Tax Deduction For Senior Citizens In India Net taxable salary will be Rs 2235900 on which tax payable will be Rs 5lakh Find out the income tax slab rates for senior citizens for the financial year 2024 25

The super senior citizens and senior citizens can now avail of a deduction of INR 25 000 for an income of up to 7 lakhs However if the income exceeds 7 lakhs the Senior citizens and super senior citizens have been provided higher tax exemption limits and specific benefits by the income tax law in order to provide some

Tax Deduction For Senior Citizens In India

Tax Deduction For Senior Citizens In India

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA184NpJ.img

Income Tax Deduction For Senior Citizens By Medical Related Investments

https://i.ytimg.com/vi/vHLVQC7uH2E/maxresdefault.jpg

Potentially Bigger Tax Breaks In 2023

https://static.fmgsuite.com/media/InlineContent/originalSize/984f6148-60aa-49b7-971c-fb3554606b40.jpg

Age total income claimed deductions exemption limits and tax regime old vs new are some of the factors that determine an elderly citizen s income tax Tax Rebate Benefits for Senior Citizens Senior citizens can avail a tax rebate under Section 87A Under the Old Tax Regime Available for total income up to

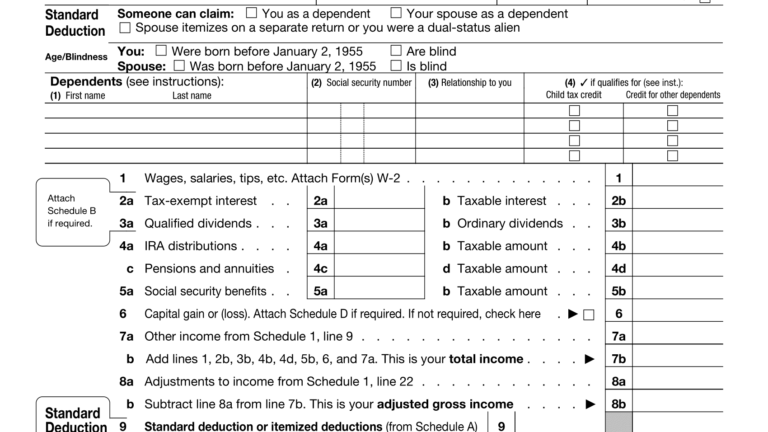

Understanding the income tax slab rates and available deductions can significantly affect tax planning and overall financial health This guide details the income What are the deductions for senior citizens in AY 2024 25 The deduction amount for senior citizen is Rs 1 lakh and Rs 40 000 for Non Senior Citizen taxpayers How much is the

Download Tax Deduction For Senior Citizens In India

More picture related to Tax Deduction For Senior Citizens In India

Tax Prep Checklist Tracker Printable Tax Prep 2022 Tax Etsy Canada

https://i.etsystatic.com/31990504/r/il/22f689/3639280950/il_fullxfull.3639280950_fitj.jpg

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

https://i.etsystatic.com/34842725/r/il/d7a013/4058712943/il_fullxfull.4058712943_8i57.jpg

Standard Deduction For Senior Citizens 2020 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/form-1040-sr-seniors-get-a-new-simplified-tax-form-for-2019-3-768x432.png

Senior citizens can use the following Income Tax Calculator for calculating their tax liability under both old and new regimes for FY 2022 23 and Fy 2023 24 New 1 Higher Tax Exemption Limit Senior citizens aged 60 80 enjoy a higher exemption limit of Rs 3 lakh compared to Rs 2 5 lakh for those below 60 The exemption

Income Tax Benefits for Senior Citizens The Income Tax Act offers several deductions and benefits on income tax for senior citizens which includes the following Higher The revised new income tax slabs proposed in Budget 2023 will require senior citizens aged 60 years and above and super senior citizens aged 80 years

Income Tax Deduction For Senior Citizens Turning 60 Claim Rs 50 000

https://cdn.zeebiz.com/sites/default/files/2023/03/01/229614-income-tax-deduction.jpg

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

https://carajput.com/blog/wp-content/uploads/2023/05/Deduction.jpg

https://tax2win.in/guide/income-tax-for-senior-citizens

Net taxable salary will be Rs 2235900 on which tax payable will be Rs 5lakh Find out the income tax slab rates for senior citizens for the financial year 2024 25

https://tax2win.in/guide/new-income-tax-slabs-senior-super-senior-citizens

The super senior citizens and senior citizens can now avail of a deduction of INR 25 000 for an income of up to 7 lakhs However if the income exceeds 7 lakhs the

Tax Benefits For Senior Citizens In India Imperial Money

Income Tax Deduction For Senior Citizens Turning 60 Claim Rs 50 000

How Much Is The Standard Deduction For Senior Citizens In 2021 Best

Income Tax Benefits For Senior Citizens Deductions To Save Income Tax

Preventive Check Up 80d Wkcn

Tax Deduction For Senior Citizens On Interest Income Under Section

Tax Deduction For Senior Citizens On Interest Income Under Section

Tax Rates Absolute Accounting Services

Corporation Prepaid Insurance Tax Deduction Financial Report

Tax Deduction For Senior Citizens Unemployable Graduate

Tax Deduction For Senior Citizens In India - Understanding the income tax slab rates and available deductions can significantly affect tax planning and overall financial health This guide details the income