Tax Deduction For Website Development Costs If you decide to develop your website in house you have the choice of two different methods of deduction You can choose to deduct the total cost of the website in the

Appropriate tax treatment of website development costs can be supported by detailed descriptive allocations of costs both in contracts and in internal records Understanding how to effectively claim capital allowances on website development costs is crucial for businesses today With the evolving stance of HM

Tax Deduction For Website Development Costs

Tax Deduction For Website Development Costs

https://adalawcompliance.com/wp-content/uploads/2021/08/TAX-CREDIT-AND-DEDUCTIONS.png

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

https://i.etsystatic.com/34842725/r/il/d7a013/4058712943/il_fullxfull.4058712943_8i57.jpg

Until the IRS issues specific guidance on deducting vs capitalizing website development costs you can apply existing guidance for other subjects Your tax advisor will determine the appropriate Deductions Editor Christine M Turgeon CPA For tax years beginning after Dec 31 2021 taxpayers must charge specified research or experimental R E

Law Co is entitled to claim a deduction for the depreciation of a capital expense and can claim the cost of the cyber security system excluding GST amount You can also deduct your business s website related fees beyond site design and development If your business has recurring support related or hosting fees you can deduct them as dues and

Download Tax Deduction For Website Development Costs

More picture related to Tax Deduction For Website Development Costs

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-11.jpg

About That Property Tax Deduction For Vets NJMoneyHelp

https://njmoneyhelp.com/wp-content/uploads/2017/08/kconnors-1024x685.jpg

Here s How Much A Professional Business Website Development Costs

https://www.converticacommerce.com/wp-content/uploads/2018/04/xwebsite-development-cost.jpg.pagespeed.ic.N0mwDT6iwz.jpg

HMRC provides clear guidelines on how businesses can deduct website development costs for tax purposes Limited companies as well as unincorporated businesses must Subject to a 200 000 1 million for expenditure between 1 January 2019 and 31 December 2020 maximum this gives you a tax deduction for the entire expense

Without a doubt a website can help your online presence but it can also help you during tax time Here s how you can deduct web development costs Fortunately established rules that generally apply to the deductibility of business costs provide business taxpayers launching a website with some guidance as to the proper

Tax Deductions For Businesses BUCHBINDER TUNICK CO

http://www.buchbinder.com/wp-content/uploads/2016/02/deduction.jpg

How Do Tax Deductions For Donating A Car Actually Work

https://i0.wp.com/automarketwatch.com/wp-content/uploads/2021/02/How-Do-Tax-Deductions-for-Donating-A-Car-Actually-Work.png?w=1000&ssl=1

https://www.bench.co/blog/tax-tips/web-development

If you decide to develop your website in house you have the choice of two different methods of deduction You can choose to deduct the total cost of the website in the

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg?w=186)

https://www.duanemorris.com/alerts/alert3149.html

Appropriate tax treatment of website development costs can be supported by detailed descriptive allocations of costs both in contracts and in internal records

The 6 Best Tax Deductions For 2020 The Motley Fool

Tax Deductions For Businesses BUCHBINDER TUNICK CO

How To Donate Real estate And Get A Tax Deduction By I Believe World

Superannuation Tax Deduction Are You Eligible

Budgeting Wisely Navigating Web Development Costs Shakuro

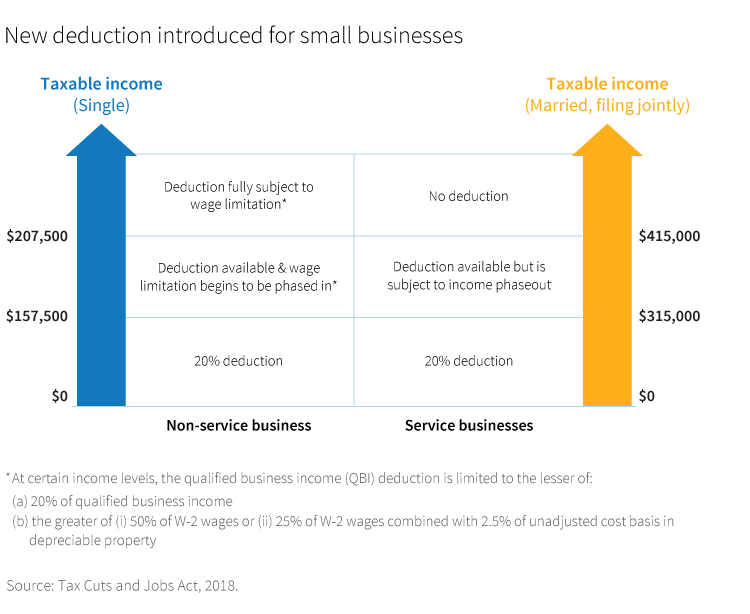

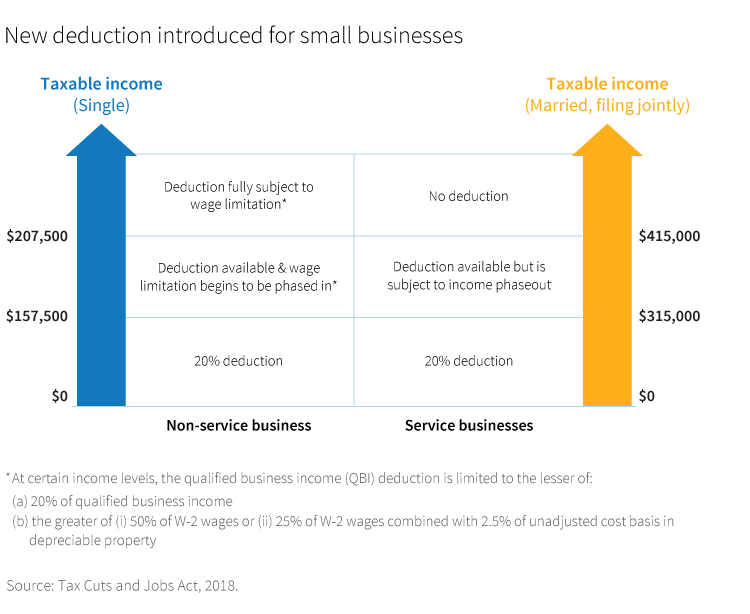

Understanding The New Small Business Tax Deduction Putnam Investments

Understanding The New Small Business Tax Deduction Putnam Investments

Health Reimbursement Arrangement Employers Are Allowed To Say A Tax

Claim Income Tax Deduction For Medical Treatment Of Specified Diseases

Can I Really Deduct That 4 Often Missed Tax Deductions

Tax Deduction For Website Development Costs - For tax years beginning in 2019 the maximum Sec 179 deduction is 1 02 million subject to a phaseout rule Under the rule the deduction is phased out if more