Tax Deduction Calculator Uk The Salary Calculator tells you monthly take home or annual earnings considering UK Tax National Insurance and Student Loan The latest budget information from April 2024 is used to show you exactly what you need to know

Calculate your take home pay given income tax rates national insurance tax free personal allowances pensions contributions and more Use our calculator to find out your take home pay considering income tax national insurance student loan repayments pension contributions and more

Tax Deduction Calculator Uk

Tax Deduction Calculator Uk

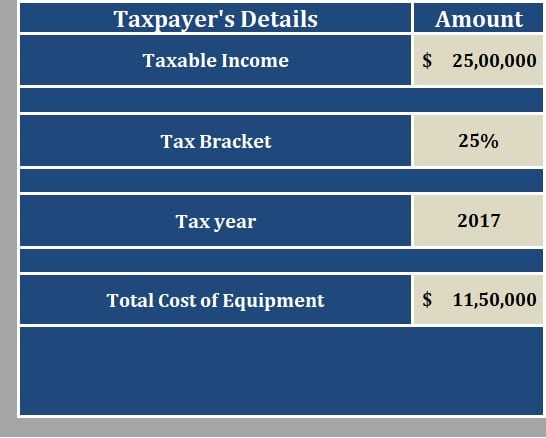

https://d25skit2l41vkl.cloudfront.net/wp-content/uploads/2018/01/Taxpayers-Details.jpg

How To Calculate Taxes With Standard Deduction Dollar Keg

https://dollarkeg.com/wp-content/uploads/2023/01/how-to-calculate-taxes-with-standard-deduction.png

What Will My Tax Deduction Savings Look Like The Motley Fool

https://g.foolcdn.com/editorial/images/436120/tax-deduction_gettyimages-515708887.jpg

The Salary Calculator tells you monthly take home or annual earnings considering UK Tax National Insurance and Student Loan The latest budget information from April 2024 is used to Our online income tax calculator will help you work out your take home net pay based on your salary and tax code Find out how much money you will actually receive based on your weekly monthly or annual wages

UK Payslip Calculator Check your current last payslip or estimate your next payday Includes Student Loan Pension Salary Sacrifice NIC Letters Directors and more Calculate your net salary and find out exactly how much tax and national insurance you should pay to HMRC based on your income Student loan pension contributions bonuses company

Download Tax Deduction Calculator Uk

More picture related to Tax Deduction Calculator Uk

Tax Deductions Can You Itemize Or Take The Standard Curo Wealth

http://static1.squarespace.com/static/55805acde4b025ad9027ad58/5b383077352f5378b7aae65c/5e47e2598639f00805dc8f07/1616532225935/calculator-taxes-deduction-GI.jpg?format=1500w

Example Tax Deduction System For A Single Gluten free GF Item And

https://www.researchgate.net/profile/Julio-Bai/publication/274087526/figure/tbl1/AS:391861509345282@1470438472540/Example-tax-deduction-system-for-a-single-gluten-free-GF-item-and-calculations-for-tax.png

Premium AI Image Tax Deduction Planning Concept Businessman Calculating

https://img.freepik.com/premium-photo/tax-deduction-planning-concept-businessman-calculating_993599-4654.jpg?w=2000

This is the most advanced income tax calculator providing a visual breakdown of how your salary is broken up for tax and other deduction purposes The Tax Calculator uses tax information from the tax year 2023 2024 to show you take home pay See where that hard earned money goes with UK income tax National Insurance student loan and pension deductions

The Reed co uk Tax Calculator estimates PAYE and NI tax deductions from your pay each week month and year Enter your salary below to check tax deductions and calculate your This handy calculator will show you how much income tax and National Insurance you ll pay in the 2024 25 2023 24 2022 23 and 2021 22 tax years as well as how much of your salary

Medical Expense Deduction AGI Threshold To Be 10 In 2019 Deductions TAX

https://i1.wp.com/deductions.tax/wp-content/uploads/2017/07/tax-deduction-hand-written.jpg?fit=864%2C555&ssl=1

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-11.jpg

https://www.thesalarycalculator.co.uk/s…

The Salary Calculator tells you monthly take home or annual earnings considering UK Tax National Insurance and Student Loan The latest budget information from April 2024 is used to show you exactly what you need to know

https://www.moneysavingexpert.com/ta…

Calculate your take home pay given income tax rates national insurance tax free personal allowances pensions contributions and more

Special Tax Deduction On Renovation Extension Jan 20 2022 Johor

Medical Expense Deduction AGI Threshold To Be 10 In 2019 Deductions TAX

CIS Tax Deduction Calculator Patterson Hall Chartered Accountants

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

Deduction Form Self Employed Tax Employment Form

Maximising Tax Benefits Your Guide To Claiming A Rental Property

Maximising Tax Benefits Your Guide To Claiming A Rental Property

Free Excel Payroll Template Easy To Use Ready In Minutes

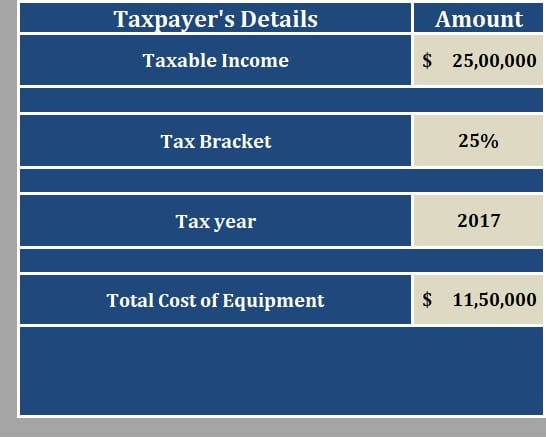

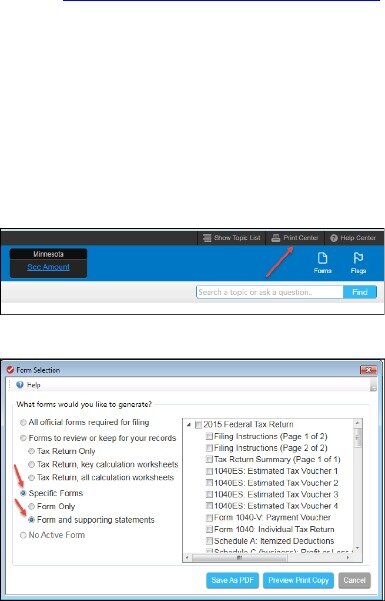

Download Itemized Deductions Calculator Excel Template ExcelDataPro

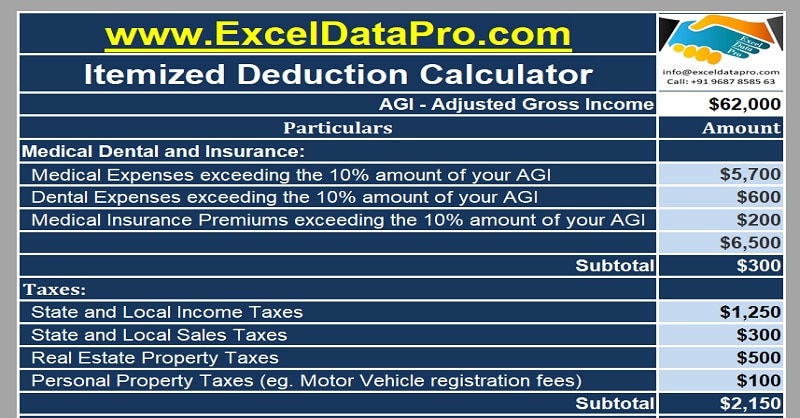

Itemized Tax Deduction Calculator Turbo Tax

Tax Deduction Calculator Uk - The Salary Calculator tells you monthly take home or annual earnings considering UK Tax National Insurance and Student Loan The latest budget information from April 2024 is used to