Tax Deduction For Hvac System You can receive up to 3 200 in federal tax credits for installing qualifying HVAC equipment into an existing home split between ACs furnaces or boilers 1 200 and air source heat pumps and biomass stoves 2 000

To be eligible the HVAC costs must be for nonresidential real property that is placed in service after the date the property was first placed in service This guide provides tax How To Qualify For and Claim HVAC Tax Rebates You can claim your residential energy tax incentive when you file your federal income taxes For federal tax returns filed

Tax Deduction For Hvac System

Tax Deduction For Hvac System

https://i.pinimg.com/originals/0c/7e/93/0c7e93ab0824aa28a0695019ce35d13b.jpg

Does My HVAC System Qualify For A Tax Deduction YouTube

https://i.ytimg.com/vi/fV-iUK3SI7w/maxresdefault.jpg

Printable Itemized Deductions Worksheet

https://i2.wp.com/www.worksheeto.com/postpic/2011/02/federal-income-tax-deduction-worksheet_472256.jpg?crop=12

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the

The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights Save Up to 2 000 on Costs of Upgrading to Heat Pump Technology These energy efficient home improvement credits are available for 30 of costs up to 2 000 and can be combined with credits up to 1 200 for other qualified

Download Tax Deduction For Hvac System

More picture related to Tax Deduction For Hvac System

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

https://i.etsystatic.com/34842725/r/il/d7a013/4058712943/il_fullxfull.4058712943_8i57.jpg

How To Deduct HVAC Equipment Purchases For Your Business With Section

https://gopaschal.com/wp-content/uploads/2021/10/Section_179-September-2022-03.jpg

Section 80C Deduction Income Tax Act

https://img.indiafilings.com/learn/wp-content/uploads/2017/05/12010349/Section-80C-Deduction-768x768.jpg

For qualified HVAC improvements homeowners might be able to claim 25c tax credits equal to 10 of the install costs up to a maximum of 500 If you re unsure of how to get the tax credit you might be eligible for don t worry We ve Which Tax Credits Are Potentially Available for HVAC Systems The rebates would apply for heating and cooling systems installed between Jan 1 2023 and Dec 31 2032 The following HVAC tax credits could be available if your state

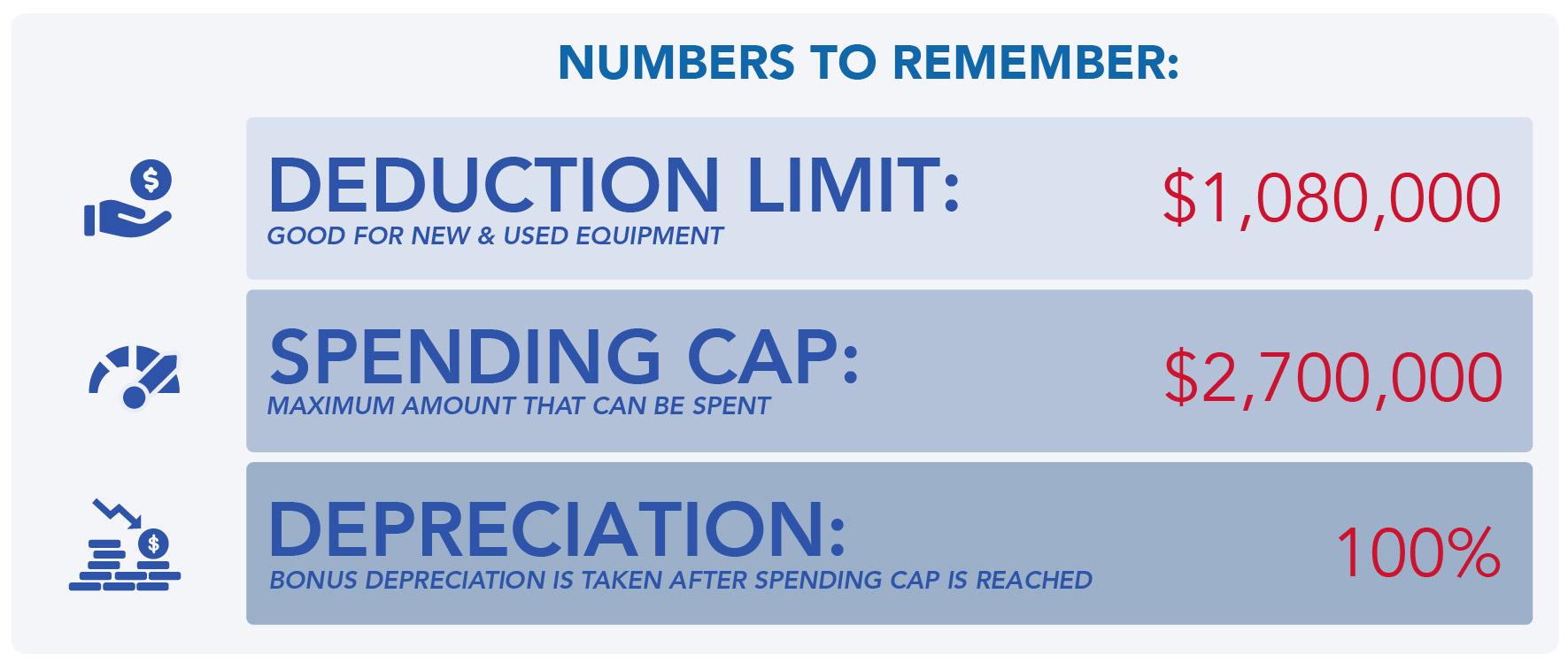

The 179D commercial buildings energy efficiency tax deduction primarily enables building owners to claim a tax deduction for installing qualifying systems in buildings Tenants may be The 25c tax credit allows taxpayers to claim certain home energy upgrades like heat pumps to reduce their tax burden In 2023 the maximum federal tax credit for installing a heat pump

10 2014 Itemized Deductions Worksheet Worksheeto

https://www.worksheeto.com/postpic/2009/12/tax-deduction-worksheet_449398.png

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

https://carajput.com/blog/wp-content/uploads/2023/05/Deduction.jpg

https://airconditionerlab.com › what-hv…

You can receive up to 3 200 in federal tax credits for installing qualifying HVAC equipment into an existing home split between ACs furnaces or boilers 1 200 and air source heat pumps and biomass stoves 2 000

https://www.thetaxadviser.com › newsletters › apr › ...

To be eligible the HVAC costs must be for nonresidential real property that is placed in service after the date the property was first placed in service This guide provides tax

How Do I Get A Tax Deduction For My Car Repayments Costs One Car Group

10 2014 Itemized Deductions Worksheet Worksheeto

Sec 179 Deduction A Boon For HVAC Industry In 2018 Contracting Business

Printable Small Business Tax Deductions Worksheet

Super Deduction Tax Relief M E Building Compliance

Owner Operator Tax Deductions Worksheet

Owner Operator Tax Deductions Worksheet

Printable Itemized Deductions Worksheet

Can I Really Deduct That 4 Often Missed Tax Deductions

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

Tax Deduction For Hvac System - If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by