Tax Credits Travel Expenses Credit is only granted for the part of the total expense that was paid for work You cannot get the credit for other costs such as equipment or travel expenses You

To write off travel expenses the IRS requires that the primary purpose of the trip needs to be for business purposes Here s how to make sure your travel qualifies as a business If you re self employed or own a business you can deduct work related travel expenses including vehicles airfare lodging and meals The expenses must be

Tax Credits Travel Expenses

Tax Credits Travel Expenses

https://content.govdelivery.com/attachments/fancy_images/USSBA/2022/09/6482828/sba-tax-webinar-banner_original.jpg

Tax Credits To Help Cover The Costs Of Higher Education Lahrmer Company

https://lahrmercpa.files.wordpress.com/2022/04/tax-credits-to-help-cover-the-cost-of-higher-education.jpg

Simplifying The Complexities Of R D Tax Credits TriNet

https://images.contentstack.io/v3/assets/blt9ccc5b591c9e2640/blt64bfb078a74eaa48/643963cd9074ca2928c792b6/RD-Tax-Credits-thumbnail.jpg

Travel expenses are business costs that involve ordinary and necessary travel for work away from your home area Learn which travel costs are tax deductible You can deduct business travel expenses when you are away from both your home and the location of your main place of business tax home Deductible expenses include

Travel expenses you can t deduct Where to claim travel expenses when filing your taxes What happens if your business deductions are disallowed What You re named on or entitled to an NHS tax credit exemption certificate if you do not have a certificate you can show your award notice you qualify if you get child tax credits

Download Tax Credits Travel Expenses

More picture related to Tax Credits Travel Expenses

Business Expenses 101 Everything You Need To Know

https://elorus.ams3.cdn.digitaloceanspaces.com/blogen/2022/06/Business-expenses---Elorus-Blog.jpg

The Value Of Investment Tax Credits For Your Business

https://torontoaccountant.ca/wp-content/uploads/2014/11/Tax-credits.jpg

Tax Credits Are Hidden Benefit For Homeowners

https://www.tennessean.com/gcdn/-mm-/c35235dca3494476ea713db1a4eea54b43cda490/c=0-1242-4148-3585/local/-/media/2016/02/08/Nashville/Nashville/635905382793361586-DeniseCreswell.jpg?width=3200&height=1808&fit=crop&format=pjpg&auto=webp

Are travel expenses tax deductible If you are self employed or run your own business they most certainly are What Travel Expenses are Deductible Airline Tickets Uber Fare Baggage Fees Mileage on a If you or an eligible family member uses the standard amount to calculate a travel deduction in the year 1 200 is the maximum total amount that may be claimed for each individual

Fortunately there are a few tax breaks available for deducting travel expenses Follow this quick guide to learn how to lower your tax bill with business travel deductions Business Travel and overnight expenses If you have to travel for your work you may be able to claim tax relief on the cost or money you ve spent on food or overnight expenses You cannot

State Tax Credits Tax Credits For Workers And Families

https://i0.wp.com/www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2022/02/TCWF_knockout_horizontal.png?w=4439&ssl=1

Tax Financial Accounting Solutions

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100063609654868

https://www.vero.fi/en/individuals/tax-cards-and...

Credit is only granted for the part of the total expense that was paid for work You cannot get the credit for other costs such as equipment or travel expenses You

https://www.bench.co/blog/tax-tips/travel-expenses-deductible

To write off travel expenses the IRS requires that the primary purpose of the trip needs to be for business purposes Here s how to make sure your travel qualifies as a business

Freelance Accounting Personal Tax Services

State Tax Credits Tax Credits For Workers And Families

Income related Expenses 2023 Flat Rate For Employees Recognition And

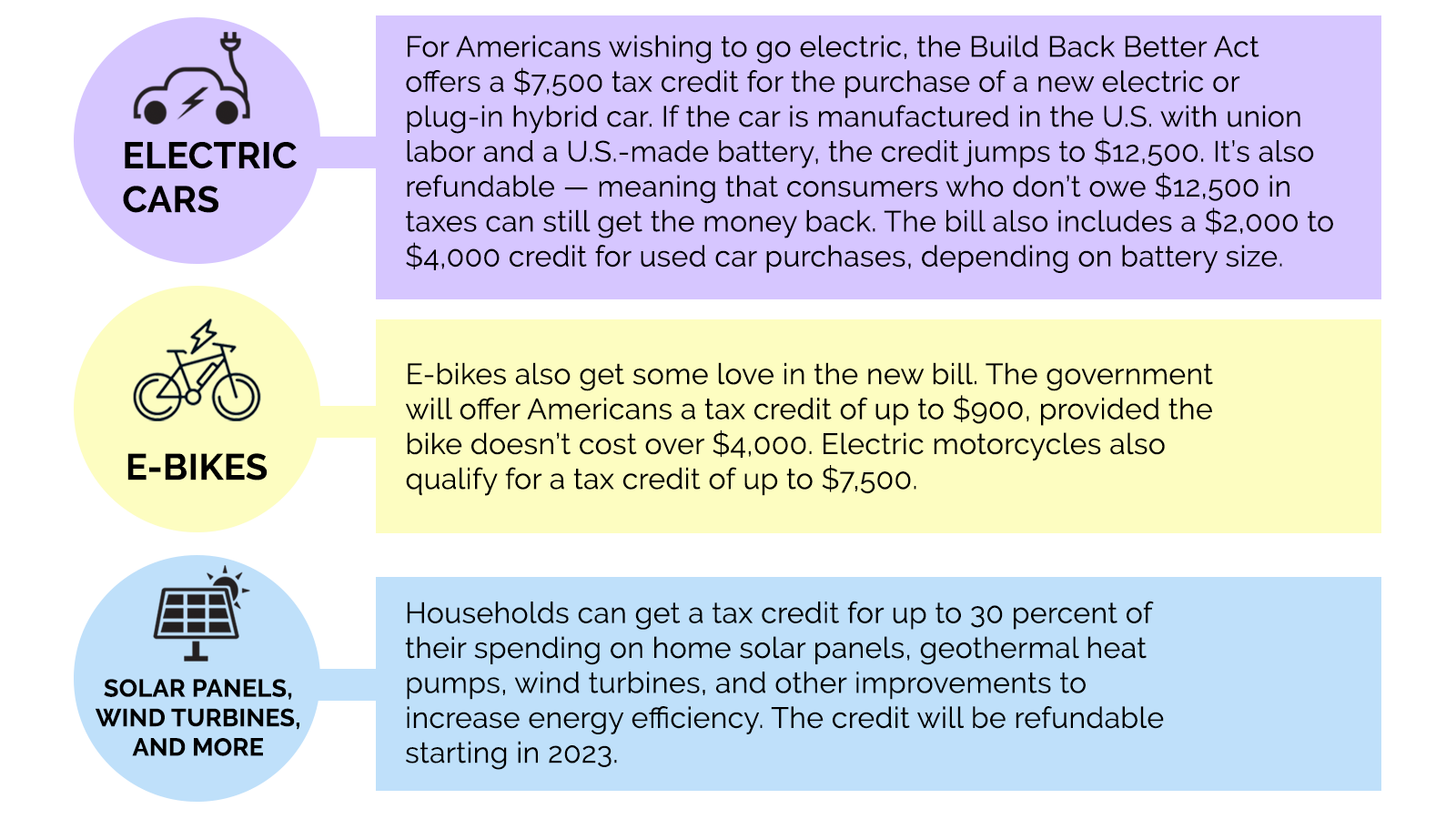

Green Incentives Usually Help The Rich Here s How The Build Back

Geothermal Tax Credits Incentives

List Of 14 Commonly Overlooked Personal Tax Deductions Credits For

List Of 14 Commonly Overlooked Personal Tax Deductions Credits For

Earning Credit For Your Wedding Expenses My Wedding Financing

What Are Tax Credits For Health Insurance Smartly Guide

Pre Trip Expenses Where Do They Fit In A Travel Budget Cinch Financial

Tax Credits Travel Expenses - Travel expenses you can t deduct Where to claim travel expenses when filing your taxes What happens if your business deductions are disallowed What