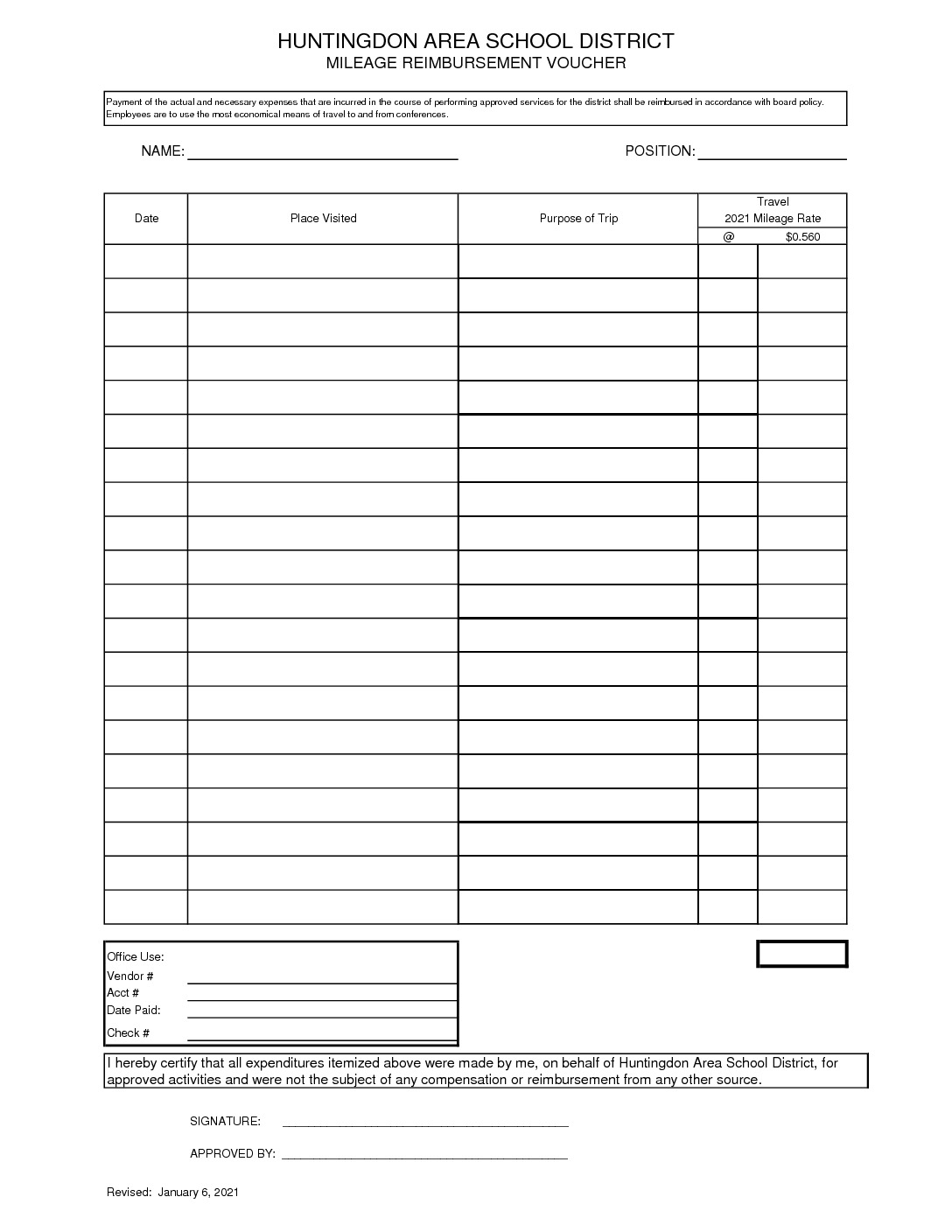

Tax Deduction For Mileage To Medical Appointments You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat impairment related

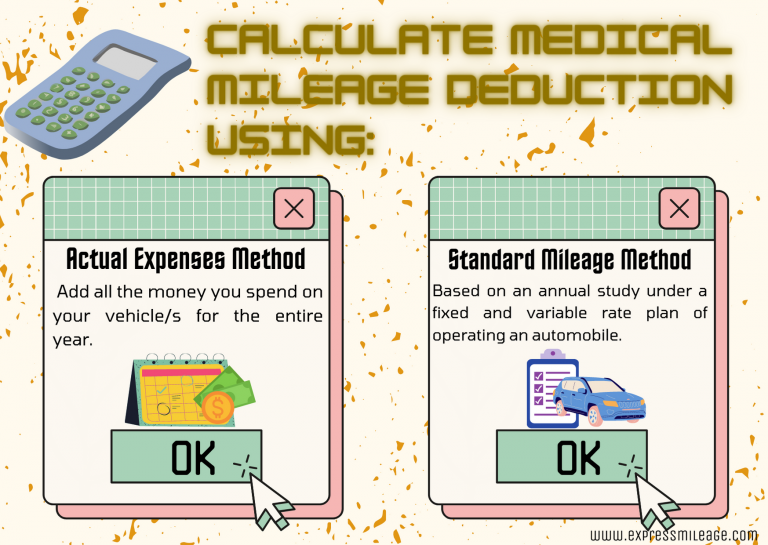

Still a mileage deduction exists for the following situations Business mileage for the self employed Mileage related to medical If you use the standard medical mileage rate you don t deduct your actual costs for gas and oil Instead you may deduct 18 cents per mile you drive for medical treatment in

Tax Deduction For Mileage To Medical Appointments

Tax Deduction For Mileage To Medical Appointments

https://expressmileage.com/pages/wp-content/uploads/2021/06/3-1-768x545.png

Everything You Need To Know About Deducting Mileage On Your Taxes

https://i.pinimg.com/originals/dd/5f/09/dd5f093e8677daf89bd08595b027e2d4.jpg

Medical Mileage Deduction On You Taxes ExpressMileage

https://expressmileage.com/pages/wp-content/uploads/2021/06/2-1-940x667.png

Yes you can deduct costs associated with using your car or public transportation for medical visits and even to pick up prescriptions For car expenses you can use either the standard If you use the standard mileage rate for a year you can t deduct your actual car expenses for that year You can t deduct depreciation lease payments maintenance and repairs gasoline

Medical mileage deduction is a form of financial relief for taxpayers who travel for various medical purposes Mileage based tax deductions can be claimed for various types of doctor As of on Jan 1 2024 the standard IRS mileage rates for cars also vans pickups or panel trucks are as follows 67 cents per mile driven for business use 21 cents per mile driven for medical purposes 14 cents per mile driven in

Download Tax Deduction For Mileage To Medical Appointments

More picture related to Tax Deduction For Mileage To Medical Appointments

How To Claim Mileage From The IRS Step By Step Updated For 2024

https://storage.googleapis.com/driversnote-marketing-pages/US-infographic-how-to-deduct-mileage-landscape.png

Business Mileage Deduction 101 How To Calculate For Taxes

https://www.patriotsoftware.com/wp-content/uploads/2019/04/mileage_reimbursement-03.png

How To Claim Your Medical Care Expense Deduction ExpressMileage

https://expressmileage.com/pages/wp-content/uploads/2021/08/1-940x667.png

17 rowsThe standard mileage rates for 2023 are Self employed and business 65 5 cents mile Charities 14 cents mile Medical 22 cents mile Moving military only 22 cents mile Find What Is the Tax Deduction for Medical Mileage and When Volunteering For 2023 the tax deduction for medical mileage is 22 cents per mile The same rate applies to

The IRS medical mileage rate for 2024 is 21 cents per mile This helps you deduct travel costs for medical appointments on your tax return Learn more Using the 2023 IRS medical mileage rate of 23 cents per mile David can deduct 1 380 6 000 miles x 0 23 from his taxable income In this example David can deduct over

13 Proven Mileage Tax Deduction Tips The Handy Tax Guy

https://www.handytaxguy.com/wp-content/uploads/2015/07/how-to-keep-track-of-tax-mileage-deduction.png

Medical Mileage Deduction What s 2024 s Medical Mileage Rate

https://triplogmileage.com/wp-content/uploads/2020/09/medical-mileage-reimbursement-qualify-irs-triplog.jpg

https://www.irs.gov/publications/p502

You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat impairment related

https://money.usnews.com/money/pers…

Still a mileage deduction exists for the following situations Business mileage for the self employed Mileage related to medical

Medical Mileage Deduction What s 2024 s Medical Mileage Rate

13 Proven Mileage Tax Deduction Tips The Handy Tax Guy

Deductions Worksheet Fill Out Sign Online DocHub

Mileage Reimbursement 2021 For Medical IRS Mileage Rate 2021

You ll Never Forget To Use This Simple Mileage Log Mileage Deduction

Mileage Log For Taxes Requirements And Process Explained MileIQ

Mileage Log For Taxes Requirements And Process Explained MileIQ

Agent How To Calculate Local Business Mileage For Taxes

How Much Is The Medical Mileage Deduction MileIQ

IRS Announces Standard Mileage Deductions For 2023 Tax Season

Tax Deduction For Mileage To Medical Appointments - As of on Jan 1 2024 the standard IRS mileage rates for cars also vans pickups or panel trucks are as follows 67 cents per mile driven for business use 21 cents per mile driven for medical purposes 14 cents per mile driven in