Tax Deduction For American Expats U S citizens living abroad often referred to as expatriates or expats are generally required to file U S income tax returns just like individuals living in the United States However the tax obligations for

American Expat Tax What U S Citizens Living Abroad Should Know At a glance U S citizens living abroad still may have a U S tax obligation to the Internal Revenue Service IRS Learn the basics As an American expat you will need to file a 2023 US tax return in 2024 if your income exceeds the following thresholds Single filers 13 850 Married Filing Jointly filers 27 700 Married Filing Separately filers 5

Tax Deduction For American Expats

Tax Deduction For American Expats

https://i.pinimg.com/originals/b9/4f/08/b94f08851ce71939ba13414fa7a2854b.png

20 Things To Know About US Expat Taxes In 2024 MyExpatTaxes

https://www.myexpattaxes.com/wp-content/uploads/facebookAds_210225_1080x1080_01-1024x1024.png

Taxes For Expats Tax Advice For American Expats Eternal Expat

https://www.eternal-expat.com/wp-content/uploads/2017/12/Taxes-for-Expats.png

However you may qualify to exclude your foreign earnings from income up to an amount that is adjusted annually for inflation 107 600 for 2020 108 700 for 2021 112 000 Many Americans living abroad qualify for special tax benefits such as the foreign earned income exclusion and foreign tax credit but they can only get them by filing a U S

Guide for expatriates US citizens and resident aliens living abroad must file a US tax return and with several important exceptions must use the same forms and must compute tax by referring to the same tax rules as their US expats are eligible for many of the same expatriate tax breaks as Americans who reside within the country This includes a variety of tax credits exclusions and deductions such as the Child Tax Credit

Download Tax Deduction For American Expats

More picture related to Tax Deduction For American Expats

Standard Tax Deduction For 2020 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/the-standard-tax-deduction-how-it-works-and-how-to-use-it-1.png

What Is The Best US Tax Deduction For American Expats

https://brighttax.com/wp-content/uploads/2023/02/bright-tax-web-taxation-resources-2023-tax-deadlines-for-expats-hero-1024x538.jpg

What Is A Tax Deduction Definition Examples Calculation

https://i0.wp.com/biznessprofessionals.com/wp-content/uploads/2020/04/Capture349.jpg?w=2048&ssl=1

Tax credits and deductions such as the Foreign Earned Income Credit and the Foreign Tax Credit can help expats reduce or eliminate their US tax bills More on that in a moment You must either We created this Guide to US Expat Taxes to explain taxation for US citizens abroad We discuss the key tax benefits for expats how to qualify and claim them The

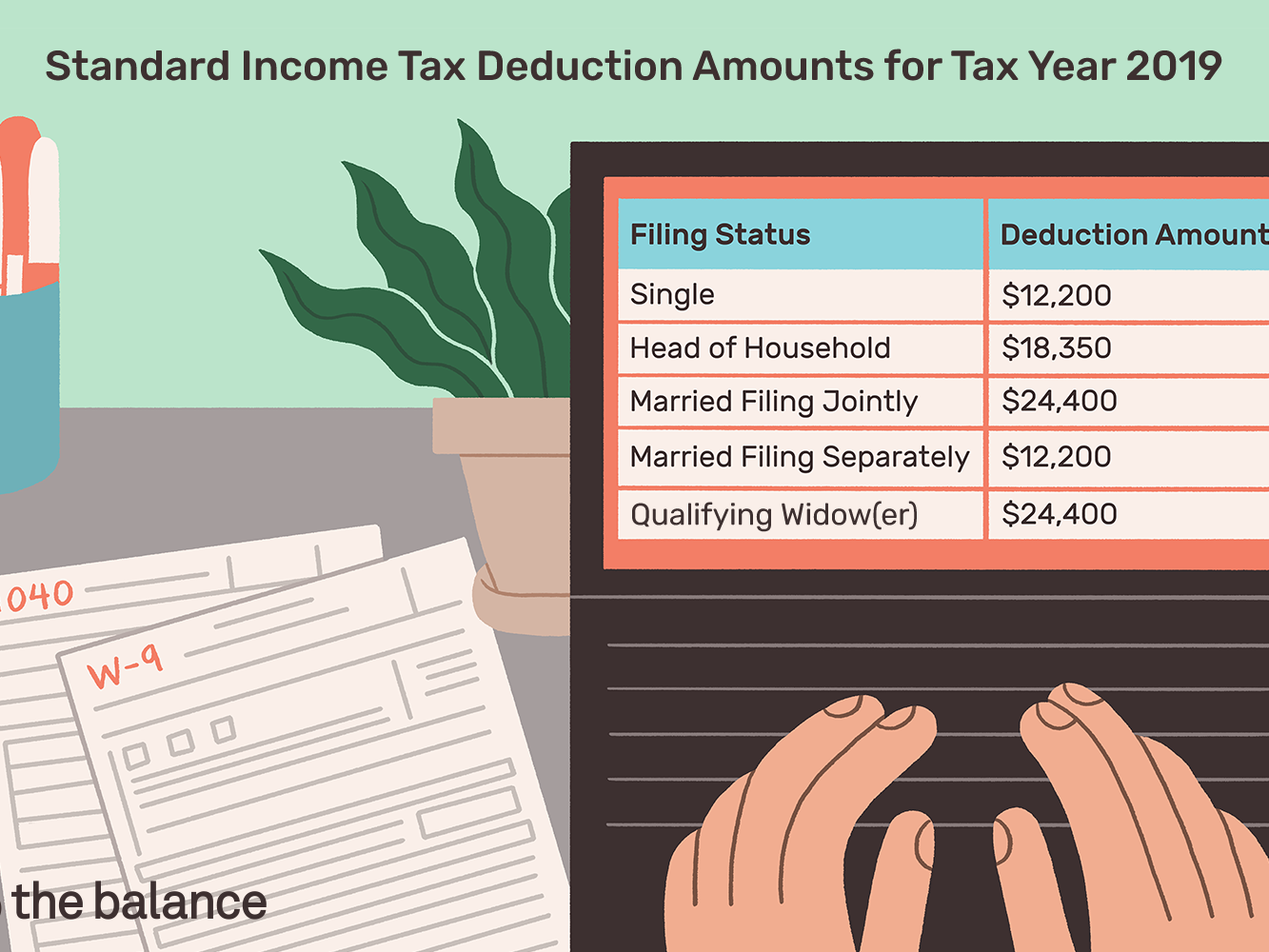

For tax year 2022 so for filing in 2023 tax season the Standard Deduction will increase to 12 950 for single Americans and those married filing separately 25 900 for If you are a U S citizen or resident living or traveling outside the United States you generally are required to file income tax returns estate tax returns and gift tax returns

Tax Returns Exclusions Credits And Deductions For U S Expats

https://1040abroad.com/wp-content/uploads/2018/06/Exclusions-and-deductions-for-US-expats-768x1920.png

US TAX DEDUCTIONS FOR EXPATS Expat Tax Professionals

https://expattaxprofessionals.com/File/cshz5buhizt

https://tax.thomsonreuters.com/blog/guide-t…

U S citizens living abroad often referred to as expatriates or expats are generally required to file U S income tax returns just like individuals living in the United States However the tax obligations for

https://www.hrblock.com/expat-tax-prepar…

American Expat Tax What U S Citizens Living Abroad Should Know At a glance U S citizens living abroad still may have a U S tax obligation to the Internal Revenue Service IRS Learn the basics

Business Tax Credit Vs Tax Deduction What s The Difference

Tax Returns Exclusions Credits And Deductions For U S Expats

1116 Form Instructions For American Expats Foreign Tax Credit

Income Tax Filing Guide For American Expats Abroad Foreigners In

Foreign Tax Credit Form 1116 And How To File It example For US Expats

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

THE VIEW FROM FEZ A Timely Reminder For American Expats

Income Tax Deductions For The FY 2019 20 ComparePolicy

How Do Tax Deductions Work

Tax Deduction For American Expats - To help you understand your rights we ve compiled a list of some of the most common expat tax deductions 1 Standard or Itemized Deduction Just like any US