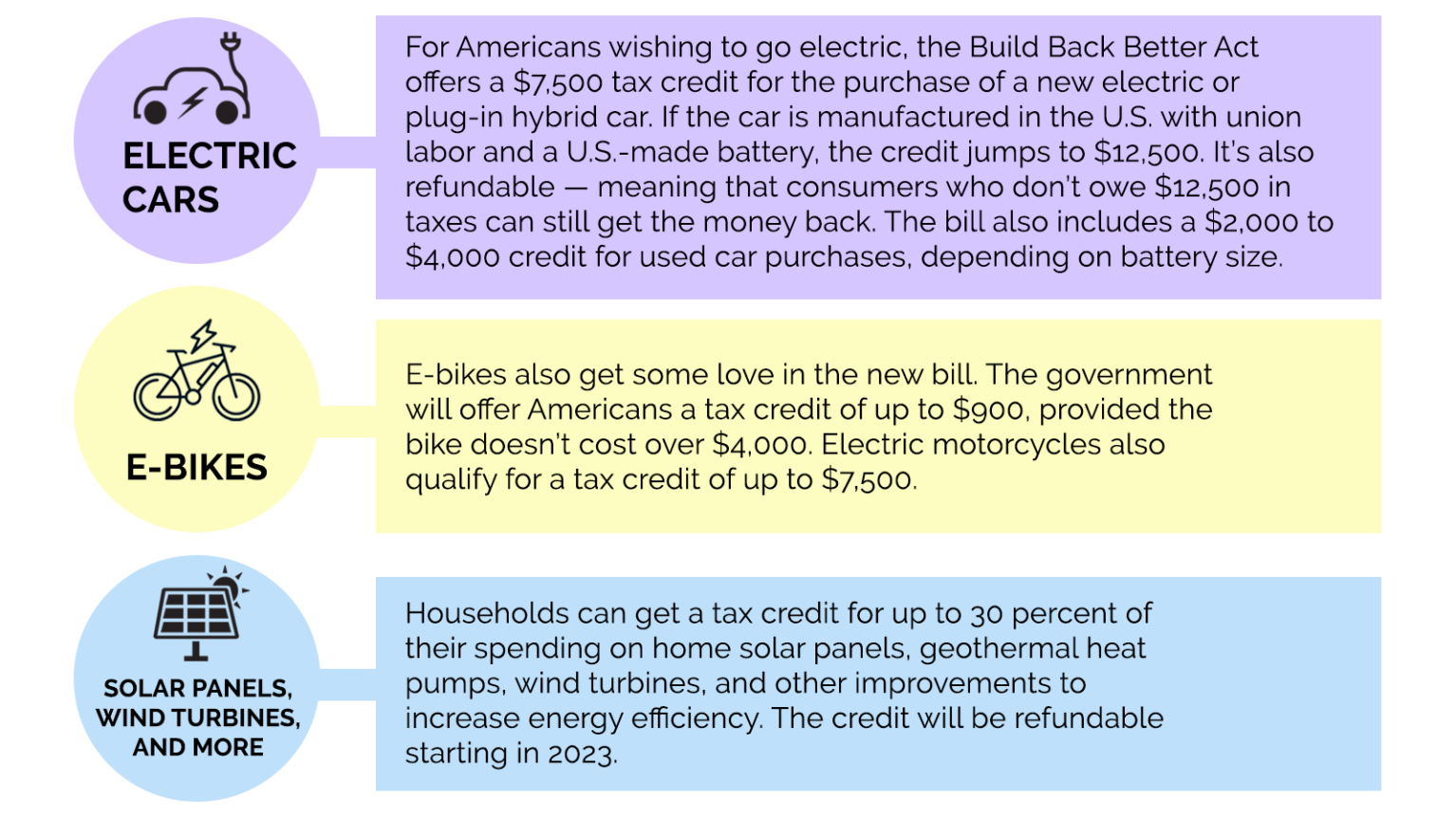

Green Incentives Usually Help The Rich Here s How The Build Back

Tax Credits For Healthcare Workers - 1 8 Image credit Getty Images Bonus Pay for Health Care Workers First Responders Health care workers and first responders including police and firefighters among essential