Tax Deduction For Work Related Self Education Expenses Web 15 Juni 2023 nbsp 0183 32 May I claim my job related education expenses as an itemized deduction or an education credit on my tax return My employer paid me additional compensation to cover my graduate school tuition and included it on my W 2 as wages The program improves skills needed in my current field of employment but doesn t qualify me for a

Web 25 Aug 2022 nbsp 0183 32 At the end of 2019 Germany s Federal Constitutional Court issued a verdict on what first degree study costs could be deducted The court decided that all costs in the context of initial education such as a Bachelor s degree or an apprenticeship without any prior qualification cannot be deducted as income related expenses Web 1 Juni 2023 nbsp 0183 32 If you re an employee of the scholarship provider normal work related self education rules apply Expenses you can claim If your self education expenses meet the eligibility criteria you can claim a deduction for the following expenses Tuition course conference or seminar fees General course expenses Decline in value of

Tax Deduction For Work Related Self Education Expenses

Tax Deduction For Work Related Self Education Expenses

https://help.myob.com/wiki/download/attachments/37403382/D4 Deductions Schedule DDCTNS.PNG?version=1&modificationDate=1563940519000&api=v2

Work Related Self Education Expenses Worksheet sed PS Help Tax

https://help.myob.com/wiki/download/attachments/37403382/D4 sed Item E and totals.PNG?version=1&modificationDate=1563939873000&api=v2

Work Related Self Education Expenses Atotaxrates info

https://atotaxrates.info/wp-content/uploads/2013/04/self-ed-spreadsheet.png

Web Self education expenses are deductible when the course you undertake leads to a formal qualification and meets the following conditions The course must have a sufficient connection to your current employment and maintain or improve the specific skills or knowledge you require in your current employment or Web 31 Mai 2022 nbsp 0183 32 Self education expenses are broken into five categories If all your self education expenses are category A items then your deduction is reduced by 250 However category E items can be used to offset the 250 myTax works this out for you when you enter and save your expenses Do not show at this section Don t show the

Web Work related education expenses for employees are no longer deductible in tax years 2018 through 2025 due to the Tax Cuts and Jobs Act TCJA that Congress signed into law on December 22 2017 Web 24 Mai 2023 nbsp 0183 32 If you received assessable income from your work as an employee outside of Australia that is shown on an income statement or a PAYG payment summary foreign employment you must claim any work related self education expenses you incurred in earning that income at this question

Download Tax Deduction For Work Related Self Education Expenses

More picture related to Tax Deduction For Work Related Self Education Expenses

Handling Deductions For Self education Expense Abacus Professional

https://www.abacuspg.com.au/site/wp-content/uploads/2020/09/Handling-deductions-for-self-education-expense-800x378.jpg

Claim Self Education Expenses In Tax Deductions

https://www.kpgtaxation.com.au/wp-content/uploads/2022/11/Claim-Self-Education-Expenses-in-Tax-Deductions.jpg

How To Claim Self Education Expenses Tax Deduction Bmgsec

https://bmgsec.com.au/wp-content/uploads/2023/01/image.png

Web Adjustments to Qualifying Work Related Education Expenses Tax free educational assistance Amounts that don t reduce qualifying work related education expenses How To Treat Reimbursements Accountable Plans Accountable plan rules not met Expenses equal reimbursement Excess expenses Allocating your reimbursements for meals Web 9 Okt 2023 nbsp 0183 32 The draft Ruling reflects the current rules following the changes in 2022 that removed the 250 non deductible threshold for self education expenses Therefore self education expenditure is deductible from the first 1 spent

Web 19 Aug 2009 nbsp 0183 32 If you are eligible to claim a deduction for your self education expenses use the following information to work out what you can and cannot claim You can claim expenses such as course fees textbooks stationery photocopying and student union fees the cost of meals if as a result of your self education you had to temporarily leave your Web This question is about self education expenses that are related to your work as an employee The ATO website is getting a refresh soon Try the updated ato gov au

Self Education Expenses You Can Claim One Click Life

https://oneclicklife.com.au/wp-content/uploads/2021/11/self-education-scaled.jpg

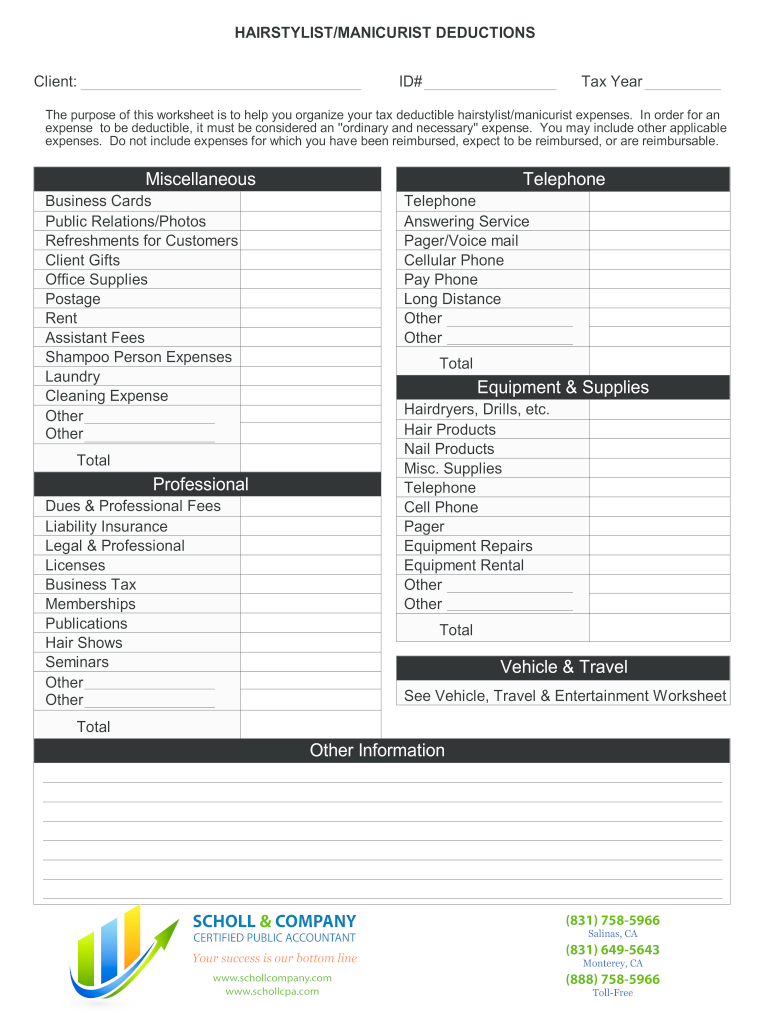

Self Employment Tax And Deduction Worksheet

https://i.pinimg.com/originals/e6/3e/e8/e63ee8d396dea4070503cc153faf2de5.jpg

https://www.irs.gov/.../education-work-related-expenses

Web 15 Juni 2023 nbsp 0183 32 May I claim my job related education expenses as an itemized deduction or an education credit on my tax return My employer paid me additional compensation to cover my graduate school tuition and included it on my W 2 as wages The program improves skills needed in my current field of employment but doesn t qualify me for a

https://taxfix.de/en/guide-german-taxes/save-money/deducting-study-costs

Web 25 Aug 2022 nbsp 0183 32 At the end of 2019 Germany s Federal Constitutional Court issued a verdict on what first degree study costs could be deducted The court decided that all costs in the context of initial education such as a Bachelor s degree or an apprenticeship without any prior qualification cannot be deducted as income related expenses

Tax Deduction For Self Education

Self Education Expenses You Can Claim One Click Life

Self Employment Tax Deduction Worksheet

Self employment Tax And Deduction Worksheet

Printable Self Employed Tax Deductions Worksheet Studying Worksheets

Self Employed Tax Deduction Worksheet

Self Employed Tax Deduction Worksheet

Part 3 Tax Deduction Series Self Education Expenses ChalkBoard

How To Claim A Handbag As A Tax Deduction Keweenaw Bay Indian Community

Printable Self Employed Tax Deductions Worksheet

Tax Deduction For Work Related Self Education Expenses - Web 29 Juni 2023 nbsp 0183 32 This calculator will check your eligibility to claim a deduction and helps you to estimate the deduction you can claim for work related self education expenses It can be used for the 2013 14 to 2022 23 income years The results of this calculator are based on the information you provide