Tax Credits Pennsylvania Web Pennsylvania offers a variety of tax incentives credits and programs to eligible Pennsylvania residents and businesses These tax credits economic development programs refund rebate opportunities and incentive programs provide economic assistance and tax reductions to individual and business taxpayers

Web 28 Okt 2022 nbsp 0183 32 The cornerstone of the legislation a tax credit to incentivize the construction of a regional hydrogen hub in Pennsylvania would provide the biggest break of them all up to 50 million in credits each year for a total of 1 billion in tax credits over a 20 year span What is a hydrogen hub Web While basic reporting for the Research and Development R amp D Tax Credit has been compulsory since its creation by Act 7 of 1997 requirements were expanded by Act 46 of 2003 to include the names of all taxpayers utilizing the credit and the amount of credits approved and utilized by each taxpayer

Tax Credits Pennsylvania

Tax Credits Pennsylvania

https://www.kankakeecountyed.org/wp-content/uploads/shutterstock_667165351.jpg

Indiana Tax Credits For Workers And Families

https://i0.wp.com/www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2022/02/TCWF_knockout_horizontal.png?w=4439&ssl=1

Tax Credits For Giving Ozarks Food Harvest

https://ozarksfoodharvest.org/wp-content/uploads/2022/11/NAPArticle2022-1024x1024.jpg

Web Enacted on June 30 2021 H B 952 provides an update to Pennsylvania s Qualified Manufacturing Innovation and Reinvestment Deduction QMIRD Applicable to tax years beginning after December 31 2020 the deduction applies to Pennsylvania taxable income i e post apportionment H B 952 provides updated deadlines for a number of credit Web 14 Juni 2019 nbsp 0183 32 In return they received a total of 124 million in Pennsylvania tax credits The program budget was capped at 135 million that year The program is most popular in Montgomery County where businesses and individuals claimed 35 million in tax credits on 39 million in charitable gifts

Web 6 Juli 2021 nbsp 0183 32 Tax credits and incentives have long been a tool for bolstering revenue for state economies In this episode we are joined by Jason Skrinak founder of Pivot Strategic Consulting in Harrisburg Pa and a member of the PICPA Fiscal Responsibility Task Force to discuss how credits and incentives are used in Pennsylvania the scrutiny they will Web 20 Okt 2023 nbsp 0183 32 HARRISBURG Pennsylvania gives out hundreds of millions of dollars in tax credits each year to create jobs and encourage companies to invest here but only some of those programs are working as intended according to five years of research by an independent legislative agency

Download Tax Credits Pennsylvania

More picture related to Tax Credits Pennsylvania

Upcoming Changes To R D Tax Credits Introducing The Additional

https://www.zest.tax/wp-content/uploads/2023/06/pexels-thisisengineering-3912480-scaled.webp

Tax Credits To Help Cover The Costs Of Higher Education Lahrmer Company

https://lahrmercpa.files.wordpress.com/2022/04/tax-credits-to-help-cover-the-cost-of-higher-education.jpg

Tax Credits Are Hidden Benefit For Homeowners

https://www.tennessean.com/gcdn/-mm-/c35235dca3494476ea713db1a4eea54b43cda490/c=0-1242-4148-3585/local/-/media/2016/02/08/Nashville/Nashville/635905382793361586-DeniseCreswell.jpg?width=3200&height=1808&fit=crop&format=pjpg&auto=webp

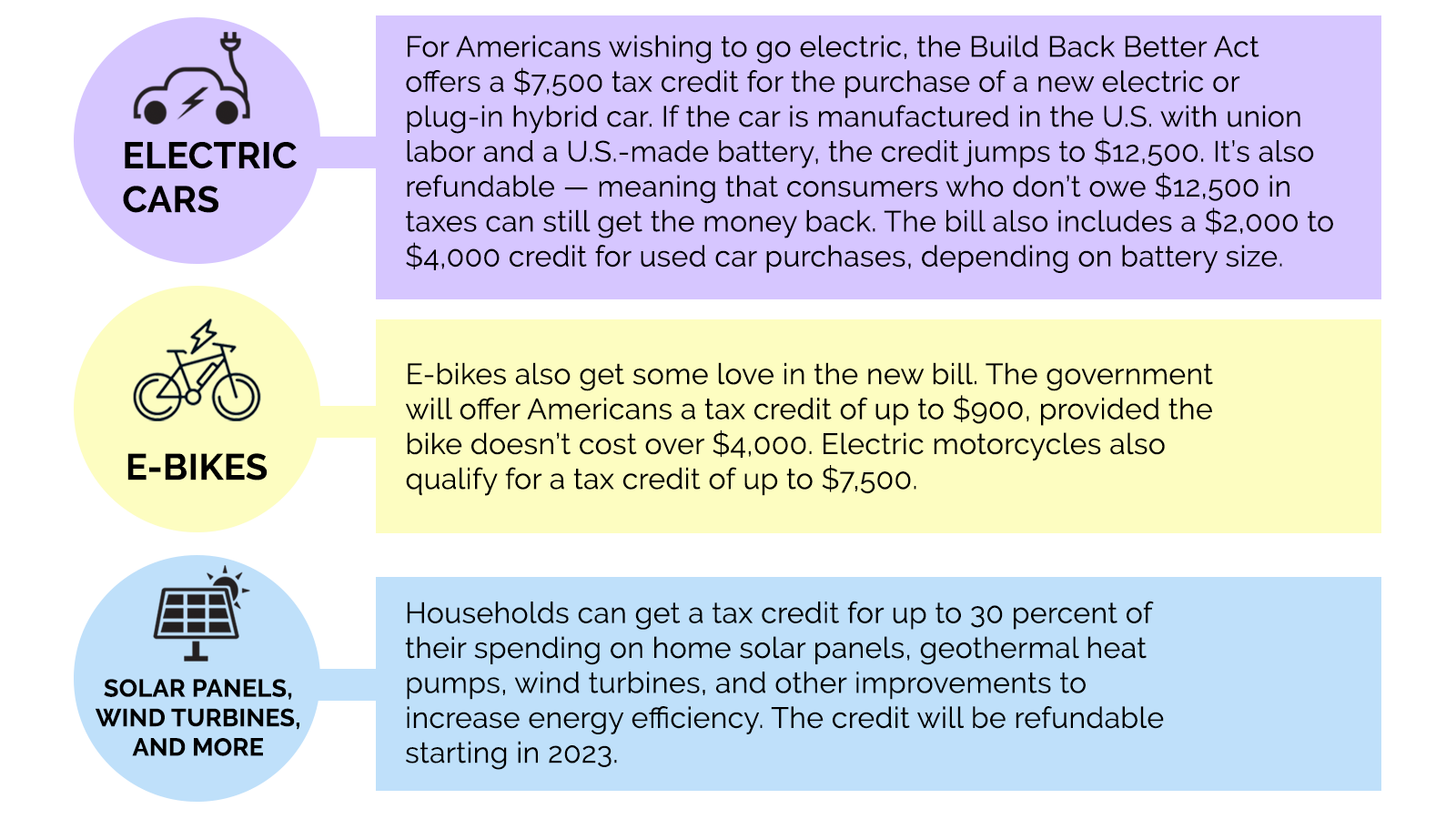

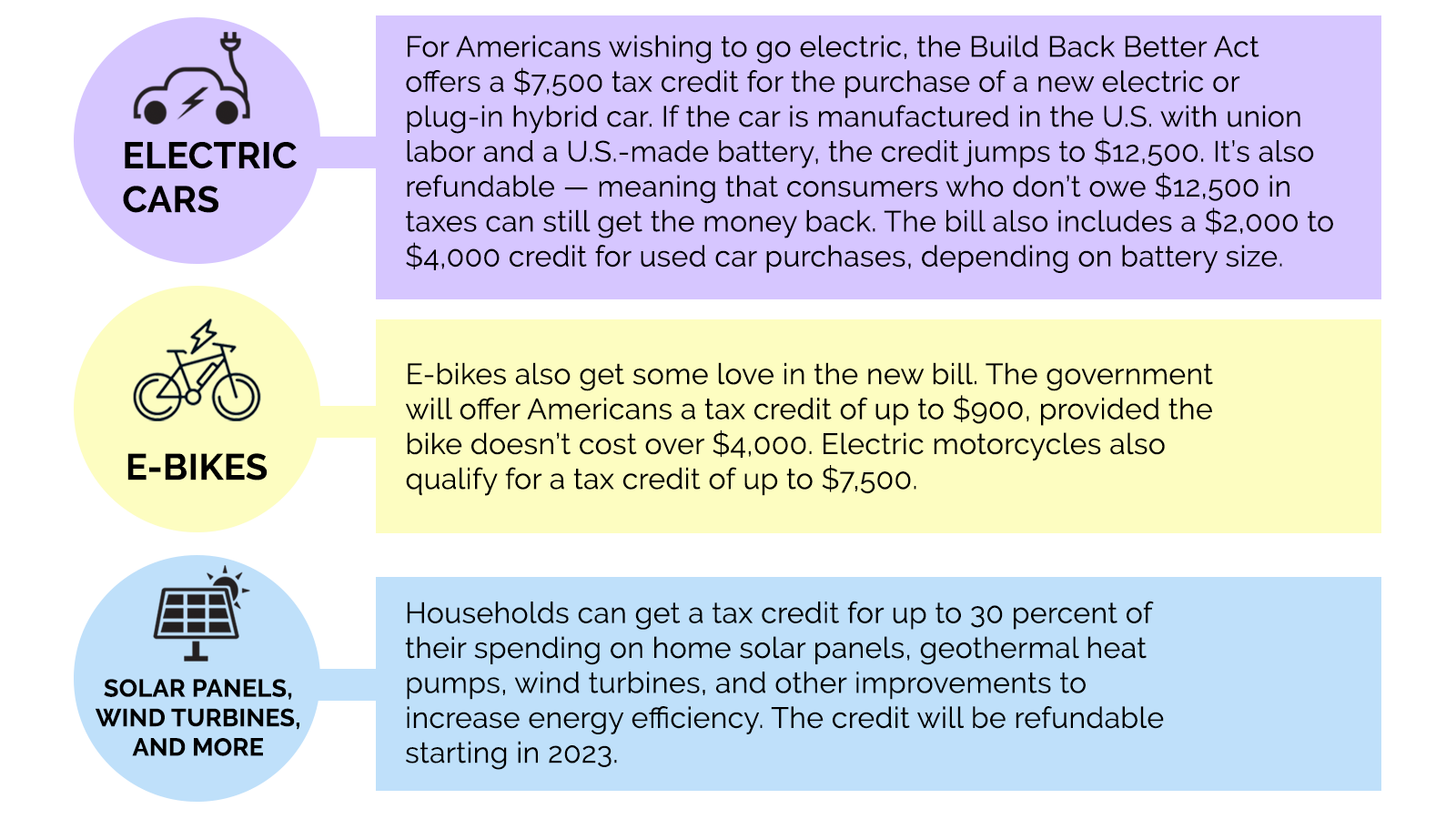

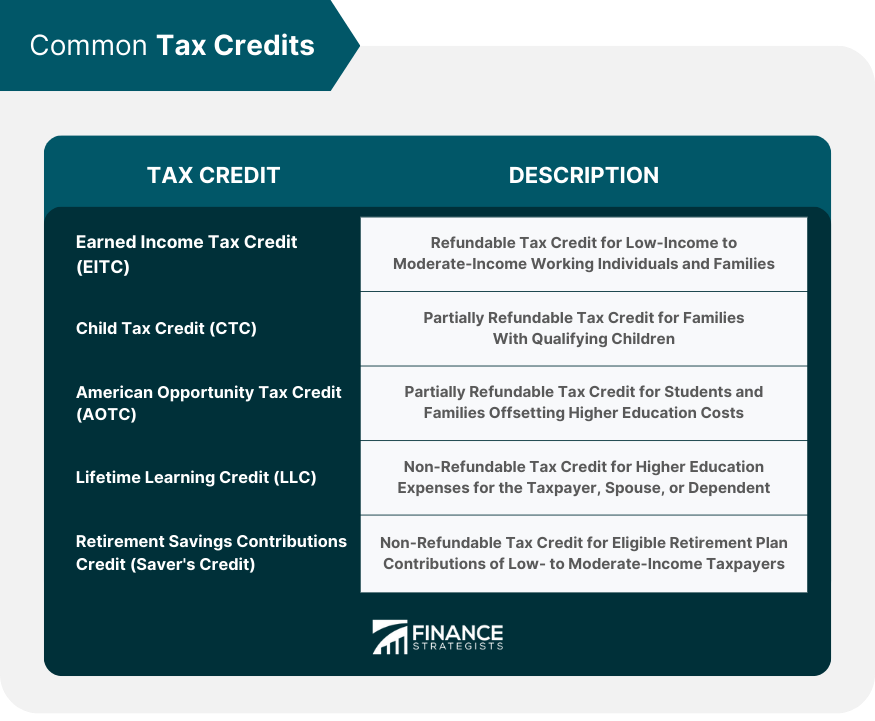

Web 21 Juni 2023 nbsp 0183 32 According to IRS data on Pennsylvanians 2020 tax returns a little less than 50 of the tax credit s almost 190 000 claimants make more than 100 000 a year receiving 50 million in tax breaks Grove also argued that the earned income tax credit would be an expensive welfare program riddled with mistakes and overpayments Web 27 Okt 2022 nbsp 0183 32 Pennsylvania lawmakers are sending a nearly 2 billion package of tax credits aimed at supporting the state s natural gas industry to Governor Tom Wolf s desk Wolf is expected to sign the bill

Web Pennsylvania does not allow taxpayers to take a credit on their tax returns for credits deducted on the federal return The below table lists may of the credits not allowed for Pennsylvania Personal Income Tax which are allowed for federal income tax purposes Resident Credit Resident Credit for Tax Paid to Another State Web Year 2 Credit Approved 12 15 2010 4 000 Tax Liability for the Period Ending 12 31 2010 2 700 Portion of 12 15 2010 credit used 2 700 Tax Credit Carry Forward from 12 15 2010 1 300 Sale of 12 15 2009 Tax Credit 500 Tax Credit Carry Forward from 12 15 2009 500

6 Tax Credits For Ontario Founders Accountero

https://www.accountero.com/wp-content/uploads/2022/10/AC-Blog-1-10.png

Home Renovation Tax Credits In Canada 2024 Loans Canada

https://loanscanada.ca/wp-content/uploads/2022/03/Home-Reno-Tax-Credits.png

https://www.revenue.pa.gov/IncentivesCreditsPrograms

Web Pennsylvania offers a variety of tax incentives credits and programs to eligible Pennsylvania residents and businesses These tax credits economic development programs refund rebate opportunities and incentive programs provide economic assistance and tax reductions to individual and business taxpayers

https://www.cityandstatepa.com/policy/2022/10/pennsylvanias-last...

Web 28 Okt 2022 nbsp 0183 32 The cornerstone of the legislation a tax credit to incentivize the construction of a regional hydrogen hub in Pennsylvania would provide the biggest break of them all up to 50 million in credits each year for a total of 1 billion in tax credits over a 20 year span What is a hydrogen hub

.jpg)

Pennsylvania R D Tax Credits R D Tax Credits

6 Tax Credits For Ontario Founders Accountero

Contact AAA Tax Service

Understanding Tax Credits Avenue Tax Service

Democratic Plan Would Close Tax Break On Exchange traded Funds

Green Incentives Usually Help The Rich Here s How The Build Back

Green Incentives Usually Help The Rich Here s How The Build Back

Geothermal Tax Credits Incentives

Tax Credits Solution By Walton Management Services ICIMS Marketplace

Maximizing Your Tax Return A Guide To Overlooked Deductions And

Tax Credits Pennsylvania - Web Research amp Development Tax Credit Program Act 7 of 1997 created the Pennsylvania Research amp Development R amp D tax credit The R amp D tax credit provision became Article XVII B of the Tax Reform Code of 1971 TRC The intent of the R amp D tax credit is to encourage taxpayers to increase R amp D expenditures within the Commonwealth in order to