Tax Deductible Travel Expenses Verkko If the round trip plane fare and other travel related expenses such as food during the trip are 1 750 you can deduct travel costs of

Verkko 29 marrask 2023 nbsp 0183 32 You cannot deduct the following expenses as business expenses fines penalty fees and other penalty like charges wages you have paid to your Verkko 213 rivi 228 nbsp 0183 32 24 marrask 2020 nbsp 0183 32 The criteria for and amounts of allowances for travel expenses to be considered exempt from tax in the 2021 taxation shall be as

Tax Deductible Travel Expenses

Tax Deductible Travel Expenses

https://i.ytimg.com/vi/2ThABQmmnak/maxresdefault.jpg

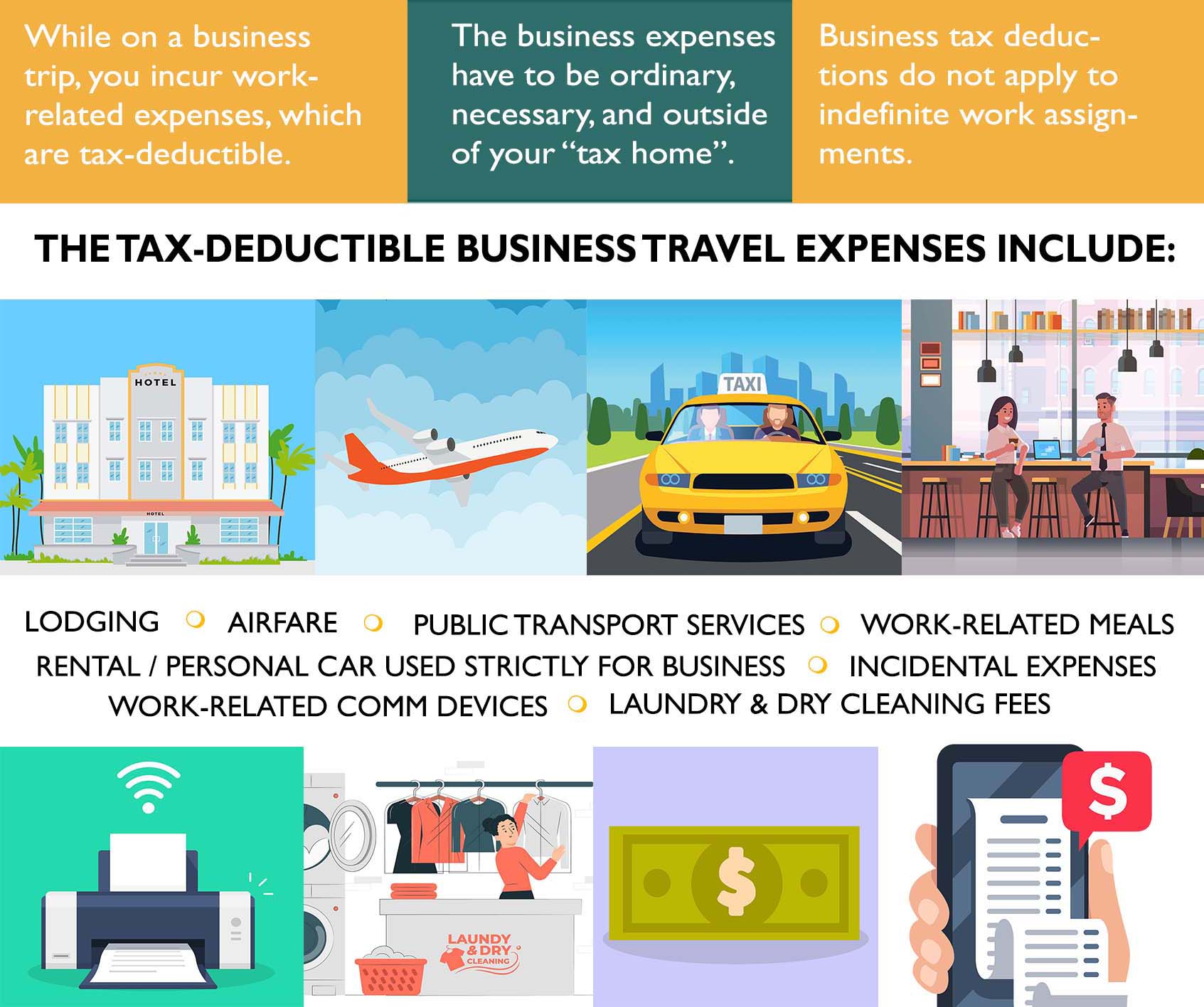

Which Business Travel Expenses Are Tax Deductible Blogger s Beat

https://i.pinimg.com/originals/0d/8e/31/0d8e318c583bd397964d6bab0de257dd.png

Which Business Travel Expenses Are Tax Deductible Blogger s Beat In

https://i.pinimg.com/originals/0a/85/0f/0a850f5c4f04f92fa8a775f1d1602041.png

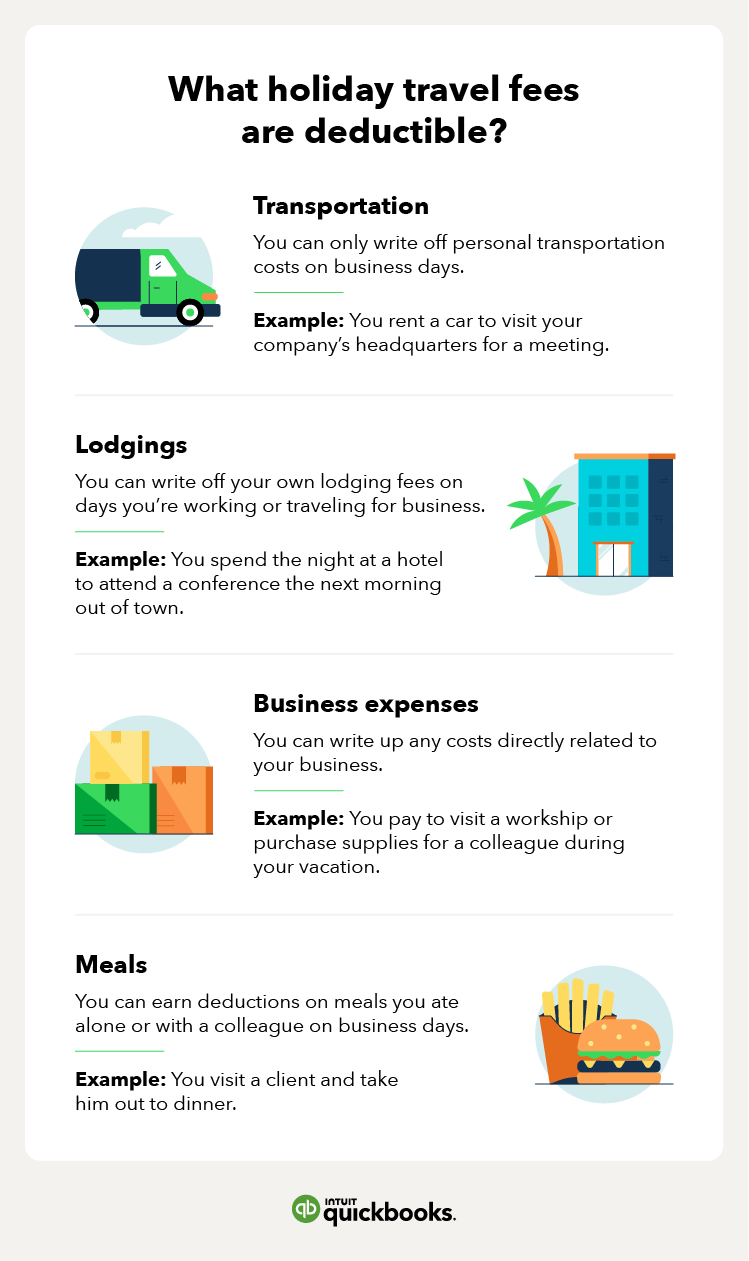

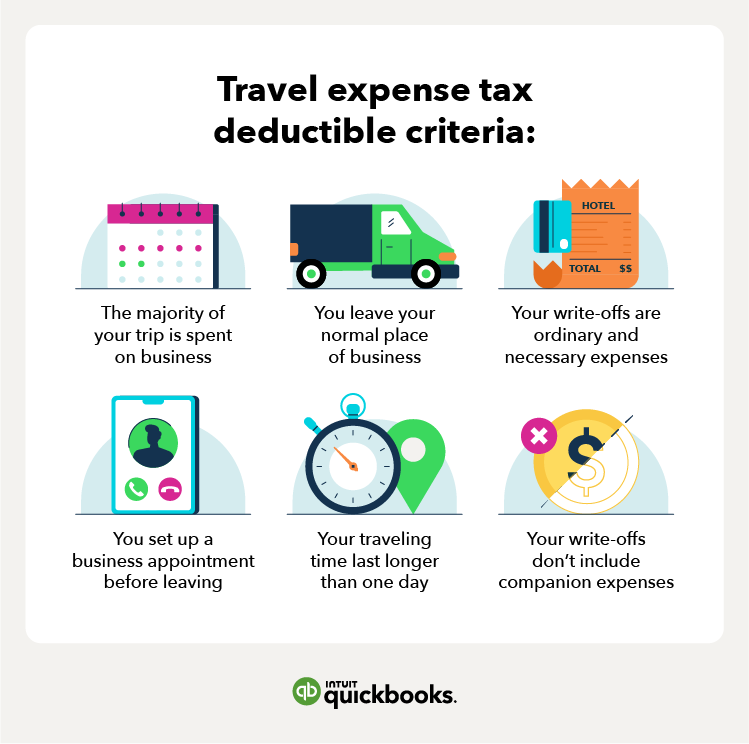

Verkko 7 jouluk 2023 nbsp 0183 32 Travel expenses are tax deductible only if they were incurred to conduct business related activities Only ordinary and necessary travel expenses are Verkko Surprised at the kinds of expenses that are tax deductible Travel expenses are just one of many unexpected deductible costs that can reduce your tax bill But with

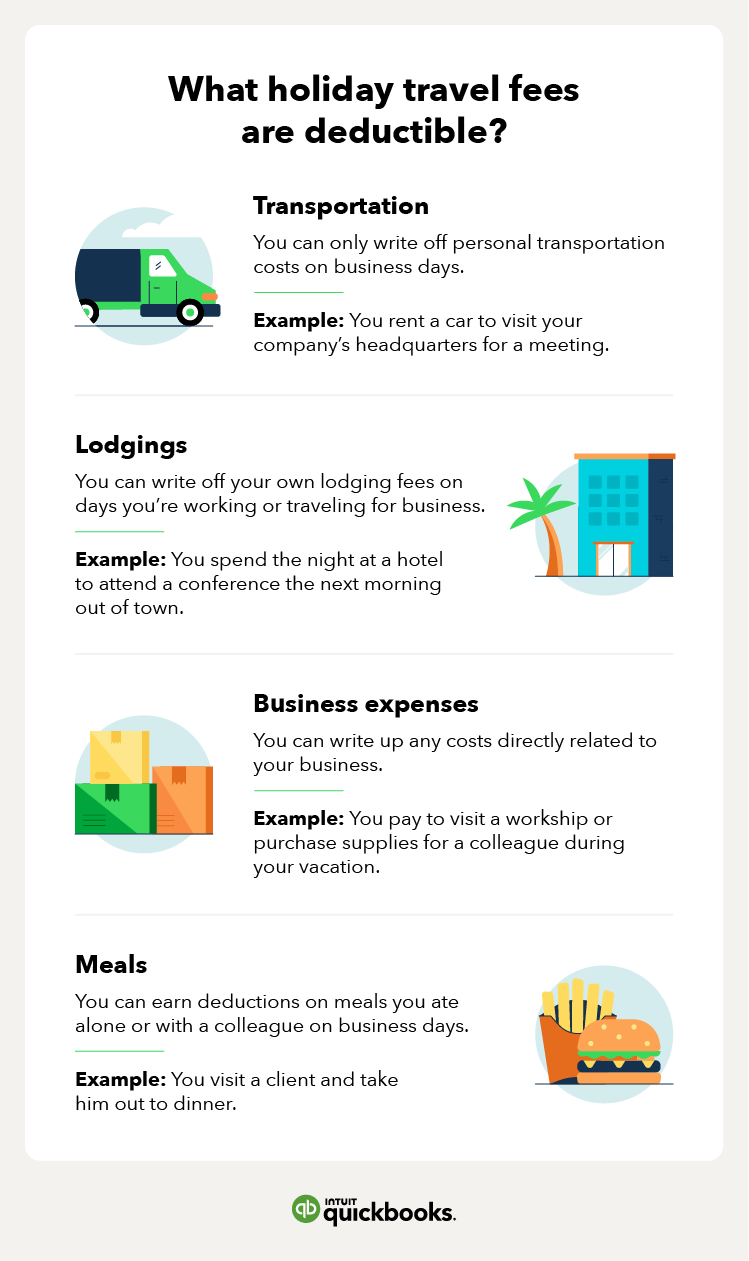

Verkko 7 helmik 2023 nbsp 0183 32 Deductible travel expenses include Travel by airplane train bus or car between your home and your business destination Fares for taxis or other types of Verkko 30 syysk 2020 nbsp 0183 32 Travel expenses must be business related Your travel must be primarily business related in order to be deductible Pleasure trips are never

Download Tax Deductible Travel Expenses

More picture related to Tax Deductible Travel Expenses

What Are Tax Deductible Business Expenses Compass Accounting

https://www.compass-cpa.com/wp-content/uploads/2018/08/what-are-tax-deductible-business-expenses.jpg

Travel Expense Tax Deductions For Expats

https://www.greenbacktaxservices.com/wp-content/uploads/2020/07/expatriate-taxes-deductible-travel-expenses.jpg

Are Travel Expenses Tax Deductible

https://taxsaversonline.com/wp-content/uploads/2022/07/Are-Travel-Expenses-Tax-Deductible-1-850x567.jpg

Verkko Topic No 511 Business Travel Expenses Travel expenses are the ordinary and necessary expenses of traveling away from home for your business profession or Verkko 6 jouluk 2022 nbsp 0183 32 Travel expenses are tax deductible costs associated with traveling for business away from your main workplace Travel expenses eligible for tax deduction

Verkko 7 lokak 2021 nbsp 0183 32 Airline tickets are 100 percent tax deductible unless you are traveling internationally and spend less than 25 percent of your time on business Remember Verkko 30 marrask 2023 nbsp 0183 32 Business related travel expenses are deductible The IRS provides details on business travel tax deductions in IRS publication 463 and the good news is

Tax Deductible Travel Expenses Accounting Freedom

https://www.accountingfreedom.com/wp-content/uploads/2018/07/Meals-Expenses-Tax-Deductions.jpg

Traveling Soon Get Updated With The New Small Business Travel Expense

https://sjwickcpa.com/wp-content/uploads/2021/12/tax-deductible-small-business-travel-expenses-fort-collins.jpg

https://www.irs.gov/publications/p463

Verkko If the round trip plane fare and other travel related expenses such as food during the trip are 1 750 you can deduct travel costs of

https://www.vero.fi/en/businesses-and-corporations/taxes-and-charges/...

Verkko 29 marrask 2023 nbsp 0183 32 You cannot deduct the following expenses as business expenses fines penalty fees and other penalty like charges wages you have paid to your

5 Gastos De Viaje Deducibles 5 Deductible Travel Expenses Conjunto De

Tax Deductible Travel Expenses Accounting Freedom

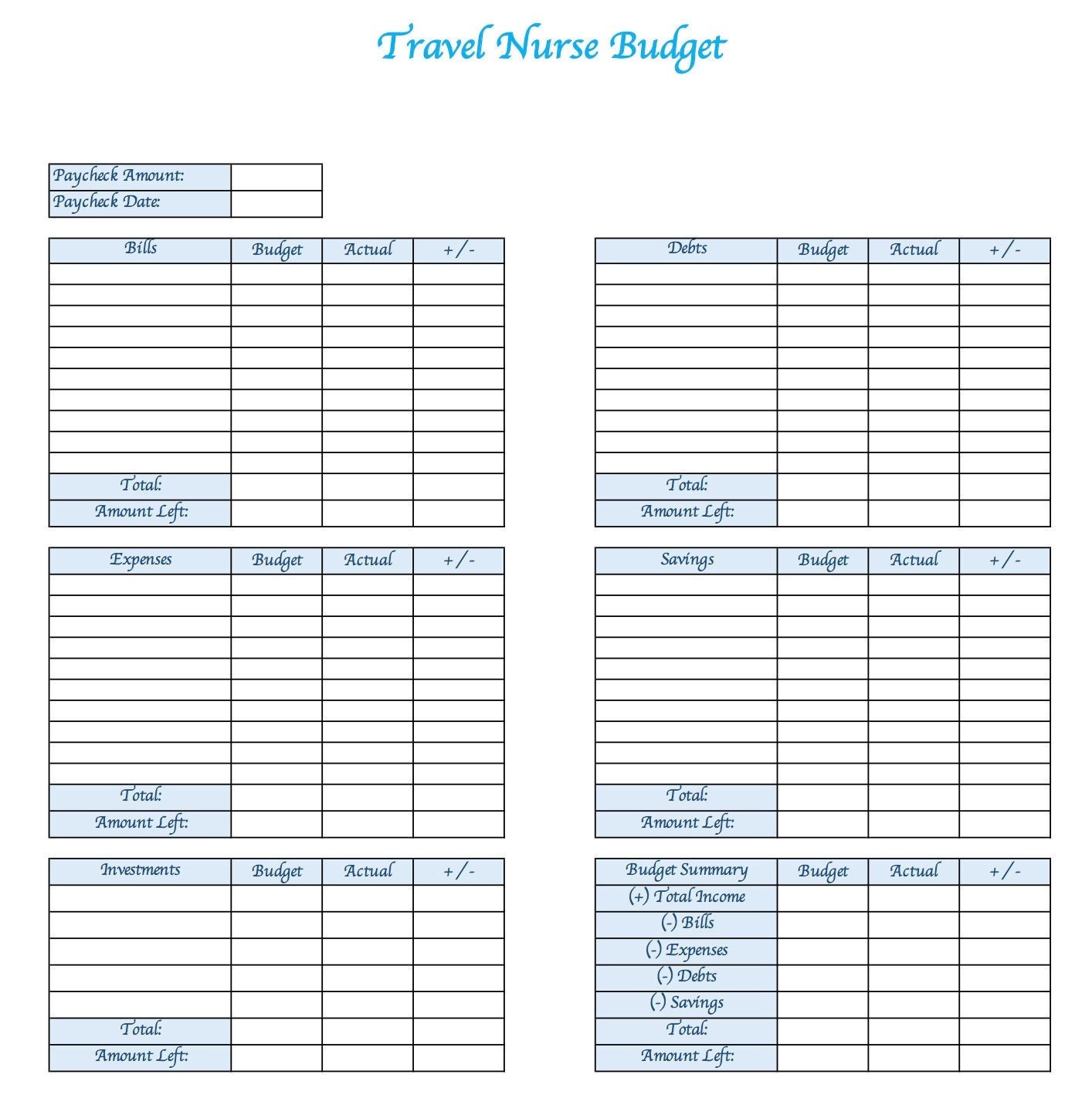

Travel Nurse Budget Template Printable PDF Instant Download Planner

Which Business Travel Expenses Are Tax Deductible Blogger s Beat

Lower Your Taxes 10 Deductible Expenses In The Philippines

Travel Expense Tax Deduction Guide How To Maximize Write offs QuickBooks

Travel Expense Tax Deduction Guide How To Maximize Write offs QuickBooks

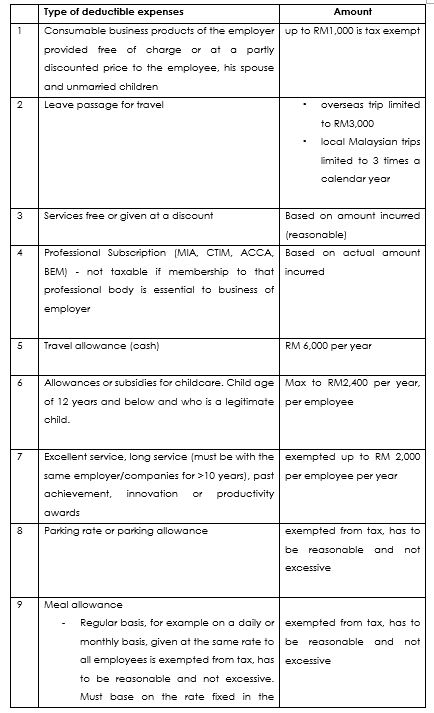

Car Allowance Taxable In Malaysia JorgefvSullivan

Travel Expense Tax Deduction Guide How To Maximize Write offs QuickBooks

Outside the Box Travel Expenses What s Deductible Small Business

Tax Deductible Travel Expenses - Verkko 7 jouluk 2023 nbsp 0183 32 Travel expenses are tax deductible only if they were incurred to conduct business related activities Only ordinary and necessary travel expenses are