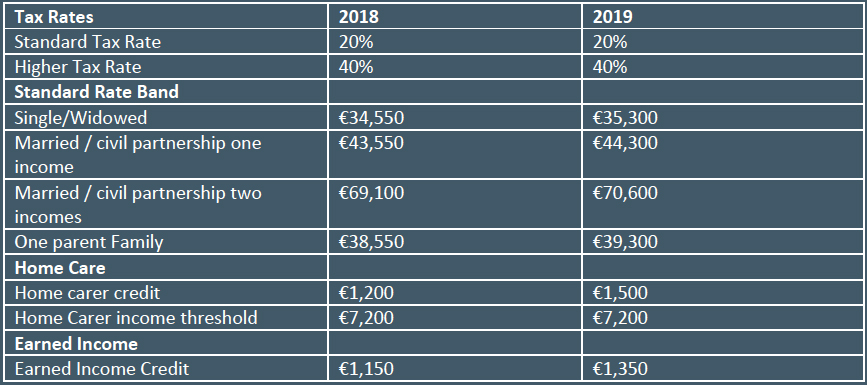

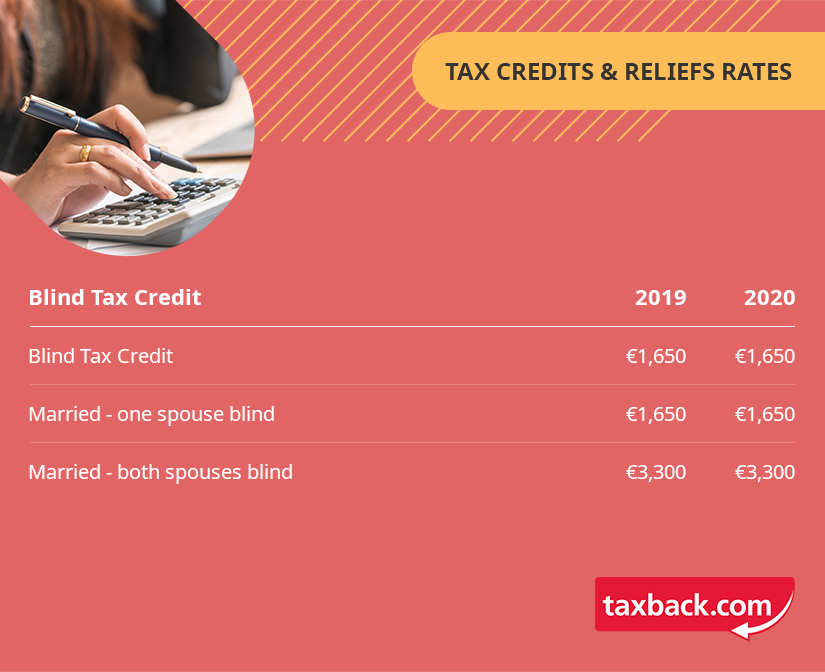

Tax Credits In Ireland The following tables show the tax rates rate bands and tax reliefs for the tax year 2024 and the previous tax years Calculating your Income Tax gives more information on how these work

What are tax credits Tax credits reduce the amount of tax you pay What are tax reliefs Tax reliefs reduce the amount of income that you pay tax on The tax credits and reliefs you are entitled to depend on your personal circumstances Introduction to income tax credits and reliefs Tax reliefs reduce the amount of tax that you have to pay Find out about the different types of income tax relief that apply to your circumstances Housing tax credits and reliefs You can claim tax relief on some housing expenses and income Find out more

Tax Credits In Ireland

Tax Credits In Ireland

https://mc2accountants.ie/wp-content/uploads/2019/01/Tax4.jpg

PAYE Explained A Guide To Understanding Irish Tax Credits And Reliefs

https://www.taxback.com/resources/blogimages/20200507125808.1588845488538.2a4b4bae750c3717b1d003871ce.png

List Of Tax Credits In Ireland 2020 AccountsIreland

https://accountsireland.com/wp-content/uploads/2020/05/woman-4783150_1920-1536x1024.jpg

All PAYE taxpayers are entitled to a tax credit known as the Employee Tax Credit formerly known as the PAYE tax credit This is worth 1 875 in 2024 1 775 in 2023 If you are married and taxed under joint assessment then you and your spouse may both claim an Employee Tax Credit Overview Introduction to income tax credits and reliefs Tax reliefs reduce the amount of tax that you have to pay Find out about the different types of income tax relief that apply to your circumstances Housing tax credits and reliefs You can claim tax relief on some housing expenses and income Find out more Tax relief on medical expenses

A single person s tax credit is 1 775 for tax year 2023 which means you can earn up to 8 87 free of income tax for the year Q3 Do married couples get a higher personal tax credit Yes for married couples the personal credit is 3 550 double the single persons tax credit for the 2023 tax year Q4 In Ireland tax credits can be deducted from your tax bill If you are paid a salary in Ireland everyone receives Personal tax credits Depending on your circumstances you may be entitled to other tax credits like Employee tax credits Earned Income tax credits and so on Here is a list of the 10 most common tax credits in Ireland 1

Download Tax Credits In Ireland

More picture related to Tax Credits In Ireland

How To Claim R D Tax Credits In Ireland

https://www.myriadassociates.ie/media/eivjnltg/the-irish-rd-tax-credits-update-giving-a-huge-cash-boost-to-businesses-sooner-than-expected.jpg?anchor=center&mode=crop&width=500&height=500&rnd=132612429153900000

List Of Tax Credits In Ireland 2020 AccountsIreland

https://accountsireland.com/wp-content/uploads/2020/05/school-design-1727586_1280.png

Share Register Template South Africa Masaka luxiarweddingphoto

http://taxaccounts.ie/wp-content/uploads/2014/06/TaxClearanceStep2.jpg

If you reside in Ireland you automatically qualify for Personal Tax Credits Plus there s more good news You might also be eligible for additional tax credits tailored to your circumstances Discover and claim what you deserve Your money your rights let s ensure you benefit fully Example 1 Take Ciara s case for example The main personal tax credits are as follows Notes With effect from 1 January 2014 available for the principal carer of the child only Reducing credit available for subsequent years re carer s income exceeds EUR 7 200 the tax credit is reduced by a sliding scale If one s income is EUR 10 400 or more then one cannot claim the tax credit

[desc-10] [desc-11]

Tax Credits Renewal S Smith Accounting

https://www.ssmith-accountants.co.uk/wp-content/uploads/2021/10/Tax-Credits-scaled-1.jpg

How Far Back Can I Claim R D Tax Credits In Ireland

https://www.myriadassociates.ie/media/zuvfi0fm/too-late-to-claim-r-and-d.jpeg?anchor=center&mode=crop&width=500&height=500&rnd=132611415823530000

https://www.revenue.ie/en/personal-tax-credits...

The following tables show the tax rates rate bands and tax reliefs for the tax year 2024 and the previous tax years Calculating your Income Tax gives more information on how these work

https://www.citizensinformation.ie/en/money-and...

What are tax credits Tax credits reduce the amount of tax you pay What are tax reliefs Tax reliefs reduce the amount of income that you pay tax on The tax credits and reliefs you are entitled to depend on your personal circumstances

What Is A Tax Credit Tax Credits Explained

Tax Credits Renewal S Smith Accounting

Tax Credits Renewal Accountants Belfast Northern Ireland

What Tax Credits Are Available In Ireland Ireland Accountant

Blog Claiming Research And Development Tax Credits In Ireland

HMRC Reveals Details Of R D Credits Anti fraud Campaign Tax Tips G T

HMRC Reveals Details Of R D Credits Anti fraud Campaign Tax Tips G T

Tax Credits Life At HMRC

Curious About Tax Breaks For Homeowners No One Knows Them Better Than

Individual Tax Rates And Tax Credits 2021 Ireland RSC

Tax Credits In Ireland - All PAYE taxpayers are entitled to a tax credit known as the Employee Tax Credit formerly known as the PAYE tax credit This is worth 1 875 in 2024 1 775 in 2023 If you are married and taxed under joint assessment then you and your spouse may both claim an Employee Tax Credit