Tax Deduction For Health Insurance Premiums For Self Employed The self employment health insurance deduction enables qualifying self employed individuals to deduct the total amount that they ve spent on health care premiums during a tax year from their net

Many self employed taxpayers can deduct health insurance premiums on their taxes including long term care coverage Here s how it works If you re a self employed person you may deduct up to 100 of the health insurance premiums you paid during the year To take the deduction

Tax Deduction For Health Insurance Premiums For Self Employed

Tax Deduction For Health Insurance Premiums For Self Employed

https://brucelandersoncpa.com/wp-content/uploads/2019/03/tax-deductions-for-self-employed.jpg

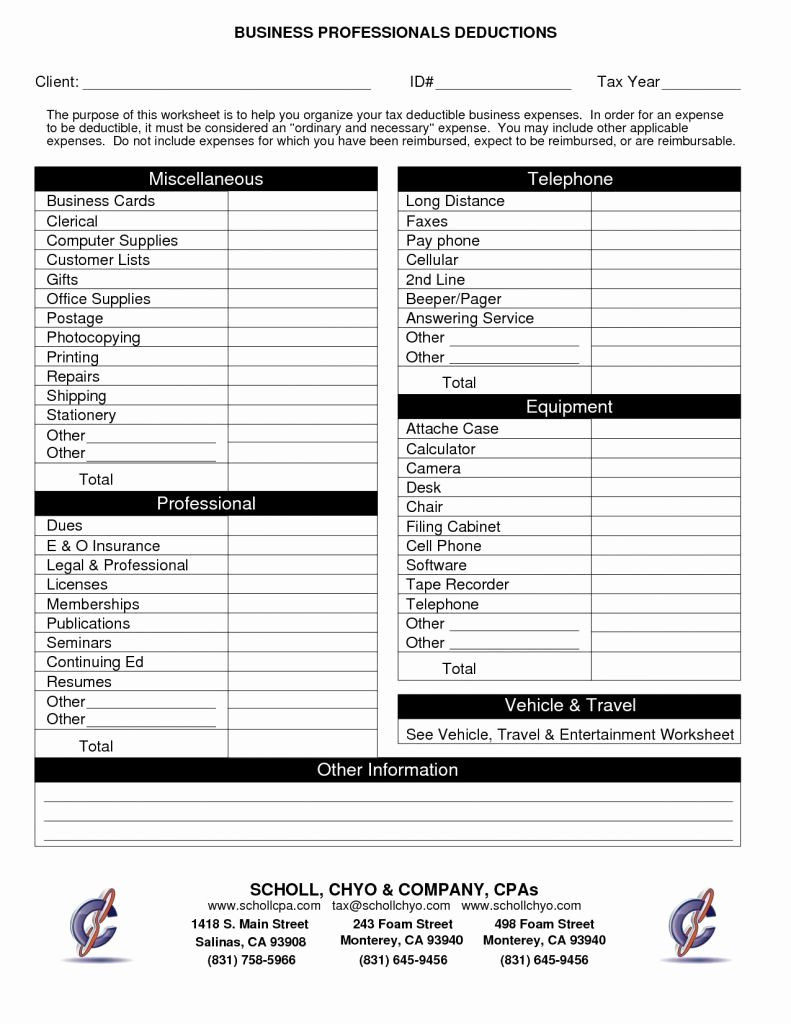

FunctionalBest Of Self Employed Tax Deductions Worksheet

https://i.pinimg.com/474x/e6/3e/e8/e63ee8d396dea4070503cc153faf2de5.jpg

Qualified Business Income Deduction And The Self Employed The CPA Journal

https://www.nysscpa.org/cpaj-images/CPA.2022.92.5.006.t001.jpg

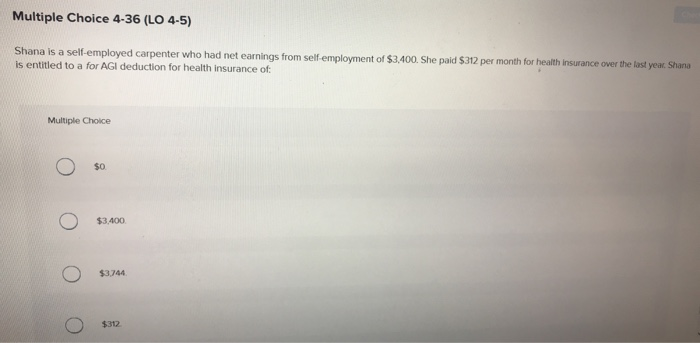

Self employed health insurance premiums are deductible as an above the line deduction on Form 1040 which means you can deduct the premium even if you Instead figure you self employed health insurance deduction using the Self Employed Health Insurance Deduction Worksheet in the Form 1040 or Form 1040NR

Health insurance costs of self employed individuals If you re self employed and have a net profit for the year you may be eligible for the self employed Use Form 7206 to determine any amount of the self employed health insurance deduction you may be able to report on Schedule 1 Form 1040 line 17 You

Download Tax Deduction For Health Insurance Premiums For Self Employed

More picture related to Tax Deduction For Health Insurance Premiums For Self Employed

Is Health Insurance Deductible For Self employed

https://healthcrust.com/wp-content/uploads/2022/03/is-health-insurance-deduction-for-self-employed.jpg

Tax Subsidies For Private Health Insurance III Special Tax Deduction

https://www.kff.org/wp-content/uploads/2014/10/7779-02-figure-7.png?resize=735

Deduction For Health Insurance U s 80D Of Income Tax 91 7838904326

https://www.mohindrainvestments.com/wp-content/uploads/2022/06/Deduction-for-Health-Insurance-us-80D-of-Income-Tax-.png

The deduction which you ll find on Line 17 of Schedule 1 attached to your Form 1040 allows self employed people to reduce their adjusted gross income by the amount they pay in health insurance There are some tax breaks available to help make health care insurance more affordable if you qualify based on your household income You may qualify for a

If you are self employed and have a workforce you can deduct dental and medical insurance premiums including qualified LTC insurance and HSA You may be eligible to deduct health insurance premiums on your taxes if you pay for your own insurance and meet certain requirements The self employed

Tax Deduction Template

https://db-excel.com/wp-content/uploads/2019/09/self-employment-health-insurance-deduction-health-insurance-750x970.png

Solved Multiple Choice 4 36 LO 4 5 Shana Is A Chegg

https://media.cheggcdn.com/study/ca6/ca6b23da-490c-4ca7-b6da-59c47d80a118/image.png

https://www.thebalancemoney.com/wha…

The self employment health insurance deduction enables qualifying self employed individuals to deduct the total amount that they ve spent on health care premiums during a tax year from their net

https://smartasset.com/insurance/how-t…

Many self employed taxpayers can deduct health insurance premiums on their taxes including long term care coverage Here s how it works

Self Employed Health Insurance Deduction Guide 3 Tips To Max It Out

Tax Deduction Template

Mattina Kent Gibbons ClientLine Newsletter December 2019 Health

17 Self employed Tax Deductions To Lower Your Tax Bill In 2023 QuickBooks

When Can You Claim A Tax Deduction For Health Insurance Yulianna FTP

Can I Deduct Short Term Health Insurance From My Taxes If I m Self

Can I Deduct Short Term Health Insurance From My Taxes If I m Self

Self Employed Health Insurance Deduction Worksheet Db excel

Breaking Down The Self Employed Health Insurance Deduction Eric Nisall

When Can You Claim A Tax Deduction For Health Insurance The TurboTax

Tax Deduction For Health Insurance Premiums For Self Employed - Yes you can deduct your health insurance costs if you re self employed This includes medical dental and long term insurance for yourself your dependents and