Tax Credits For Home Renovations Ontario Claim the multigenerational home renovation tax credit MHRTC You may be able to claim a refundable tax credit for certain qualifying expenditures paid for a qualifying

Multigenerational Home Renovation Tax Credit The MHRTC could provide a valuable refundable credit for eligible expenses related to certain qualifying renovations to Home renovation tax credits allow homeowners a tax credit for eligible renovation costs Some of these credits are non refundable so the tax credit can only be used to reduce taxes owing in the current taxation year

Tax Credits For Home Renovations Ontario

Tax Credits For Home Renovations Ontario

https://imageio.forbes.com/specials-images/imageserve/6382a9dd088a90f846f35930/0x0.jpg?format=jpg&crop=3207,3207,x0,y0,safe&width=1200

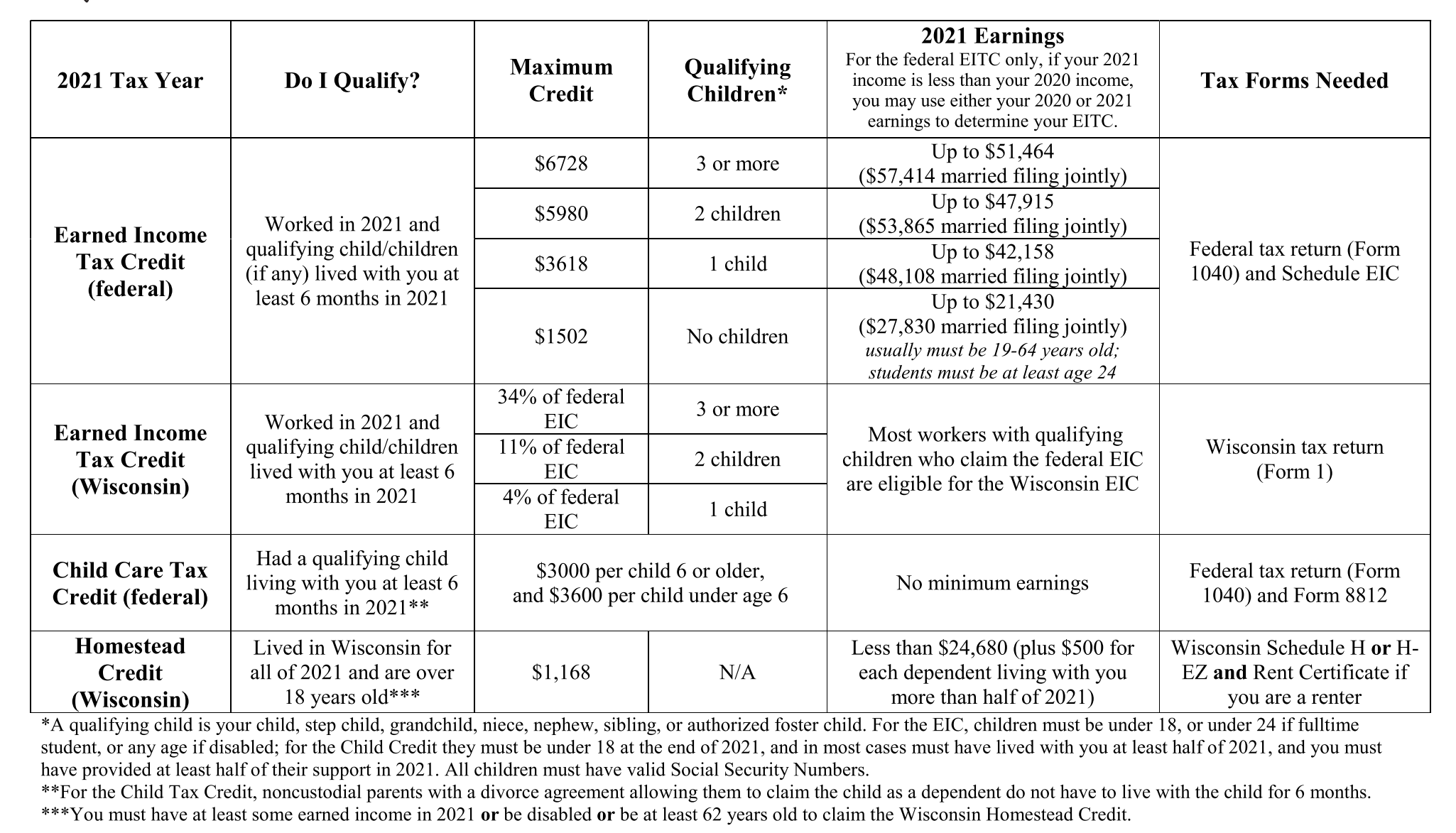

2021 Tax Credits Get The Credit You Deserve Financial Education

https://finances.extension.wisc.edu/files/2021/09/2021-tax-credits-e1643336436945.png

Canada To Set Up Tax Credits For Clean Tech Launch Growth Fund

https://hydrogen-central.com/wp-content/uploads/2022/11/canada-tax-credits-hydrogen-1024x684.png

Home renovation tax credit in Ontario In Ontario seniors age 65 and over or those living with family members over the age of 65 can claim a tax credit for some types of work on their homes The work must help a person to The new Home Renovation Savings Program will launch on January 28 2025 and offer rebates of up to 30 per cent for home energy efficiency renovations and improvements

The multigenerational home renovation tax credit MHRTC is a new federal tax credit that offers up to 7 500 for your renovation costs in 2023 and beyond The tax credit helps offset the costs of building a secondary dwelling Provincial home renovation tax credits are currently available in Ontario British Columbia Quebec Manitoba and New Brunswick The Multigenerational Home Renovation Tax Credit first appeared in the 2022

Download Tax Credits For Home Renovations Ontario

More picture related to Tax Credits For Home Renovations Ontario

Save On Taxes 3 Home Renovations With Tax Credits

https://vcgconstruction.com/wp-content/uploads/2016/03/Remodeling-tax-credits.jpg

Tax Credits Versus Tax Deductible Home Renovation Costs LP Design

https://lpinspiredrenovations.com/wp-content/uploads/2020/12/Tax-Credits-versus-Tax-Deductible-Home-Renovation-Costs-1080x675.jpg

Federal Tax Credits To Support Affordable Housing In Detroit Friedman

https://friedmanrealestate.com/wp-content/uploads/2019/06/federal-tax-credits-to-support-affordable-housing.jpg

Read on to find out how home renovation and green tax credits in Canada can put some cash back in your pocket Federal Home Renovation Tax Credits The federal government currently offers the following home On January 7 the Government of Ontario announced 14 new and expanded energy efficiency programs including the Home Renovation Savings Program as part of a new 10 9 billion

The Toronto Regional Real Estate Board TRREB commends Minister Lecce and the Government of Ontario for the launch of the Home Renovation Savings Program coming There are home renovation and improvement tax credits that you may be eligible for to help offset the cost of your project But how do you know if your home qualifies for these tax credits This

Tax Credits For Your Home Renovations Glickman

https://www.glickmandesignbuild.com/wp-content/uploads/2021/04/10DJI_0396-R.jpg

Tax Credits For Giving Ozarks Food Harvest

https://ozarksfoodharvest.org/wp-content/uploads/2022/11/NAPArticle2022-1024x1024.jpg

https://www.canada.ca › en › revenue-agency › news › ...

Claim the multigenerational home renovation tax credit MHRTC You may be able to claim a refundable tax credit for certain qualifying expenditures paid for a qualifying

https://www.canada.ca › en › revenue-agency › news › ...

Multigenerational Home Renovation Tax Credit The MHRTC could provide a valuable refundable credit for eligible expenses related to certain qualifying renovations to

The Value Of Investment Tax Credits For Your Business

Tax Credits For Your Home Renovations Glickman

Can You Get A Tax Credit For Your Energy Saving Roof Slate Slate

Tax Credits For Paid Sick And Paid Family And Medical Leave Questions

The Ultimate List Of Homeowner Tax Credits For 2020 Lifestyle

Save Big On Childcare Costs With Tax Credits Here s How

Save Big On Childcare Costs With Tax Credits Here s How

Tax Credits Save You More Than Deductions Here Are The Best Ones

PDF States Tax Credits For Company Financed Research

Federal Tax Credits Carrier Residential

Tax Credits For Home Renovations Ontario - The multigenerational home renovation tax credit MHRTC is a new federal tax credit that offers up to 7 500 for your renovation costs in 2023 and beyond The tax credit helps offset the costs of building a secondary dwelling