Tax Credits Salary Threshold Verkko 13 jouluk 2023 nbsp 0183 32 The aim of Working Tax Credit has been to give an extra boost to those in work on lower pay to stop that happening especially if they drop below your

Verkko 13 hein 228 k 2023 nbsp 0183 32 Working tax credit is a means tested benefit paid by HMRC to support people on a low income So if your salary is 163 8 000 a year you ll be earning 163 545 over this threshold For each pound Verkko 6 jouluk 2023 nbsp 0183 32 For the 2023 tax year taxes filed in 2024 the child tax credit could get you up to 2 000 per kid with 1 600 being

Tax Credits Salary Threshold

Tax Credits Salary Threshold

https://uploads-ssl.webflow.com/61dc4865ed3fbe81d9394e78/62c58c629962eb50327132ea_tax credits.png

Minnesota Tax Credits For Workers And Families

https://i0.wp.com/www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2022/02/TCWF_knockout_horizontal.png?w=4439&ssl=1

Sept 30th At 1pm Business Tax Credits In Your Favor Don t Miss Out

https://content.govdelivery.com/attachments/fancy_images/USSBA/2022/09/6482828/sba-tax-webinar-banner_original.jpg

Verkko 19 hein 228 k 2023 nbsp 0183 32 You can no longer make a new claim for Tax Credits if you are getting or previously got a severe disability premium SDP Before January 27 2021 Verkko 4 p 228 iv 228 228 sitten nbsp 0183 32 The earned income credit EIC or EITC is for low and moderate income workers See what it is how it works how to qualify and how much you may get for 2023 2024

Verkko 15 marrask 2023 nbsp 0183 32 The child tax credit reverted back to pre 2021 levels in 2022 and the refundable portion of the credit for each child under 17 is adjusted for inflation As of 2024 tax year the refundable Verkko To support your claim keep records of your income bills payslips benefits tax credits childcare and child s education for the current tax year and at least 2 years before

Download Tax Credits Salary Threshold

More picture related to Tax Credits Salary Threshold

Tax Credits Spsgz

https://www.taxformreporting.com/wp-content/uploads/Tax-Credits-1.png

Upcoming Changes To R D Tax Credits Introducing The Additional

https://www.zest.tax/wp-content/uploads/2023/06/pexels-thisisengineering-3912480-scaled.webp

Tax Credits Are Hidden Benefit For Homeowners

https://www.tennessean.com/gcdn/-mm-/c35235dca3494476ea713db1a4eea54b43cda490/c=0-1242-4148-3585/local/-/media/2016/02/08/Nashville/Nashville/635905382793361586-DeniseCreswell.jpg?width=3200&height=1808&fit=crop&format=pjpg&auto=webp

Verkko 27 November 2023 Rates for Working Tax Credit Child Tax Credit tax credits income threshold and withdrawal rates Child Benefit and Guardian s Allowance for the 2024 Verkko 14 huhtik 2022 nbsp 0183 32 Calculating tax credits 2011 2012 and earlier years For WTC only claimants the calculation of tax credits in 2011 2012 and earlier years was as

Verkko Threshold for maximum Child Tax Credit where neither partner meets conditions for Working Tax Credit 163 17 005 163 18 725 Income threshold for families who meet Verkko 13 marrask 2023 nbsp 0183 32 To claim the Earned Income Tax Credit EITC you must have what qualifies as earned income and meet certain adjusted gross income AGI and credit

T22 0188 Repeal Child Tax Credit CTC Earned Income Threshold By

https://www.taxpolicycenter.org/sites/default/files/styles/full-page-1500x700/public/model-estimates/images/t22-0188.gif?itok=6FfQuMuW

Details From IRS About Enhanced Child Tax Credits

https://www.gannett-cdn.com/presto/2020/10/09/NETN/6fd18418-b434-4fe3-b42f-55875f385db0-p1DavidBruce070716_1.JPG?crop=2630,1479,x180,y168&width=2630&height=1479&format=pjpg&auto=webp

https://www.moneysavingexpert.com/family/tax-credit-child-working...

Verkko 13 jouluk 2023 nbsp 0183 32 The aim of Working Tax Credit has been to give an extra boost to those in work on lower pay to stop that happening especially if they drop below your

https://www.which.co.uk/money/tax/tax-credits-a…

Verkko 13 hein 228 k 2023 nbsp 0183 32 Working tax credit is a means tested benefit paid by HMRC to support people on a low income So if your salary is 163 8 000 a year you ll be earning 163 545 over this threshold For each pound

Understanding Tax Credits Avenue Tax Service

T22 0188 Repeal Child Tax Credit CTC Earned Income Threshold By

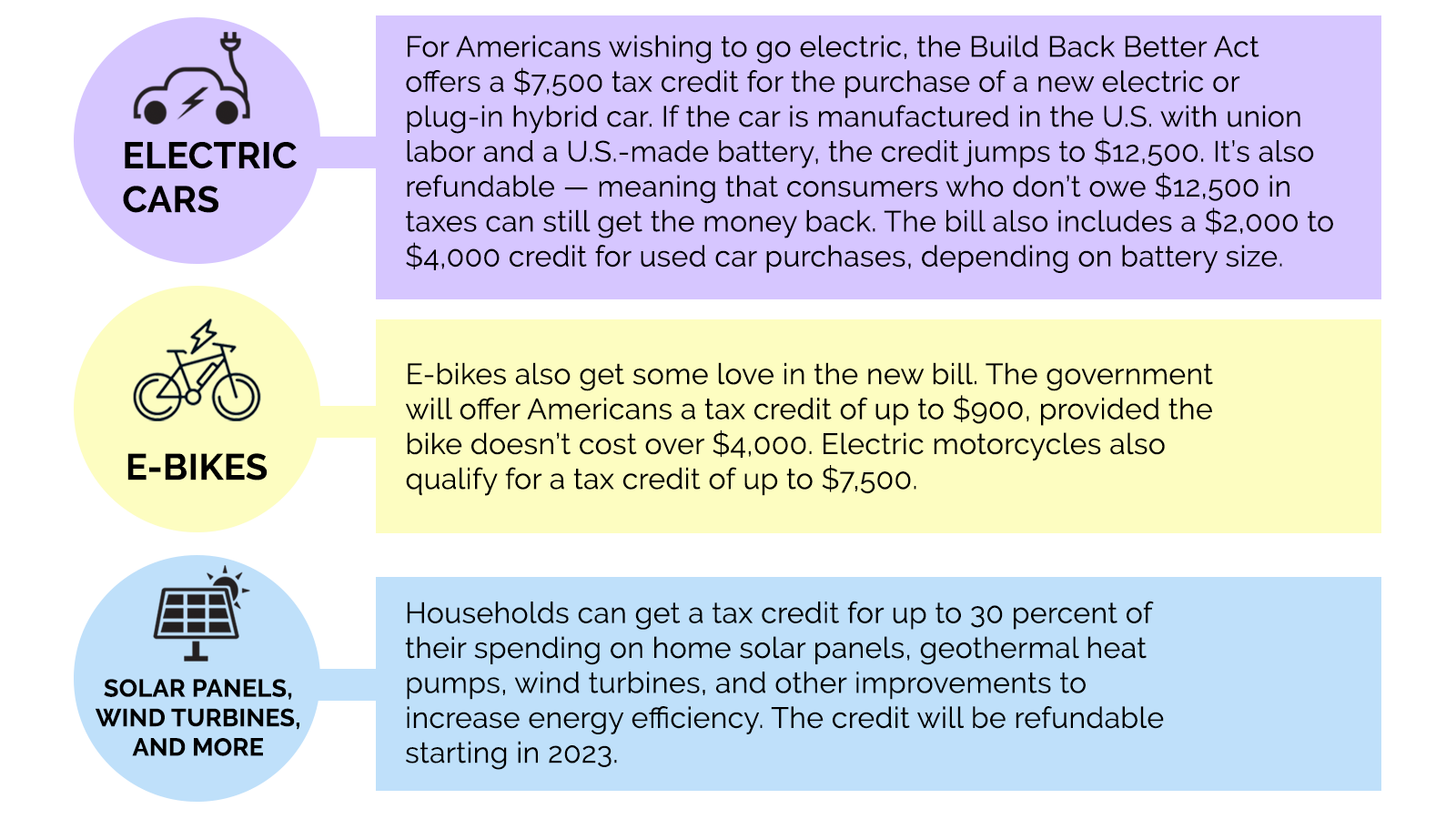

Green Incentives Usually Help The Rich Here s How The Build Back

Geothermal Tax Credits Incentives

Wordly Account Gallery Of Photos

Potential Claims Arising From The Use and Abuse Of Research And

Potential Claims Arising From The Use and Abuse Of Research And

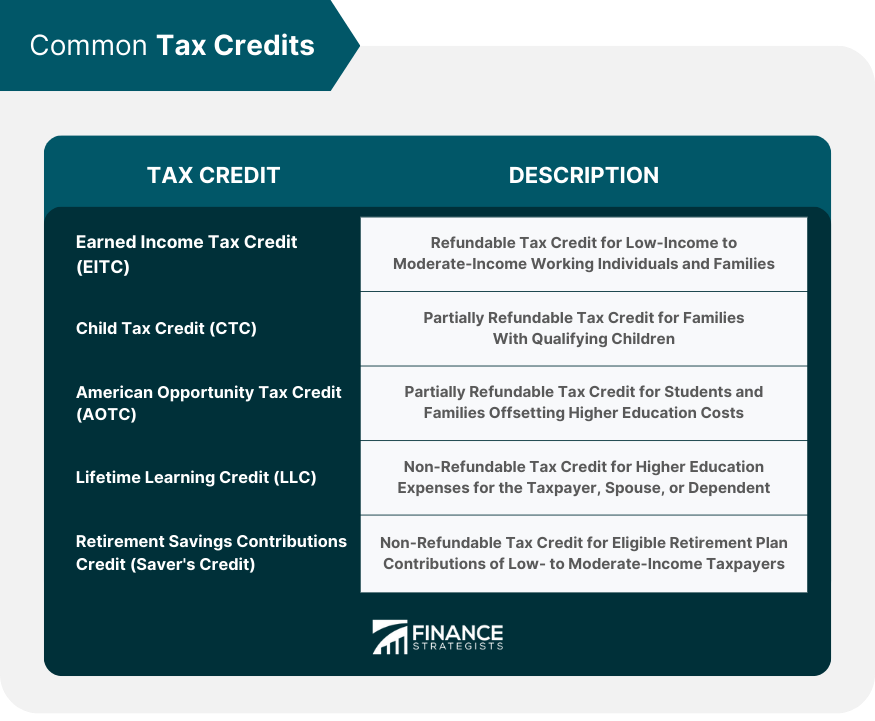

Maximizing Your Tax Return A Guide To Overlooked Deductions And

List Of 14 Commonly Overlooked Personal Tax Deductions Credits For

5 Big Tax Credits That Could Increase Your Refund TaxSlayer

Tax Credits Salary Threshold - Verkko To support your claim keep records of your income bills payslips benefits tax credits childcare and child s education for the current tax year and at least 2 years before