Tax Credits For New Heating And Air Systems The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights

Taxpayers who invest in energy improvements for their main home including solar wind geothermal fuel cells or battery storage may qualify for an annual residential clean If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by

Tax Credits For New Heating And Air Systems

Tax Credits For New Heating And Air Systems

http://airideal.com/wp-content/uploads/2020/04/hvacsystem.jpg

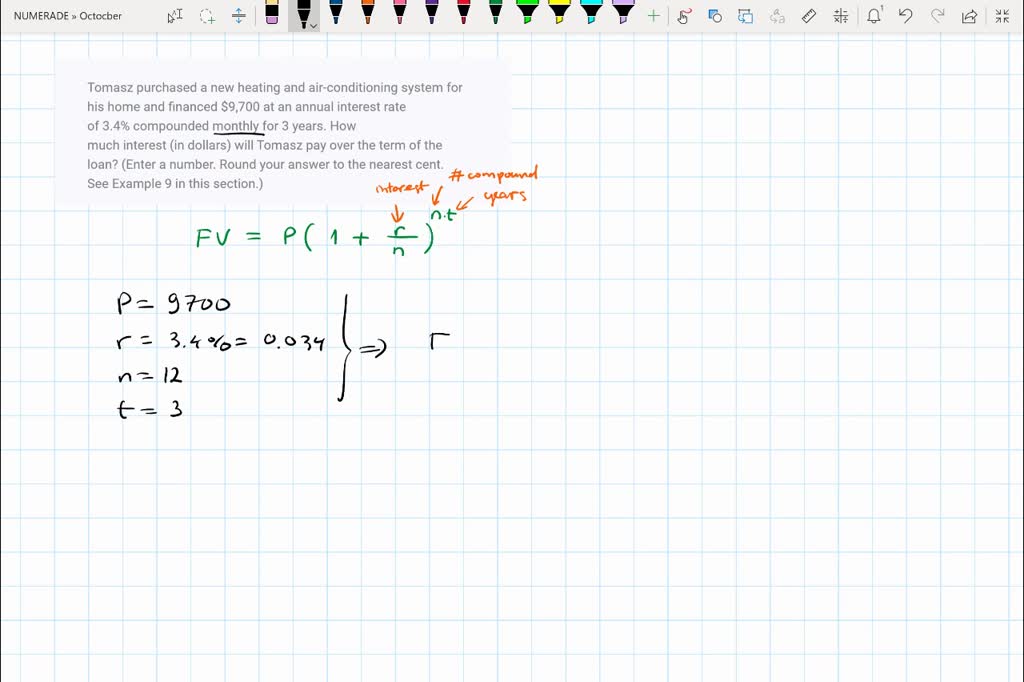

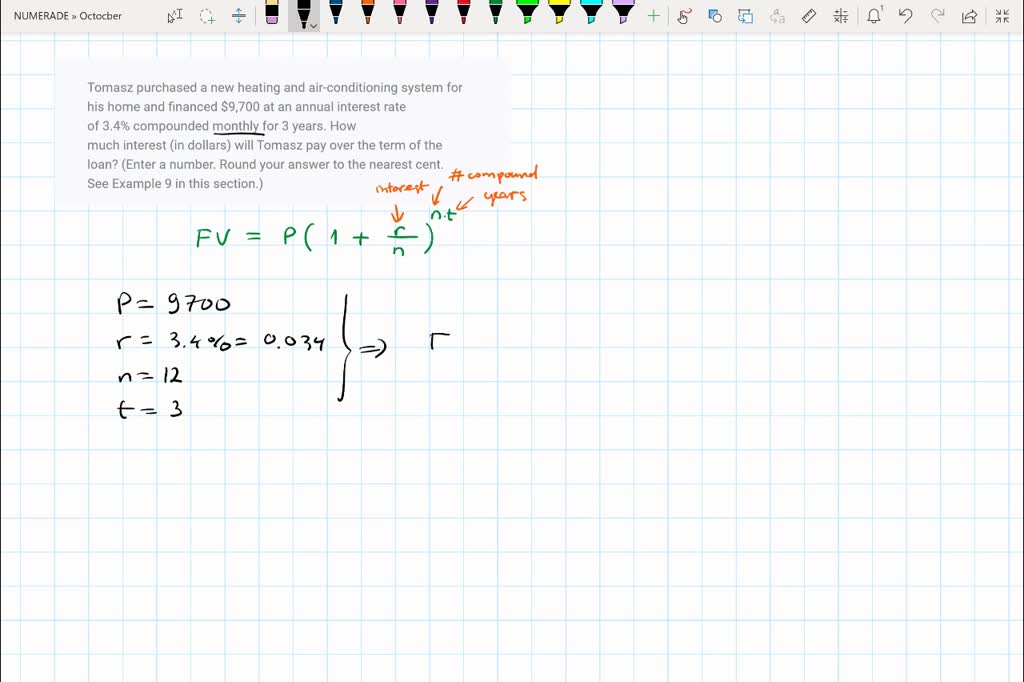

Tomasz Purchased A New Heating And Air conditioning S SolvedLib

https://cdn.numerade.com/ask_previews/13ffcc4b-c9e0-4480-bdb6-03a44eeffad3_large.jpg

Amana Central AC Unit Prices

https://www.iheartamana.com/wp-content/uploads/2021/12/amana-hvac-2048x1234.jpg

Save Up to 2 000 on Costs of Upgrading to Heat Pump Technology These energy efficient home improvement credits are available for 30 of costs up to 2 000 and can be An HVAC tax credit can help you save money on your tax dues and energy bills Learn if you qualify with our 2023 guide to HVAC tax credits

Effective Jan 1 2023 Provides a tax credit to homeowners equal to 30 of installation costs for the highest efficiency tier products up to a maximum of 600 for qualified air conditioners and The federal government offers tax credits for homeowners who install energy efficient HVAC systems Under the Energy Efficient Home Improvement Tax Credit extended

Download Tax Credits For New Heating And Air Systems

More picture related to Tax Credits For New Heating And Air Systems

The Top Air Conditioner Size Guide

https://www.furnaceprices.ca/wp-content/uploads/2022/06/central-air-conditioner-size.jpeg

What Do You Call The Ac Electrical Outlet 3 Prong Holes Quora Images

https://trusteyman.com/wp-content/uploads/2015/03/HEAT-AIR.jpg

Taking Advantage Of HVAC Tax Credits Ace Plumbing Heating And Air

https://www.aceplumbing.com/wp-content/uploads/2018/05/air-conditioning-repair-742x494.jpg

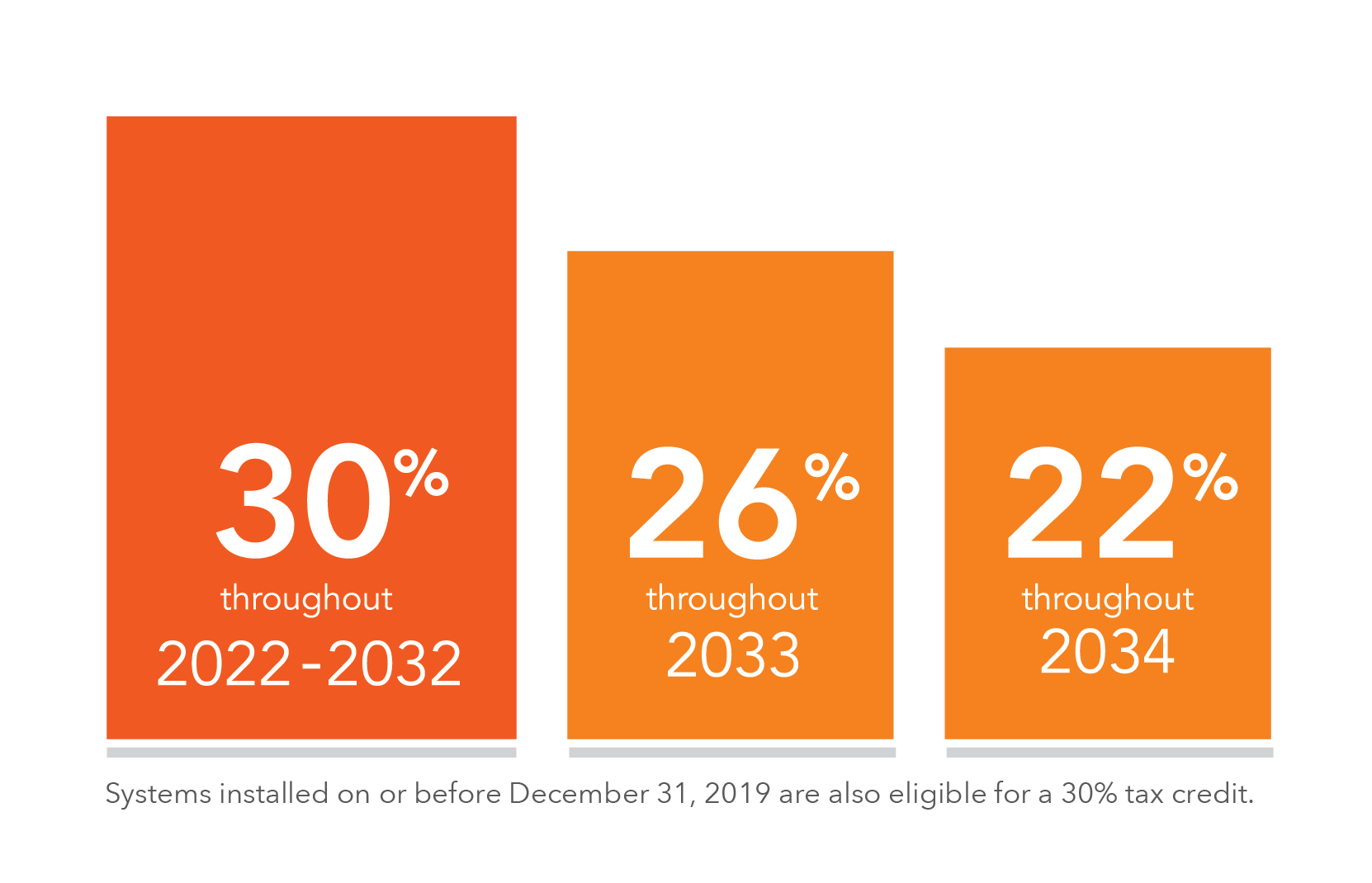

Included in the Inflation Reduction Act federal tax credits are available for energy efficient home upgrades especially HVAC systems like air conditioners These credits offer Which Tax Credits Are Potentially Available for HVAC Systems The rebates would apply for heating and cooling systems installed between Jan 1 2023 and Dec 31 2032 The following

The cost of increasing the insulation and reducing air leaks in a home may be eligible for a federal tax credit when the improvements meet the 2021 International Energy With help from the Inflation Reduction Act federal tax credits are available for energy efficient home upgrades especially HVAC systems like air conditioners These credits

Home Energy Assessments In Rochester NY Ryan Plumbing Heating

https://cdn-iiinn.nitrocdn.com/SQCeMnjgJDBomkPneReOHHrHWFNXxHnR/assets/images/optimized/rev-a2540b6/ryanservice.wpenginepowered.com/wp-content/uploads/2022/03/5-980x980.png

Keeping Your HVAC Systems In Prime Condition Is Of Paramount Importance

https://airtempcontrol.com/wp-content/uploads/2019/10/heating-systems-in-greer-sc.jpg

https://www.energystar.gov/about/federal-tax...

The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights

https://www.irs.gov/newsroom/irs-home-improvements...

Taxpayers who invest in energy improvements for their main home including solar wind geothermal fuel cells or battery storage may qualify for an annual residential clean

How Much Does A New Air Conditioning And Heating System Cost Air

Home Energy Assessments In Rochester NY Ryan Plumbing Heating

30 Federal Tax Credits For Heat Pump Water Heaters 2023

Can You Write Off New AC And Furnace On Taxes Leia Aqui Can You Write

Types Of Air Conditioners Bayside AC

American Heating And Air Conditioning Top Rated Air Conditioner And

American Heating And Air Conditioning Top Rated Air Conditioner And

Home Energy Tax Credits Will Ease The Pain Of An Ailing A C

Best HVAC Systems Of 2020 Polar Bear Heating Cooling

Solar Tax Credits For PV And Solar Hot Water Systems RevoluSun

Tax Credits For New Heating And Air Systems - Save Up to 2 000 on Costs of Upgrading to Heat Pump Technology These energy efficient home improvement credits are available for 30 of costs up to 2 000 and can be