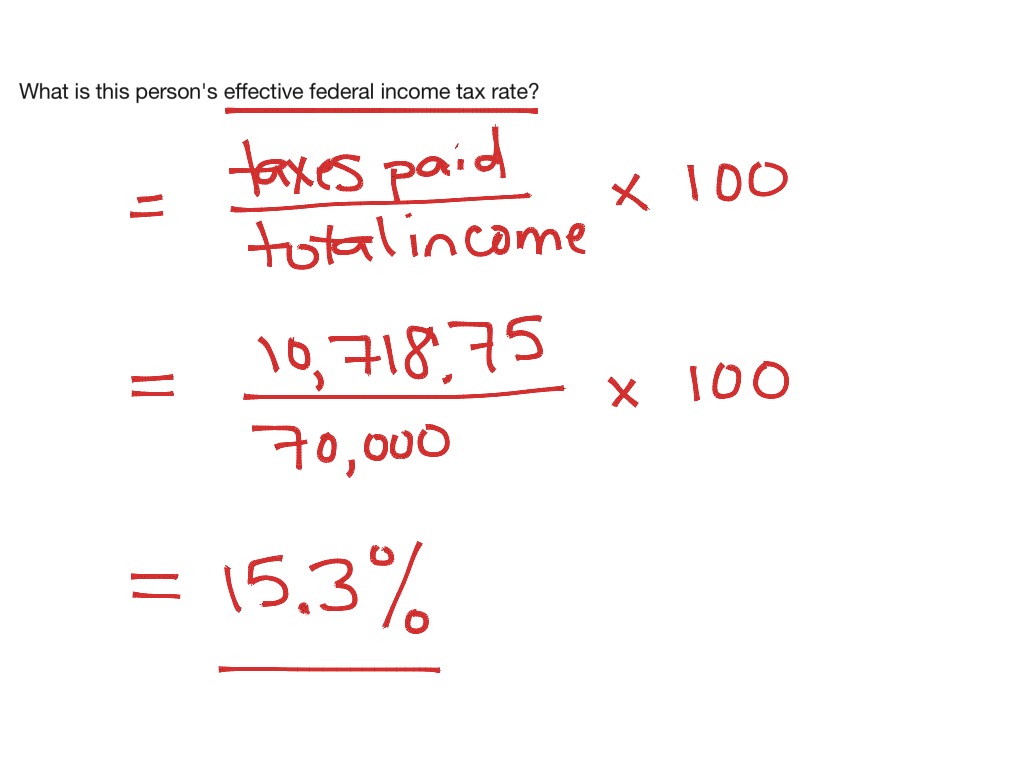

Tax Deduction Formula In Excel To calculate the total income tax owed in a progressive tax system with multiple tax brackets you can use a simple elegant approach that leverages Excel s new dynamic array engine In the worksheet shown the main challenge is to split the income in cell I4 into the correct tax brackets

This article shows step by step procedures to calculate income tax in excel using IF function Learn them download workbook and practice The simplest way to calculate income tax in Excel is using the generic formula We ll use a fixed tax rate for all the employees and calculate the income tax on their salaries Steps First we calculate taxable income from the Gross Salary and Total Deduction Select the cell in which to calculate the taxable income cell E5

Tax Deduction Formula In Excel

Tax Deduction Formula In Excel

https://www.exceldemy.com/wp-content/uploads/2022/10/How-to-Create-a-Salary-Deduction-Formula-for-Late-Coming-in-Excel-9.png

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

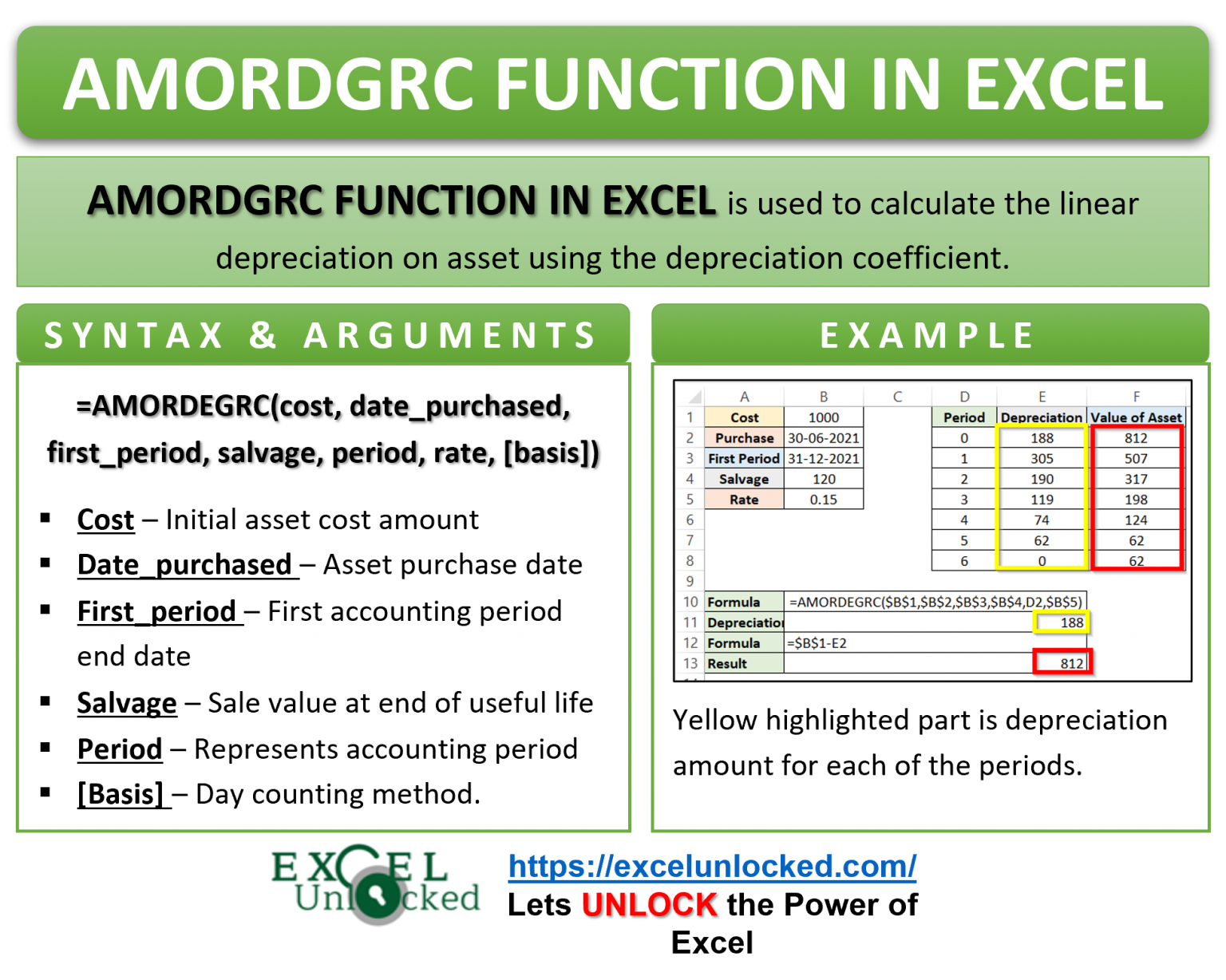

AMORDEGRC Function Of Excel Depreciation Of Asset Excel Unlocked

https://excelunlocked.com/wp-content/uploads/2021/09/Infographic-AMORDGRC-Formula-Function-in-Excel-1536x1228.png

In this post we ll examine a couple of ideas for computing income tax in Excel using tax tables Specifically we ll use VLOOKUP with a helper column we ll remove the helper column with SUMPRODUCT and then we ll use data validation and the INDIRECT function to make it easy to pick the desired tax table such as single or married Enter your deductions in the cell under Amount in for Deductions e g 10 000 in our example The Taxable Income will be automatically calculated in the Taxable Income row Our calculator uses the 2023 federal tax brackets and will automatically calculate the

Fortunately Excel offers a function that s ideally suited for this task Excel SUMPRODUCT function This function simplifies the process and makes it more accessible for accurate tax calculations In this tutorial we will explore how to use Excel to calculate tax amounts visualize tax data and add additional information such as deductions or credits Generating tax reports using the calculated tax amounts Formulas Excel allows you to create formulas to calculate tax amounts based on income expenses and other financial data

Download Tax Deduction Formula In Excel

More picture related to Tax Deduction Formula In Excel

Tax Deduction Spreadsheet Excel Spreadsheet Downloa Income Tax

https://db-excel.com/wp-content/uploads/2019/01/tax-deduction-spreadsheet-excel-inside-008-free-mileage-log-template-tax-deduction-spreadsheet-excel.jpg

Income Tax Formula Math Marginal Tax Rate Bogleheads If You Claim

https://showme0-9071.kxcdn.com/files/1000093366/pictures/thumbs/2302829/last_thumb1456332448.jpg

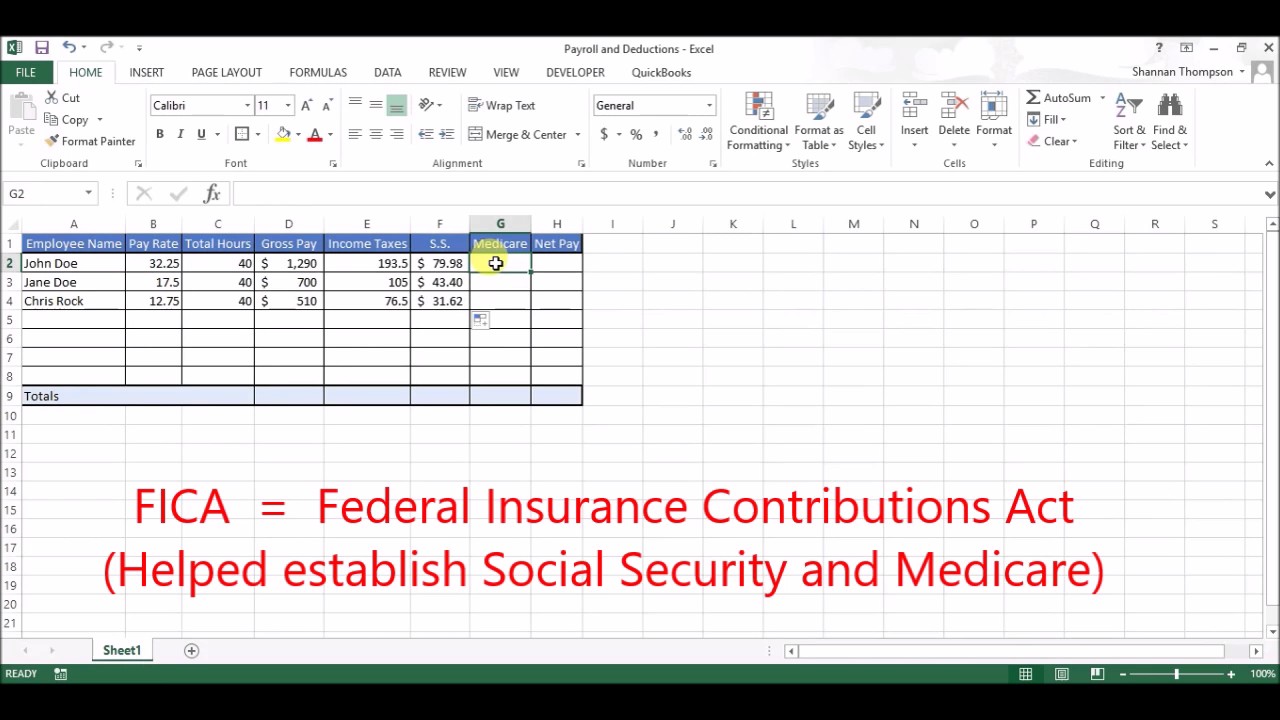

Setting Up Payroll Deductions In Excel YouTube

https://i.ytimg.com/vi/-u0dZiTM45A/maxresdefault.jpg

I m going to give you some tips and tricks on how to do taxes in Excel including a free tax tracker template you can download and start using right away Take your budget spreadsheet to a whole new level Learn how to calculate income tax in Excel using formulas Step by step guide covers tax slabs calculations and simplifying tax computation with examples

Income tax formula using VLOOKUP is not a simple formula you need to follow a bit lengthy calculation You can use VLOOKUP to calculate income tax on a certain income in Excel Syntax for VLOOKUP To understand the VLOOKUP formula you should know the syntax of the VLOOK function To help you calculate your income tax in Excel we have added a downloadable ready for use Excel template here Go ahead and download the template Here is how you can use the Template 1 Enter your income from any all income sources in cells B2 to B6 2 Add the amount for deductions and exemptions in cells B7 B8

Tax Deductions Excel Spreadsheets Budgeting Tracking Finance Spending

https://i.etsystatic.com/7329950/r/il/0a4d8c/1935516758/il_fullxfull.1935516758_mwfz.jpg

Microsoft Excel Calculating Multiple Deductions Based On More Than 1

https://i.stack.imgur.com/P39jU.png

https://exceljet.net/formulas/income-tax-bracket-calculation

To calculate the total income tax owed in a progressive tax system with multiple tax brackets you can use a simple elegant approach that leverages Excel s new dynamic array engine In the worksheet shown the main challenge is to split the income in cell I4 into the correct tax brackets

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg?w=186)

https://www.exceldemy.com/calculate-income-tax-in...

This article shows step by step procedures to calculate income tax in excel using IF function Learn them download workbook and practice

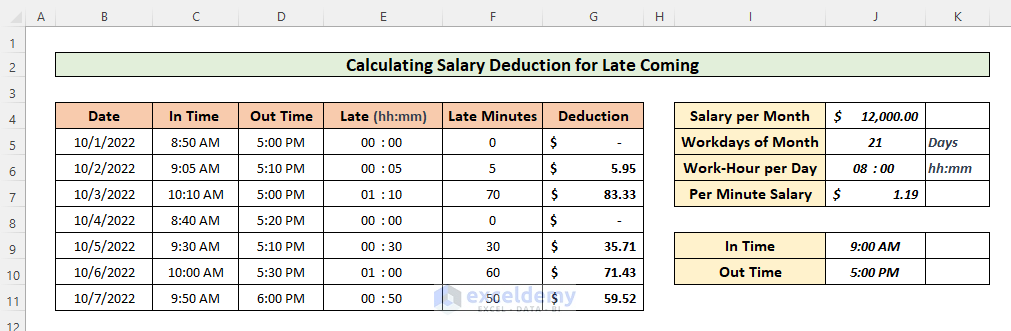

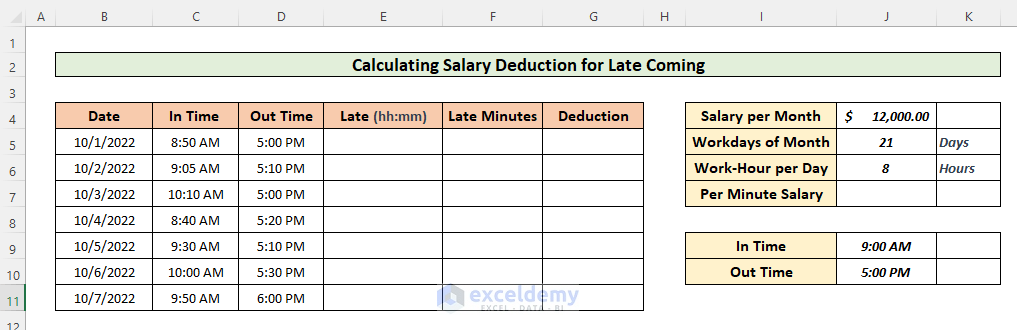

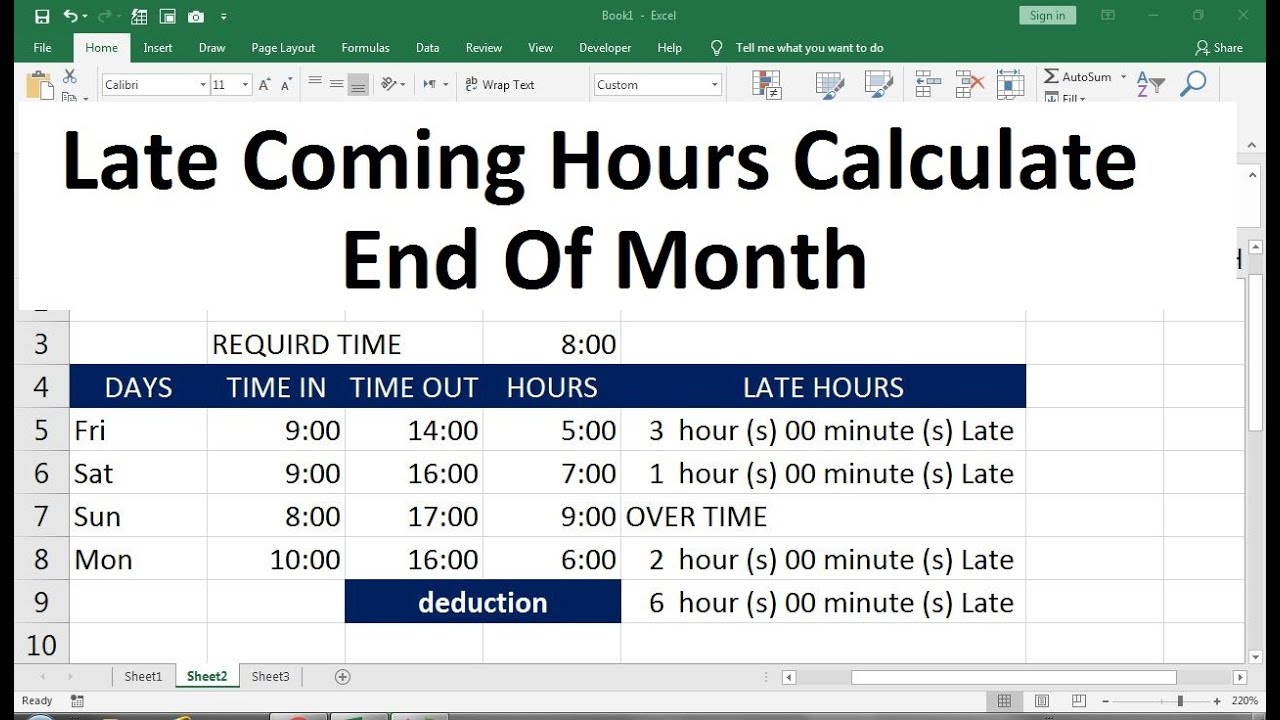

Salary Deduction Formula In Excel For Late Coming with Example

Tax Deductions Excel Spreadsheets Budgeting Tracking Finance Spending

Tax Deduction Worksheet Excel

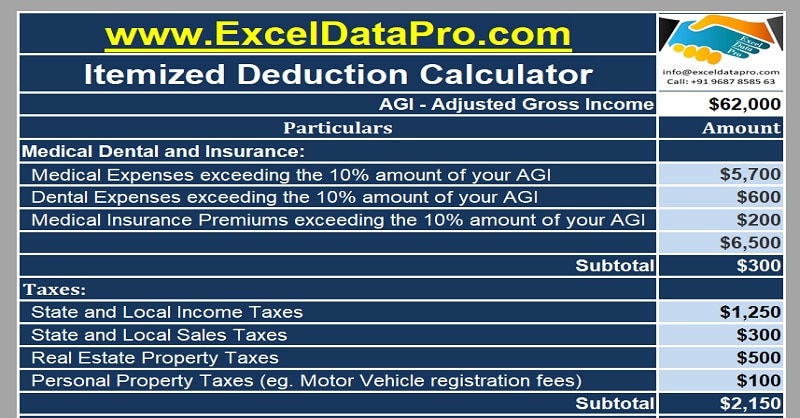

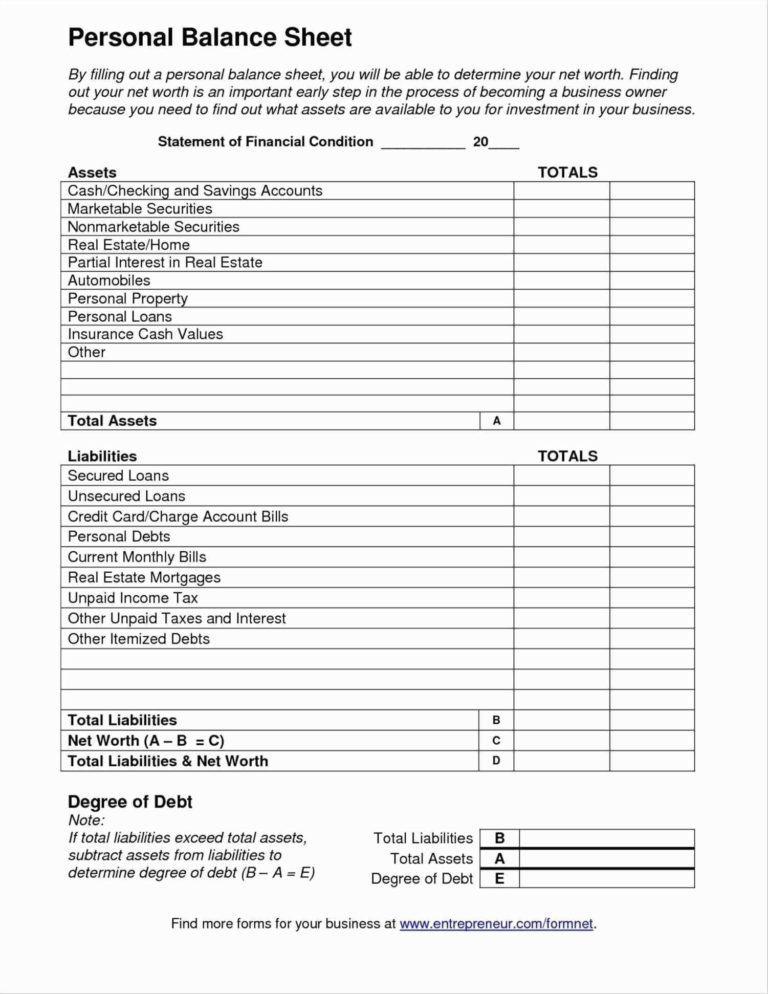

Download Itemized Deductions Calculator Excel Template ExcelDataPro

Tax Deduction Tracker Spreadsheet Spreadsheet Downloa Tax Deduction

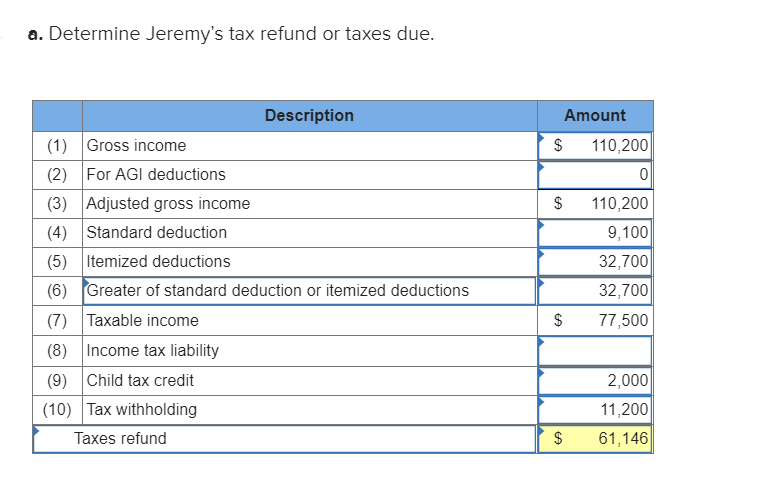

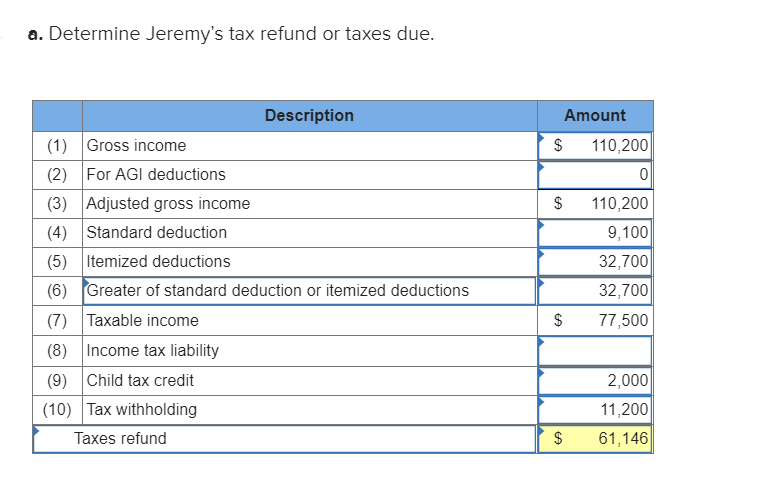

Solved Please Show Me How To Calculate STANDARD DEDUCTIONS Chegg

Solved Please Show Me How To Calculate STANDARD DEDUCTIONS Chegg

Salary Deduction For Late Coming Formula In Excel YouTube

Tax Deduction Spreadsheet Excel On Inventory Spreadsheet Spreadsheet

Itemized Deductions Spreadsheet In Business Itemized Deductions

Tax Deduction Formula In Excel - You can see a sample data set given below that will help us compute income tax in Excel format Method 1 Computing Income Tax for Flat Rates in Excel Format Steps Add more cells to calculate taxable income from gross income Subtract total deductions and total exemptions from gross income in cell E5 Use the following formula